October 2023

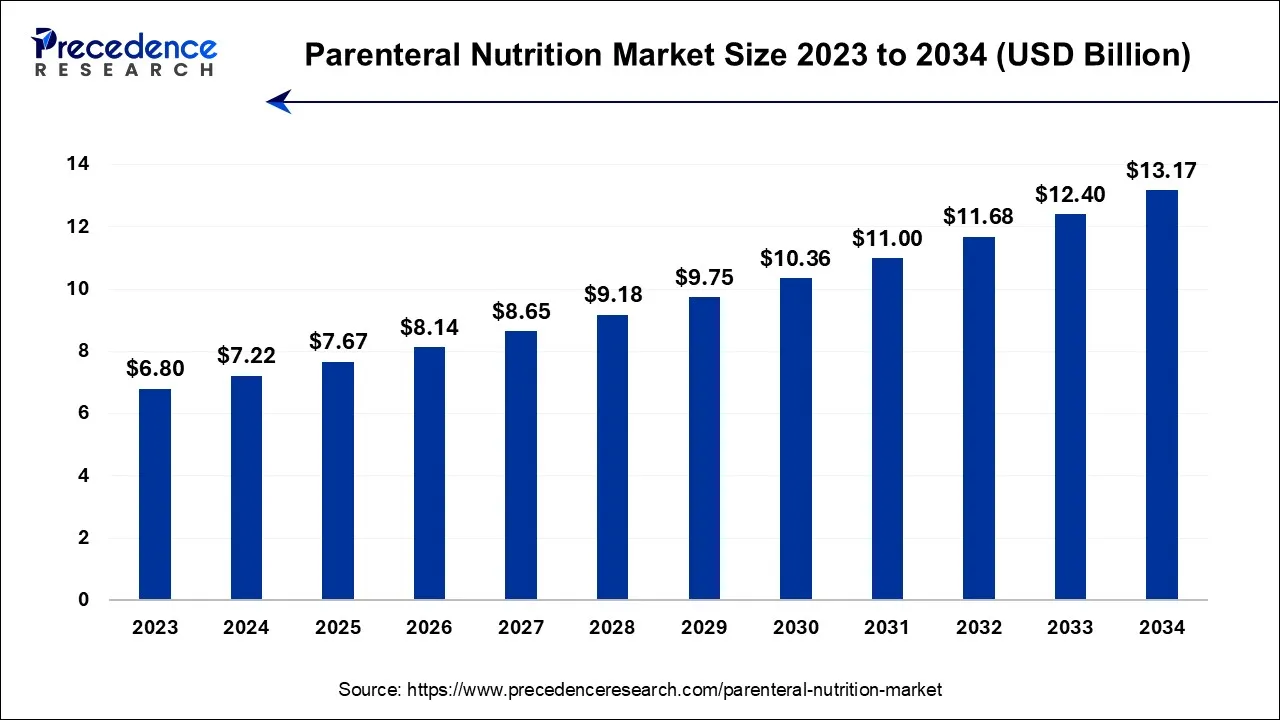

The global parenteral nutrition market size is calculated at USD 7.22 billion in 2024, grew to USD 7.67 billion in 2025, and is predicted to hit around USD 13.17 billion by 2034, poised to grow at a CAGR of 6.2% between 2024 and 2034. The North America parenteral nutrition market size accounted for USD 2.96 billion in 2024 and is anticipated to grow at the fastest CAGR of 6.33% during the forecast year.

The global parenteral nutrition market size is expected to be valued at USD 7.22 billion in 2024 and is anticipated to reach around USD 13.17 billion by 2034, expanding at a CAGR of 6.2% over the forecast period from 2024 to 2034.

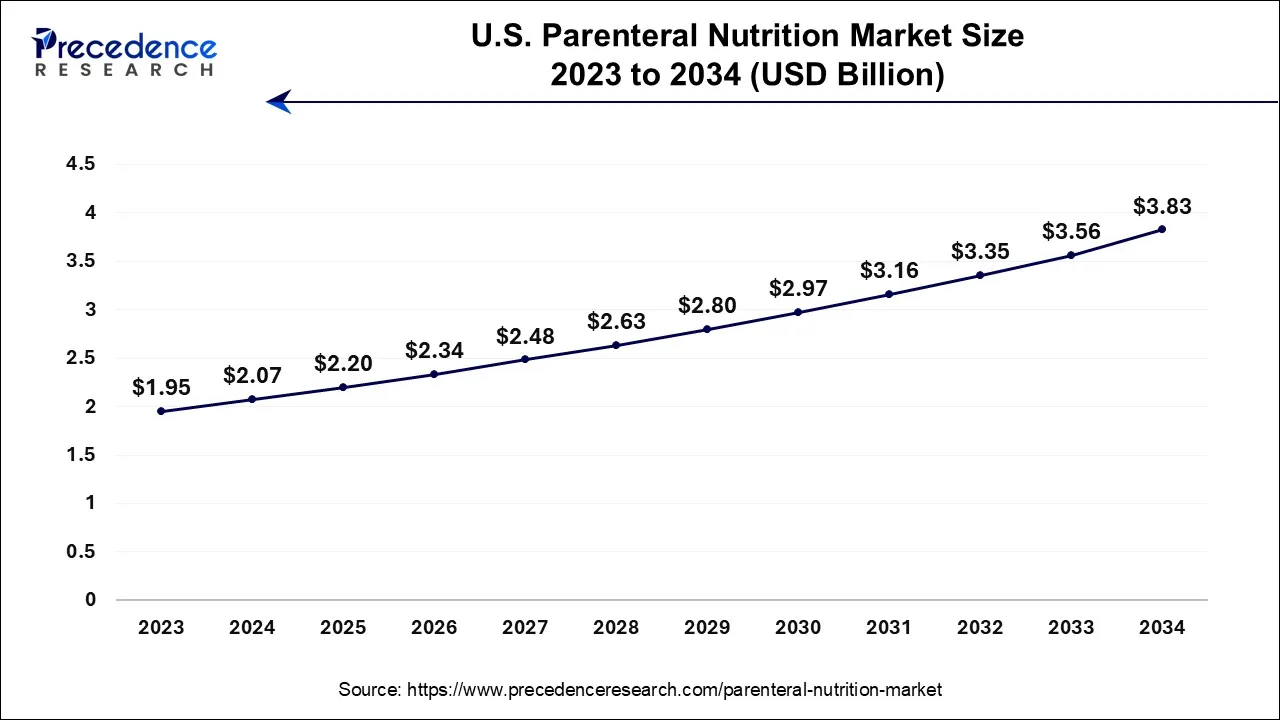

The U.S. parenteral nutrition market size is accounted for USD 2.07 billion in 2024 and is projected to be worth around USD 3.83 billion by 2034, poised to grow at a CAGR of 6.35% from 2024 to 2034.

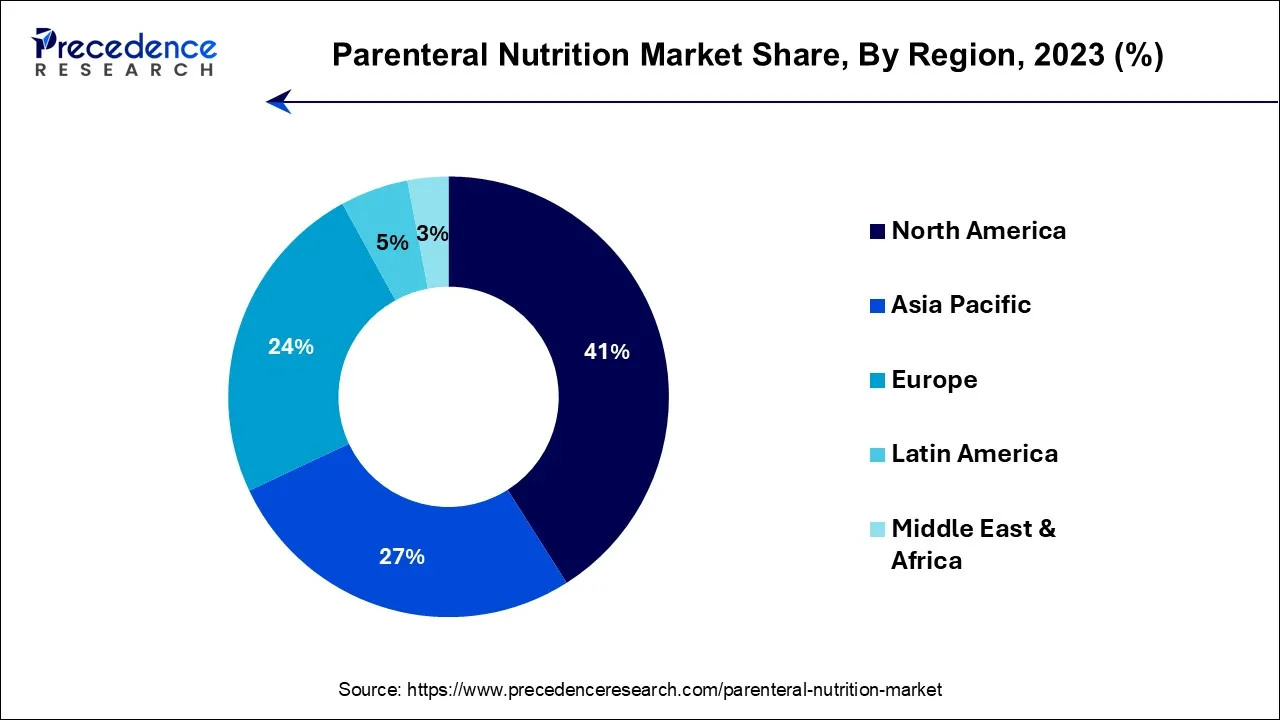

North America has held the largest revenue share 41% in 2023. North America commands a substantial share of the parenteral nutrition market owing to its mature healthcare infrastructure, substantial healthcare investments, and a sizable elderly demographic with intricate medical requirements. Furthermore, the region's prominence is reinforced by a significant presence of key industry participants, ongoing research and development endeavors, and a favorable regulatory milieu. North America's commitment to pioneering solutions, alongside a high incidence of chronic illnesses and the integration of cutting-edge healthcare technologies, underscores its pivotal role in the parenteral nutrition market, cementing its status as a leading contributor to the sector's overall revenue.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region has asserted a dominant position in the parenteral nutrition market, influenced by several distinctive factors. Foremost, the region's expansive populace, notably in countries such as China and India, has fostered a substantial patient base necessitating parenteral nutrition interventions. Furthermore, continuous enhancements in healthcare infrastructure and escalating healthcare expenditures have spurred the adoption of advanced medical therapies, including parenteral nutrition. The prevalence of a substantial aging demographic beset by age-related health challenges has further propelled demand. Lastly, the heightened recognition of the advantages of parenteral nutrition and augmented governmental support for healthcare initiatives have propelled robust market expansion within the Asia-Pacific realm.

The parenteral nutrition market denotes the global sector dedicated to delivering vital nourishment through intravenous means, catering to individuals who cannot orally ingest food or absorb nutrients through their digestive tract. It encompasses a diverse array of products, including parenteral nutrition solutions, infusion apparatus, and associated accessories. Growth in this sector is propelled by factors such as an aging demographic, a rising incidence of chronic ailments, and advancements in healthcare infrastructure. It is a fiercely competitive arena where prominent participants, including pharmaceutical firms, medical equipment producers, and healthcare service providers, vie to fulfill the nutritional requirements of patients.

The realm of parenteral nutrition constitutes a pivotal sector in healthcare, specializing in the intravenous delivery of essential nutrients to individuals who are unable to partake in oral nutrition or nutrient absorption through their gastrointestinal tract. Within this global market, a diverse array of products, including parenteral nutrition formulations, infusion apparatus, and associated adjuncts, is harnessed to fulfill the nutritional requirements of patients.

Numerous prevailing trends and catalysts for growth exert a profound influence on the parenteral nutrition market. A salient demographic factor is the aging global populace, whose nutritional needs often necessitate the administration of parenteral nutrition due to underlying medical conditions. Furthermore, the escalating incidence of chronic ailments, encompassing cancer and gastrointestinal disorders, has precipitated an uptick in demand for parenteral nutrition solutions. Concomitantly, advancements in healthcare infrastructure and technology, marked by the refinement of parenteral nutrition formulations and administration modalities, are instrumental in propelling market expansion.

Despite its burgeoning prospects, the parenteral nutrition arena confronts its share of challenges. The intricate landscape of regulations and stringent quality standards can present formidable obstacles for manufacturers and healthcare providers alike. The potential for infection associated with intravenous nutrition delivery systems necessitates scrupulous adherence to rigorous hygiene and safety protocols. Moreover, the cost factor looms large, rendering parenteral nutrition less attainable for certain segments of the patient populace, especially in emerging economies.

Notwithstanding the hurdles, substantial business prospects are discernible within the parenteral nutrition market. Pioneering innovations in parenteral nutrition formulations and delivery mechanisms, such as personalized nutritional solutions and intelligent infusion devices, are poised to be pivotal drivers of growth. Additionally, venturing into burgeoning markets characterized by evolving healthcare infrastructure holds the promise of robust returns for market participants. Synergistic collaborations among pharmaceutical entities, medical device manufacturers, and healthcare providers have the potential to yield comprehensive solutions tailored to the unique needs of patients necessitating parenteral nutrition.

In summation, the parenteral nutrition domain occupies a pivotal niche in healthcare, catering to individuals with intricate nutritional exigencies. Market expansion hinges on demographic shifts, the ascendancy of chronic ailments, and technological progress, despite regulatory and cost-related impediments. To seize the opportunities inherent in this arena, stakeholders should orient themselves toward innovation and global outreach, fostering partnerships that enhance patient care and broaden access to parenteral nutrition interventions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.2% |

| Market Size in 2024 | USD 7.22 Billion |

| Market Size by 2034 | USD 13.17 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Nutrient Type, By Stage Type, By Indication, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Shortage of nutrient absorption

The deficiency in nutrient assimilation stands as a pivotal instigator propelling the burgeoning of the parenteral nutrition market. Assorted medical conditions and gastrointestinal disorders, including the likes of short bowel syndrome, inflammatory bowel ailment, and post-surgical complications, can profoundly hinder the organism's capacity to extract vital nourishment from customary dietary intake. In such scenarios, parenteral nutrition assumes an irreplaceable role by enabling the direct intravenous infusion of essential nutrients, circumventing the compromised digestive processes. This dependence on parenteral nutrition is on an unwavering ascent, driven by the mounting incidence of these conditions and a maturing population predisposed to the emergence of gastrointestinal afflictions over time.

Patients grappling with the intricacies of nutrient absorption challenges necessitate the careful tailoring of intravenous nutritional regimens to preserve their well-being and mitigate the specter of malnutrition-related complications. Furthermore, ongoing scientific explorations perpetually augment parenteral nutrition formulations, rendering them progressively efficacious and individualized to cater to the unique requisites of each patient. Consequently, healthcare providers are progressively embracing parenteral nutrition as an inescapable therapeutic recourse, thus vigorously propelling the parenteral nutrition market's growth in response to the burgeoning clamor for these life-sustaining interventions.

Nutritional imbalance

Nutritional imbalance constitutes a substantial impediment to the expansion of the parenteral nutrition market. While parenteral nutrition remains indispensable for individuals with compromised nutrient absorption, it falls short of replicating the intricate nutritional harmony found in a well-rounded diet. The intravenous administration of nutrients may not encompass the full spectrum of micronutrients and bioactive compounds present in whole foods, potentially engendering enduring nutritional asymmetry. This deficiency in comprehensive nutrient provision can give rise to an array of complications, encompassing deficiencies in vitamins and minerals, metabolic irregularities, and impairments in organ function. Healthcare practitioners must meticulously oversee and fine-tune parenteral nutrition protocols to ameliorate these perils, augmenting the intricacy and cost of treatment.

Additionally, patients may grapple with unfavorable repercussions linked to nutritional imbalances, adversely affecting their overall health. This limitation has spurred a predilection for enteral nutrition whenever feasible, as it enables the conveyance of nutrients through the gastrointestinal tract, a process more closely aligned with the body's natural physiological rhythms. Consequently, the adoption of parenteral nutrition may be circumscribed in scenarios where alternative methodologies can be employed, thereby influencing the market's growth prospects.

Innovation in formulations

Revolutionary strides in formulation innovation present a pivotal avenue of opportunity within the parenteral nutrition market. These innovations usher in a new era of tailored and highly specialized nutritional solutions, meticulously crafted to precisely align with the unique needs and medical conditions of individual patients. This degree of customization not only enhances the efficacy of parenteral nutrition but also elevates patient outcomes and overall satisfaction. Innovations in formulations empower the market to comprehensively address the distinctive nutritional demands of diverse patient demographics, ranging from neonates and geriatric individuals to those grappling with specific medical ailments.

For instance, the development of lipid-based emulsions featuring heightened stability and enhanced bioavailability is reshaping the landscape of intravenous nutrition, particularly in the care of premature infants. Furthermore, these formulation advancements are instrumental in mitigating the inherent risks of complications and adverse effects that have historically been associated with conventional nutritional solutions. This dual benefit of optimizing patient care while fostering greater acceptance of parenteral nutrition within the healthcare ecosystem positions the market for remarkable growth and enduring success.

According to the Nutrient Type, the single-dose amino acid solution sector has held a 31% revenue share in 2023. The dominant share held by the single-dose amino acid solution segment in the parenteral nutrition market can be attributed to several compelling factors. Notably, it offers precise and user-friendly dosing methods, mitigating the potential for dosage errors. In critical care environments where stringent aseptic conditions are imperative, single-dose solutions are favored, enhancing patient safety and reducing contamination risks. These solutions exhibit versatility, effectively addressing a broad spectrum of medical conditions, including malnutrition, cancer, and gastrointestinal disorders, thus expanding their applicability. Moreover, their straightforward administration and storage advantages further bolster their appeal and substantial presence within the market.

The trace elements sector is anticipated to expand at a significant CAGR of 8.1% during the projected period. The Trace Elements segment holds a significant share in the parenteral nutrition market due to its crucial role in supporting various physiological functions. Trace elements like zinc, copper, selenium, and chromium are essential for metabolic processes, immune function, and tissue repair. They are particularly vital for critically ill patients with impaired absorption or increased losses. As a result, healthcare providers prioritize the inclusion of trace elements in parenteral nutrition formulations, driving the demand for these specialized products and contributing to their major share in the market.

Based on the stage type, the adult is anticipated to hold the largest market share of 85% in 2023. The dominance of the adult segment in the parenteral nutrition market is attributed to the heightened occurrence of medical ailments among adults who mandate intravenous nutritional intervention. Conditions like cancer, gastrointestinal disorders, and post-operative complexities are notably more prevalent in adult populations, fueling the demand for parenteral nutrition solutions. The aging demographic, with its susceptibility to age-associated health challenges and chronic diseases, further amplifies this segment's significance. Additionally, the extended duration of parenteral nutrition therapy often required by adults contributes to their substantial market presence when compared to pediatric patients.

On the other hand, the single touch sector is projected to grow at the fastest rate over the projected period. The dominant growth of the pediatrics segment in the parenteral nutrition market can be attributed to several compelling reasons. Children grappling with conditions that hinder their normal nutrient absorption often necessitate intravenous nutritional support. Moreover, neonatal intensive care units (NICUs) heavily rely on parenteral nutrition to sustain prematurely born or critically ill infants. The segment's prominence is further underscored by the escalating demand for specialized pediatric formulations and the increasing prevalence of pediatric ailments, particularly gastrointestinal disorders. Consequently, the Pediatrics segment stands as a pivotal driver in propelling the overall growth trajectory of the parenteral nutrition market.

The other segment held the largest revenue share of 31% in 2023. The "others" segment, encompassing various health ailments like Crohn's disease, cystic fibrosis, pancreatitis, cancer-related treatments, and other medical conditions, commands a substantial share in the parenteral nutrition market. This is primarily due to patients battling these ailments often requiring intensive therapies such as radiation therapy, immunotherapy, and medication. These treatments can compromise their ability to consume and absorb nutrients orally, making intravenous nutrition support, provided by parenteral nutrition, a crucial lifeline. Hence, the demand for parenteral nutrition in this patient population significantly contributes to the segment's prominence within the market.

The Alzheimer's sector is anticipated to grow at a significantly faster rate, registering a CAGR of 9.9% over the predicted period. The dominant share of the Alzheimer's segment within the parenteral nutrition market can be attributed to the distinctive nutritional demands posed by Alzheimer's disease. The condition frequently leads to profound cognitive decline, rendering self-feeding and dietary management challenging. Consequently, parenteral nutrition assumes a pivotal role in directly supplying essential nutrients, ensuring that Alzheimer's patients receive the requisite nourishment. The escalating global prevalence of Alzheimer's within aging demographics has accentuated the demand for parenteral nutrition in this specific context, solidifying its prominent position in the market landscape.

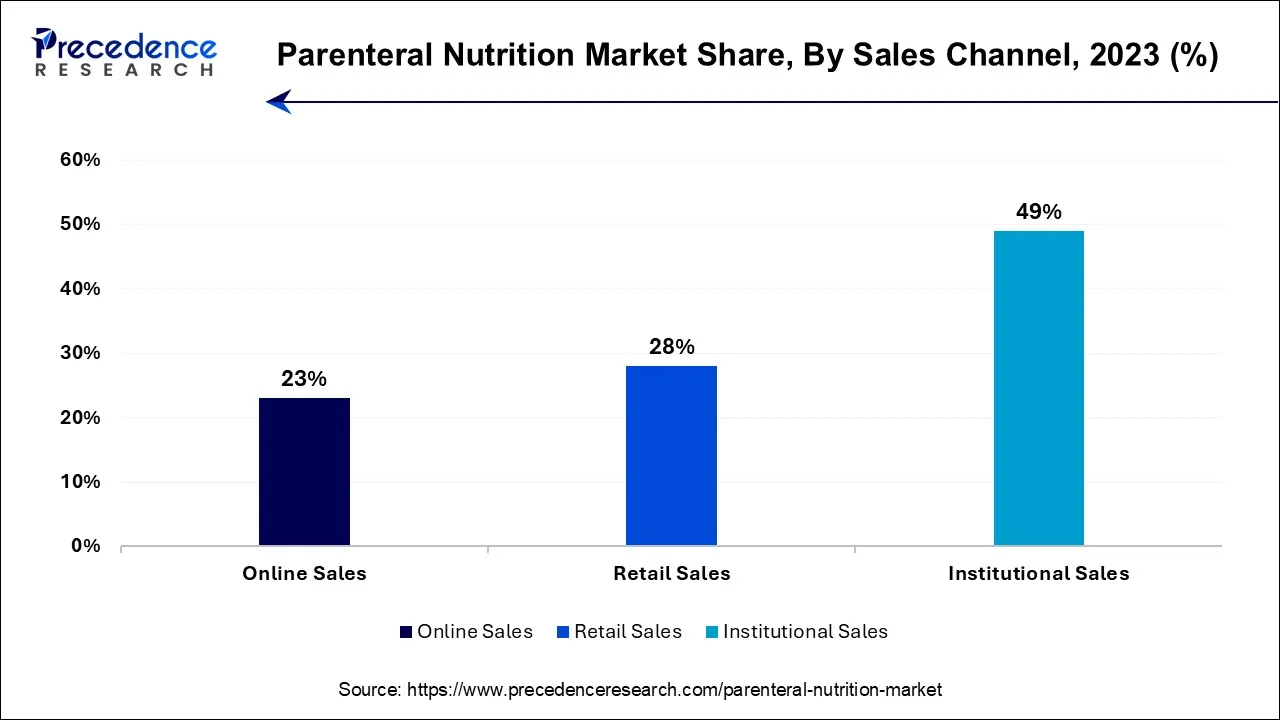

The institutional sales channel segment has generated a revenue share of 49% in 2023. The institutional sales channel segment dominates the parenteral nutrition market due to several key factors. Hospitals, clinics, and healthcare institutions are the primary providers of parenteral nutrition therapy, especially for critically ill patients and those with complex medical conditions. These facilities have established infrastructure, trained medical staff, and the capacity to handle intravenous therapies effectively. Additionally, the institutional segment benefits from bulk purchasing, economies of scale, and the ability to provide comprehensive care, making it the preferred channel for the procurement and administration of parenteral nutrition products.

The Online Sales segment is anticipated to grow at a significantly faster rate, registering a CAGR of 11.8% over the predicted period. The online sales segment has garnered a significant share in the parenteral nutrition market due to several factors. Firstly, it offers convenience and accessibility, allowing healthcare professionals and patients to procure essential parenteral nutrition products quickly and efficiently. Moreover, the COVID-19 pandemic accelerated the adoption of online platforms for healthcare purchases, including parenteral nutrition, as it minimized physical contact. Additionally, the online channel often provides a wider range of product options, competitive pricing, and the ability to compare brands and features, further driving its popularity and market share in the parenteral nutrition industry.

Segments Covered in the Report

By Nutrient Type

By Stage Type

By Indication

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

January 2025

February 2024

August 2024