December 2024

OTT Devices and Services Market (By Type: OTT Services, OTT Devices; By Device: Smart TV, Set-Top Box, Smart Phones, Desktop & Laptop, Other; By Content: Video, Audio, Games, Communication, Other) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

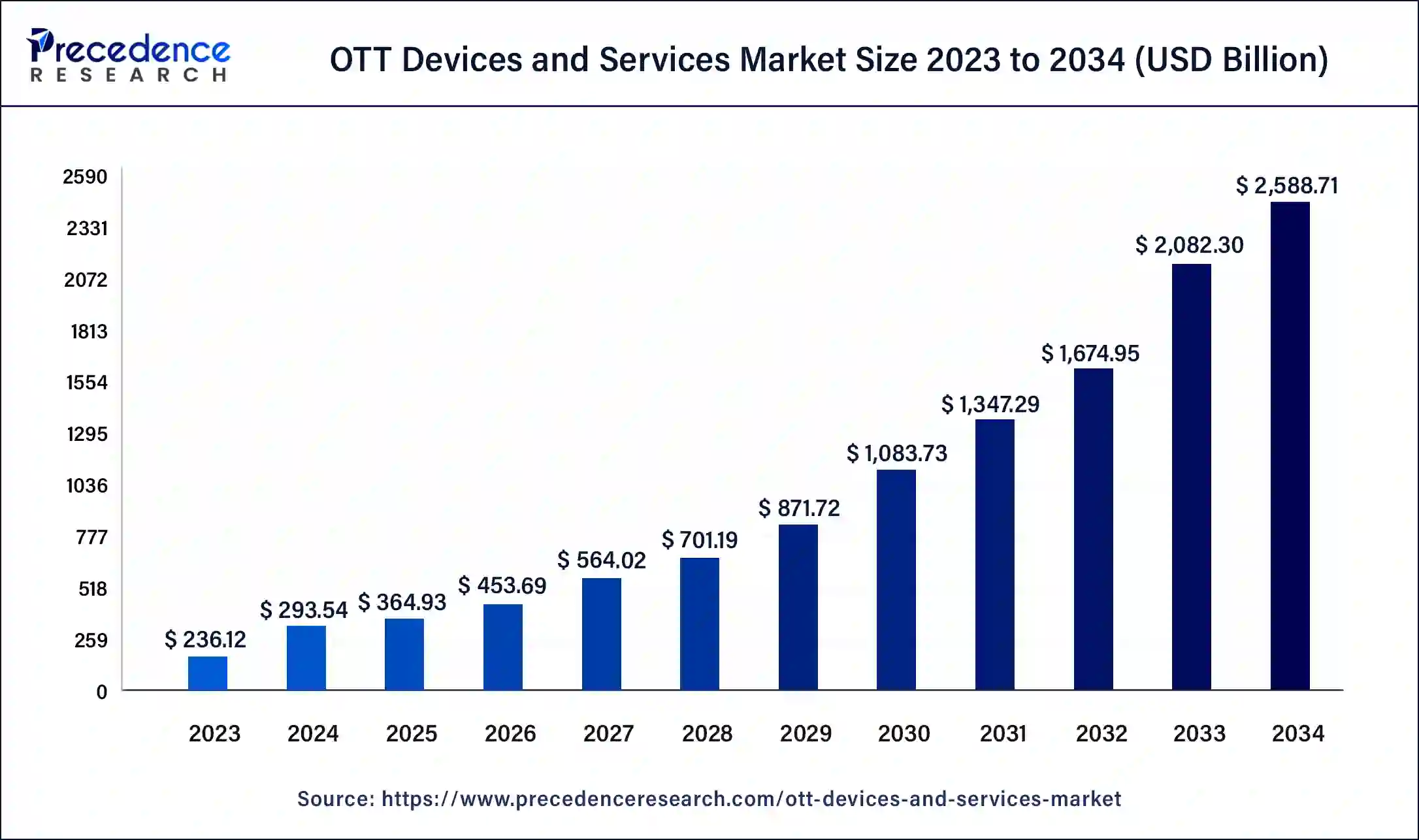

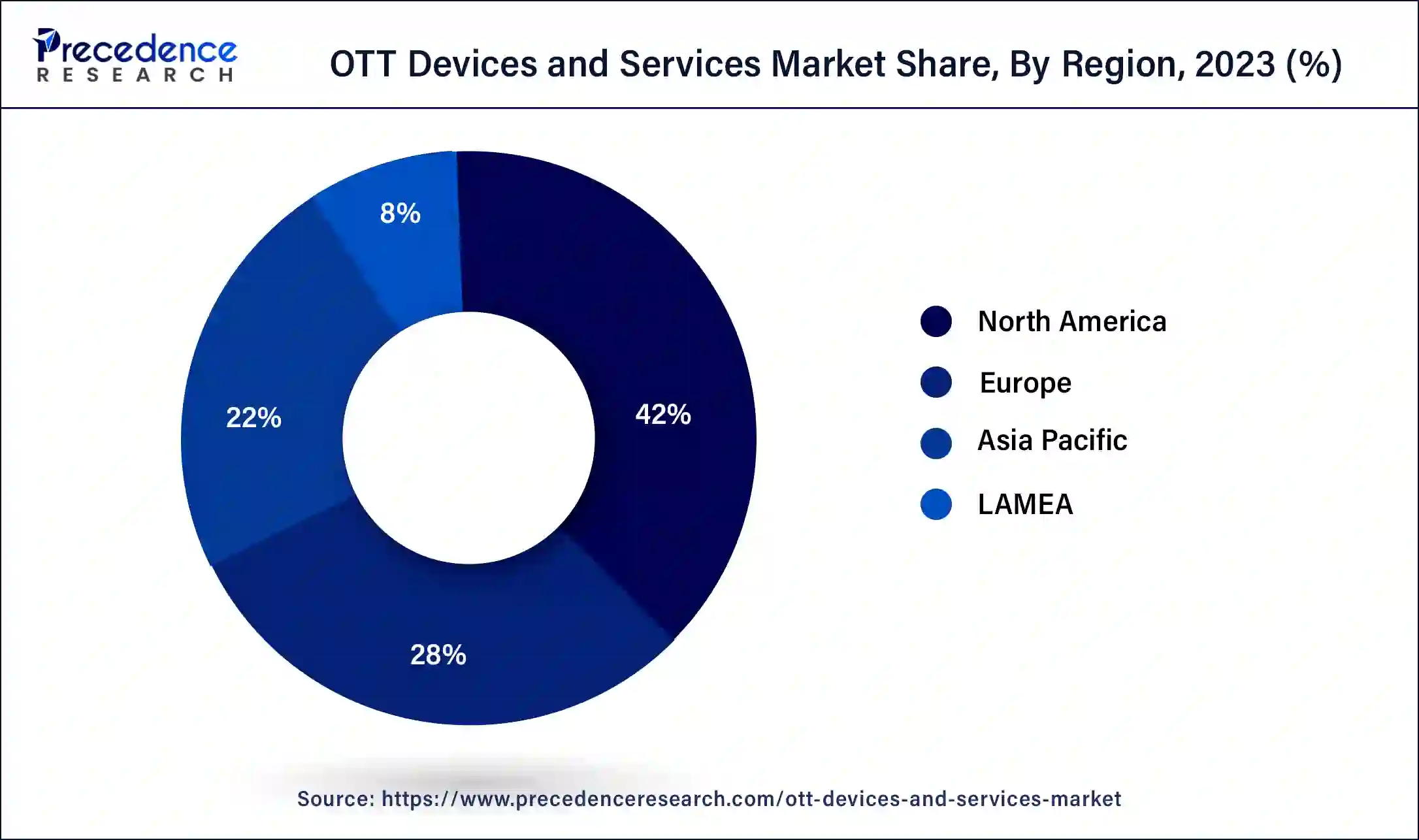

The global OTT devices and services market size was USD 236.12 billion in 2023, calculated at USD 293.54 billion in 2024 and is expected to reach around USD 2588.71 billion by 2034. The market is expanding at a solid CAGR of 24.32% over the forecast period 2024 to 2034. The North America OTT devices and services market size reached USD 99.17 billion in 2023. Application of OTT devices and services are live TV broadcast, video streaming, music streaming and access to news which is driving the market.

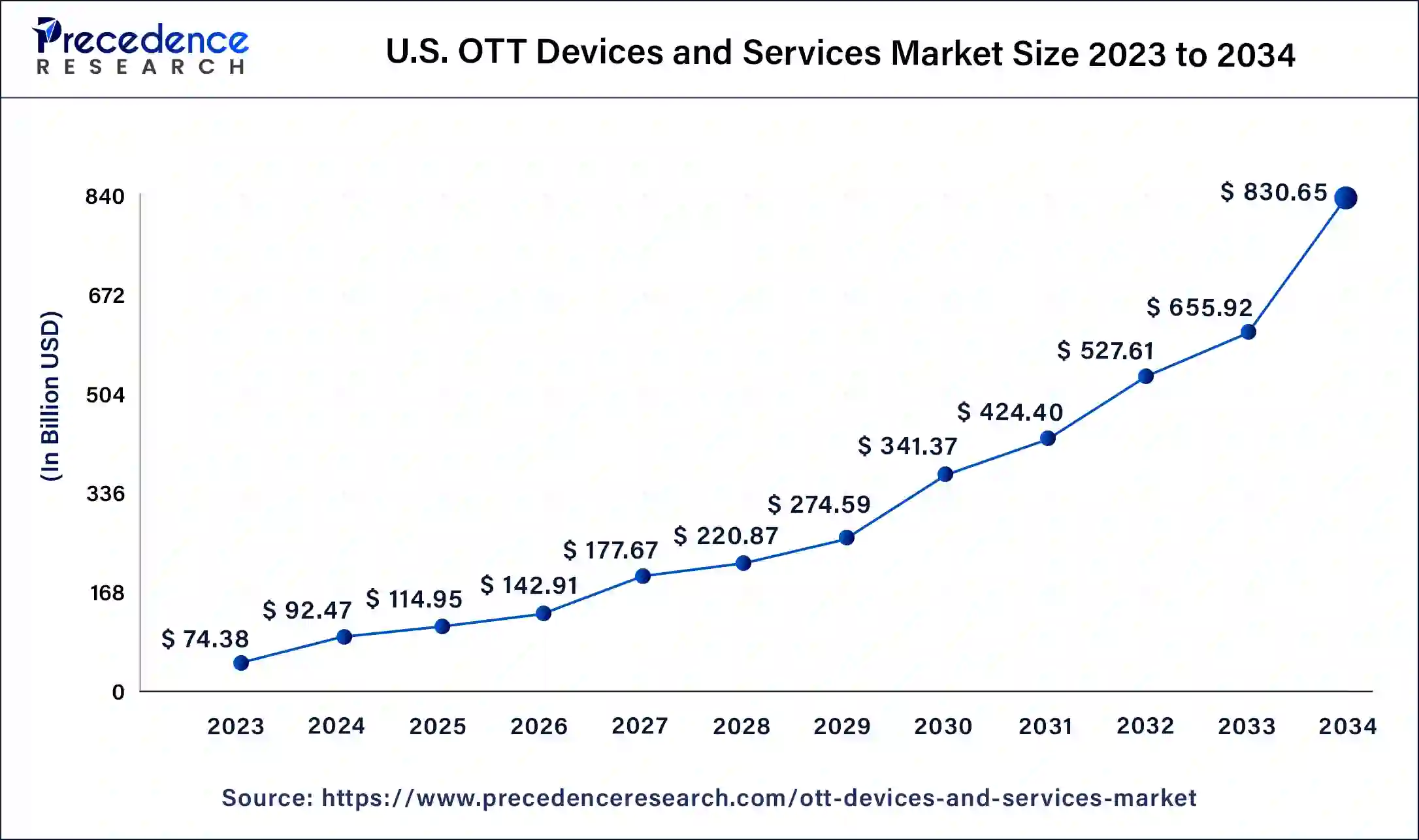

U.S. OTT Devices and Services Market Size and Growth 2024 to 2034

The U.S. OTT devices and services market size was exhibited at USD 236.12 billion in 2023 and is projected to be worth around USD 2588.71 billion by 2034, poised to grow at a CAGR of 24.32% from 2024 to 2034.

North America held the largest share of the OTT devices and services market in 2023. A few of the main factors contributing to the country's OTT market are high penetration of technologies such as Smart TV and mobile phones, the growing demand for video-on-demand content in addition to a high number of users that pay with their own money. Moreover, Subscription Package Flexibility, Increased Device Availability, Internet Access and Lower Costs which is contributing use of OTT platform in United State.

As of right now, projections indicate that the U.S. will dominate the worldwide OTT devices and services market. Americans are spending an increasing amount of money on OTT video, but they are also spending an increasing amount of time on subscription OTT video services. Almost one-third of OTT subscriptions in the US are made by Netflix. This year, over 254 million Americans, or about 75% of the population, will view over-the-top (OTT) video. There are many different types of OTT, and the majority of the aforementioned categories blend together or nest inside one another.

The Europe OTT devices and services market is experiencing rapid growth driven by increasing internet penetration, smartphone adoption, and the shift towards digital streaming and on-demand content consumption. This market segment is characterized by a diverse landscape of providers offering a wide range of streaming devices and content services.

The Asia Pacific OTT devices and services market is experiencing robust growth driven by rapid internet adoption, increasing smartphone penetration, and the growing popularity of digital streaming and on-demand content consumption. This market segment is characterized by a diverse ecosystem of providers offering a wide range of streaming devices and content services tailored to diverse regional preferences.

Market Overview

The growth of the OTT devices and services market driven by number of factors such as internet penetration, wireless devices, personalized and original content and rising popularity of streaming services. Furthermore, OTT services are expanding their reach globally and entering into new markets and creating content tailored for local audiences. Similarly, Increased demand for digital entertainment in different regions and a growing number of internet users worldwide have led to this expansion. In order to improve user experience, now OTT providers are using artificial intelligence by using AI recommendation system that analyse user preference a viewing habits to recommend personalised content. In addition, content tagging, metadata management and video analysis is also supported by AI. Some OTT providers are incorporating their services with other platforms and companies to expand their reach.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,588.71 Billion |

| Market Size in 2023 | USD 236.12 Billion |

| Market Size in 2024 | USD 293.54 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 24.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Device, Content, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for personalized content

Growing demand for personalized content is one of the significant drivers of OTT devices and services market. Today’s customer is demanding for a personalised experience which means that OTT platforms have become at the forefront of delivering personalised content. This demand plays a vital role in shaping the market and riving growth. OTT service provider relies on advanced algorithm and data analysis to gather insights into user preference and viewing habit this data is used to deliver personalized recommendation, suggesting content that aligns with individual choose and preferences by this OTT provider enhance the overall user experience, making it more engaging. Furthermore, Retention and loyalty of users are driven by personalised content. Which make user more likely to remain on the OTT platform and use its services if they discover content which has a resonance with them. This is also contributing to platform growth and success. As market continues to evolve, the focus on personalized content is likely to remain an important factor in shaping the future of the OTT devices and services market.

Geography blocking of content

Geo-blocking can act as restraint to OTT devices and services market. Geo- blocking is a practice in which content providers restrict access to their content to user of a particular geographic region. In order to comply with licensing agreement or for the purpose of protecting intellectual property rights , this practice is frequently used. This can be frustrating for user who wanted to watch a specific content but are not available in their region.

In addition, on some platform user have to pay more to access a specific content, this can restraint the growth of OTT platform and increase customer dissatisfaction and churn rate as user may be more inclined to cancel their subscription and switch to a competitor service that offer better content availability. However, the industry is undergoing changes to address this problem and offer more accessible content worldwide.

AI integration enhancing user experiences

AI integration is a one of opportunities in OTT devices and services market, With Ai integration in OTT platform, enhanced user experience by personalised content recommendation, improving content discovery, optimizing user interfere, automatic classification of video and enhancement Of Video Quality is prime focus of industry in OTT devices and services market. Furthermore, content curation algorithmize used to classify and tag content for accurate filtering and easy discovery.

In addition, AI optimizes UI design based on user interactions, feedback, and engagement metrics, enhancing usability. Similarly, The opportunity for AI integration extends beyond the user experience. Artificial intelligence also helps to optimize content acquisition strategies, enhance operation efficiency and facilitate decision making based on data.

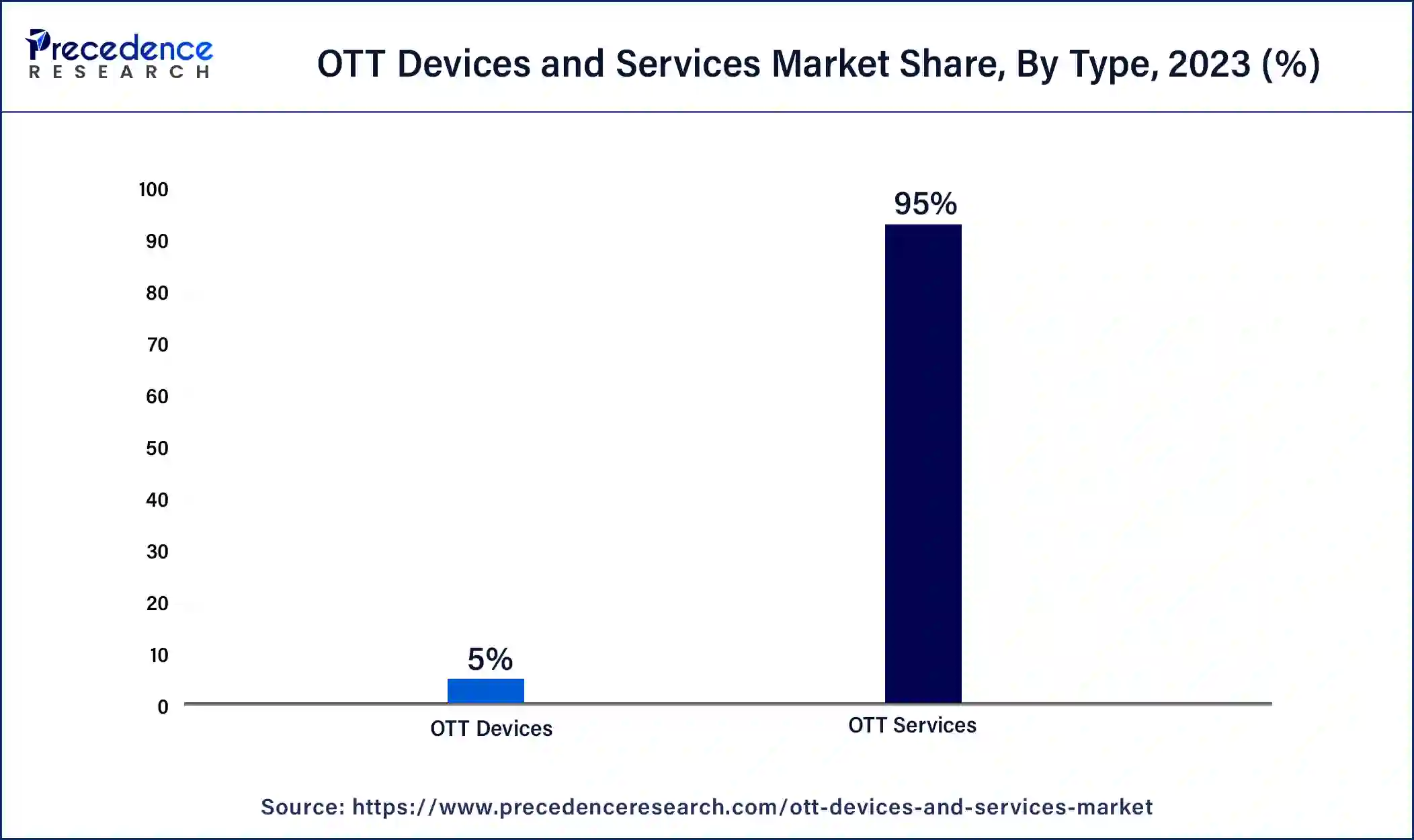

Based on type, the OTT services segment dominated the OTT devices and services market in 2023 due to factor such as increasing demand for online content, the rising popularity of streaming devices and high internet penetration’s OTT service is segment into subscription video-on-demand, transactional video-on demand and advertising supported video on demand. Subscription video on demand is most popular type in which the provider charge monthly fees or subscription pack to access unlimited content. Major player likes Netflix, amazon prime provides such services. Similarly, Adverting-supported video on demand is a type of OTT service where they provide free content to watch and charge through advertisement.

Moreover, this service is gaining more popularity as people are looking different way to watch content free. The service provider like YouTube Jio cinema , MX player use this type of services. Moreover, The high internet penetration rates, low costs of broadband access and the increasing digitalization are creating opportunities in a country like India or China. The OTT devices and services market is forecast to continue to grow in coming years, as more people are adopting streaming service over traditional TV service.

The streaming sticks segment held the largest share of the OTT devices and services market in 2023 and play critical role in market as it provides direct access to OTT platform and service from their phones. Therefore, in order to develop strategies for smartphone segment, the need and preference of smartphone user must be taken under consideration by OTT provider. Additionally factor that are driving demand within smartphone segment are convenience and affordability. Furthermore, few Market trend in smartphone on the market are rise of 4K streaming content and Growth of HDR streaming. Additionally, the smartphone segment of the OTT devices and services market is growing rapidly since It takes more powerful components to process the high-resolution videos smoothly, and they have wireless coverage anywhere you go while streaming online media.

The video segment held the largest share of the OTT devices and services market in 2023. A significant part of the service is video content, ranging from OTT series produced by studios such as Netflix, Hulu, Disney Plus, to shortform user generated content such as reaction videos or vlogs by YouTube and TikTok, Moreover, Various genres are available, such as animation, documentary, international films, music programming, sporting rights and so on by Amazon Prime Video, Netflix and Hulu etc. Platforms also host original content created exclusively for them, which differentiates themselves from competitors and attracts subscribers. Furthermore, rise of virtual reality and augmented reality which has potential to revolutionize the way we consume OTT content.

Segments Covered in the Report

By Type

By Device

By Content

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

February 2025

September 2024