December 2024

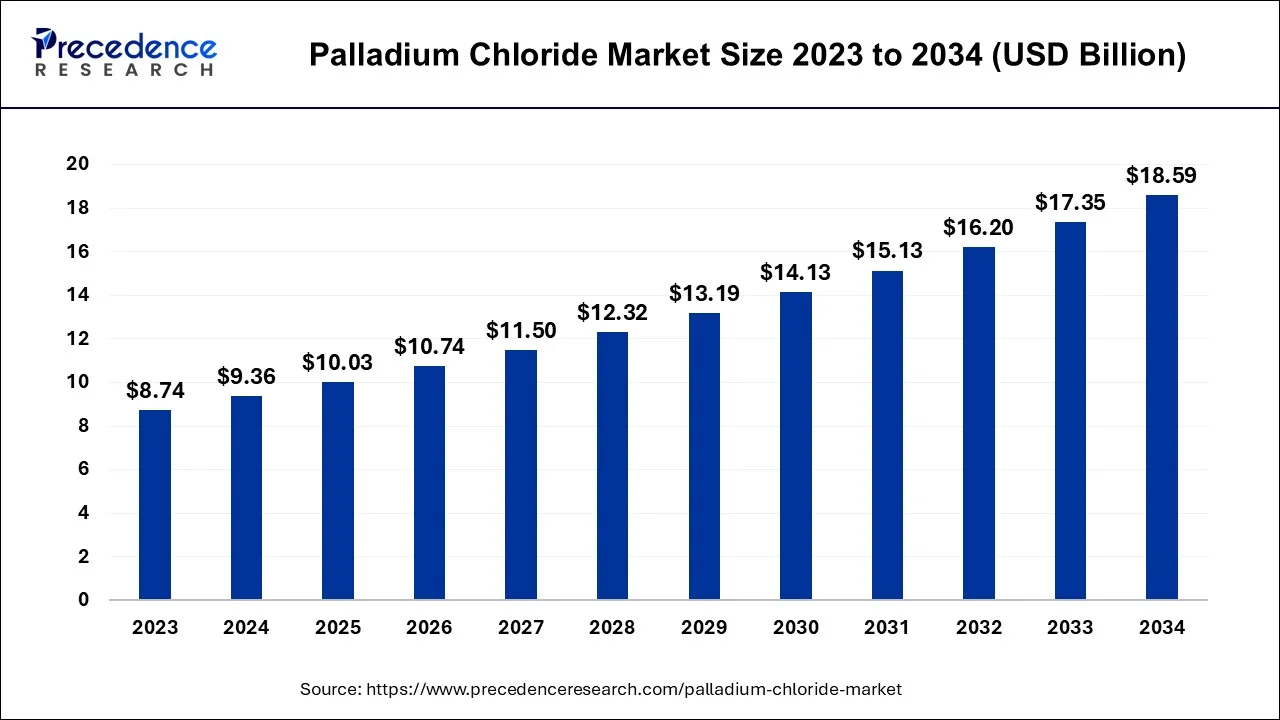

The global palladium chloride market size is estimated at USD 9.36 billion in 2024, grew to USD 10.03 billion in 2025 and is predicted to hit around USD 18.59 billion by 2034, expanding at a CAGR of 7.10% between 2024 and 2034. The North America palladium chloride market size accounted for USD 3.56 billion in 2024 and is anticipated to grow at a fastest CAGR of 7.23% during the forecast year.

The global palladium chloride market size accounted for USD 9.36 billion in 2024 and is anticipated to reach around USD 18.59 billion by 2034, rising at a CAGR of 7.10% between 2024 and 2034.

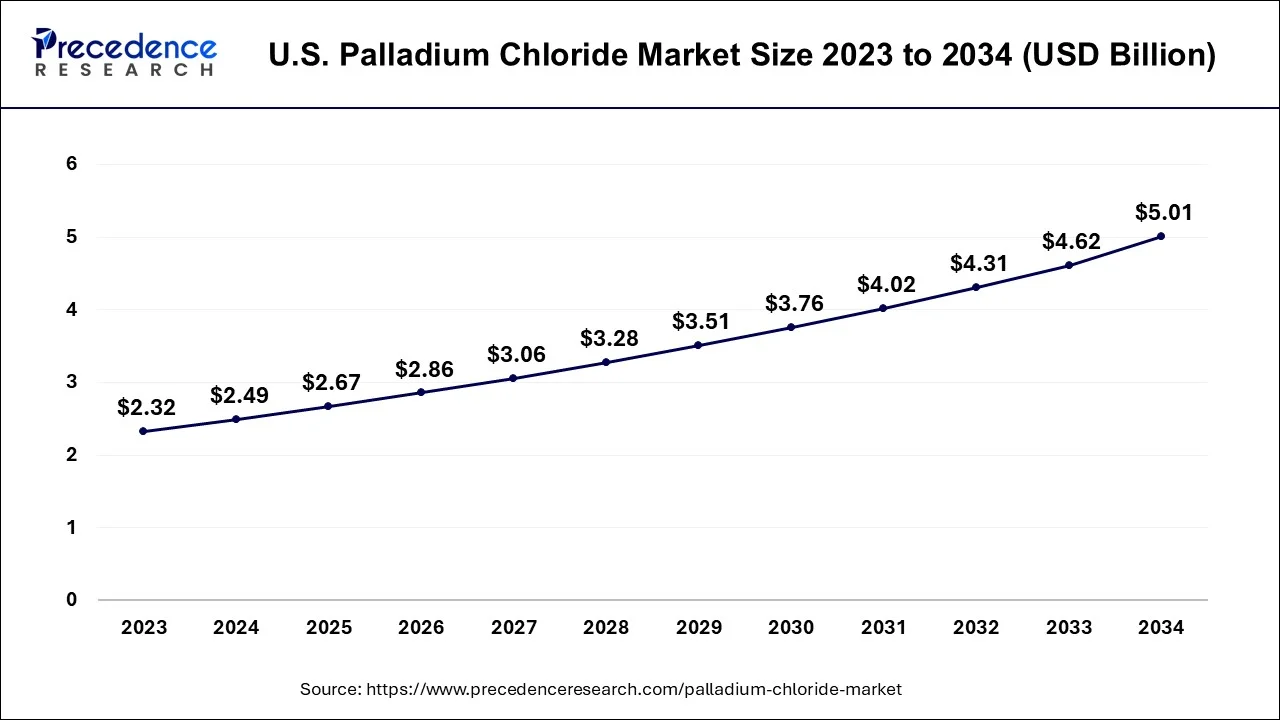

The U.S. palladium chloride market size ie estimated at USD 2.49 billion in 2024 and is expected to be worth around USD 5.01 billion by 2034, growing at a CAGR of 7.24% between 2024 and 2034.

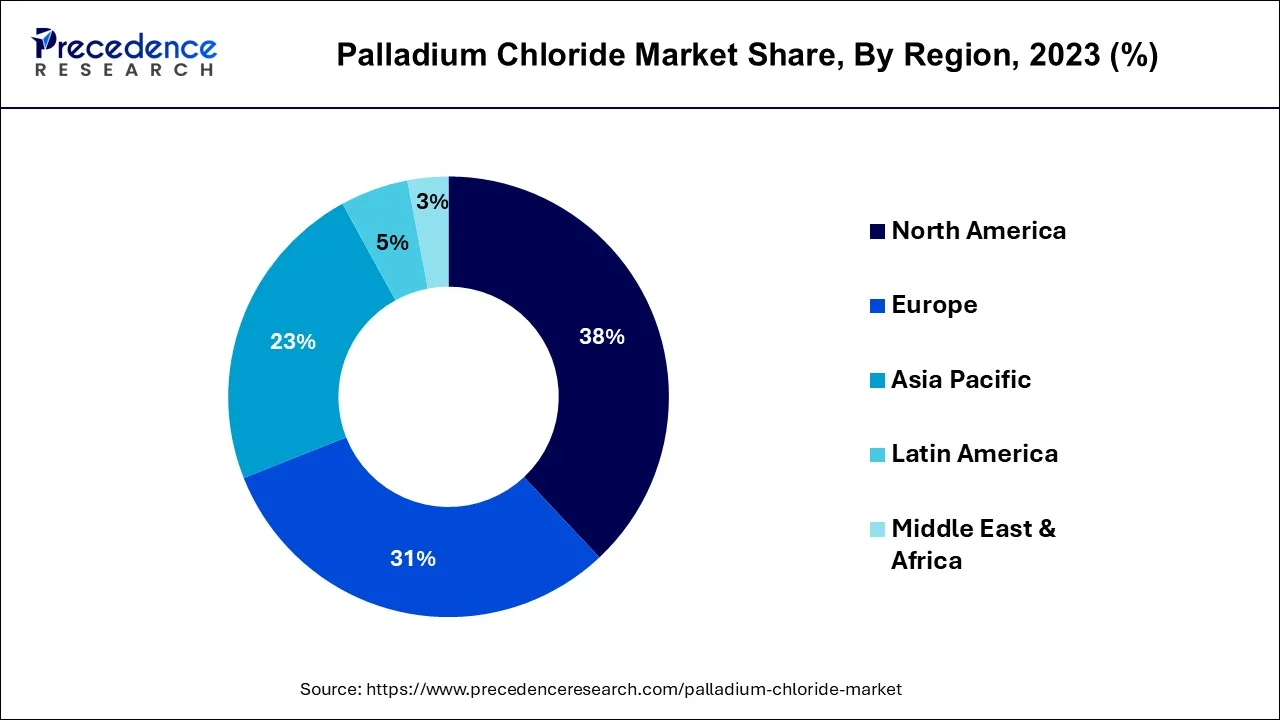

North America has held the largest revenue share 38% in 2023. North America's palladium chloride market is characterized by a strong focus on research and innovation, with the United States being a key player in catalysis and electronics. Stringent environmental regulations are driving the adoption of greener chemistry practices, thereby influencing the use of palladium chloride. Additionally, the automotive industry's demand for palladium in catalytic converters remains robust. North America's market is poised for steady growth as it aligns with sustainability trends and ongoing research.

Asia Pacific is estimated to observe the fastest expansion. The region is witnessing robust growth in the palladium chloride market. Rapid industrialization and the electronics manufacturing sector's expansion have heightened the demand for palladium chloride, particularly in China, South Korea, and Japan. The shift towards cleaner energy sources, including fuel cells, also presents significant opportunities. Moreover, emerging markets like India offer untapped potential. Asia Pacific's market is dynamic, with increasing applications and expanding consumer bases, making it a prominent player in the global market.

A strong focus on sustainability and green chemistry practices marks the palladium chloride market in Europe. The region emphasizes strict environmental regulations, driving the adoption of eco-friendly palladium chloride applications. Additionally, the automotive sector's demand for palladium in catalytic converters aligns with the growing emphasis on reducing emissions. Europe's market combines traditional applications with emerging green technologies, positioning it as a vital contributor to the global palladium chloride industry.

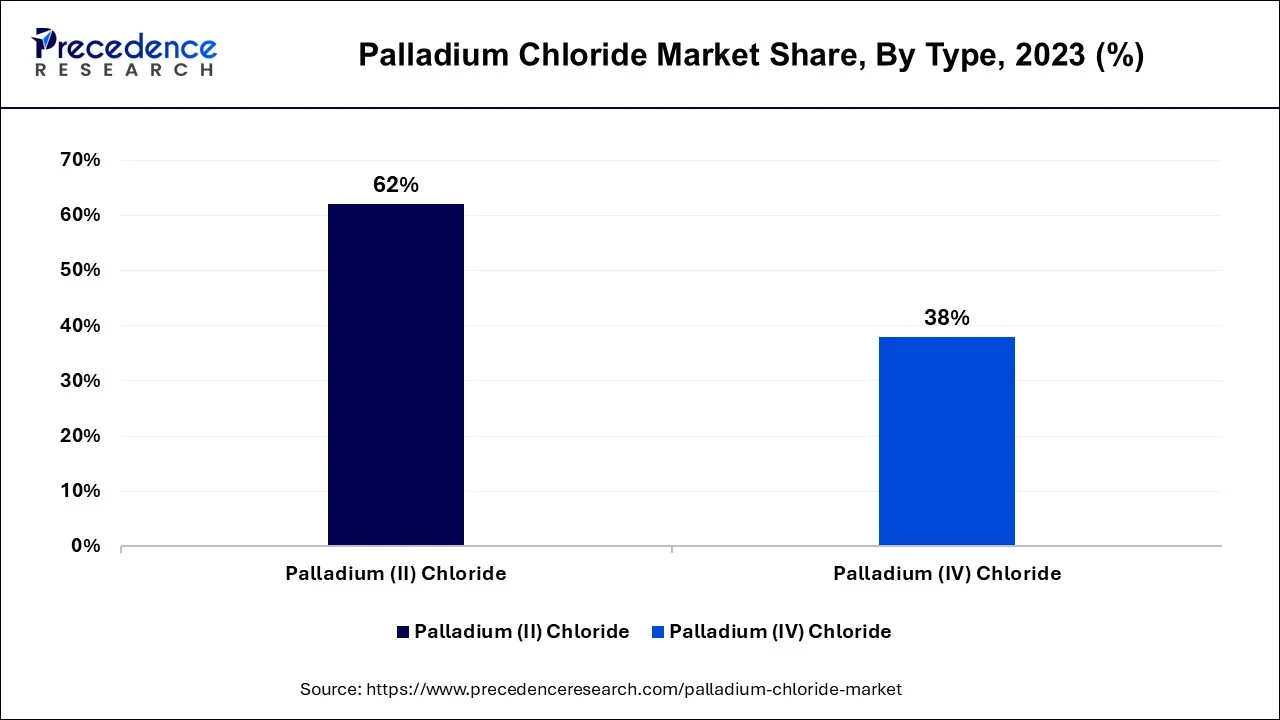

The palladium chloride market pertains to the trade and distribution of palladium chloride, a chemical compound with various applications. This market primarily involves two common forms palladium (II) chloride and palladium (IV) chloride. Palladium chloride serves as a crucial catalyst in numerous chemical reactions and is widely used in chemical synthesis and electroplating processes.

It finds applications in the chemical industry, electronics manufacturing, metallurgy, and laboratories. The market caters to the demand from these sectors, providing them with this essential chemical for their diverse applications, and contributing to advancements in chemistry, electronics, and materials science.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.1% |

| Market Size in 2024 | USD 9.36 Billion |

| Market Size by 2034 | USD 18.59 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Metallurgical applications and electronics industry growth

Metallurgical applications and the thriving electronics industry are instrumental in surging the demand for the palladium chloride market. In metallurgy, palladium chloride is a crucial component for various alloy formulations, enhancing the mechanical and corrosion-resistant properties of metals. The increasing industrial applications, from aerospace to automotive sectors, have fueled the demand for advanced alloys, consequently boosting the need for palladium chloride.

Furthermore, the burgeoning electronics industry is a pivotal driver of demand. With ongoing consumer electronics and technology advancements, the need for top-quality electronic components and materials has seen a notable rise. Palladium chloride is utilized for electroplating processes in the electronics sector, providing the essential properties for manufacturing circuit boards, connectors, and semiconductors.

The relentless pace of innovation and the quest for miniaturization and enhanced performance in electronics drive the continuous demand for palladium chloride, making it a fundamental element in this industry. As these sectors expand, the palladium chloride market experiences robust growth, positioning itself as a critical player in various industrial applications.

Environmental regulations, palladium availability and cost

Environmental regulations, limited palladium availability, and cost constraints pose significant challenges to the palladium chloride market, potentially restraining its demand. Stringent environmental regulations require careful handling and disposal of palladium chloride waste, increasing the operational and compliance costs for manufacturers. These regulations may necessitate investments in advanced waste management and treatment processes, which can strain profit margins.

The limited availability of palladium, a precious metal, can lead to price volatility, affecting the overall cost structure of palladium chloride production. Scarcity and price fluctuations can lead to unpredictable production costs, potentially making palladium chloride less economically viable for certain applications. Moreover, increased demand for palladium in other industries, such as automotive catalytic converters, can create supply challenges for palladium chloride manufacturers. These constraints on availability and cost may discourage potential users from adopting palladium chloride in their processes, hampering market demand.

Expansion into developing markets and exploring new applications

Expansion into developing markets and exploring new applications are key drivers that significantly surge the demand for the palladium chloride market. As developing economies experience rapid industrialization and technological growth, the need for palladium chloride escalates. These markets offer untapped opportunities for the chemical and electronics industries, both major consumers of palladium chloride. Expansion into these regions provides fresh consumer bases and can lead to increased sales and market exposure.

Furthermore, the exploration of new applications opens doors for innovative uses of palladium chloride. This involves diversifying its role beyond traditional applications, such as catalysis and electroplating, into emerging sectors like green energy and fuel cell technology. As the world shifts towards cleaner and more sustainable practices, palladium chloride's use in green technologies becomes particularly promising. This shift drives research and development, resulting in novel applications and increasing demand. Consequently, expansion into developing markets and embracing new applications not only bolsters the palladium chloride market but also positions it for long-term growth and adaptability in a rapidly changing industrial landscape.

Impact of COVID-19

The COVID-19 pandemic left a significant impact on the palladium chloride market. Initially, the market experienced disruptions in the supply chain and production processes due to lockdowns and restrictions. This caused volatility in palladium prices, affecting the cost of palladium chloride production. Moreover, reduced industrial activities in the early days of the pandemic led to a temporary decline in demand, particularly in the automotive sector, which utilizes palladium in catalytic converters.

As the world adapted to the new normal, the market witnessed a resurgence. The growing demand for electronics, especially for remote work and communication, stimulated the need for palladium chloride in electroplating.

The emphasis on green chemistry and the expansion of clean energy technologies boosted palladium chloride's application in fuel cells, providing a new avenue for market growth. Overall, the market demonstrated resilience and adaptability in the face of pandemic challenges, ultimately rebounding with renewed opportunities.

According to the type, the palladium (II) chloride segment has held a 62% revenue share in 2023. Palladium (II) chloride is a common form of palladium chloride, featuring palladium in a +2 oxidation state. It is a versatile catalyst widely used in chemical synthesis, catalytic processes, and electroplating. A key trend in the palladium chloride market related to this form is its sustained demand in catalytic applications, particularly in pharmaceutical and fine chemical production, driving the market's growth.

The palladium (IV) chloride segment is anticipated to expand at a significant CAGR of 10.8% during the projected period. Palladium (IV) chloride is another variant that involves palladium in a +4 oxidation state. It has more specialized uses in certain chemical reactions. In the market, a trend is emerging towards exploring its potential in niche applications, driven by ongoing research and development efforts to harness its unique properties for specific chemical processes.

Based on the application, catalysis segment is anticipated to hold the largest market share of 39% in 2023. Catalysis involves palladium chloride's use as a catalyst to facilitate chemical reactions. A notable trend is the increasing adoption of palladium chloride in pharmaceutical and fine chemical manufacturing. Its efficiency in promoting selective reactions has gained prominence, contributing to the growth of the market. Green chemistry practices have driven research into sustainable catalytic processes using palladium chloride, aligning with the global shift toward environmentally friendly chemical production.

On the other hand, the chemical synthesis segment is projected to grow at the fastest rate over the projected period. In chemical synthesis, palladium chloride plays a pivotal role in forming various compounds. A key trend is its application in the synthesis of complex organic molecules, including pharmaceutical intermediates. The market is witnessing a surge in demand for palladium chloride for these purposes, driven by advances in synthetic chemistry and the quest for more efficient and precise chemical reactions. This trend underscores the compound's versatility and continued relevance in chemical synthesis.

In 2023, the chemical industry segment had the highest market share of 42% on the basis of the end user. In the palladium chloride Market, the chemical industry is a prominent end-user. Palladium chloride acts as a catalyst in various chemical reactions, notably in the production of fine chemicals and pharmaceuticals. A key trend in this sector is the increasing adoption of palladium chloride for sustainable and green chemistry practices, aligning with environmental regulations and consumer demands for eco-friendly products.

The metallurgy segment is anticipated to expand at the fastest rate over the projected period. Metallurgy is another significant end-user, utilizing palladium chloride, especially in alloy production. A trend in this sector is the development of advanced metallurgical processes that require palladium chloride to enhance the properties of alloys, making them suitable for specific applications. This highlights the vital role palladium chloride plays in shaping metallurgical advancements.

Segments Covered in the Report

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

February 2025

August 2024