January 2025

Oxycodone Drugs Market (By Product Type: Short-acting, Long acting; By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

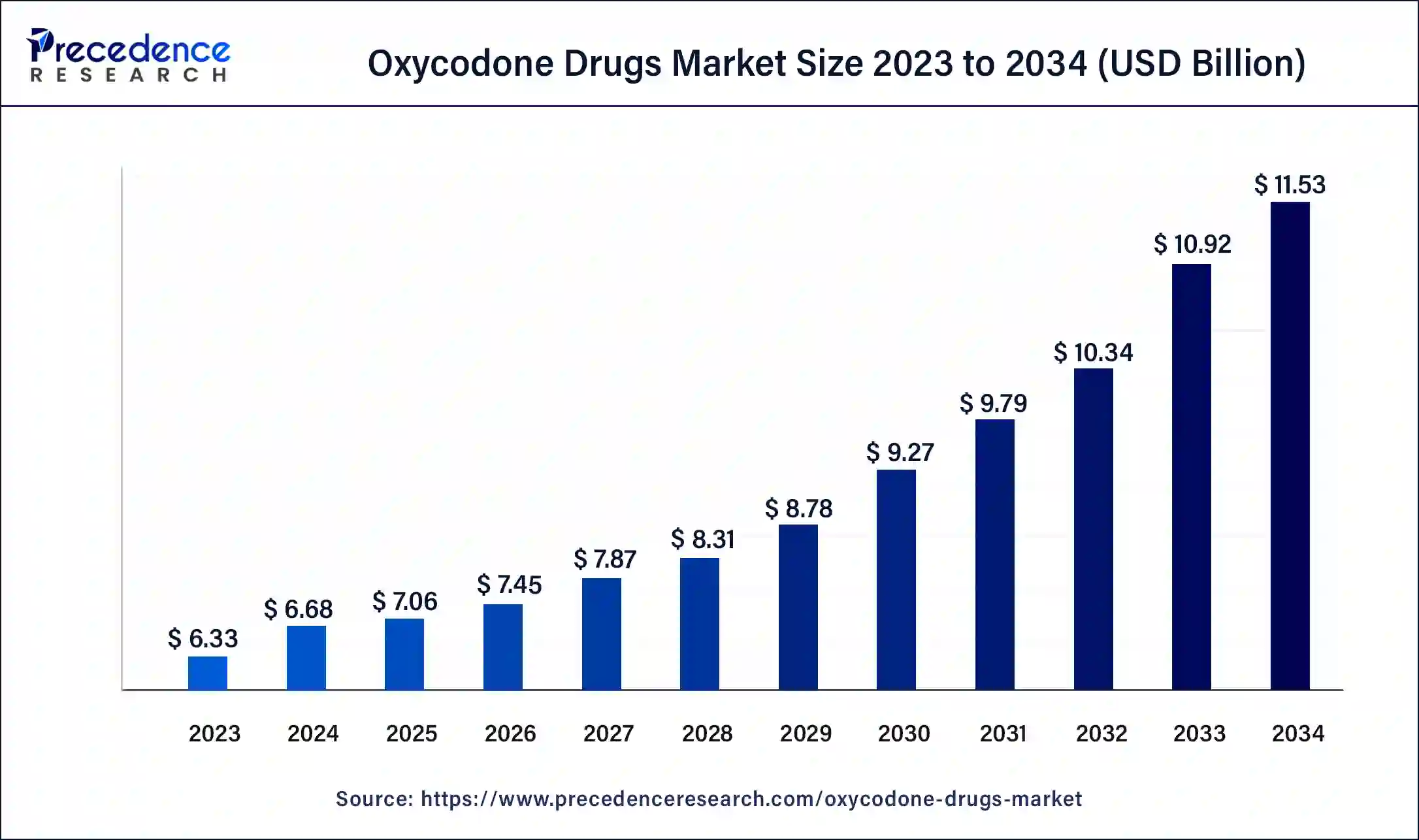

The global oxycodone drugs market size was USD 6.33 billion in 2023, accounted for USD 6.68 billion in 2024, and is expected to reach around USD 11.53 billion by 2034, expanding at a CAGR of 5.6% from 2024 to 2034. The oxycodone drugs market is driven by growing number of older adults. As people age, they are more likely to experience chronic pain conditions, which calls for drug management.

Potent opioid painkillers like oxycodone are used to treat moderate to severe pain and are frequently prescribed for chronic illnesses like cancer, injuries, and surgery. The oxycodone drugs market exists to give patients with illnesses that call for opioid therapy sufficient pain relief. By attaching itself to opioid receptors in the brain and spinal cord, oxycodone modifies how pain is perceived. But if taken contrary to prescription, its strength also entails a risk of addiction, misuse, and overdose.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.6% |

| Global Market Size in 2023 | USD 6.33 Billion |

| Global Market Size in 2024 | USD 6.68 Billion |

| Global Market Size by 2034 | USD 11.53 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A rise in the incidence of chronic pain diseases

Globally, chronic pain is becoming more widely acknowledged as a significant health concern. Chronic pain issues are becoming more and more common due to several factors, including sedentary lifestyles, aging populations, and the rising burden of chronic diseases. The need for efficient pain management treatments is rising in tandem with the number of people who are afflicted with these conditions.

Specific chronic pain problems are still challenging to treat, even with improvements in pain management methods. Physical therapy, alternative therapies, and non-opioid drugs may not provide enough relief for patients. In these situations, oxycodone and other opioids may be prescribed by medical professionals as a practical means of treating pain.

Increasing regulatory scrutiny and efforts to combat opioid abuse and addiction

Governments throughout the world have put strict laws into place to try and stop oxycodone abuse and diversion. Prescription guidelines, monitoring plans, and limitations on production and distribution are typical examples of these rules. For example, oxycodone is subject to stringent laws surrounding its manufacturing, distribution, and prescription, as it is classed as a Schedule II controlled narcotic by the U.S. Drug Enforcement Administration (DEA), regulations in the industry create a restraint for the oxycodone drugs market.

To treat chronic pain, medical professionals are increasingly looking into non-opioid alternatives such as physical therapy, acupuncture, cognitive-behavioral therapy, and non-steroidal anti-inflammatory medicines (NSAIDs). The market for oxycodone products has shrunk due to this move away from opioids.

Increasing demand for pain management solutions

Chronic diseases, including cancer, degenerative bone diseases, and arthritis, are becoming more common as the world's population ages. These illnesses frequently cause persistent pain, which increases the demand for efficient painkillers like oxycodone. Globally, the number of surgical procedures performed has increased due to advancements in medical technology. Surgery can be necessary to cure several illnesses, but it also frequently results in postoperative pain, for which doctors often prescribe oxycodone and other opioids. Thereby, the rising demand for pain management solutions is observed to create opportunities for the oxycodone drugs market.

Advancements in drug delivery systems

Advancing edge medication administration techniques can lessen the possibility of oxycodone overuse and misuse. Abuse-deterrent formulations, for instance, lower the risk of opioid abuse through injection, inhalation, or ingestion by using chemical and physical barriers to stop tampering, crushing, or extraction. Utilizing personalized medicine techniques in oxycodone therapy is made possible by advancements in medication delivery methods. Transdermal patches and buccal films, for example, provide an alternative mode of delivery for patients who might have trouble swallowing tablets or need continuous, round-the-clock pain management.

The short-acting segment had the largest share in 2023 and sustain to grow in the oxycodone drugs market during the forecast period. Healthcare providers have more freedom to modify dosage schedules for short-acting oxycodone based on patient reaction and pain thresholds. This adaptability makes it possible to implement customized pain treatment plans, which improves patient happiness and comfort. Short-acting oxycodone formulations offer flexibility in dosage adjustment, allowing healthcare providers to titrate the dose based on individual patient needs and pain severity. This flexibility is particularly beneficial in acute pain management settings where precise control of pain intensity is essential for optimizing patient outcomes and minimizing adverse effects.

The long-acting segment shows a notable growth in the oxycodone drugs market during the forecast period. When it comes to pain relief, long-acting oxycodone formulations provide more than immediate-release forms. Patients with chronic pain issues, including cancer, neuropathy, or severe musculoskeletal disorders, can benefit most from this prolonged pain relief. The need for long-acting opioid medications is rising in tandem with patients and healthcare professionals' growing understanding of the significance of effective pain management. Pharmaceutical companies are allocating resources towards research and development to present innovative long-acting oxycodone formulations that exhibit enhanced safety profiles, efficacy, and features that inhibit misuse.

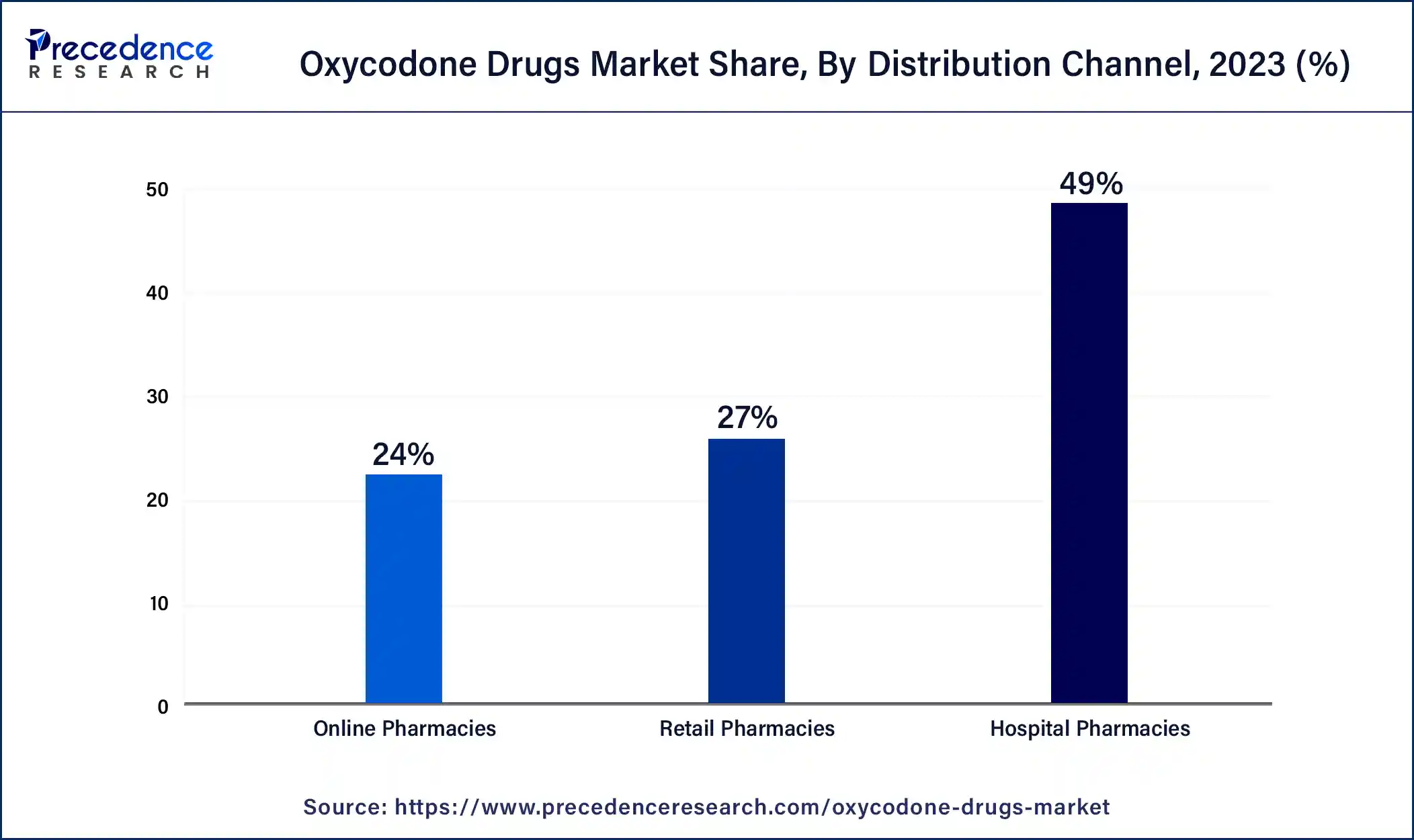

The hospital pharmacies segment dominated the oxycodone drugs market in 2023. Hospital pharmacies usually employ highly skilled pharmacists and medical specialists who follow protocols for evidence-based prescribing. They have the skills and information necessary to evaluate patients' needs, choose the right dosages, and monitor for possible oxycodone abuse or misuse. Thanks to their emphasis on patient safety and therapeutic effectiveness, hospital pharmacies are perceived as reputable providers of controlled medications by the public.

The retail pharmacies segment shows a significant growth in the oxycodone drugs market during the forecast period. Pharmacies advertise their oxycodone products using various marketing strategies, including physician detailing and direct-to-consumer advertising. In addition to increasing public knowledge of oxycodone's effectiveness in treating pain, these marketing campaigns also impact prescribing practices, leading to a shift in consumer behavior toward filling prescriptions at retail pharmacies.

North America has its largest share in 2023 in the oxycodone drugs market and is observed to sustain the position throughout the predicted timeframe. Despite the opioid crisis and initiatives to reduce the prescribing of opioids, oxycodone continues to have a substantial market share in pharmaceuticals. This is because it works wonders for treating moderate-to-severe pain, which makes it an essential tool for treating a wide range of illnesses, including pain from cancer and the healing process following surgery. The market for oxycodone products is growing because of the established demand, especially in North America, where the healthcare system easily allows for its prescription and distribution.

Asia-Pacific is the fastest growing oxycodone drugs market during the forecast period. Prescription drugs, such as oxycodone, are getting easier to get and more affordable because of rising healthcare costs and better economic conditions in Asia-Pacific nations. As a result, there are now more patients seeking pharmaceutical interventions for pain management, which has increased the demand for oxycodone medications. Western medical standards and practices are progressively impacting the healthcare systems in the Asia-Pacific area. Since oxycodone is a common opioid used to treat pain in Western nations, its use and adoption in Asia-Pacific have increased, contributing to the market's rise.

Europe is observed to have a notable share in the oxycodone drugs market in the upcoming years. Europe has witnessed a rise in the prevalence of chronic pain conditions, such as arthritis, neuropathy, and cancer-related pain, among its aging population. Oxycodone, a potent opioid analgesic, is commonly prescribed for managing moderate to severe chronic pain that is inadequately controlled by non-opioid analgesics. The growing burden of chronic pain contributes to the demand for oxycodone drugs in the European market.

The incidence of cancer is increasing across Europe, driving the need for effective pain management strategies for cancer patients. Oxycodone is frequently used as part of multimodal analgesic regimens for alleviating cancer-related pain, improving patients' quality of life, and enhancing their ability to tolerate chemotherapy and other cancer treatments. The expanding oncology market in Europe fuels the demand for oxycodone drugs as an essential component of supportive care for cancer patients.

Segments Covered in the Report

By Product Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025