September 2024

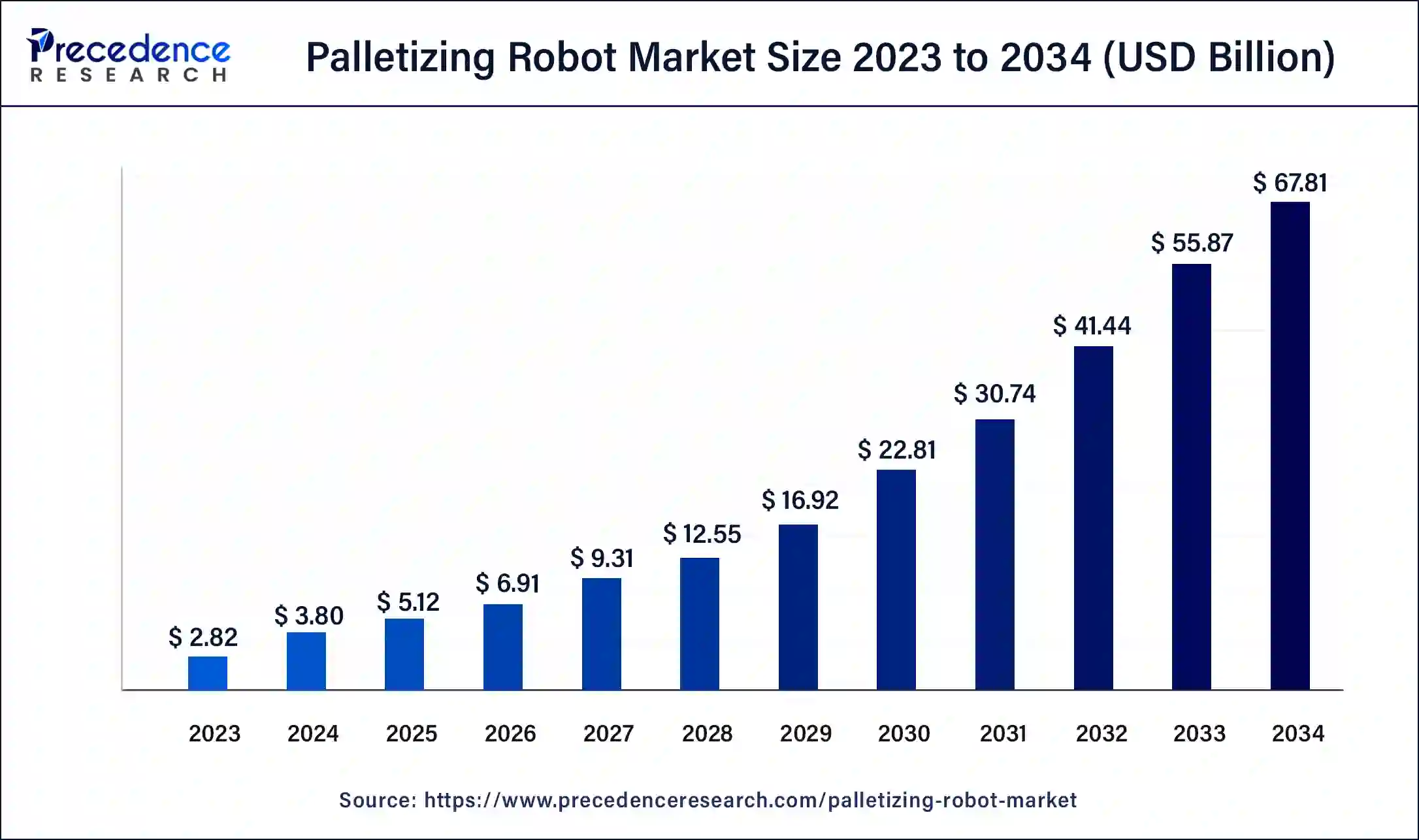

The global palletizing robot market size was USD 2.82 billion in 2023, estimated at USD 3.80 billion in 2024 and is anticipated to reach around USD 67.81 billion by 2034, expanding at a CAGR of 33.40% from 2024 to 2034.

The global palletizing robot market size accounted for USD 3.80 billion in 2024 and is predicted to reach around USD 67.81 billion by 2034, growing at a CAGR of 33.40% from 2024 to 2034.

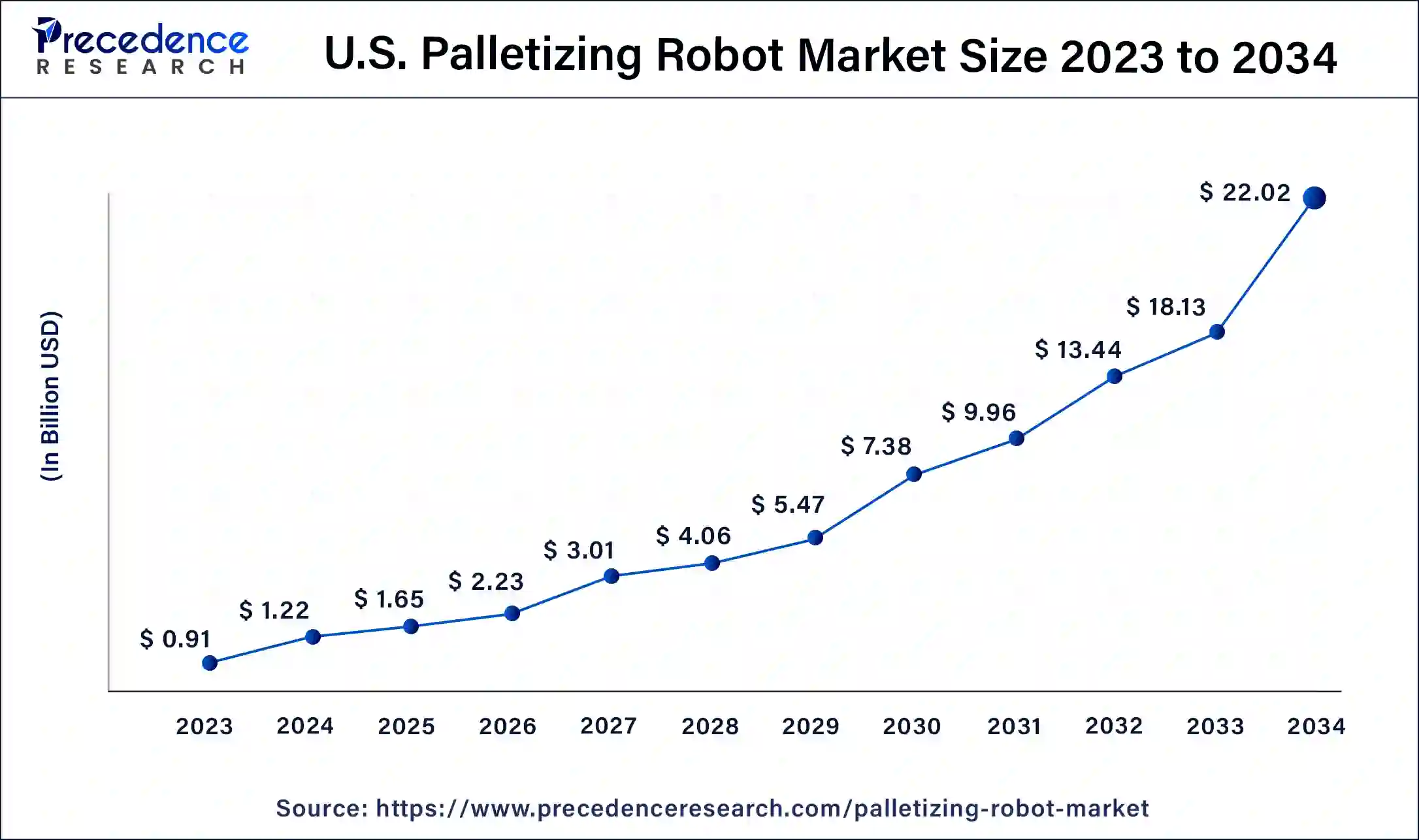

The U.S. palletizing robot market size was valued at USD 0.91 billion in 2023 and is expected to be worth around USD 22.02 billion by 2034, at a CAGR of 33.50% from 2024 to 2034.

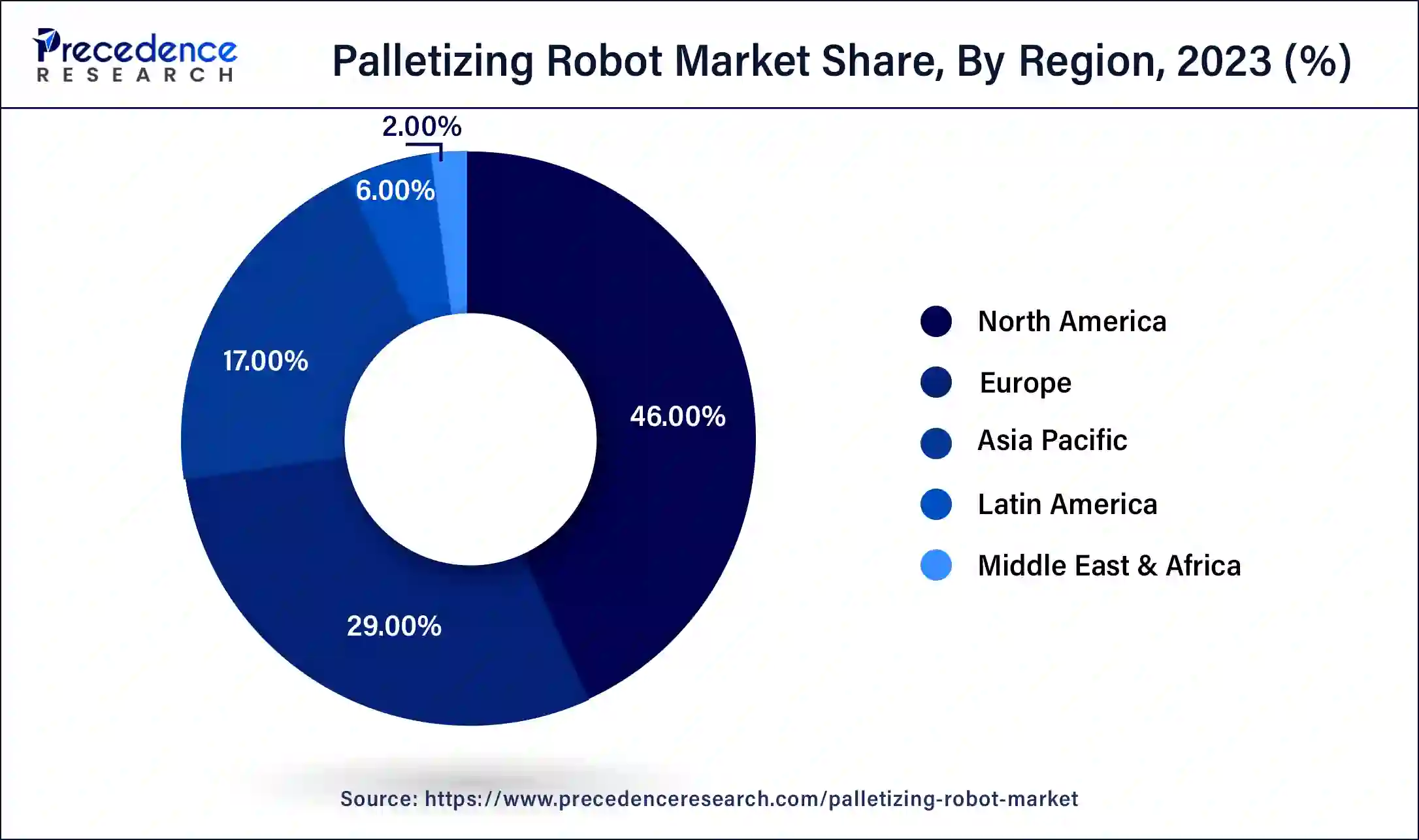

North America has held the largest revenue share 46% in 2023. In North America, the palletizing robot market is witnessing a robust growth trajectory, driven by the increasing adoption of automation in the manufacturing and logistics sectors. The region's advanced industrial landscape and emphasis on optimizing operational efficiency contribute to the widespread deployment of palletizing robots. Moreover, the demand is fueled by the growing need for cost-effective and flexible solutions in industries like food and beverage, automotive, and e-commerce.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific showcases a dynamic palletizing robot market with rapid industrialization and a surge in e-commerce activities. Countries like China, Japan, and South Korea are at the forefront of adopting advanced robotic technologies for palletizing purposes. The region benefits from a strong manufacturing base, coupled with a focus on enhancing productivity through automation. The increasing demand for consumer goods, coupled with labor shortages, propels the adoption of palletizing robots across diverse industries in Asia-Pacific.

In Europe, the palletizing robot market is characterized by a steady adoption of robotic solutions across various industries, including manufacturing and logistics. The region emphasizes efficiency improvements and resource optimization, leading to an increased integration of palletizing robots. With a strong manufacturing tradition and a focus on automation, European countries contribute significantly to the growth and evolution of the palletizing robot industry.

The palletizing robot market refers to the industry focused on robotic systems designed for palletizing applications. Palletizing robots are automated machines equipped with robotic arms and grippers, specifically tailored for stacking goods or materials on pallets. These robots enhance efficiency, reduce manual labor, and streamline the palletization process across various industries, including manufacturing and logistics. The market growth is driven by the increasing adoption of automation solutions to optimize warehouse operations, improve productivity, and meet the growing demand for efficient material handling in the global supply chain.

The palletizing robot market is witnessing robust growth as industries prioritize automation for enhanced efficiency and reduced operational costs. With advanced features like vision systems and collaborative capabilities, palletizing robots cater to diverse industrial needs, making them a pivotal component of modern material handling solutions across various sectors, including manufacturing, logistics, and e-commerce.

| Report Coverage | Details |

| Growth Rate from 20234 to 2034 | CAGR of 33.40% |

| Market Size in 2023 | USD 2.82 Billion |

| Market Size in 2023 | USD 3.80 Billion |

| Market Size by 2034 | USD 67.81 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Range, Payload, Robot Type, End Use Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automation demand and technological advancements

The palletizing robot market experiences a surge in demand driven by the dual forces of increasing automation needs and ongoing technological advancements. As industries across the globe seek to enhance operational efficiency and reduce manual labor, the demand for automated solutions has risen significantly. Palletizing robots, with their ability to streamline and automate the palletization process, have become pivotal in meeting these demands. This surge in automation demand is evident across various sectors, from manufacturing to logistics and e-commerce, where the need for efficient material handling is paramount.

Simultaneously, continuous technological advancements in robotics play a crucial role in propelling the palletizing robot market forward. These advancements encompass sophisticated features such as vision systems, collaborative capabilities, and enhanced safety measures. Technologically advanced palletizing robots not only improve overall performance but also offer increased flexibility in adapting to diverse manufacturing environments. As businesses embrace these cutting-edge solutions to stay competitive, the market for palletizing robots is poised for sustained growth, further solidifying their role as integral components in modern industrial and logistics processes.

Concerns over job displacement and integration challenges

The increasing automation of tasks through palletizing robots raises concerns about potential job displacement. As companies deploy robots for palletizing, there is apprehension about the impact on human workers. Job displacement worries arise particularly in industries where manual palletizing has been a traditional job. The fear of reduced job opportunities and the need for reskilling workers to adapt to the evolving work environment contribute to hesitancy in embracing palletizing robots.

Integrating palletizing robots into existing workflows poses challenges for businesses. Many industries already have established processes, and incorporating robots seamlessly requires significant planning and investment. Integration challenges include the need for compatible software, workforce training, and adapting infrastructure. Businesses may face disruptions during the integration phase, impacting productivity. These challenges act as barriers, preventing some companies from readily adopting palletizing robots despite their potential benefits.

Integration with Industry 4.0 technologies and collaborative palletizing robots

The surge in demand for palletizing robots is closely linked to their integration with Industry 4.0 technologies and the emergence of collaborative robots, marking a significant shift in modern material handling processes. Integration with Industry 4.0 enables these robots to be part of smart, interconnected systems, facilitating real-time data exchange and advanced automation. Palletizing robots, equipped with sensors and IoT capabilities, contribute to the creation of intelligent warehouses where they can adapt to dynamic production requirements and communicate seamlessly with other machinery.

Collaborative palletizing robots further enhance the market demand by fostering a safe and efficient working environment. These robots can work alongside human operators, optimizing the strengths of both, and ensuring flexible and adaptable palletization processes. The collaborative nature of these robots opens up possibilities for their use in diverse industries, including manufacturing, logistics, and e-commerce, where dynamic and customizable palletizing solutions are crucial. As a result, the integration of Industry 4.0 technologies and collaborative features positions palletizing robots as essential components for businesses seeking advanced, efficient, and flexible material handling solutions.

According to the product, the case palletizing segment has held a 42% revenue share in 2023. Case palletizing in the Palletizing Robot Market involves the use of robots to stack and organize individual cases of products onto pallets. This process is common in industries such as food and beverage, consumer goods, and manufacturing. A key trend in case palletizing is the adoption of vision systems and artificial intelligence to enhance accuracy in picking and placing cases on pallets, optimizing the overall efficiency of the palletizing process.

The bag palletizing segment is anticipated to expand at a significant CAGR of 38.1% during the projected period. In bag palletizing, robots are employed to handle bags of various materials, such as cement, grains, or pet food, and arrange them onto pallets. A notable trend in bag palletizing is the integration of robotic grippers and end-of-arm tools designed for precise bag manipulation. This ensures gentle handling of bags while maintaining high-speed palletizing capabilities. Additionally, advancements in machine learning algorithms enable these robots to adapt to different bag sizes and shapes, contributing to greater flexibility in bag palletizing applications.

Based on the range, the 1000-3000 mm range segment held the largest market share of 43% in 2023. Palletizing robots within the 1000-3000 mm range are characterized by their medium to high payload capacities, making them suitable for handling various-sized pallets. The trend in this range is towards increased versatility and precision, allowing these robots to efficiently palletize different products in industries such as food and beverage, logistics, and manufacturing. Their flexibility in accommodating diverse payloads and pallet sizes aligns with the growing demand for adaptable and scalable robotic solutions.

On the other hand, the above 3000 mm segment is projected to grow at the fastest rate over the projected period. Palletizing robots with a range above 3000 mm typically have higher payload capacities, catering to large and heavy palletizing tasks. The trend in this range emphasizes enhanced efficiency and speed, optimizing the handling of bulk materials and oversized pallets. These robots often feature advanced technologies such as vision systems for accurate placement, contributing to improved productivity in industries like automotive, construction materials, and large-scale manufacturing. The market demand for robots in this range reflects the need for robust and high-capacity solutions in handling substantial loads efficiently.

In 2023, the 100-300kg segment had the highest market share of 42% on the basis of the payload. Palletizing robots with a payload capacity of 100-300kg are characterized by their versatility and efficiency in handling moderate to heavy loads. These robots find widespread applications in industries with diverse palletizing needs, including food and beverage, manufacturing, and logistics. The trend in this segment focuses on enhancing speed, precision, and adaptability, allowing these robots to seamlessly integrate into dynamic production environments and accommodate various packaging sizes and weights.

The above 500kg segment is anticipated to expand at the fastest rate over the projected period. Palletizing robots with a payload above 500kg are designed for heavy-duty tasks, catering to industries with substantial material handling requirements such as automotive, construction, and large-scale manufacturing. The trend in this category revolves around robustness, advanced safety features, and integration capabilities with other automation systems. These high-capacity robots are crucial for optimizing efficiency in applications where handling bulky or massive loads is a primary requirement, contributing to improved productivity and operational excellence.

Based on the robot type, the SCARA segment held the largest market share of 44% in 2023. SCARA (Selective Compliance Assembly Robot Arm) robots are a type of industrial robot known for their horizontal reach and precision in assembly and handling tasks. In the palletizing robot market, SCARA robots excel in applications requiring high-speed and accurate palletizing, especially in industries like food and beverage and manufacturing. Their speed and accuracy contribute to efficient palletizing operations, enhancing productivity and reducing cycle times.

On the other hand, the cobots segment is projected to grow at the fastest rate over the projected period. Cobots, or collaborative robots, are designed to work alongside humans in a shared workspace. In the palletizing robot market, cobots play a pivotal role in optimizing collaborative palletizing processes. With advanced safety features and sensors, these robots can safely collaborate with human workers, offering flexibility in handling various palletizing tasks. The trend in adopting cobots for palletizing is driven by the need for adaptive and space-efficient solutions, particularly in environments where humans and robots collaborate seamlessly.

Based on the end-use industry, the discrete manufacturing segment held the largest market share of 32% in 2023. In the palletizing robot market, discrete manufacturing refers to industries that produce distinct items, such as automotive or machinery parts. The trend in this sector involves deploying palletizing robots to automate the stacking and packaging of manufactured components. Palletizing robots enhance efficiency, reduce errors, and optimize space utilization in discrete manufacturing processes, contributing to streamlined production and logistics operations.

On the other hand, the electrical and electronics segment is projected to grow at the fastest rate over the projected period. In the realm of electrical and electronics manufacturing, palletizing robots play a pivotal role in handling fragile and intricate components. The trend focuses on implementing robots equipped with advanced vision systems and grippers to delicately palletize electronic items.

Precision and speed are paramount in this sector, and palletizing robots contribute to error-free and rapid stacking of electronic products. The adoption of collaborative robots is also increasing, ensuring a seamless interaction between human workers and robots in the palletization process for improved productivity and safety.

Segments Covered in the Report

By Product

By Range

By Payload

By Robot Type

By End Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024