January 2025

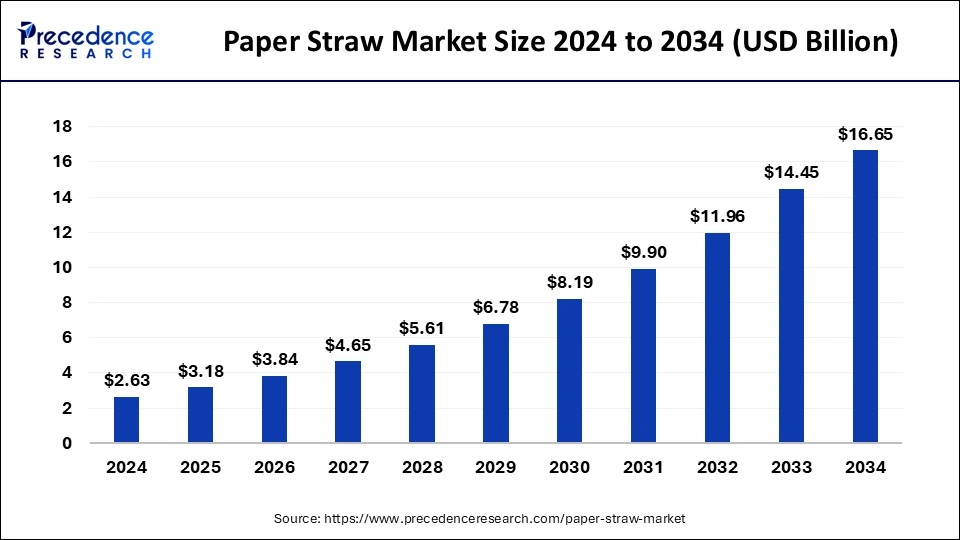

The global paper straw market size is evaluated at USD 3.18 billion in 2025 and is forecasted to hit around USD 16.65 billion by 2034, growing at a CAGR of 20.27% from 2025 to 2034. The North America market size was accounted at USD 890 million in 2024 and is expanding at a CAGR of 20.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global paper straw market size accounted for USD 2.63 billion in 2024 and is predicted to increase from USD 3.18 billion in 2025 to approximately USD 16.65 billion by 2034, expanding at a CAGR of 20.27% from 2025 to 2034. The increasing emphasis towards sustainable packaging is driving market growth.

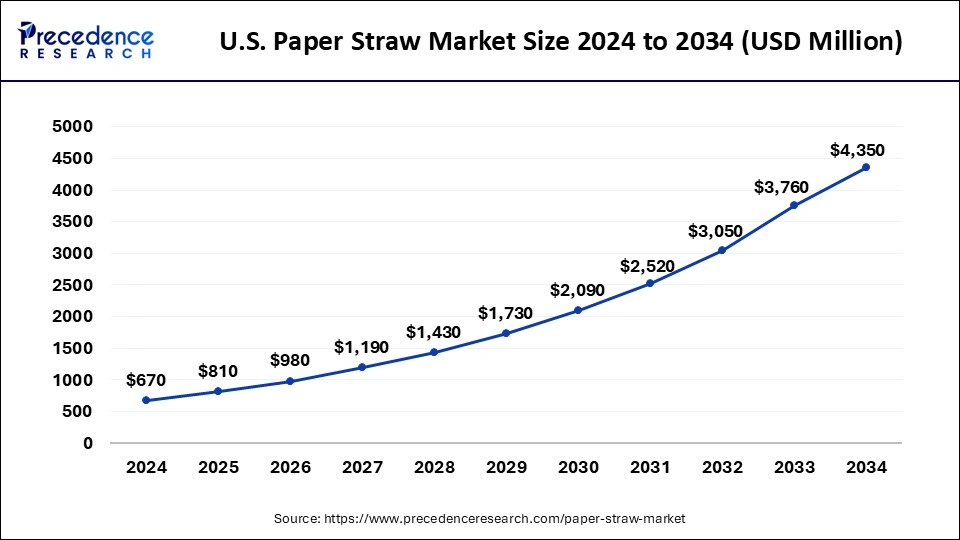

The U.S. paper straw market size was exhibited at USD 670 million in 2024 and is projected to be worth around USD 4,350 million by 2034, growing at a CAGR of 20.57% from 2025 to 2034.

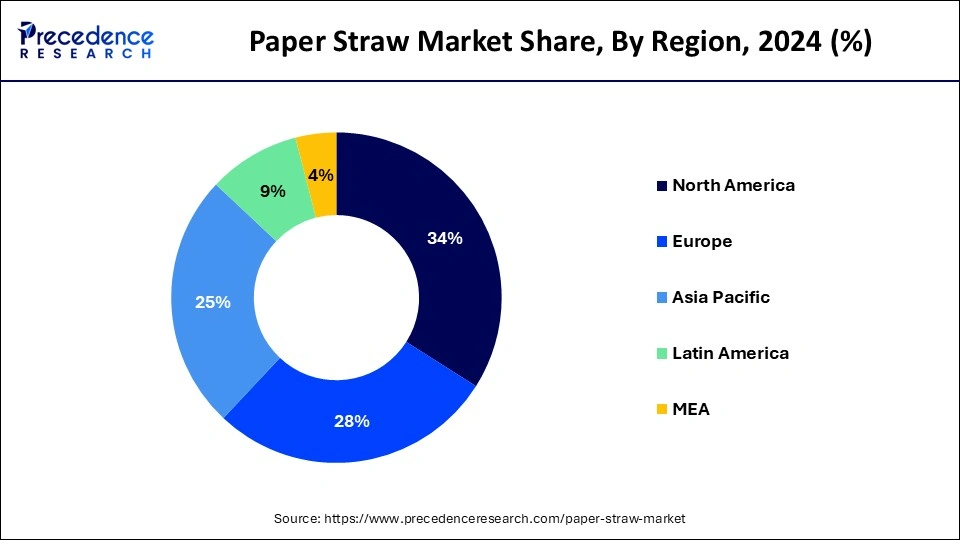

North America dominated the global paper straw market with the largest share in 2024. Countries like the United States and Canada are imposing strict regulations for eliminating the use of plastic in use of various products including straws. Additionally, the increasing use of online food delivery is driving the growth of the paper straw market. The influence of social media has played a crucial role in spreading awareness regarding the elimination of plastic which makes it a popular option in the region. North America has also been adopting advanced technologies in manufacturing and logistics, which has improved efficiency in supply chain management and distribution networks. This technological adoption has further fueled the growth of industrial distribution in the region.

Asia Pacific is expected to register the fastest growth during the forecast period 2025 to 2034. The increasing awareness among businesses is driving the growth of the paper straw market in the region. Countries like China, Japan, and India are expected to play a crucial role in the development of the region. Many governments in the region are focusing on infrastructure development, industrial policies, and trade agreements that support industrial growth. These initiatives create a conducive environment for industrial distribution activities. With a large population base and rising middle-class consumers, there is a growing domestic market for industrial products and services in Asia-Pacific. This domestic demand, coupled with export opportunities, provides a robust growth environment for industrial distributors.

The paper straw market is expected to register significant growth due to the change from plastic to sustainable production in the packaging industry. Many global food chains are also implementing the use of sustainable products due to the increasing government rules and regulations regarding the use of plastic.

The paper straw is a single-use replacement for plastic straws made from edible inks, food-grade paper and raw materials. These straws are environmentally friendly as they are made from renewable resources. These straws are biodegradable as they break into organic matter in a few months. Paper straws are gaining wide popularity as they provide convenient use in hot and cold beverages without any unpleasant smell in the drink. The paper straw market is witnessing a rapid increase in the need for paper straws due to the rapid expansion in the tourism and hospitality sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.65 Billion |

| Market Size in 2025 | USD 3.18 Billion |

| Market Size in 2024 | USD 2.63 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 20.27% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, Straw Length, Diameter, Sales Channel, End-user, and Regions |

| Regions Covered | Regions Covered |

Rising environmental concerns

The use of plastic in the past decades has worsened environmental health by affecting the ecosystem and many other things. Rising concerns about the use of plastic in straws have led to various changes including the adoption of the use of paper straws. The demand for paper straws has increased among the public due to numerous campaigns and news circulated among the youth. Three cautions will play a vital role in preserving biodiversity and contributing towards the growth of the paper straw market.

Increasing demand for online food delivery

The online food landscape has gained immense popularity, especially in urban areas due to increasing technologies in the infrastructure and the food chain connectivity. Preference towards ordering food and beverages has increased due to the doorstep delivery service which helps the people in urban areas with a busy lifestyle. In 2022, McDonald's in Japan announced the elimination of plastic straws replaced by paper straws in all their locations. This move aims to eliminate 900 tons of plastic every year.

Higher costs of manufacturing

The paper straw market has gained significant popularity in the food and beverage industry but there are some factors which could affect the market growth. Paper straw production usually requires more expensive materials, leading to higher costs than plastic straws. This would create barriers especially for the low cap companies, as they might face difficulties in generating profit. The regulatory bodies should focus on producing these products from the ground level, which could help in reducing the transportation costs and might tackle the associated problem.

Expansion in new sectors

Paper straw adoption has gained significant popularity due to increasing sustainable practices which has led to the expansion of paper straws in different sectors like hospitals where it would help patients who can't directly drink and require assistance. Paper straws in hospitality and tourism are expected to play a vital role in the upcoming years due to the increasing sustainable practices by the governments. The global influence of sustainability is expected to drive the growth of the paper straw market in the upcoming years.

Government regulations towards sustainability

The ban on plastic use in many countries is leading towards many changes in consumer patterns and then production too. Manufacturing paper straws has been promoted by governments as the use of plastic has raised many concerns in recent years. There are various agreements between organizations like the UN and G20 working to preserve biodiversity. This might help the new business to promote the use of bio-degradable products which provide tax benefits in some nations. These practices will help the paper straw market to grow in the upcoming years.

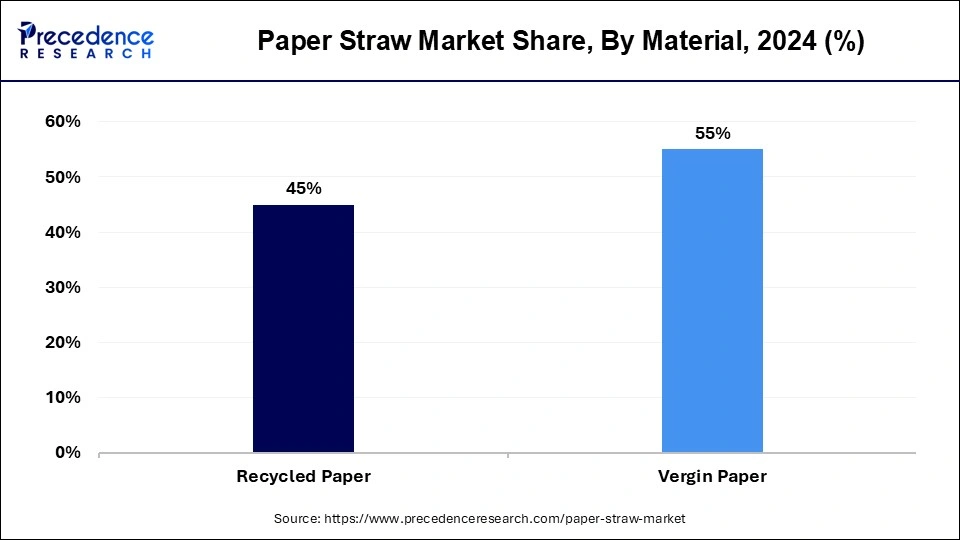

The virgin paper segment held the largest share of the paper straw market in 2024. Virgin papers are created from new wood pulp that has never been used or recycled before. Their high quality stands out as a reason behind their dominance and popularity. The high-quality material provides an option to create more designed straws. These straws are gaining popularity in the food and beverage industry due to the increasing number of online food delivery services which require high-quality straws while delivering food items. Many consumers prefer virgin paper as they do not have any previous exposure to any bacteria which would maintain the hygiene and the quality.

The recycled paper segment is expected to register the fastest growth during the forecast period. These papers are made from previously used papers. The main reason behind the increasing demand for recycled paper is that it reduces it requirements for less raw materials and reduces the generated waste. The increasing government preferences towards sustainability are leading to increasing the use of recycled paper while making these products. Manufacturing of recycled papers has been increasing as it has lower production costs which makes it a convenient option for small-cap companies. Additionally, the increasing campaigns and advertisements for sustainable product use are expected to drive the interest of consumers and contribute towards the growth of the paper straw market.

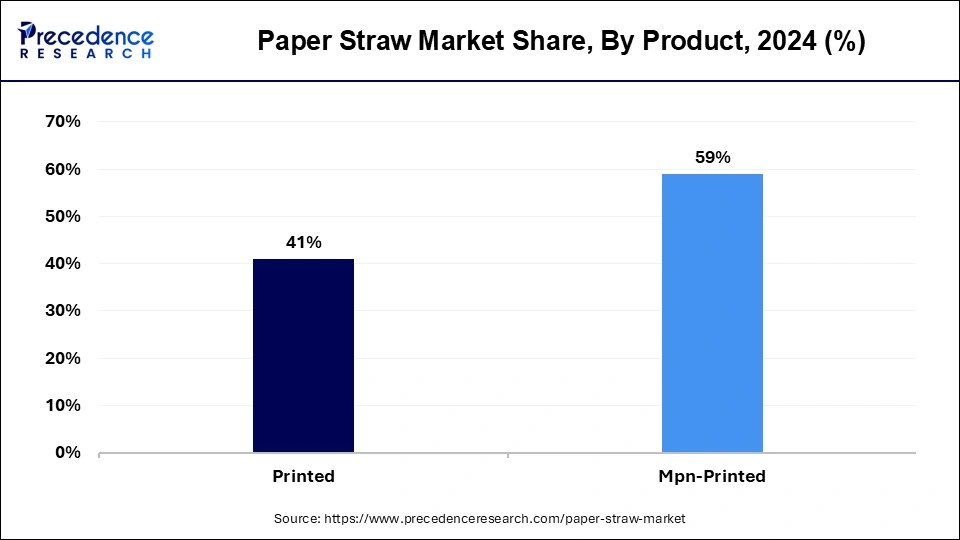

The non-printed segment held the largest share of the paper straw market in 2024. The biggest factor behind the dominance of these straws is their cost-effectiveness. These products usually have lower production costs which makes them a great option for small businesses in the food and beverage industry. This makes it a convenient option in various industries like tourism and hospitality. Non-printed straws have less environmental impact as they do not contain any inked design which would lower the environmental footprints. These factors are expected to carry forward the growth of the paper straw market during the forecast period.

The printed paper segment is expected to witness the fastest growth during the forecast period. The competitive business environment, especially in the food and beverage industry, has led to new and unique techniques to attract customers. The printed straws display an aesthetic appeal to the youth which would increase the popularity of the printed straws. Many companies are focusing on developing printed straws which would reduce the environmental impact and drive the growth of the paper straw market in the upcoming years.

The 7.75 to 8.5 inches segment held the largest share of paper straw market in 2024. These length straws are widely accepted as a convenient option for beverages of any size. Many businesses use these straws in their setups as they consider that these lengths might attract the consumers showcasing a greater impression of their brand.

The < 5.75-inch segment is expected to witness the fastest growth with a significant CAGR during the forecast period. This growth is carried out due to the increasing online food delivery beverage services. These length paper straws are easy to carry while delivering the product, it prevents the package from any possible damage. Additionally, it is considered that the demand for these straws is attributed to the changing consumer preferences in the market.

The 0.196-0.25 inches segment was the dominant in the year 2024. These size straws are considered perfect as they can be used for thin drinks like water and soda to thick drinks like thick shakes and smoothies. The increasing demand for these size straws is expected to rise in the upcoming years. These size straws are gaining popularity as they are cheaper which makes them a good option for small businesses. The less material consumed while making these straws also has a less impact on the environment which stands as a preferable option for consumers.

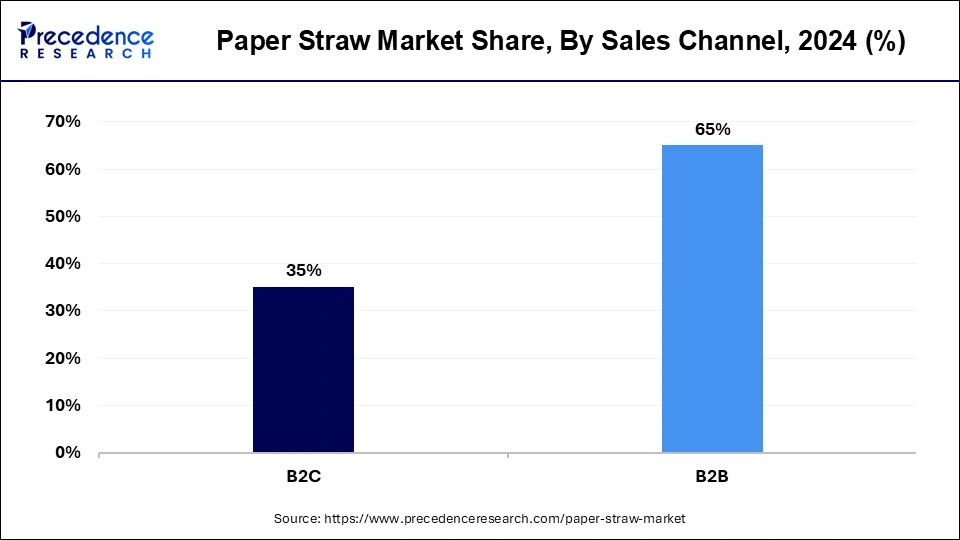

The B2B segment held the largest share of the paper straw market in 2024. This includes the larger side of the business which includes purchasing of larger number of straws for reselling purposes. It includes customers like food chains, restaurants and hotels which require a large number of straws in their businesses. This improves the connectivity among businesses and expands brand recognition. The inclination of big companies towards paper straws is expected to carry out the growth of the paper straw market in the upcoming years.

The B2C segment is expected to register growth during the forecast period 2023 to 2033. The rising environmental concerns are leading towards the direct purchase of paper straws from retailers. Many supermarkets and hypermarkets provide these kinds of products in bulk which stands out as a convenient option for small businesses. The increasing availability of paper straws in these settings will help in the growth of the paper straw market during the forecast period 2024 to 2033.

The food processing segment held the largest share of the paper straw market in 2024. Its popularity is increasing due to rapid demand for packaged products like boxed juices. This growth is also attributed to the tourism industry as it is a major growth contributor to these packaged items. The increasing government rules are leading these companies to stick to the sustainable goals which is creating more demand in the paper straw market. The paper straw market is experiencing a great demand due to the increasing number of restaurants, cafes and global food chains. These businesses also have the advantage of getting feedback from their customers, which helps them in understanding the customer preferences.

By Material

By Product

By Straw Length

By Diameter

By Sales Channel

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

November 2023

May 2024