February 2025

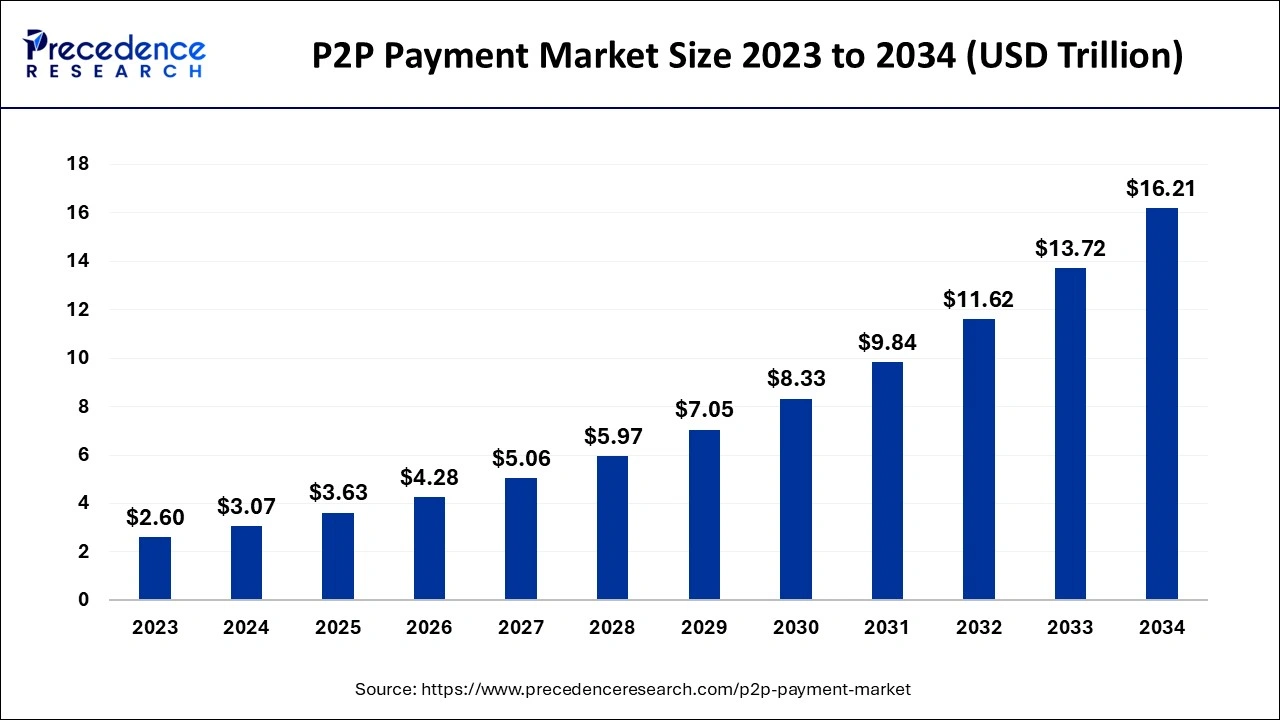

The global P2P payment market size accounted for USD 3.07 trillion in 2024, grew to USD 3.63 trillion in 2025 and is predicted to surpass around USD 16.21 trillion by 2034, representing a healthy CAGR of 18.10% between 2024 and 2034.

The global P2P payment market size is accounted for USD 3.07 trillion in 2024 and is anticipated to reach around USD 16.21 trillion by 2034, growing at a CAGR of 18.10% from 2024 to 2034.

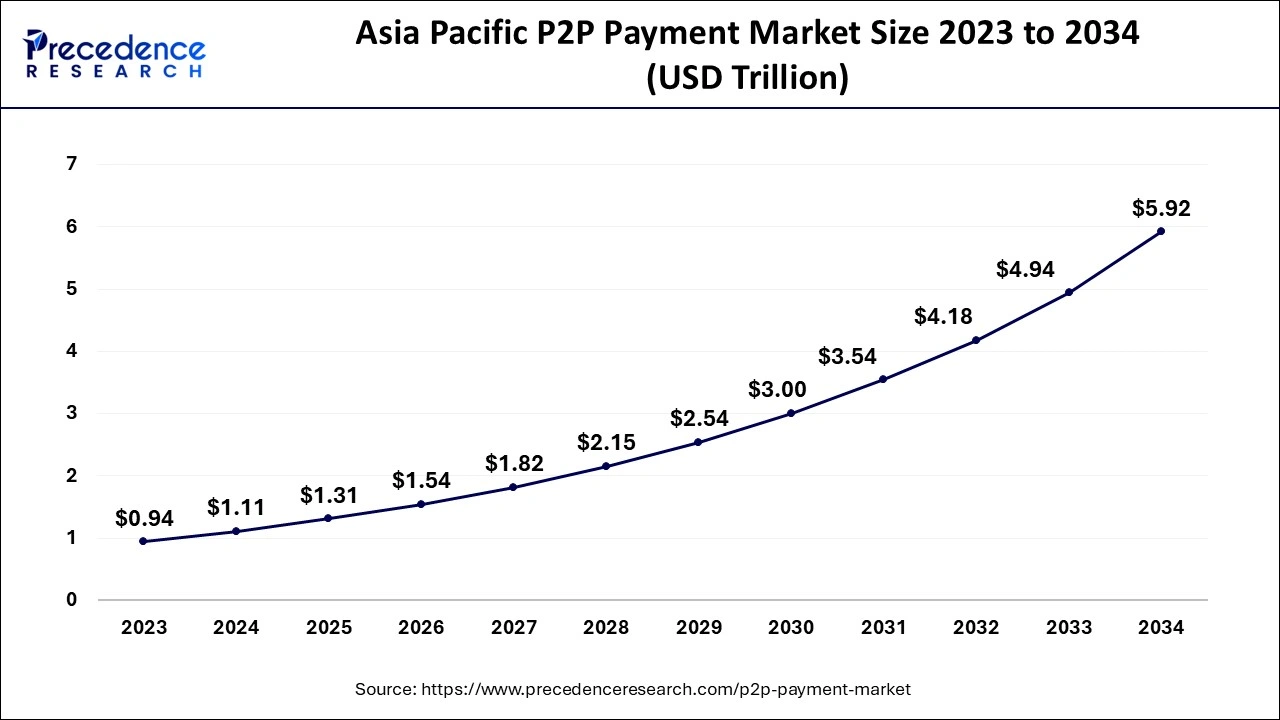

The Asia Pacific P2P payment market size is evaluated at USD 1.11 trillion in 2024 and is predicted to be worth around USD 5.92 trillion by 2034, rising at a CAGR of 18.21% from 2024 to 2034.

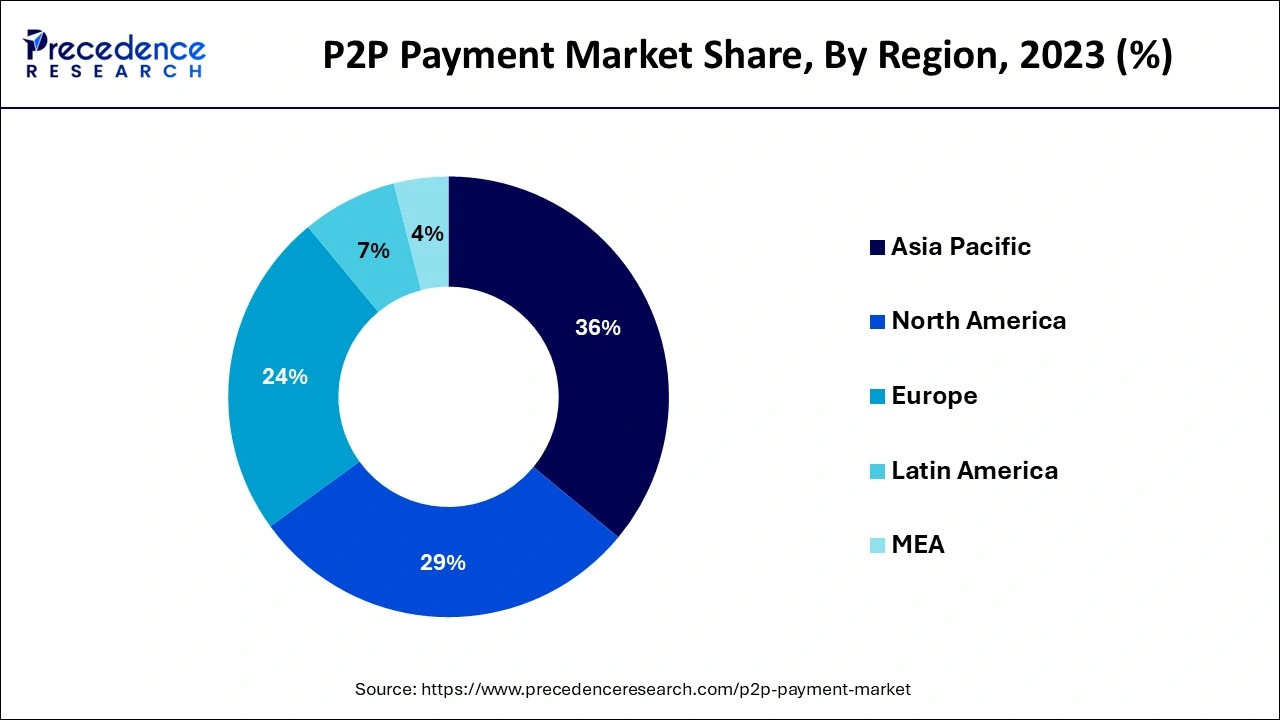

Asia Pacific region led the market in 2023 with highest revenue share. Over the projection period, the evolving way of life, most up to date internet shopping patterns, and higher cell phone entrance are probably going to fuel local market development. The growing government drives to go credit only all through Asia Pacific nations are probably going to produce expected possibilities for the provincial business. The fast utilization of versatile innovation in developing business sectors furnishes fintech firms and saves money with another road for giving portable financial answers for underserved and unbanked individuals in provincial spots.

North America is supposed to increment fundamentally all through the anticipated period. It is recognized by the interest of different huge market members. The region has additionally been an early client of state of the art innovations. The extending number of automated stores in the United States is likewise pushing versatile instalment use.

The development of the web based business is generally to fault for the far and wide utilization of versatile instalment arrangements in North America. Far off instalments are turning out to be more famous, particularly with the beginning of the COVID-19 pandemic, since they require no immediate association while making instalments. A few organizations are making distant instalment applications that empower clients to make buys from anyplace. Sum-up, for instance, reported the send-off of versatile instalments and invoicing across Europe in March 2020 to help clients in paying from a distance and safely through cell phones. The developing utilization of virtual terminals for remote charging is projected to fuel classification extension. Over the projection period, the closeness instalment class is anticipated to develop at the quickest CAGR.

Factors like the developing m-business industry and the expanded worldwide cell phone infiltration can be connected to advertise development. A shared installment is an exchange of money starting with one individual's financial balance then onto the next individual's ledger. Moreover, P2P exchanges are started and finished by two people moving monies with banks through the web. Besides, a P2P installment framework permits clients to demand a specific measure of cash to a particular individual among their associations. Besides, due to expanded cell phone use and m-business acknowledgment, the heft of P2P end clients is twenty to thirty year olds. The developing utilization of the web for internet shopping is probably going to drive market extension all through the conjecture period.

Organizations from one side of the planet to the other are making their installment strategies dynamic, which is filling industry improvement. Versatile installment choices are fast and simple to utilize. Clients from one side of the planet to the other are progressively tolerating the thought of utilizing cell phones and tablets to pay for labor and products. Besides, because of the COVID-19 plague, both web based business and customary organizations are chipping away at answering changing client conduct, including credit only installment choices through cell phones. These variables are projected to drive market development all through the gauge period.

The covid pandemic affected market development. The ascent in wellbeing related concerns brought about by Coronavirus is additionally affecting shopper buying propensities. The plague has expanded purchaser craving for contactless installments to diminish the quantity of contacts at the hour of exchange. As per EastWestBank figures, contactless installment utilization in the United States flooded by 150 percent in 2020 contrasted with 2019. Besides, 87 percent of shoppers liked to buy in-store using contactless installment choices. Purchaser acknowledgment of internet banking, portable banking, and internet business, as well as expanded cell phone infiltration among the more youthful age, drive the development of the P2P installment business. Besides, the extension of the m-trade business in developing business sectors impacts market development.

The goal of a dispersed portion network is to diminish useful expenses by lessening the costs of genuine branches, staffing, and branch association, subsequently consoling association improvement. Shared portion networks give an effective development to borrowers to get pay, cutting down market risk for monetary benefactors. Monetary sponsor could lessen many kinds of market bets, for instance, credit expenses, joblessness levels, and property cost risk, with the use of an individual to individual organization, which influences overall association improvement. In any case, issues, for example, an expansion in information breaks and security worries in P2P installments are projected to obstruct industry development. Running against the norm, expanded interest for speedy and simple exchange administrations, as well as expanded utilization of NFC, RFID, and have card imitating advances in P2P installments, are probably going to give rewarding potential to showcase development all through the projection period. During the projected period, the portable web installments area is probably going to acquire a huge offer.

Versatile web-based installments are the most widely recognized and favored method for directing portable installments since purchasers basically require a cell phone, which upholds improvement in this section's P2P installment industry. Notwithstanding, because of a few advantages of NFC innovation, for example, further developed security, quicker exchange handling, and expanded interest for NFC innovation among end clients, the close to handle correspondence area is anticipated to create at the quickest rate all through the projection period.

| Report Coverage | Details |

| Market Size by 2024 | USD 3.07 Trillion |

| Market Size by 2034 | USD 16.21 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 18.10% |

| Asia Pacific Market Share in 2023 | 36% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Payment Type, Application, End user, Geography |

In 2023, the Business to Business segment had an income portion of more than 62%. Confidential value and adventure finance organizations' forceful interests in B2B installments are giving new development possibilities. For instance, Rupifi, a B2B installment application supplier, got USD 25 million in a series-A series of speculation drove by Tiger Global Management, LLC and Bessemer Venture Partners in January 2022. Rupifi plans to utilize this cash to foster a full B2B checkout item as well as omnichannel portable first B2B installments answers for wholesalers, dealers, and merchants.

Moreover, banks are quickly embracing B2B portable installments to work on the experience for business clients. Over the projected period, the B2C class is anticipated to develop at the quickest CAGR.

Purchasers make B2C installments when they purchase an item or buy into a help for individual use. The rising extent of portable installments in the web based business vertical is impelling the fragment's development. As per a SalesForce review, portable clients represent 60% of all internet business traffic around the world. The developing worldwide acknowledgment of computerized wallets is probably going to support B2C area development all through the projection period.

The worldwide P2P Payment Market is separated into three portions in light of exchange mode: NFC/Smartcard, SMS, and Mobile Apps. A solid interest for NFC/smartcards will in all probability help customers serve better by giving a simple and bother free installment strategy. Independent venture credits are conjecture to have the greatest volume share and to increment at the quickest CAGR. Worldwide Peer-to-Peer installment framework End-client portions incorporate Real Estate installments, Consumer Credit installments, Student installments, and Small Business installments. This extension is owing to an expansion in the quantity of private ventures in nations like India and Singapore.

The versatile web installment segment will lead the market in upcoming year. The section's ascent can be credited to the security and adaptability presented by versatile web-based instalment choices. The expanded notoriety of m-business additionally looks good for the portion's development. Clients can without much of a stretch return to or share the versatile web-based instalment frameworks since they have a URL and might be accurately bookmarked.

Over the projected period, the close field correspondence class is anticipated to develop at the quickest CAGR. NFC innovation empowers retailers to integrate client dedication programs into their instalment cycles and clients to reclaim coupons utilizing cell phones rapidly. The increment of web based business stages and the constant utilization of state of the art innovation in monetary exchanges are probably going to help the section's development. The developing fame of wearable instalment gadgets, as well as the creating versatile trade pattern, is probably going to speed up the reception of NFC-based instalments. During the COVID-19 epidemic, many banks and money related establishments are giving their purchasers with new high level contraptions and approaches, like flexible portion and dispersed portions, which have seen huge take-up. Plus, the overall extension in mobile phone entrance makes improvement potential for the P2P portion business. Besides, a couple of banks and fintech associations are executing dispersed portions to ease setbacks achieved by the pandemic crisis and addition their slice of the pie. Plus, the rising in COVID-19 patients generally through the world has incited numerous people to use P2P portion procedures to move cash to relatives in a wellbeing related emergency, supporting the improvement of the P2P portion business in a pandemic crisis.

The banking and finance classification drove the market. A few banks are endeavouring to forcefully advance portable instalments, adding to the fragment's turn of events. Organizations are likewise dealing with carrying out a tweaked set-up of complete instalment answers for address explicit troubles in the abundance the executives, loaning, and protection areas. Portable banking and instalments give up new roads to banks to give more noteworthy comfort to existing clients while likewise arriving at countless unbanked clients in arising countries.

Over the projected period, the retail and online business industry is anticipated to develop at the quickest CAGR. The rising number of cell phone clients and the subsequent expansion in portable trade deals forecast well for the fragment's development. Cell phone applications are rapidly turning into the most well-known technique to purchase. As per the J.P. Morgan 2020 E-trade Payments Trends Report, 54% of versatile business instalments are made utilizing specific shopping applications. Expanded cross-line accepting is another significant explanation expanding the pattern for versatile instalments. A few banks are endeavouring to forcefully advance portable instalments, adding to the fragment's turn of events. Organizations are likewise dealing with carrying out a modified set-up of complete instalment answers for address explicit troubles in the abundance the executives, loaning, and protection areas. Versatile banking and instalments give up new roads to banks to give more noteworthy comfort to existing clients while likewise arriving at countless unbanked clients in arising countries.

Over the projected period, the retail and web based business industry is anticipated to develop at the quickest CAGR. The rising number of cell phone clients and the subsequent expansion in versatile trade deals forecast well for the fragment's development. Cell phone applications are rapidly turning into the most well-known technique to purchase.

By Type

By Payment Type

By Application

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

January 2025

December 2024