March 2025

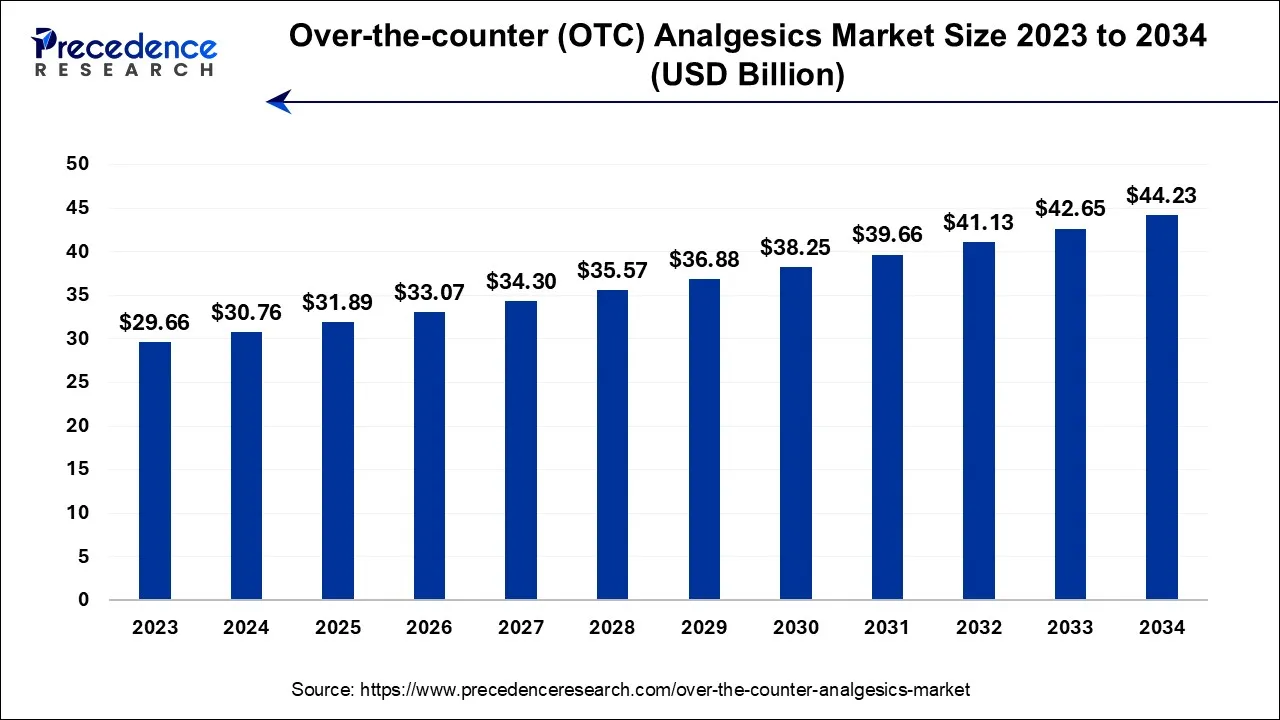

The global over-the-counter (OTC) analgesics market size accounted for USD 30.76 billion in 2024, grew to USD 31.89 billion in 2025 and is expected to be worth around USD 44.23 billion by 2034, registering a healthy CAGR of 3.70% between 2024 and 2034. The North America over-the-counter (OTC) analgesics market size is calculated at USD 13.53 billion in 2024 and is estimated to grow at a fastest CAGR of 3.81% during the forecast period.

The global over-the-counter (OTC) analgesics market size is calculated at USD 30.76 billion in 2024 and is expected to surpass around USD 44.23 billion by 2034, growing at a CAGR of 3.70% from 2024 to 2034.

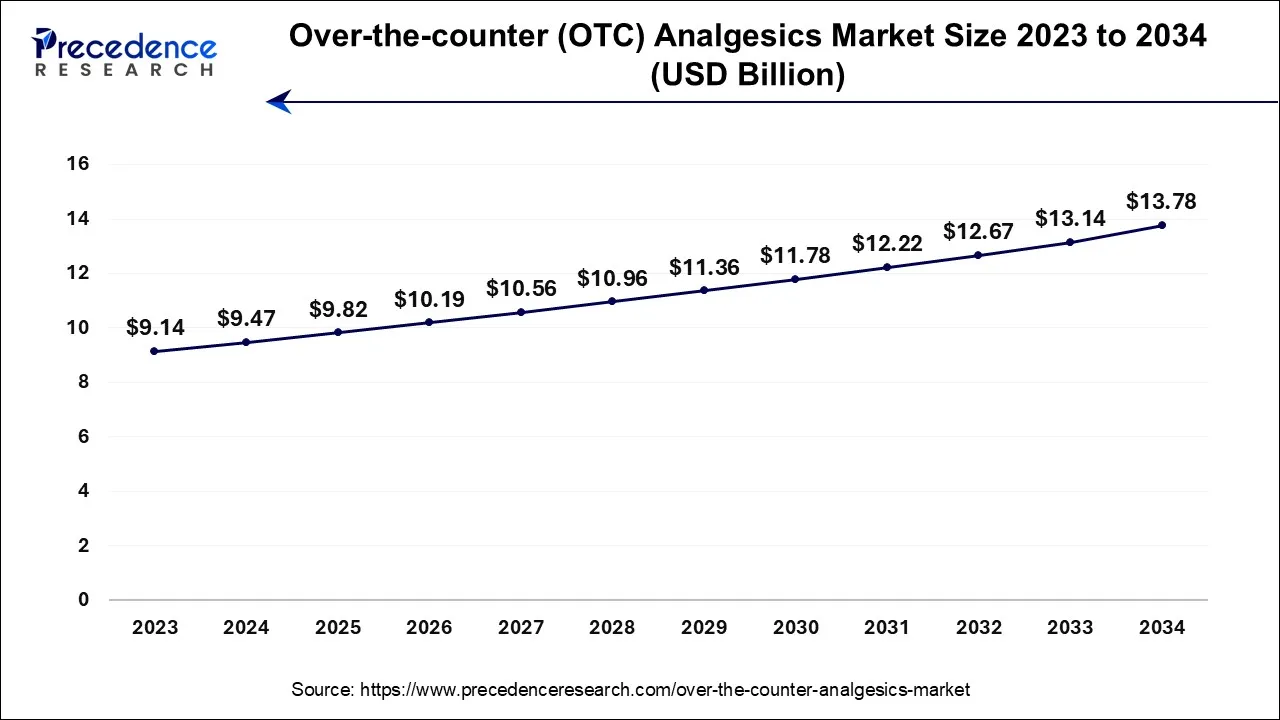

The U.S. over-the-counter (OTC) analgesics market size was valued at USD 9.47 billion in 2024 and is estimated to reach around USD 13.78 billion by 2034, growing at a CAGR of 3.82% from 2024 to 2034.

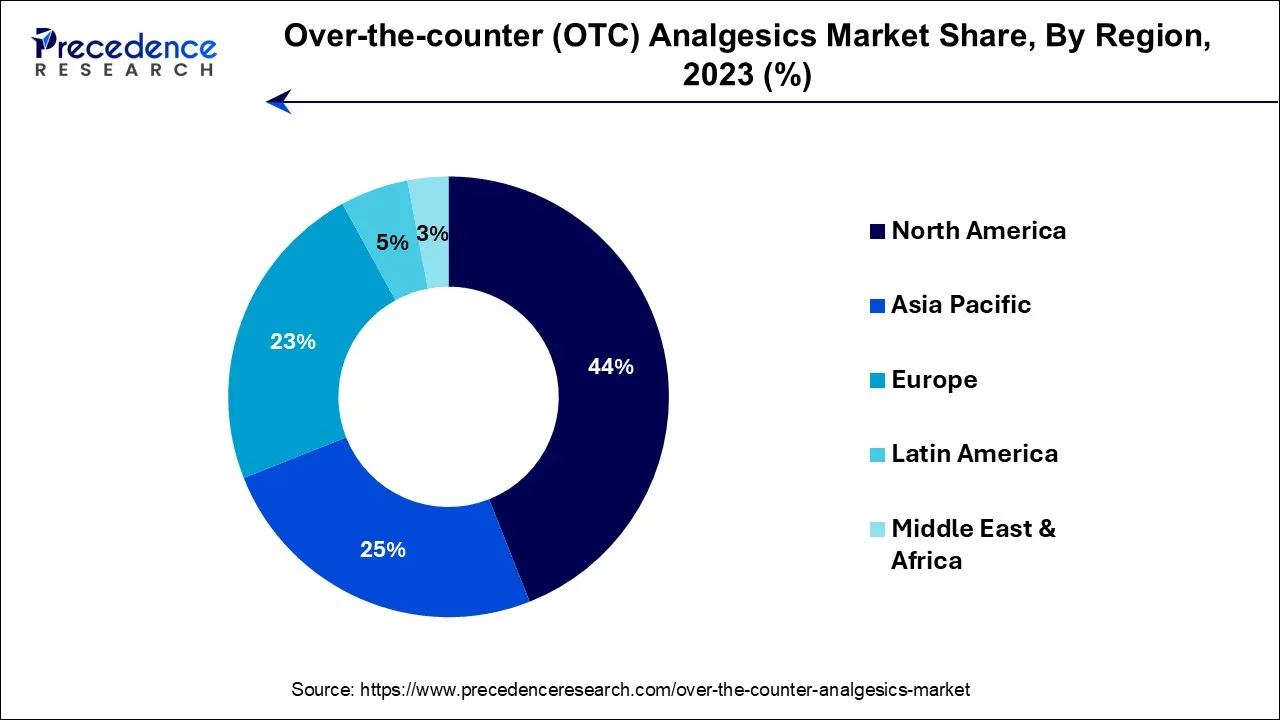

North America has held the largest revenue share 44% in 2023. North America commands a significant share in the over-the-counter (OTC) analgesics market due to several key factors. Firstly, the region has a well-established healthcare infrastructure and a high degree of consumer health awareness, driving demand for OTC analgesics.

Additionally, an aging population and the prevalence of chronic pain conditions contribute to sustained usage. Robust pharmaceutical regulations ensure product quality and safety, fostering consumer trust. Extensive marketing and advertising efforts by manufacturers further stimulate consumption. Lastly, the presence of prominent pharmaceutical companies and the widespread availability of OTC products in retail stores solidify North America's dominant position in the OTC analgesics market.

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 5.3% during the forecast period. The Asia-Pacific region commands significant growth in the over-the-counter (OTC) analgesics market primarily due to its vast population, increasing healthcare awareness, and a rising middle-class with greater purchasing power. Countries like China and India have witnessed substantial growth in disposable income and urbanization, leading to heightened demand for OTC analgesics.

Furthermore, the prevalence of common ailments and a cultural inclination towards self-medication have boosted market expansion. As a result, pharmaceutical companies are strategically focusing on this region, introducing a wide range of OTC analgesic products to cater to the burgeoning consumer base.

The over-the-counter (OTC) analgesics market encompasses the worldwide arena of non-prescription pain-alleviating remedies, encompassing items such as aspirin, ibuprofen, and acetaminophen. This sector is undergoing rapid expansion, fueled by factors like increasing consumer consciousness, a burgeoning elderly populace, and the prevalence of typical discomforts like headaches and bodily aches. OTC analgesics deliver convenience and cost-efficiency, contributing to their broad popularity. Market contenders frequently introduce inventive formulations and branding approaches to secure a market foothold. Regulatory oversight and safety considerations are also pivotal aspects.

The OTC analgesics market is highly competitive and is projected to sustain growth owing to consumer demand for conveniently accessible pain relief solutions.

One noteworthy trend in the OTC analgesics market is the escalating consumer consciousness about self-care and easily accessible healthcare remedies. As individuals become more health-aware, they seek convenient and economical methods to manage everyday ailments such as headaches and muscular discomfort. The burgeoning elderly demographic is another substantial growth catalyst, given their frequent need for pain relief due to age-related conditions. Furthermore, the prevalence of lifestyle-induced stressors and chronic health issues contributes to the surging demand for OTC analgesics.

The OTC analgesics market's growth is further propelled by innovations in product formulations and branding approaches undertaken by industry players. These innovations cater to the evolving preferences of consumers and enhance competitiveness within the market. Regulatory bodies also exert influence by ensuring the safety and efficacy of products, shaping the dynamic nature of the industry.

Despite its growth trajectory, the OTC analgesics market confronts challenges, including heightened scrutiny from regulatory entities concerning the safety of these products. Addressing safety concerns and ensuring accurate product labeling is imperative for industry participants. Additionally, the market's competitiveness drives companies to invest in marketing and distribution strategies to maintain or augment their market share.

A multitude of business prospects abound within the OTC analgesics market. Companies can explore opportunities in developing innovative formulations tailored to address specific pain relief requirements or offer value-added features such as extended release or targeted delivery methods. Venturing into emerging markets characterized by heightened healthcare awareness presents avenues for market expansion. Collaborations with healthcare providers or engagement with telemedicine platforms to educate consumers about responsible OTC analgesics usage can also be a fruitful means of fostering growth.

In recapitulation, the OTC analgesics market is on a robust growth trajectory owing to increased consumer awareness, an aging populace, and the ubiquity of common ailments. Innovations, regulatory adherence, and market competition constitute pivotal dynamics in this landscape. While challenges persist, numerous business opportunities beckon, allowing companies to distinguish themselves and meet the evolving demands of consumers.

| Report Coverage | Details |

| Market Size by 2034 | USD 44.23 Billion |

| Market Size in 2024 | USD 30.76 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type of Drug, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Consumer demand for self-care

The over-the-counter (OTC) analgesics market is experiencing substantial growth driven by the increasing consumer appetite for self-care. This phenomenon reflects a shift in consumer behavior where individuals are actively taking charge of their healthcare needs. This rising demand for self-care solutions is evident in the OTC analgesics market, as consumers seek accessible and user-friendly remedies for common ailments like headaches, muscle discomfort, and minor aches. OTC analgesics have gained popularity as they provide a swift and convenient means of addressing these everyday health issues without the requirement of a physician's prescription.

Furthermore, the desire for self-sufficiency in managing health is leading people to proactively embrace OTC analgesics as their primary choice for pain relief. This trend is particularly pronounced in regions that emphasize personal wellness and self-medication. As consumers grow increasingly informed and health-conscious, their inclination toward self-care continues to drive the demand for OTC analgesics, establishing them as household staples worldwide. Pharmaceutical companies are responding by introducing inventive products and implementing fresh marketing strategies to cater to this evolving consumer preference, thereby further advancing the market's growth.

Consumer preference for natural remedies

Consumer inclination toward natural remedies serves as a constraint on the growth of the over-the-counter (OTC) analgesics market. This limitation stems from the rising attraction to holistic and alternative healthcare approaches.

A considerable portion of consumers is increasingly drawn to exploring herbal therapies, dietary supplements, and non-pharmacological methodologies for alleviating pain. They perceive these natural remedies as safer and more in alignment with their overall well-being. Consequently, this preference for natural remedies has the potential to divert potential consumers away from traditional OTC analgesics like aspirin, ibuprofen, and acetaminophen. Consumers are motivated by the perception of fewer adverse effects and a desire for a holistic health outlook, particularly when seeking enduring pain management solutions. Concerns about the potential drawbacks linked to OTC analgesics further drive this shift.

As consumer interest in natural remedies continues to surge, OTC analgesic manufacturers may encounter difficulties in preserving or enlarging their market presence. Addressing this constraint may necessitate innovative tactics and product diversification to accommodate evolving consumer inclinations.

Expanding target demographics

Expanding target demographics is opening up significant opportunities in the over-the-counter (OTC) analgesics market. Traditionally dominated by adult consumers, this market is evolving to cater to a broader range of age groups, creating new avenues for growth. One notable opportunity lies in addressing the pediatric population. Manufacturers are developing OTC analgesics tailored to children, offering safe and effective pain relief options for parents and caregivers. These child-friendly formulations, such as liquid suspensions or chewable tablets, meet the unique needs of young patients.

Additionally, targeting the elderly demographic is another lucrative opportunity. With the aging global population, there's a rising demand for pain relief solutions for age-related conditions like arthritis. OTC analgesics designed with seniors in mind, such as easy-to-open packaging and lower-dose options, can cater to this expanding demographic. By diversifying their product offerings and adapting to the changing consumer landscape, OTC analgesics manufacturers can tap into these growing target demographics and secure a competitive edge in the market.

The nonsteroidal anti-inflammatory drugs (NSAIDs) segment held a 37% revenue share in 2023. The nonsteroidal anti-inflammatory drugs (NSAIDs) segment holds a significant share in the over-the-counter (OTC) analgesics market due to its effectiveness in pain relief and anti-inflammatory properties. NSAIDs, including ibuprofen and aspirin, are widely trusted for alleviating various types of pain, making them a preferred choice for consumers. Their over-the-counter availability and affordability contribute to their dominance. Additionally, NSAIDs are suitable for addressing both short-term and chronic pain conditions, further solidifying their market position. Overall, the versatility and established reputation of NSAIDs make them a major contributor to the OTC analgesics market.

The salicylates segment is anticipated to expand at a significant CAGR of 4.3% during the projected period. The Salicylates category maintains a substantial growth within the over-the-counter (OTC) analgesics market, primarily attributed to the widespread utilization of aspirin, a leading analgesic in this sector. Aspirin's prevalence can be traced back to its established reputation for pain alleviation, fever reduction, and anti-inflammatory attributes. Consumers turn to aspirin to address a variety of discomforts, ranging from headaches and muscle aches to minor pains. Moreover, its cost-effectiveness and ready accessibility make significant contributions to its dominant position. Aspirin's well-documented efficacy as a pain-relieving solution underscores the pivotal role played by the Salicylates category in the OTC analgesics market.

The hospital pharmacies segment had the highest market share of 57% In 2023. Hospital pharmacies hold a significant share in the over-the-counter (OTC) analgesics market due to their role as trusted healthcare providers. Patients often seek medical advice in hospitals, leading to high visibility and accessibility of OTC analgesics. Hospital pharmacists recommend and dispense these products, bolstering consumer confidence.

Additionally, hospital settings cater to diverse patient populations, including those with chronic pain or post-operative pain, driving the demand for OTC analgesics. Hospitals prioritize quality and safety, aligning with the reliability consumers expect from OTC analgesic products, thereby solidifying their dominant position in this market segment.

The online pharmacies segment is anticipated to expand at the fastest rate over the projected period. Online pharmacies hold a significant growth in the over-the-counter (OTC) analgesics market due to several factors. Firstly, the convenience of purchasing OTC analgesics online appeals to consumers seeking hassle-free shopping experiences. Secondly, the COVID-19 pandemic accelerated the shift towards e-commerce as people preferred contactless transactions.

Additionally, online pharmacies offer a wide range of OTC products, providing greater variety and accessibility to consumers. Furthermore, aggressive marketing, promotional offers, and discounts online attract cost-conscious buyers. The availability of comprehensive product information and customer reviews also enhances the online shopping experience, cementing the segment's dominance growth in the OTC analgesics market.

Segments Covered in the Report

By Type of Drug

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

March 2025

October 2024

July 2024