January 2025

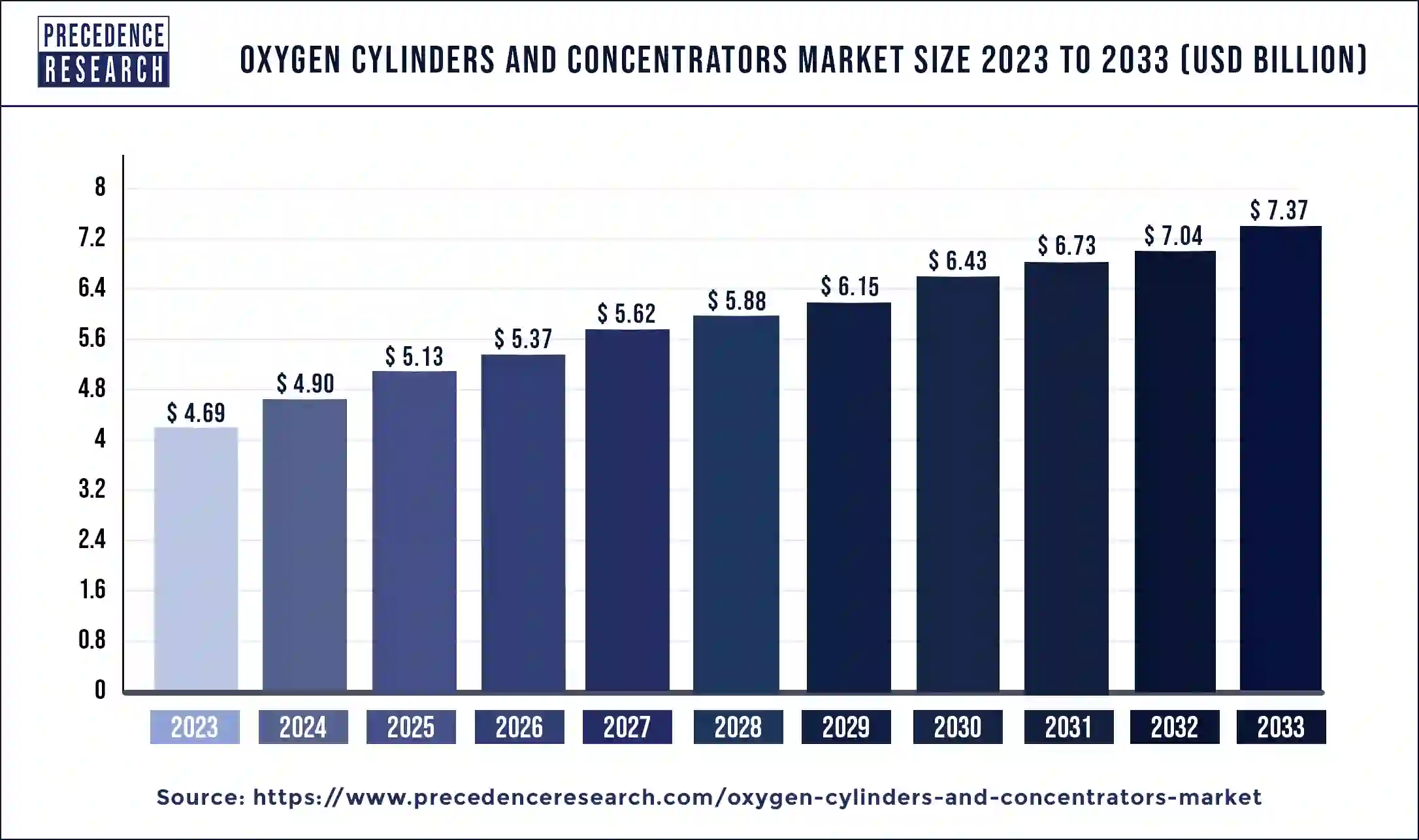

The global oxygen cylinders and concentrators market size was USD 4.69 billion in 2023, calculated at USD 4.90 billion in 2024, and is expected to reach around USD 7.37 billion by 2033, expanding at a CAGR of 4.63% from 2024 to 2033. The number of old people with respiratory and other chronic illnesses requiring oxygen therapy rises as the world's population ages, driving the oxygen cylinders and concentrators market growth.

Because of their portability and the increasing demand from people suffering from ailments including COPD, asthma, and pneumonia, the portable oxygen concentrators and cylinders market with the quickest rate of growth, chronic respiratory diseases like asthma and COPD are becoming more common, especially in areas with high pollution levels. This has greatly increased the need for oxygen therapy supplies.

Technological advancements, including component shrinking, Internet of Things connectivity, and improved oxygen delivery methods, have increased the devices' use and efficacy and increased their appeal in the oxygen cylinders and concentrators market. Due to the pandemic, there has been an increase in demand for oxygen concentrators and cylinders since these supplies were essential for treating the virus's severe respiratory symptoms.

Oxygen cylinders and concentrators, both portable and stationary, make up the oxygen cylinders and concentrators market. Because they're portable and simple to use, portable devices are becoming more and more popular. Hospitals, home healthcare settings, and ambulatory care are the main end-users. Hospitals continue to be the largest market, but home healthcare is expanding at the quickest rate because more people are choosing to receive their medical treatment at home.

Purchasing and maintaining oxygen cylinders and concentrators can be expensive up front, especially in low- and middle-income nations. The COVID-19 pandemic's aftereffects, expanding respiratory health difficulties, and technology improvements are all contributing to the oxygen cylinders and concentrators market robust growth for oxygen cylinders and concentrators. Nonetheless, there are still a lot of obstacles to market expansion, including expensive costs and infrastructure difficulties.

| Report Coverage | Details |

| Market Size by 2033 | USD 7.37 Billion |

| Market Size in 2023 | USD 4.69 Billion |

| Market Size in 2024 | USD 4.90 Billion |

| Market Growth Rate | CAGR of 4.63% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, End-Use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising healthcare expenditure

One important aspect is the rising prevalence of respiratory conditions such as pneumonia, asthma, and chronic obstructive pulmonary disease (COPD). The need for oxygen cylinders and concentrators is increased by the fact that these circumstances frequently call for extra oxygen. In an effort to better handle public health emergencies such as the COVID-19 pandemic, numerous governments have boosted financing for healthcare infrastructure, which includes oxygen supply systems.

Because of the increased funding, the market for oxygen concentrators and cylinders has grown. The need for the oxygen cylinders and concentrators market has increased due to the expanding number of hospitals and healthcare facilities, as well as the growing popularity of home healthcare. More transportable and effective oxygen delivery systems are required since home healthcare enables patients to get treatment in the comfort of their own homes.

Dependency on electricity for concentrators

For oxygen concentrators to work, a constant power source is needed. After drawing in and filtering the surrounding air, they provide the patient with a concentrated dose of oxygen. Oxygen concentrator demand has increased, particularly in times of health emergencies, such as the COVID-19 epidemic, underscoring the necessity of dependable power supplies. Concentrators with longer battery lives and lower power usage are the products of manufacturers' efforts to lessen reliance on a steady supply of electricity.

To guarantee a steady supply of oxygen, governments and healthcare institutions should make investments in upgrading the electrical infrastructure and offering financial assistance for backup power options. In order to lessen reliance on conventional power sources, there is an increasing emphasis on sustainable and renewable energy alternatives, such as solar-powered concentrators.

Healthcare infrastructure development

The development of healthcare infrastructure is essential, and the COVID-19 epidemic has brought attention to this point. This is especially true when it comes to oxygen cylinders and concentrators. For patients needing long-term oxygen therapy, innovations in oxygen delivery devices, such as portable and stationary oxygen concentrators, have increased accessibility and convenience.

A major obstacle still exists in the effective distribution and delivery of oxygen equipment to isolated and underprivileged locations. Constructing strong distribution networks to guarantee the prompt delivery of oxygen supplies to medical facilities, particularly those located in rural and distant places. Educating healthcare professionals on how to maintain and operate oxygen delivery systems correctly is important to guarantee their safe and efficient use.

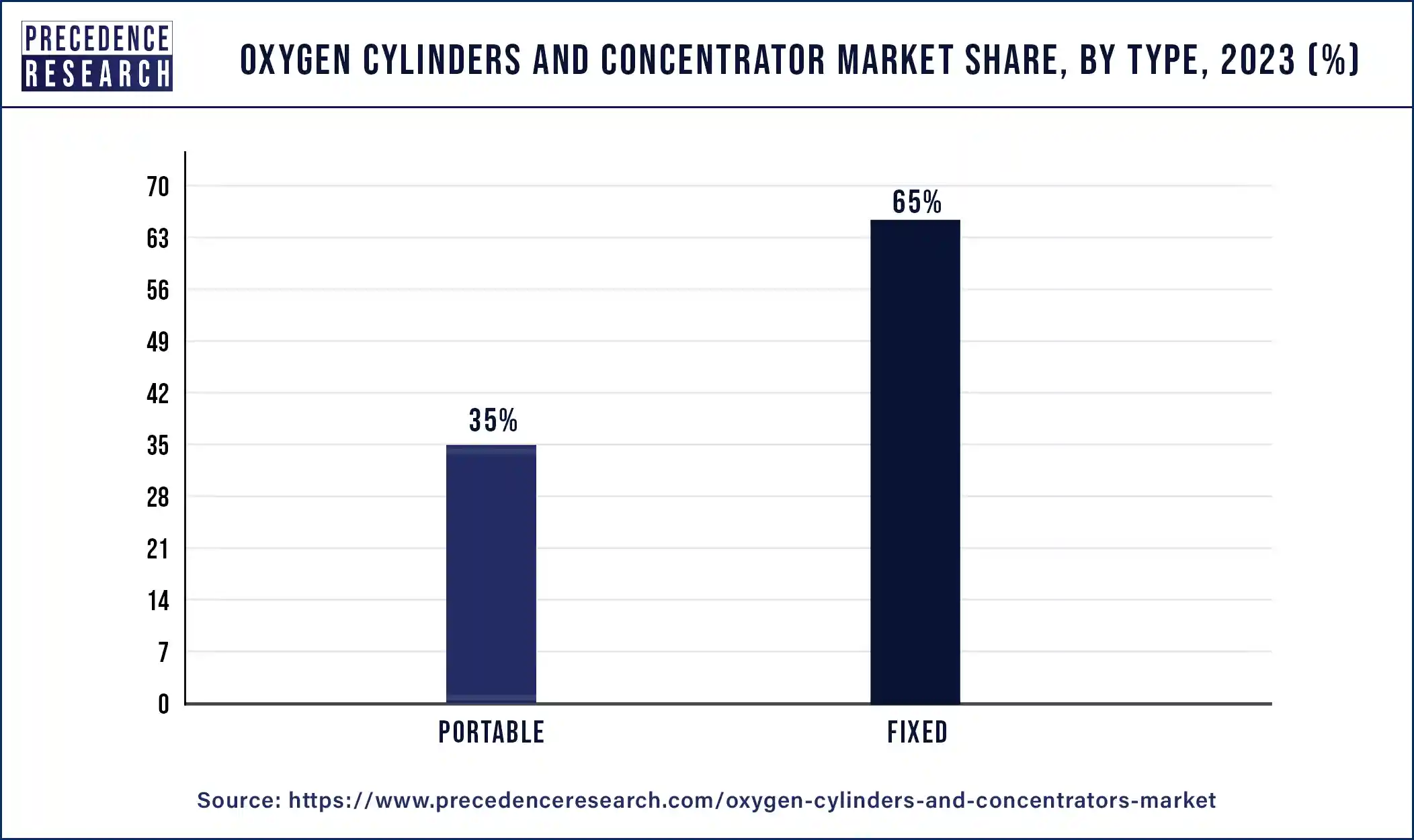

The fixed segment held the largest share of the oxygen cylinders and concentrators market in 2023. Fixed segments are market segments that are characterized by particular categories or divisions that remain largely constant throughout time. These segments frequently stand for different end-user industries, product kinds, or applications. This can entail classifying oxygen delivery systems according to their technology, design, or intended use. Fixed segments could include several types of oxygen cylinders, such as stationary or portable cylinders, or concentrators, such as continuous flow concentrators or pulse dosage concentrators. Segmenting the market based on the kinds of clients or end users. End-user segments may comprise, among others, individual customers, industrial users, emergency medical services, and healthcare facilities.

The portable segment is expected to grow at the fastest rate in the oxygen cylinders and concentrators market in 2023. In the market for oxygen cylinders and concentrators, the term "portable segment" describes a group of goods intended to give patients oxygen therapy in a portable and practical manner. In this market, oxygen cylinders are usually lightweight, compact tanks that hold compressed oxygen gas. Patients who need more oxygen on the go frequently utilize them to keep up their mobility and carry out their regular activities when they're not at home. People who require oxygen therapy outside of clinical settings, such as those recovering from surgery or illness or those with chronic respiratory disorders like COPD (chronic obstructive pulmonary disease), are served by the portable section of the oxygen cylinders and concentrators market.

The healthcare segment led the oxygen cylinders and concentrators market in 2023. In the market for oxygen cylinders and concentrators, the healthcare segment includes supplies and machinery that are mainly utilized in medical settings to give oxygen therapy to patients who are experiencing oxygen deficiency or respiratory disorders. These are transportable oxygen gas containers that have been compressed. They are frequently utilized for patients in need of extra oxygen outside of hospital settings, at home, when traveling, or in emergency medical situations. In order to immediately administer oxygen treatment to patients experiencing respiratory distress or cardiac arrest, oxygen cylinders are a critical component of emergency medical services (EMS) and hospital emergency rooms. Both oxygen cylinders and concentrators are used to treat patients with severe respiratory failure, including those on mechanical ventilation, in intensive care units (ICUs), and in critical care settings.

The manufacturing segment is expected to grow at a rapid rate in the oxygen cylinders and concentrators market. The creation of various oxygen delivery devices, including both portable and stationary systems, is the responsibility of the manufacturing segment in the market for oxygen cylinders and concentrators. This section covers every step of the process, from locating raw materials to putting the finishing touches on goods. Manufacturers of medical devices, suppliers of specialty oxygen equipment, and industrial gas businesses are usually major players in this market. Making high-pressure containers that can properly store and dispense oxygen is a necessary step in the manufacturing of oxygen cylinders. These cylinders come in a range of sizes and designs, from compact, portable devices for home use to bigger tanks used in medical facilities and commercial settings.

North America held the largest share in the oxygen cylinders and concentrators market in 2023. Because of the rising frequency of chronic respiratory diseases like COPD, asthma, and sleep apnea, there is a growing need for respiratory care, which is fueling the market for oxygen cylinders and concentrators in North America. Patients with busy lives are finding these more and more convenient, which is why demand for them is increasing. They held a large portion of the market and are predicted to keep expanding quickly.

Asia Pacific is expected to host the fastest-growing oxygen cylinders and concentrators market during the forecast period. It is anticipated that the market for oxygen concentrators and cylinders in Asia Pacific will grow significantly. Urbanization, better healthcare infrastructure, and the rise of patients with chronic respiratory illnesses are some of the factors driving this trend. The feasibility of home healthcare is increasing due to advancements in portable and user-friendly oxygen concentrators, which are especially appealing in urban and semi-urban regions.

Oxygen cylinders and concentrators can be prohibitively expensive, especially in low-income areas. This covers not only the purchase price but also the costs associated with upkeep and operation. The oxygen cylinders and concentrators market in Asia Pacific is expected to develop significantly due to changing demographics and rising healthcare demands.

Segment Covered in the Report

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

November 2024

October 2024