January 2025

The global orthopedic contract manufacturing market size surpassed USD 7.79 billion in 2023 and is estimated to increase from USD 8.39 billion in 2024 to approximately USD 17.67 billion by 2034. It is projected to grow at a CAGR of 7.73% from 2024 to 2034.

The global orthopedic contract manufacturing market size is expected to be valued at USD 8.39 billion in 2024 and is anticipated to reach around USD 17.67 billion by 2034, expanding at a solid CAGR of 7.73% over the forecast period from 2024 to 2034. The North America orthopedic contract manufacturing market size reached USD 2.88 billion in 2023. Innovations in technology, rising incidence of orthopedic disorders, increased orthopedic surgeries, and cost efficiencies associated with outsourcing are a few of the factors driving the orthopedic contract manufacturing market growth.

The U.S. orthopedic contract manufacturing market size was exhibited at USD 2.16 billion in 2023 and is projected to be worth around USD 5 billion by 2034, poised to grow at a CAGR of 7.92% from 2024 to 2034.

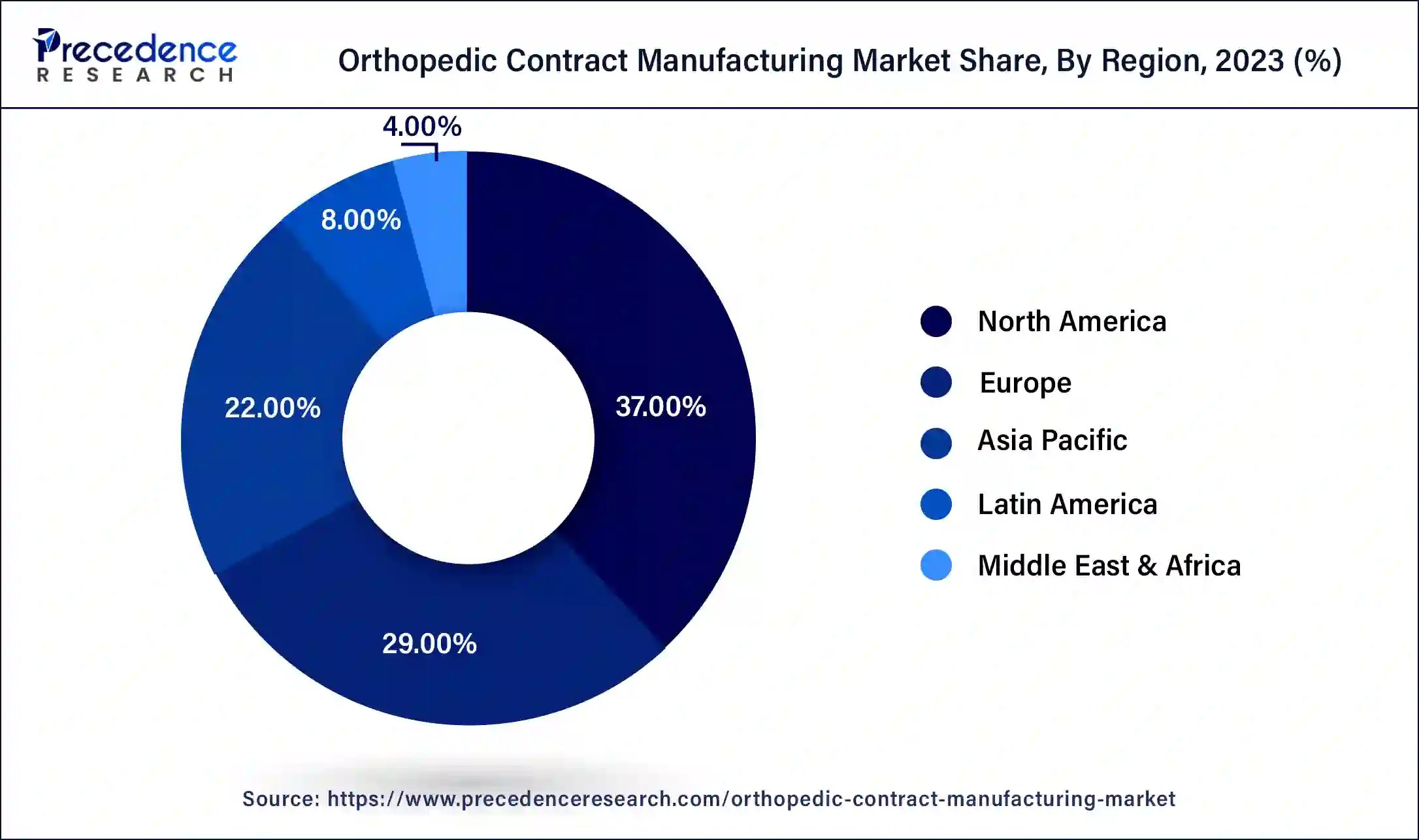

North America led the global orthopedic contract manufacturing market in 2023. Due to the growing demand for advanced orthopedic devices and increased healthcare spending, the region is anticipated to hold the largest share of the global orthopedic contract manufacturing market during the forecast period. The United States stands out as a key market for orthopedic contract manufacturing, driven by the high demand for customized orthopedic implants and devices. Numerous leading orthopedic device manufacturers in the country outsource manufacturing to contract manufacturers to minimize costs and concentrate on their core competencies.

Asia Pacific is expected to host the fastest-growing orthopedic contract manufacturing market throughout the forecast period. Several factors, including raised budget scrutiny in developed economies, pricing pressures, and changes in reimbursement schemes, are driving OEMs to implement cost-containment strategies. China emerged as a significant market for orthopedic contract manufacturing, boasting numerous companies that provide an extensive array of services, from prototype development to large-scale production. Also, the country’s lower labor costs and substantial manufacturing capacity make it an appealing destination for outsourcing orthopedic manufacturing.

Japan is also a prominent player of the orthopedic contract manufacturing market, renowned for its emphasis on precision engineering and superior-quality production. The country's reputation for advanced technology and a highly skilled workforce make it a favored choice for contract manufacturing services.

The orthopedic contract manufacturing market is a critical component of the ever-evolving healthcare sector, which offers vital services for the production of orthopedic devices and implants. Orthopedic contract manufacturers excel in specific processes or activities and provide valuable advice based on their expertise. They offer a range of services, including process verification, product innovation and validation, procurement, specialized production, and distribution. Additionally, they manage the supply chain and ensure the delivery of goods to the end customer, which benefits clients, customers, and medical device manufacturers.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.67 Billion |

| Market Size in 2023 | USD 7.79 Billion |

| Market Size in 2024 | USD 8.39 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.73% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Services, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of customized implants

The increasing demand for personalized implants tailored to individual patients' needs and anatomy is driving the need for specialized contract manufacturers in the orthopedic contract manufacturing market. Additionally, the growth of medical tourism, where patients travel abroad for bone health treatments, is leading to a greater demand for outsourced manufacturing of orthopedic implants. These trends are boosting the use of contract manufacturing services in the orthopedic sector, leading to market growth and providing opportunities for innovation and market differentiation.

Rising consolidation within the medical devices sector

Amidst the global financial crisis, the orthopedic industry has experienced a significant decline in global revenue. Hence, leveraging business process outsourcing services to trim operational, management, and infrastructure expenses has proven to be an effective strategy. To streamline capital expenditure and reduce labor costs, medical device companies are also intensifying their outsourcing efforts. However, market expansion faces obstacles due to increased consolidation within the medical devices sector. Major players are focusing on improving their manufacturing capabilities by acquiring smaller firms and contract manufacturing organizations (CMOs). This trend could potentially impact the growth of the orthopedic contract manufacturing market.

Opportunities in product innovations

Achieving reduced procedure times is increasingly important for meeting the demands of both patients and healthcare providers. With a growing aging population driving up the need for orthopedic procedures, there is a pressing requirement for advanced and highly precise products. Additionally, leveraging advanced technology has simplified these devices by making them more intuitive and accurate. However, the most daunting challenge remains to create devices that encompass all these attributes while remaining affordable. This continues to be a significant obstacle for leading firms in the global orthopedic contract manufacturing market.

The implants segment dominated the orthopedic contract manufacturing market in 2023. The rise in this percentage is driven by technological innovations in implant materials and designs, as well as increasing demand for orthopedic implants due to the rising incidence of orthopedic conditions. Companies responding to the growing demand for orthopedic products are concentrating on the development and launch of novel implants, leading to a notable upsurge in product introductions. Furthermore, the segmental growth is bolstered by the increasing demand for patient-centric products and customized implants specific to individual needs.

The cases segment is expected to show considerable growth in the orthopedic contract manufacturing market over the forecast period. The demand for high-quality orthopedic implants, devices, cases, and related solutions is being driven by the increasing prevalence of bone health conditions, such as osteoarthritis. To efficiently meet this growing demand, many orthopedic original equipment manufacturers (OEMs) are leveraging contract manufacturers' advanced technologies, specialized expertise, and cost-effective solutions. As a result, the growth of the cases in the segment is expected to be driven by these factors in the near future.

The orthopedic contract manufacturing market was mainly led by the forging/casting segment in terms of services. Contract manufacturers are significantly expanding their service offerings, contributing to the orthopedic contract manufacturing market. The dominance of the forging/casting segment is driven by the growing demand for its services in creating orthopedic products, as there is an increasing number of contract manufacturers in the orthopedic industry. Additionally, many are focusing on developing advanced materials for innovative orthopedic products, further facilitating the growth of this segment.

The orthopedic contract manufacturing market is expected to see the fastest growth in the spine & trauma segment. Most injuries occur in the low cervical and thoracolumbar areas, such as the cervicothoracic, low cervical, thoracic, thoracolumbar, and low lumbar segments of the spine. Additionally, the increasing occurrence of sports injuries is a significant factor driving the demand for trauma devices. The substantial growth of this segment is mainly due to the rising global demand for spine and trauma products.

Segments Covered in the Report

By Type

By Services

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

December 2024