August 2024

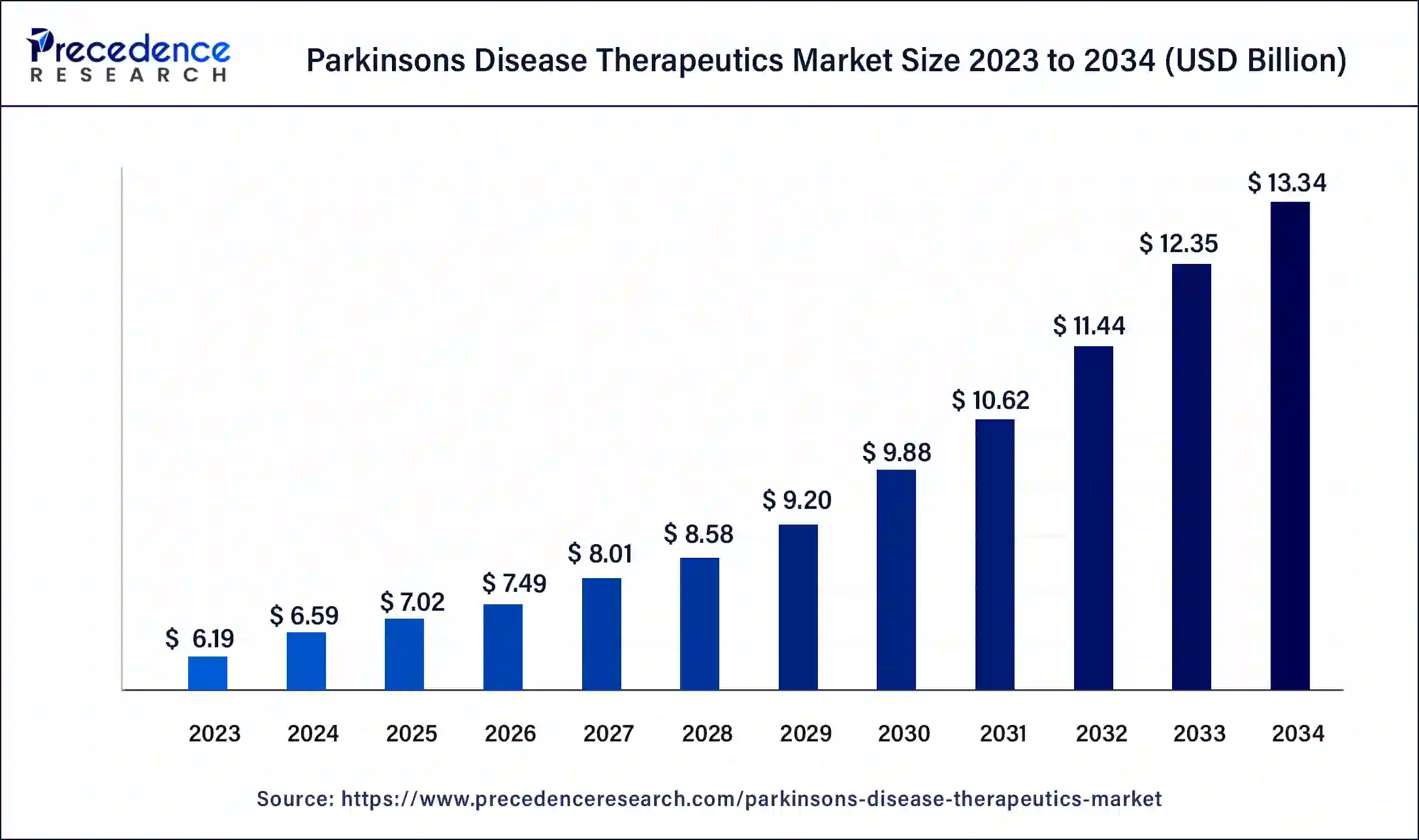

The global parkinson’s disease therapeutics market size was USD 6.19 billion in 2023, calculated at USD 6.59 billion in 2024 and is projected to surpass around USD 13.34 billion by 2034, expanding at a CAGR of 7.3% from 2024 to 2034.

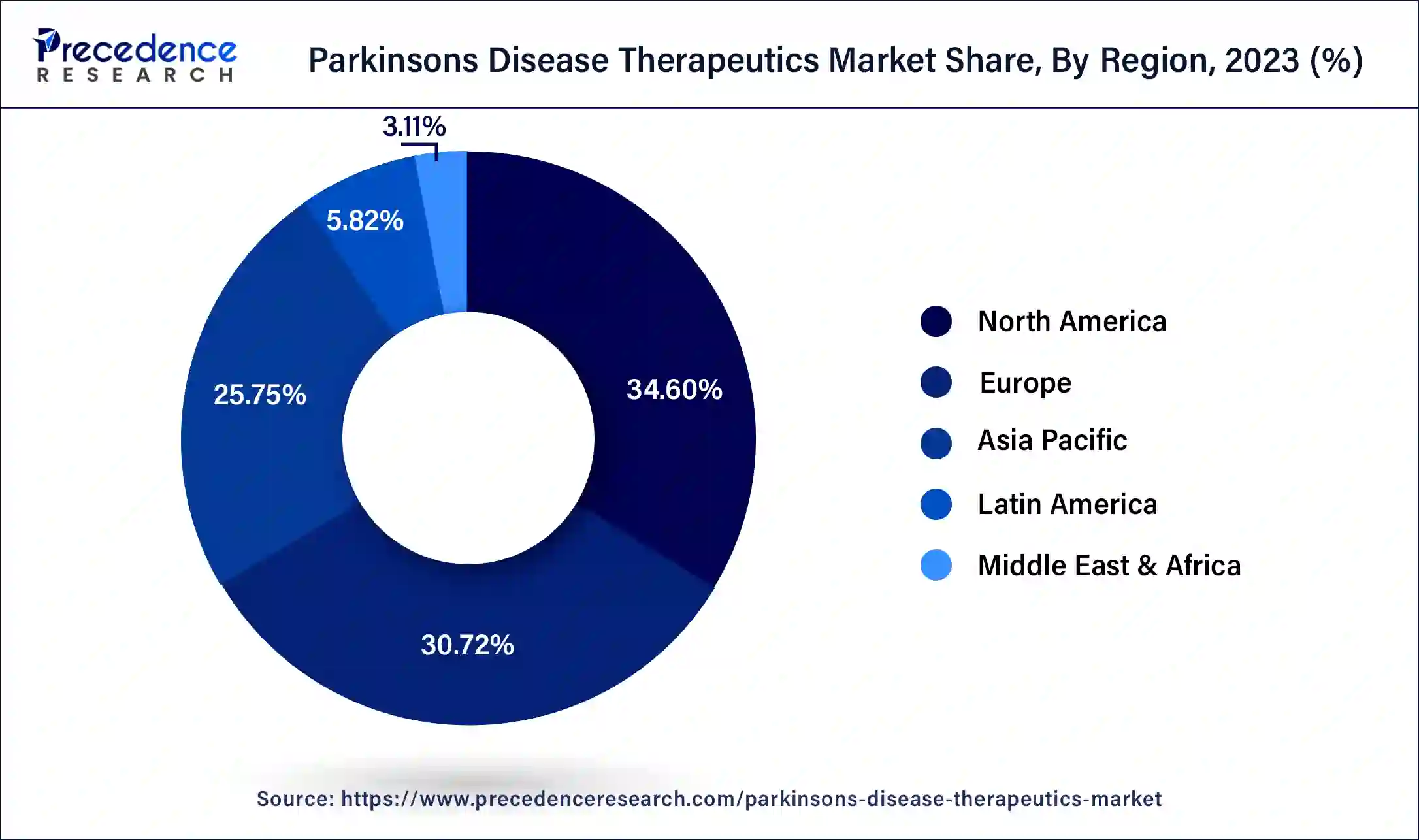

The global parkinson’s disease therapeutics market size accounted for USD 6.59 billion in 2024 and is expected to be worth around USD 13.34 billion by 2034, at a CAGR of 7.3% from 2024 to 2034. The North America parkinson’s disease therapeutics market size reached USD 2.14 billion in 2023. Growing environmental concerns and genetic heredity are increasing the number of cases of Parkinson's disease, which increases the demand for Parkinson's disease therapeutics.

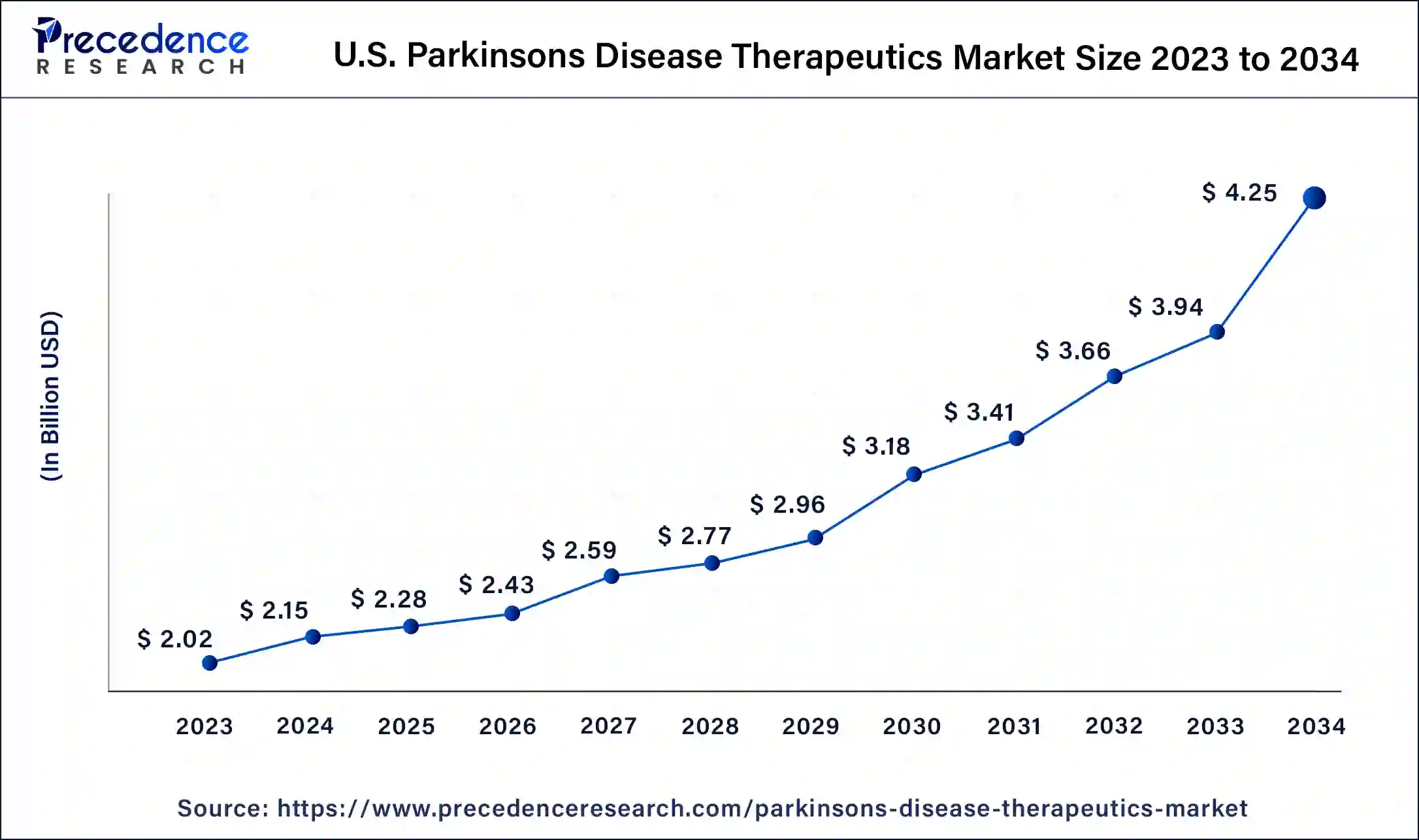

The U.S. parkinson’s disease therapeutics market size was estimated at USD 2.02 billion in 2023 and is predicted to be worth around USD 4.25 billion by 2034, at a CAGR of 7.1% from 2024 to 2034.

North America dominated the Parkinson’s disease therapeutics market in 2023. A significant number of people in North America, especially in the US, have Parkinson's disease. The number of people diagnosed with the ailment is rising in this area due to aging populations, which creates a greater market for therapies. North America is home to cutting-edge medical facilities and technology, as well as a sophisticated healthcare infrastructure. This increases the need for medications by enabling early diagnosis, thorough therapy, and improved management of Parkinson's disease. Many prestigious pharmaceutical firms and research facilities that make significant investments in Parkinson's disease research and development are located in the region. As a result, there is a constant flow of novel and cutting-edge treatments into the Parkinson’s disease therapeutics market.

The Parkinson’s disease therapeutics market provides the resources needed for the treatment of Parkinson’s disease, which affects the nervous system and the parts of the body controlled by nerves. In the early stage of Parkinson’s disease, the face of the patient shows little or no experience. There is no movement in the arms while walking. The patient's voice becomes soft and slurred. The symptoms of Parkinson’s disease include tremors, bradykinesia, rigid muscles, difficulties in thinking, depression and emotional changes, swallowing problems, chewing and eating problems, sleep problems and sleep orders, bladder problems, impaired posture, and balance, loss of automatic movements, changes in speech, changes in writing, and constipation, etc. The causes of Parkinson’s disease are unknown, but factors that appear to play a role include genes and environmental triggers.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.19 Billion |

| Market Size in 2024 | USD 6.59 Billion |

| Market Size by 2034 | USD 13.34 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.3% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drug Class, Route of Administration, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rise in the aging population can be the driver of the Parkinson’s disease therapeutics market. Parkinson’s disease is more prevalent among Older individuals, and as the population ages, the number of people affected by Parkinson’s disease rises. With the aging population, there’s a heightened focus on improving the quality of life for individuals living with chronic conditions like Parkinson’s disease.

The side effects of Parkinson’s Disease therapeutics include gastrointestinal disturbances such as nausea & vomiting and orthostatic hypotension. Neuropsychiatric features include anxiety and hallucinations that may occur due to “off-target” effects of dopamine acting in extranigral brain regions.

The rising research and development activities for developing advanced Parkinson’s disease therapies can be an opportunity for the growth of the Parkinson’s disease therapeutics market for these therapies. Research and development activities include technological innovations, drug discoveries, pipeline clinical trial expansion, collaborative effects efforts, patient sanitary approaches, and regulatory support. For instance, Pharmaceutical companies invest in R&D in anticipation of future profits. For each drug that a company considers pursuing, anticipated returns depend on three main factors: the expected lifetime global revenue from the drug, the new drug’s likely R&D costs, and policies that affect the supply of and demand for prescription drugs.

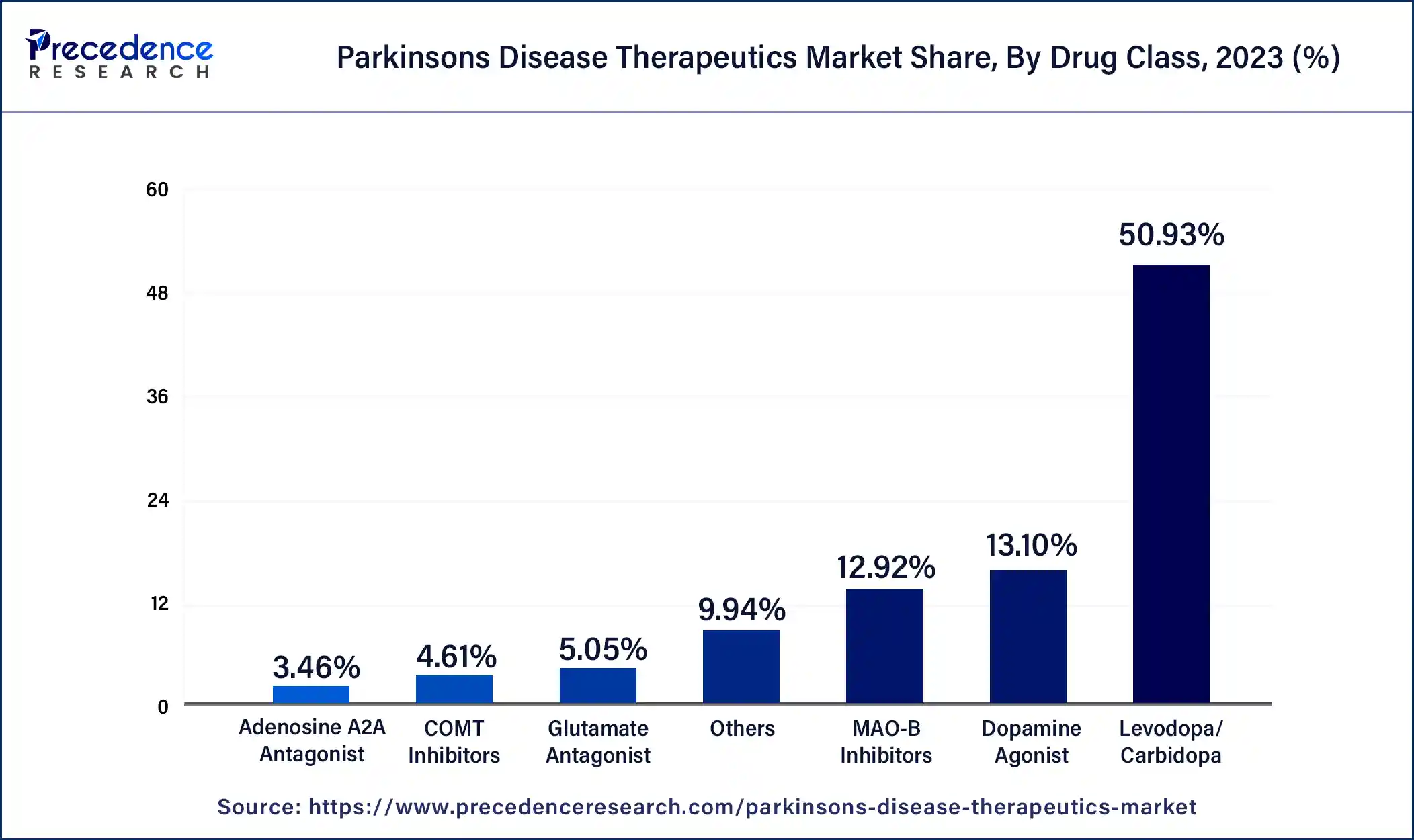

The levodopa/carbidopa segment dominated the Parkinson’s disease therapeutics market in 2023. The most common therapy for Parkinson's disease for many years has been levodopa, frequently in conjunction with carbidopa. Because it restores dopamine levels in the brain, it is quite effective at reducing motor symptoms. Parkinson's disease symptoms, such as bradykinesia (slow movement), stiffness, and tremors, are especially well-managed with levodopa. For many patients as well as healthcare professionals, this makes it the right option. The levodopa has a lengthy history of safety and efficacy, which accounts for its widespread usage in therapeutic settings. That maintains its dominance in the Parkinson’s disease therapeutics market because it is frequently the first-line treatment for Parkinson's disease.

The COMT inhibitors segment is expected to grow at the highest CAGR during the forecast period. COMT stands for Catechol-O-methyltransferase. COMT is a protein that degrades levodopa before the crossing of the blood-brain barrier. Levodopa/carbidopa treatment is combined with COMT inhibitors, such as entacapone and opicapone. They extend the activity and increase the effectiveness of levodopa by inhibiting the COMT enzyme, which breaks it down. Better symptom management is the outcome of this combination, which is quite advantageous for the patients. COMT inhibitors can lessen the "off" periods when the medication's benefits wear off and symptoms reappear by prolonging the half-life of levodopa. Because of this, patients may have a higher quality of life, which makes COMT inhibitors an appealing choice. The advantages of COMT inhibitors and other supplemental therapies are becoming increasingly apparent as our understanding of Parkinson's disease develops. In addition to the usual levodopa/carbidopa therapy, this has resulted in a rise in adoption and more regular prescriptions. The COMT is used in the management of the later center but used in conjunction with levodopa.

Global Parkinson’s Disease Therapeutics Market Revenue, By Drug Class, 2021-2023(USD Million)

| Drug Class | 2021 | 2022 | 2023 |

| Levodopa/Carbidopa | 2,800.4 | 2,969.3 | 3,152.8 |

| Dopamine Agonist | 730.0 | 768.8 | 810.7 |

| Adenosine A2A Antagonist | 187.5 | 200.2 | 214.0 |

| COMT Inhibitors | 242.0 | 262.8 | 285.6 |

| MAO-B Inhibitors | 732.1 | 764.6 | 799.5 |

| Glutamate Antagonist | 267.4 | 289.1 | 312.9 |

| Others | 531.4 | 571.4 | 615.1 |

The oral segment dominated the Parkinson’s disease therapeutics market in 2023. The oral route of administration is an administration in which drugs or active ingredients are delivered from the mouth, which proceeds via the digestive system for systemic distribution. The drug is ingested by the patient; it is usually taken as a pill, capsule, or liquid. The medication dissolves in the gastrointestinal tract's fluids, mostly in the intestines and stomach. The gastrointestinal tract's lining, especially the small intestine, is where the dissolved medication is absorbed. The gut walls' large surface area and abundant blood flow aid in this absorption. The absorbed medication travels via the portal vein through the liver before entering the bloodstream. A percentage of the medication is metabolized by the liver, which may limit the quantity of active medication that enters the bloodstream. First-pass metabolism or the first-pass effect are terms used to describe this. The residual active medication enters the circulation and spreads throughout the body to carry out its medicinal effects.

The transdermal segment is growing significantly in the Parkinson’s disease therapeutics market. Drug distribution via transdermal patches is a practical and non-invasive approach. In particular, they are simpler to administer than oral drugs for older patients or those who experience dysphagia, which is a prevalent symptom of Parkinson's disease. Over a lengthy period of time, transdermal patches offer a continuous and regulated release of medicine. This lessens the swings brought on by oral dosage that might cause "on-off" phenomena by helping to maintain steady medication levels in the circulation. The transdermal patches help reduce adverse gastrointestinal effects, including nausea and vomiting, which are frequently connected to oral drugs, by avoiding the gastrointestinal tract. The transdermal devices that administer drugs continuously can result in better treatment results. For example, studies have demonstrated the efficacy of the rotigotine transdermal patch (Neupro) in the management of both motor and non-motor symptoms of Parkinson's disease.

Global Parkinson’s Disease Therapeutics Market Revenue, By Route of Administration, 2021-2023(USD Million)

| Route of Administration | 2021 | 2022 | 2023 |

| Oral | 3,569.1 | 3,733.9 | 3,911.0 |

| Subcutaneous | 362.9 | 390.9 | 421.6 |

| Transdermal | 541.2 | 575.9 | 613.7 |

| Others | 1,017.9 | 1,125.5 | 1,244.3 |

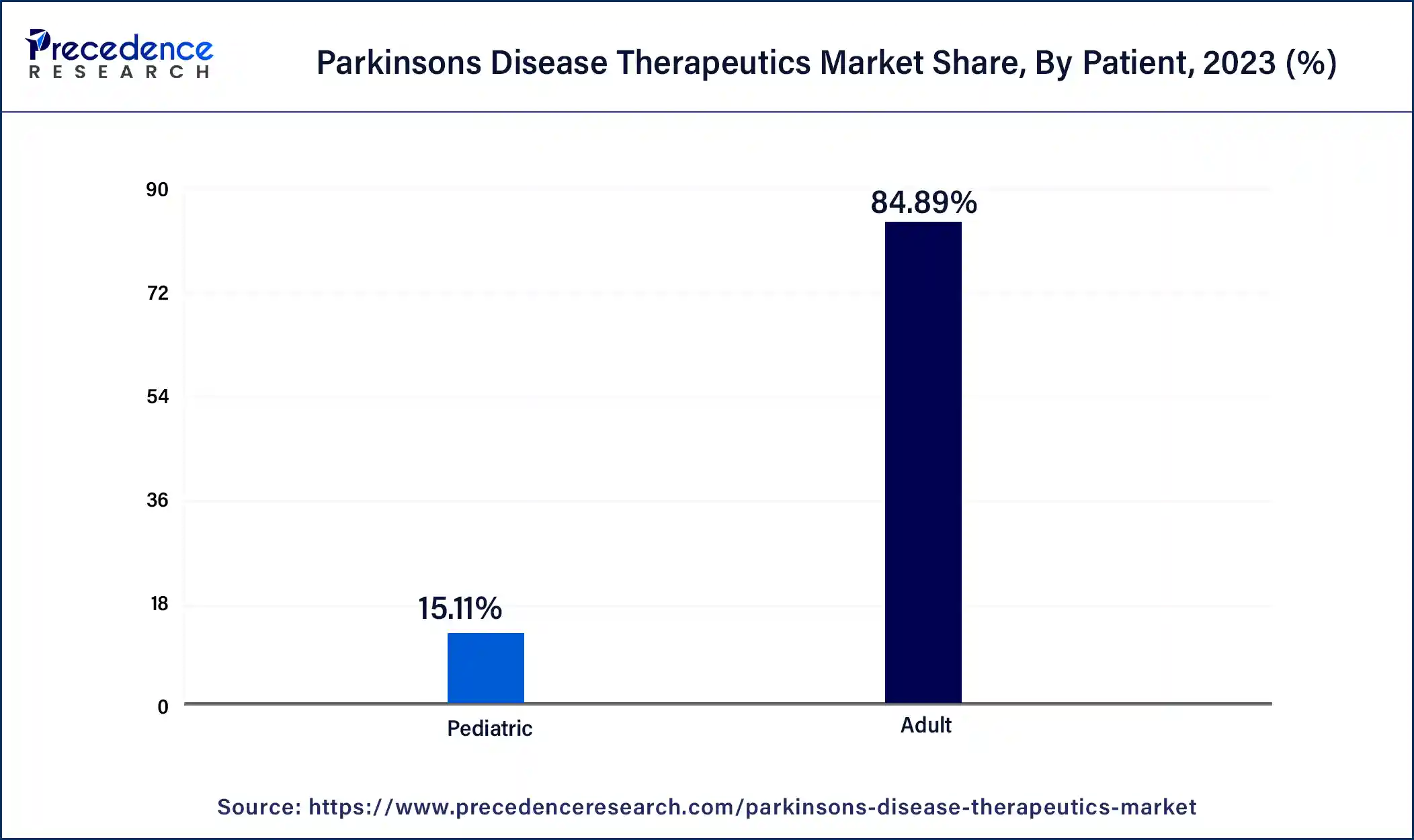

The adult segment dominated the Parkinson’s disease therapeutics market in 2023. The older persons are most affected by Parkinson's disease. Parkinson's disease is more common, and its incidence rises sharply with age, especially in people over 60. This demographic trend guarantees that the majority of patients in need of therapeutic interventions are adults. The number of people entering age groups where Parkinson's disease is more common is rising as the world's population ages. As a result of this change in demographics, the illness is detected and treated in a greater percentage of people. Historically, the adult population has been the primary target of Parkinson's disease drug development and approval. A market that is mostly focused on adult therapies results from the fact that the majority of clinical studies and treatment recommendations are created with adult patients' requirements in mind.

The pediatric segment is growing in the Parkinson’s disease therapeutics market. Parkinson's disease in children and those with early onset is becoming more well-recognized and may be diagnosed more accurately. The need for pediatric-specific therapies is driven by earlier and more frequent diagnoses in younger kids as a result of increased awareness among parents and healthcare providers. Recent developments in genetic research have revealed certain mutations linked to juvenile and early-onset Parkinson's disease. As a result, the pediatric population now has improved knowledge, diagnosis, and tailored therapy. Parkinson's disease treatment has typically neglected the juvenile population. As pharmaceutical companies concentrate on creating medicines, especially for younger patients, closing this gap offers enormous revenue prospects.

Global Parkinson’s Disease Therapeutics Market Revenue, By Patient, 2021-2023(USD Million)

| Patient | 2021 | 2022 | 2023 |

| Adult | 4,628.1 | 4,928.1 | 5,254.9 |

| Pediatric | 862.9 | 898.1 | 935.7 |

Segments Covered in the Report

By Drug Class

By Route of Administration

By Patient

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

August 2024

January 2025