November 2024

Passenger Car Accessories Aftermarket (By Type: External Accessories, Internal Accessories; By Applications: Roof Rack, LED Lights, Body Kits, Alloy Wheels, Tires, Car Care Products, Window Films, Seat And Steering Covers, Electronic Accessories, Knobs, Floor Mats, Sunshades, Car Organizers, Air Freshener, Vacuum Cleaners, Pillow And Cushions) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

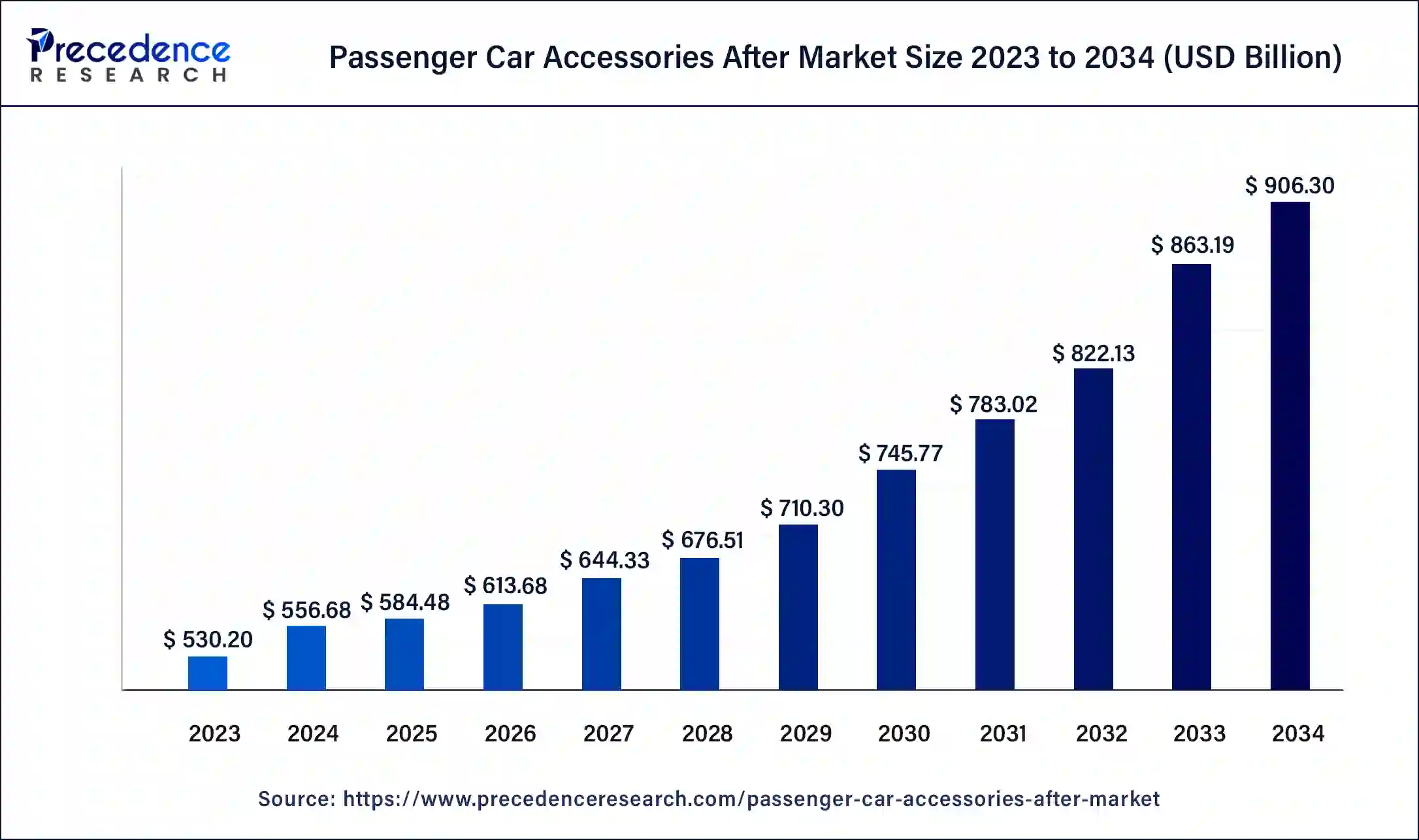

The global passenger car accessories aftermarket size was USD 530.20 billion in 2023, calculated at USD 556.68 billion in 2024 and is expected to reach around USD 906.30 billion by 2034, expanding at a CAGR of 4.99% from 2024 to 2034. Stringent government regulations to replace or upgrade the accessories and an increase in the trend of vehicle customization, along with an increase in disposable income, promote the passenger car accessories aftermarket growth.

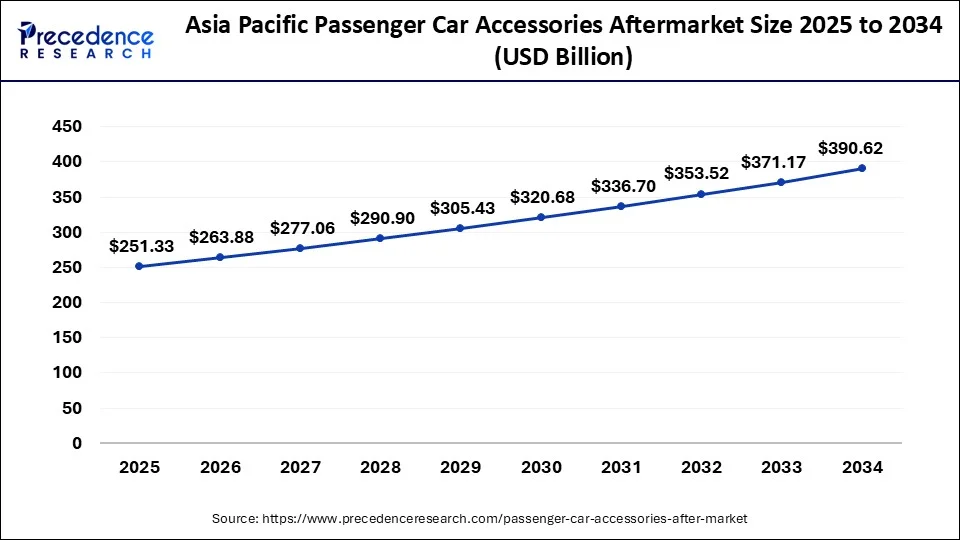

Asia Pacific Passenger Car Accessories Aftermarket Size and Growth 2024 to 2034

The Asia Pacific passenger car accessories aftermarket size was exhibited at USD 227.99 billion in 2023 and is projected to be worth around USD 390.62 billion by 2034, poised to grow at a CAGR of 5.01% from 2024 to 2034.

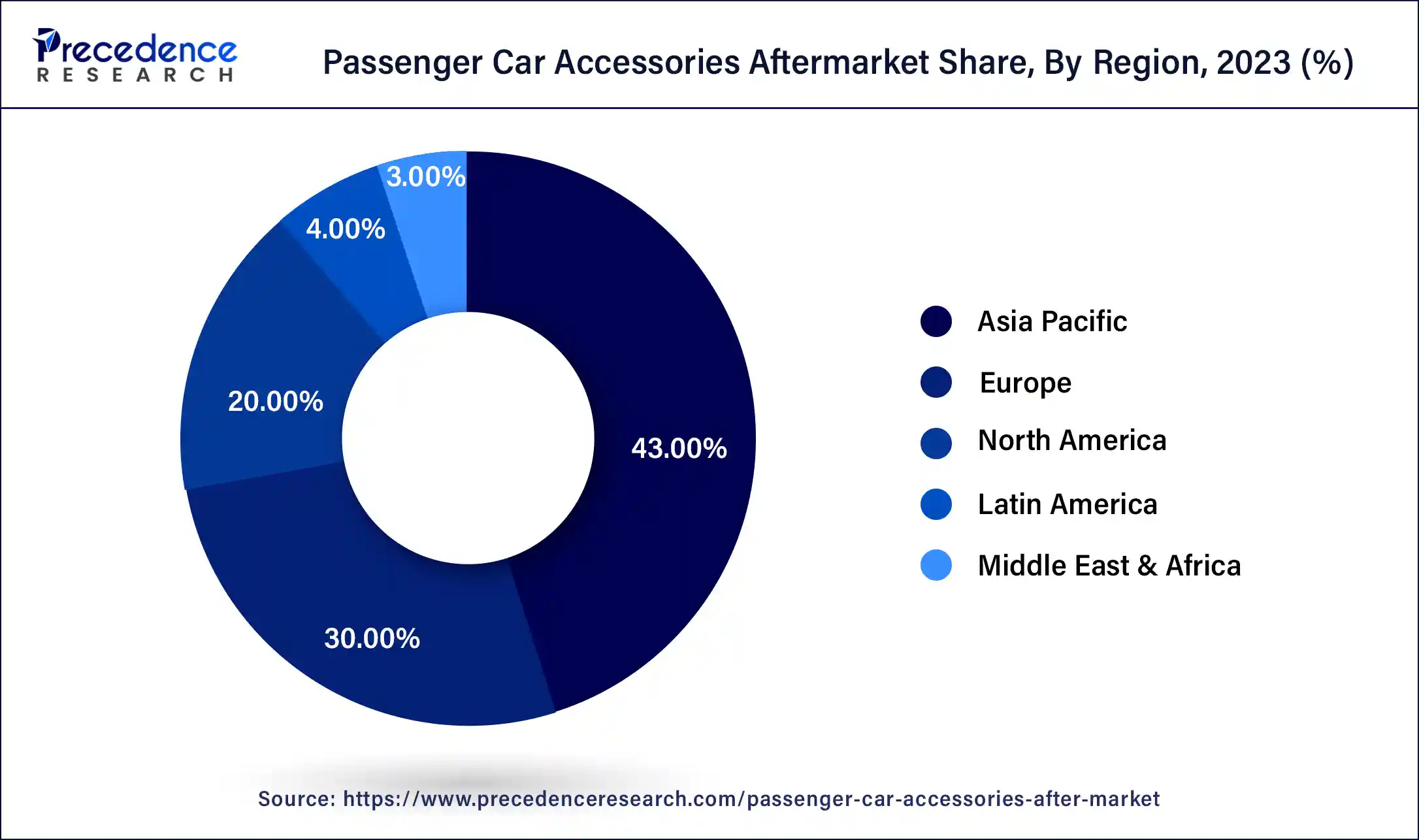

Asia Pacific dominated the passenger car accessories aftermarket in 2023. Government policies promoting sustainable manufacturing and investments heavily influence the Asia Pacific automotive motor industry. The surge in passenger car and vehicle registrations within the region creates lucrative opportunities for the expansion of the passenger car accessories aftermarket.

The increasing demand for advanced vehicles among consumers and the rise of IoT in the automotive sector also drive the growth of the passenger car accessories aftermarket in Asia Pacific. Moreover, various technological advancements in the automotive industry, promoted by government initiatives such as investment in R&D for automotive manufacturing, further boost market growth.

North America is expected to witness the fastest growth in the passenger car accessories aftermarket over the projected period. The North American passenger car accessories aftermarket plays a crucial role in vehicle maintenance and customization, addressing the diverse needs of consumers seeking to enhance, repair, or modify their vehicles based on individual preferences and requirements. Furthermore, the anticipated technological advancements and market factors are expected to transform the market landscape by providing new opportunities for growth and innovation.

Also, strategic foresight and proactive adaptation to emerging trends will be important for stakeholders who aim to leverage this effectively within the evolving dynamics of passenger car accessories aftermarket. This can lead to the growth of the market in the region.

Car accessories are parts added to the interior or exterior of a vehicle to enhance its aesthetics. Car owners prioritize both exterior and interior accessories to achieve a stylish exterior look and a comfortable, convenient interior feel. Passenger car accessories enable owners to upgrade them vehicles with advanced features, improving comfort, convenience, and functionality. These accessories cater to the specific needs and preferences of car owners and come in various forms. Interior accessories such as sunshades, floor mats, and seat covers enhance passenger comfort. For example, Bluetooth connectivity and audio systems improve the driving experience. Exterior modifications like spoilers, roof racks, and window visors not only boost the vehicle's appearance but also refine its functionality.

| Report Coverage | Details |

| Market Size by 2034 | USD 906.30 Billion |

| Market Size in 2023 | USD 530.20 Billion |

| Market Size in 2024 | USD 556.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.99% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in passenger car registrations

Countries such as Russia, Europe, Brazil, Japan, China, and India have experienced a significant rise in passenger car registrations. The car markets in India and Russia have expanded rapidly by exhibiting double-digit growth rates. Since then, sales have been on the rise, creating numerous opportunities for industry players in the passenger car accessories market to expand and increase their profits. For example, thermoplastic and high-strength steel are key raw materials used in producing car accessories for light vehicles. Additionally, industry players in the passenger car accessories aftermarket can supply these essential materials to car manufacturers to meet the increasing global demand for light vehicles.

Global vehicle numbers per capita (year 2024)

| Region | Vehicles per Capita | Vehicles per 1000 People |

| North America | 0.71 | 710 |

| Europe | 0.52 | 520 |

| South America | 0.21 | 210 |

| Middle East | 0.19 | 190 |

| Asia/Oceania | 0.14 | 140 |

| Africa | 0.06 | 58 |

| Antarctica | 0.05 | 50 |

The need for regular maintenance

The global passenger car accessories market faces several challenges. Primarily, the high cost of automotive accessories poses a significant barrier to accessibility, which might prevent many consumers from making purchases. This issue predominantly affects budget-conscious consumers and those in developing nations. Additionally, regular maintenance, such as cleaning, part replacements, and software updates, is required to ensure optimal functionality of auto accessories. Overcoming these obstacles is essential for the expansion and effective operation of the passenger car accessories aftermarket.

Rise in the trend of vehicle customization

The global trend of vehicle customization is on the rise, driven by a growing consumer desire to personalize their cars. This trend is especially noticeable among younger individuals who aim to enhance both their driving experience and their vehicle's aesthetics. Popular additions like chrome accessories, spoilers, LED lights, and alloy wheels not only improve the vehicle's look but also its functionality, which can boost the aftermarket for passenger car accessories. Furthermore, Digital technologies have transformed the design and operation of car accessories, including video panels, GPS, and multiple speakers. These advancements are not only improving the in-car experience but also fueling the demand for the passenger car accessories aftermarket.

In June 2024, MG (Morris Garages), a British automobile brand with a 100-year-old Legacy, launched its all-new Summer Accessories Range designed for its portfolio of cars. This newly introduced range is specifically crafted to keep customer drives cool and comfortable during the summer months, ensuring an enhanced driving experience while protecting the vehicle. The accessories included in this range are tailored to meet the unique needs of MG car owners, promising both functionality and style.

The external accessories segment led the global passenger car accessories aftermarket in 2023. External accessories encompass items installed outside the car, including roof racks, LED lights, body kits (chrome accessories, bumper guards, and door visors), tires, car care products, body covers, alloy wheels, and window films. The growth of the external accessories market is driven by rising disposable incomes and strict vehicle regulations in certain countries.

The internal accessories segment is expected to show the fastest growth in the passenger car accessories aftermarket over the forecast period. This can be attributed to the growing preference for improving vehicle comfort, convenience, and aesthetics, which are driving the segment's growth. Moreover, the increasing demand for in-car comfort and Convenience is another key factor contributing to this expansion. Also, the advancement and incorporation of cutting-edge technologies, such as wireless charging stations, voice-controlled interfaces, and augmented reality displays, can present significant opportunities for the segment.

The tires segment held the largest share of the passenger car accessories aftermarket in 2023. A tire is a circular component that encases the wheel's rim. It plays a critical role in transferring the vehicle's load from the axle through the wheel to the ground, ensuring traction on the driving surface. Tires enable vehicles to gain traction on the road, which can significantly influence the overall design, performance, and handling.

The seat & steering cover segment will witness considerable growth in the passenger car accessories aftermarket over the forecast period. Recent trends in the steering wheel cover market include developing advanced products, such as covers equipped with sensors to monitor driver fatigue and vital signs. Additionally, the demand for eco-friendly and sustainable materials for steering wheel covers is increasing, mirroring the broader consumer preference for environmentally friendly products. Hence, the segment for steering covers is set for significant growth in the coming years.

The car care products segment is expected to grow at a notable rate in the passenger car accessories aftermarket during the forecast period. Car care products typically consist of surface solvents and chemicals (acids or bases) designed to remove stains, clean marks, and restore the gloss and shine of car surfaces. A high-quality car wash shampoo can protect the vehicle's finish by eliminating mud, grime, and other contaminants. Waxing and polishing your car's paint also provides a shield against UV rays and other environmental hazards, such as tree sap and bird droppings.

Segments Covered in the Report

By Type

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

October 2024

October 2024