List of Contents

Palletizer Market Size and Forecast 2025 to 2034

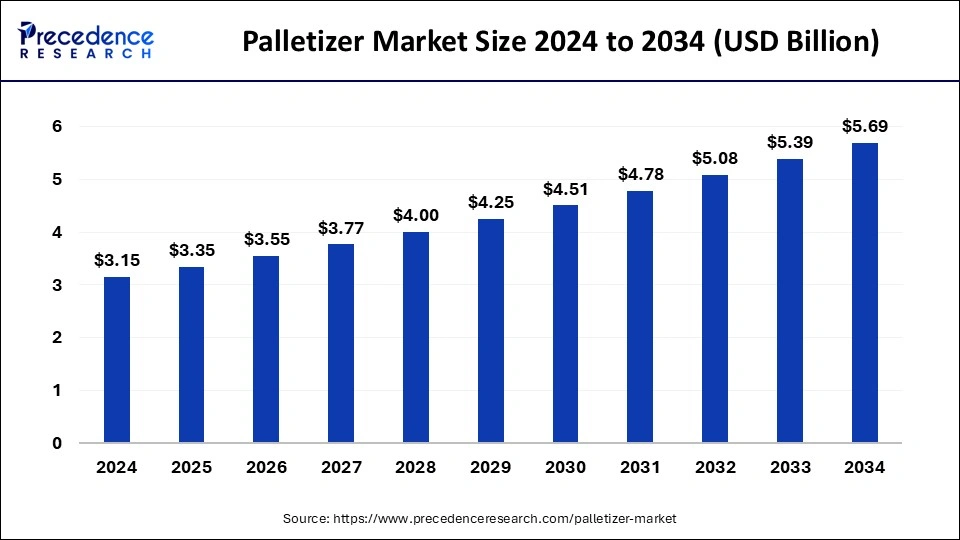

The global palletizer market size accounted for USD 3.15 billion in 2024 and is predicted to increase from USD 3.35 billion in 2025 to approximately USD 5.69 billion by 2034, expanding at a CAGR of 6.09% from 2025 to 2034. The rise in the demand for the palletizing system due to increasing concern about fragile goods, smaller items, and the declining number of skilled individuals is estimated to drive the growth of the global palletizer market over the forecast period.

Palletizer Market Key Takeaways

- The global palletizer market was valued at USD 3.15 billion in 2024.

- It is projected to reach USD 5.69 billion by 2034.

- The palletizer market is expected to grow at a CAGR of 6.09% from 2025 to 2034.

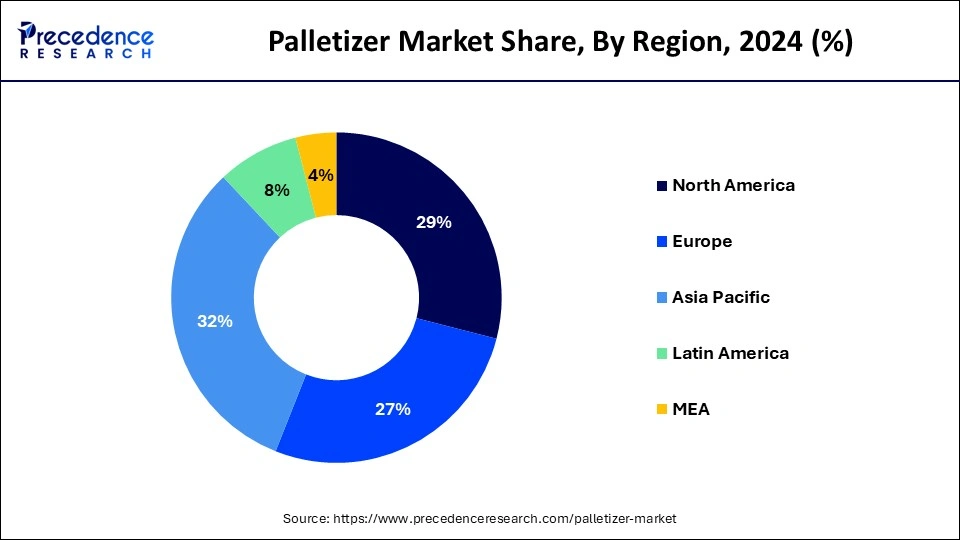

- Asia Pacific dominated the market with the largest revenue share of 32% in 2024.

- By technology, the conventional palletizers segment dominated the market with the largest share in 2024.

- By product type, the boxes and cases segment is expected to grow at significant rate during the forecast period.

- By end user, the pharmaceutical segment dominated the palletizer market in 2024.

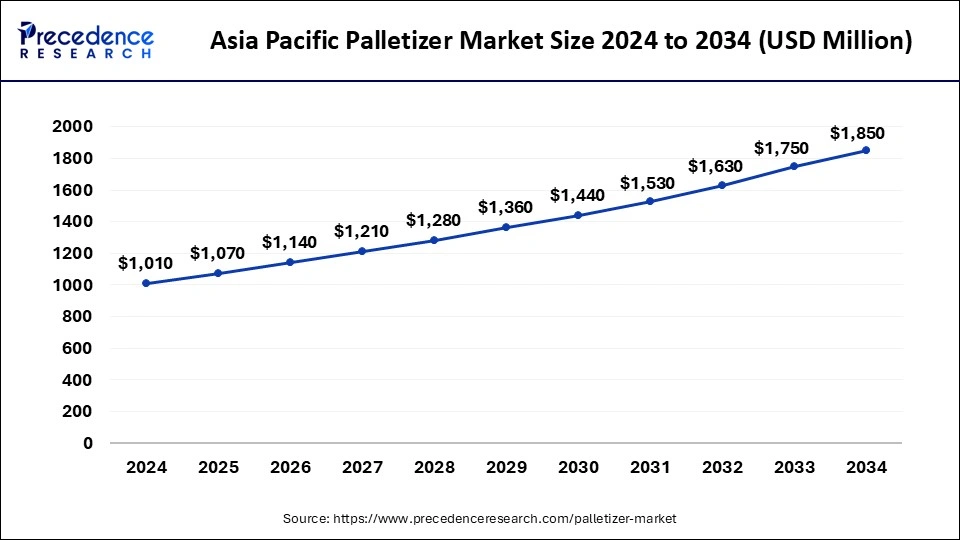

Asia Pacific Palletizer Market Size and Growth 2025 to 2034

The Asia Pacific palletizer market size was exhibited at USD 1,010 million in 2024 and is projected to be worth around USD 1,850 million by 2034, growing at a CAGR of 6.24% from 2025 to 2034.

North America witnessed the largest share of the palletizer market in 2024. The key players operating in the North America market are focused on developing the advanced technology robotic palletizing system integrated with artificial intelligence, which is estimated to drive the growth of the palletizer market in North America region over the forecast period.

- For instance, in February 2024, OSARO, Inc., technology solution providing company headquartered in U.S. announced the launch of the robotic palletization and depalletization system powered by artificial intelligence (AI). The OSARO SightWorks Perception Software, which is integrated into the system, enables the robot to recognize and manage packages of different sizes and materials, which are frequently stacked erratically on mixed-case pallets.

Asia Pacific is observed to be the fastest growing and lucrative marketplace due to rise in the rate of production of the consumer goods and rapid technology advancement. China, Japan, India, and the Rest of Asia Pacific make up the palletizer market, which is the one with the quickest rate of growth in the Asia Pacific area. China's economy and India's stand out as the fastest-growing in the globe. The need for automation solutions is rising across a range of industries, including manufacturing, logistics, and warehousing, as a result of the region's fast industrialization and urbanization, particularly in China, India, and Southeast Asian countries.

Effective material handling techniques are necessary due to the rise in industrial activity, and palletizers are essential for streamlining processes and increasing output. The retail and e-commerce sectors are expanding due to changing consumer tastes and rising disposable incomes. As a result, palletizing systems are becoming more and more necessary to manage the flow of goods in warehouses and distribution centers.

How Asia's Retail Industry Helps the Market to Grow?

- For instance, in May 2024, according to the data published by the National Bureau of Statistics, non-profit organization, it was estimated that based on the location of business units, retail sales of consumer products increased by 3.7 percent year over year in May, 2024 to 469.2 billion US$ in urban areas and by 4.1 percent year over year to 70.0 billion US$ in rural areas.

- Consumption trends show that in May 2024, retail sales of items reached 480.5 billion US$, up 3.6 percent from the previous year; catering industry revenue reached 58.7 billion US$, up 5.0 percent. Retail sales of items increased by 3.5 percent to 2,388.0 billion US$ from January, 2024 to May, 2024 while the catering industry's revenue increased by 8.4 percent to 297.5 billion US$.

Market Overview

Palletizing is the technique of packing a lot of similar goods onto a pallet for transportation. Stuff is piled in a way that supports stability and maintains the integrity of the product and based on weight. Palletizing was initially done by hand, with workers physically placing goods onto pallets; however, modern palletizing equipment speeds up and secures the process considerably. It can be costly and time-consuming to manually place boxes on pallets, and it can also cause exceptional stress in the workers. Loads are stacked on a row forming area in row-forming palletizing applications, and then they are relocated to another area for layer formation.

Palletizing mixed cases presents extra issues because it involves not only determining the position of the product and the robot's kinematics to pick it up, but also determining its size and the best space for it on the pallet. Recent years have seen the use of deep reinforcement learning in some research, where robotic agents are simulated to stack numerous pallets in an attempt to determine the best placement location. Certain works employ the model they have learned in practical settings.

Palletizer Market Growth Factors

- Emerging markets for palletizing system market is expected to drive the growth of the global palletizer market over the forecast period.

- Increasing government initiatives for the development of the palletizing system is estimated to fuel the growth of the market over the forecast period.

- Increasing adoption of the inorganic growth strategies such as merger is expected to drive the growth of the market over the forecast period.

- The key market players are focus on expansion of their product portfolio which is estimated to fuel the growth of the global palletizer market over the forecast period.

- Increasing automation and evolving in the manufacturing industries is expected to drive the growth of the market over the forecast period.

- Increasing adoption of the organic strategies like marketing of the products is expected to drive the growth of the global palletizer market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.69 Billion |

| Market Size in 2025 | USD 3.35 Billion |

| Market Size in 2024 | USD 3.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.09% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamic

Driver

Advantages associated with palletizing system

Due to increase in the rate of the production of consumer goods the processing, manufacturing and whole-sale companies are highly influenced by the advantages offered by the palletizing system after emerging it into workplace. The key players operating in the market have been influenced by the advantages offered by the palletizing system, which is estimated to fuel the growth of the palletizer market over the forecast period.

- For instance, in June 2023, according to the data published by the Robopac, a company that provides secondary packaging solutions, estimated the five major benefits associated with the palletizing system which have been mentioned here as follows: the palletizing system offers less product damage along with better consistency, the use of automatic palletizer reduces the labour cost, palletizing system assists in improved work retention, reduces the risk of accidents and injuries to the labours at work area and the most important benefit of palletizing is customer satisfaction.

Restraint

Some limitations and high cost for deploying palletizers

The limitations imposed by the palletizing system and high initial cost for installation can restrict the growth of the palletizer market over the forecast period. For instance, in March 2023, the Robotiq, automation & technology company, revealed some limitations and challenges occurred while working with palletizing system. Conveyors are utilized to transport goods and materials throughout establishment. They probably come first in the sequence that leads up to palletizing. Improper design or maintenance might lead to problems that impact palletizing. Pallet loading problem occurs for large number of product.

These problems can be held responsible for a large number of product defects that arise during palletizing or during future shipments. As an example, items may move during in shipment if they are arranged on a pallet too closely or too widely apart. Improper pallet wrapping of the filled pallet is a significant contributor to product damage. Wrapping is crucial because it keeps cargo safe while it's being transported. Using too much, too little, or the improper kind of stretch wrap are common issues. The financial barrier occurs for installing the machine as well as for the infrastructure required and integrating it with manufacturing plant/warehouse.

Opportunity

Palletizer integration with warehouse automation

The key players are focused on warehouse automation by the integration palletization system, which is expected to create lucrative opportunity for growth of the global palletizer market during the forecast period. When most people think of warehouse automation, they mostly think of automated storage and retrieval solutions (AS/RS). The use of automated technology, such as robotics, sensors, and software platforms, to carry out repetitive activities in a warehouse with little to no human intervention is known as warehouse automation. The major objectives of warehouse automation are to boost production, decrease errors, and increase efficiency in the warehouse setting.

- For instance, in August, 2023, Dexterity Inc., automation and technology company, announced the introduction of the Version 3.0 of its depalletizing and palletizing, software for warehouse robots. The version 3.0 of the palletizing system includes features to enhance throughtput, reduce integration and installation time and cost, higher performance flexibility.

Technology Insights

The conventional palletizers held the dominating share of the palletizer market in 2024. The technology component is segmented into robotic and conventional palletizers. A traditional palletizer is a palletizing device that methodically stacks goods into pallets using grippers, mechanical arms, or other mechanisms. In industrial settings, conventional palletizers are advantageous because to their dependability, affordability, and ease of maintenance. These systems are well-suited for applications with stable product sizes and palletizing patterns because of their demonstrated performance history and ease of use. Conventional palletizers can be space-efficient and offer design flexibility, and they are well-known for their high throughput in standardized applications.

Furthermore, the robotic palletizers segment is observed to growth at significant rate over the forecast period. Increasing launch of the advanced technology robotic palletizers is expected to drive the growth of robotic palletizer segment over the forecast period. For instance, on May 06, 2024, Doosan Robotics Inc., collaborative robot (cobot) manufacturers, announced the launch of the newest P-SERIES (PRIME-SERIES) at Automate 2024, event and exhibition of the automated system held in Ohio, U.S. Doosan Robotics' P-SERIES announcement was accompanied by the world premiere of the new P3020, the most potent palletizing cobot in existence, on the show floor.

Product Type Insights

The boxes and cases segment held the largest share of the palletizer market in 2024. The palletizers for boxes and cases are specialized devices made to automatically stack and arrange individual boxes, cartons, or cases onto pallets. These package forms, which have defined sizes and shapes that are perfect for automated palletizing procedures, are widely used in a variety of sectors. Palletizers that are automated effectively handle a large amount of merchandise that is packed into boxes and cartons, maximizing pallet load stability and optimizing stacking patterns. In the food and beverage, consumer goods, pharmaceutical, logistics, e-commerce, and retail sectors, where commodities are packaged in smaller quantities for distribution and storage, these palletizers are frequently utilized.

End User Insights

The food and beverages segment led the palletizer market in 2024. Technological advancements in robotics and artificial intelligence have enhanced the capabilities of palletizers, making them more efficient, precise, and adaptable to various production needs. Palletizers are increasingly integrated with smart manufacturing systems, allowing for real-time monitoring, data analysis, and optimization of the palletizing process.

The pharmaceutical segment is observed to grow at the fastest rate in the palletizer market during the forecast period. Pharmaceutical firms that conduct research, develop, manufacture, and distribute pharmaceuticals and treatments for medical usage are part of the palletizer market. Pharmaceutical companies make considerable use of palletizers to automate the palletization of packaged pharmaceutical goods for distribution, storage, and transit. Typically, pharmaceuticals are packaged in a variety of ways, such as cartons, blister packs, vials, and bottles. Automated palletizing solutions efficiently ensure that safety precautions are followed and that precise handling is carried out, reducing the possibility of contamination and human mistake in compliance with strict laws and quality requirements. Automated palletizers provide for scalable production quantities while preserving product quality in response to the growing demand for pharmaceutical products.

Palletizer Market Companies

- ABB

- A+F Automation + Fördertechnik GmbH

- A-B-C Packaging Machine

- Bastian Solutions, LLC

- Blenzor

- Brenton, LLC

- Clevertech S.p.A.

- CSi palletising

- CFT S.p.A. (CFT Group)

- ELETTRIC80 S.P.A.

- Eriez Manufacturing Co

- Fuji Robotics (Fuji Yusoki Kogyo Co., Ltd)

- Honeywell International, Inc.

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

- Kawasaki Heavy Industries, Ltd.

- Krones AG

- Lorenz Pan S.p.A - AG

- M.AS. Automation

- Meypack Verpackungssystemtechnik GmbH

- Kawasaki Heavy Industries, Ltd.

- Krones AG

- Lorenz Pan S.p.A - AG

- M.A.S, Automation

- Meypack Verpackungssystemtechnik GmbH

- OCME SHI

- Schneider Packaging Equipment Co. Inc.

- MB International GmbH

- Transnova-Ruf GmbH

- Möllers Packaging Technology GmbH

- KUKA AG

- Yaskawa America, Inc. (Yaskawa Europe GmbH)

- FANUC CORPORATION

- Seiko Epson Corporation

- I.H.S.d.o.o

Recent Development

- In January, 2024, FANUC announced the launch of the new M-9501A/500 robot, with a payload capacity of 500 kg. The M-950iA/500 is a serial-link robot offering a wider range of motion compared to standard parallel-link robots and can extend its arm upright anc then rotate backward with minimal interference.

- On May 06, 2024, Mujin, Inc. automation & technology firm, estimated that industry leaders who are invited for Automate 2024 are cordially invited to visit Mujin's booth (#4636) to learn more about the streamlined future of robotic automation. The latest improvements to the MujinController, which leverages machine intelligence to give robotic systems real-time decision-making power that enables genuinely autonomous, dependable, and production-capable robot applications, will be highlighted, along with Mujin's inventive vision for robotics. Executives from Mujin will also provide their professional insights on how to simplify robotics with no-code programming and what's coming up in logistics and warehousing automation, giving attendees a thorough understanding of how robotic automation is developing.

- In October 2023, Schneider Packaging Equipment Company, Inc., a Pacteon Group company, signed partnership with ITW Harness Division to enter the robotic high-speed palletizing industry. For the high-speed robotic palletizing services offered by the Harness Division, Schneider inked a licensing deal to guarantee project support in the future. The deal also covers Schneider's capacity to support systems that Hartness has already commissioned.

- In March 2023, Sidel introduced RoboAccess_ Pal S, a robotic palletizer featuring an excellent performance/footprint ratio and foldable protection in case it needs to be transferred to a different line.

Segment Covered in the Report

By Technology

- Conventional Palletizers

- High Level Palletizers

- Low Level Palletizers

- Robotic Palletizers

By Product Type

- Trays

- Kegs

- Boxes And Cases

- Buckets

- Foil Bundles

- Bags

- Crates

- Others (case, can, etc.)

By End User

- Pharmaceuticals

- Beauty & Personal Care

- Food & Beverages

- Automotive

- Tissue

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client