December 2024

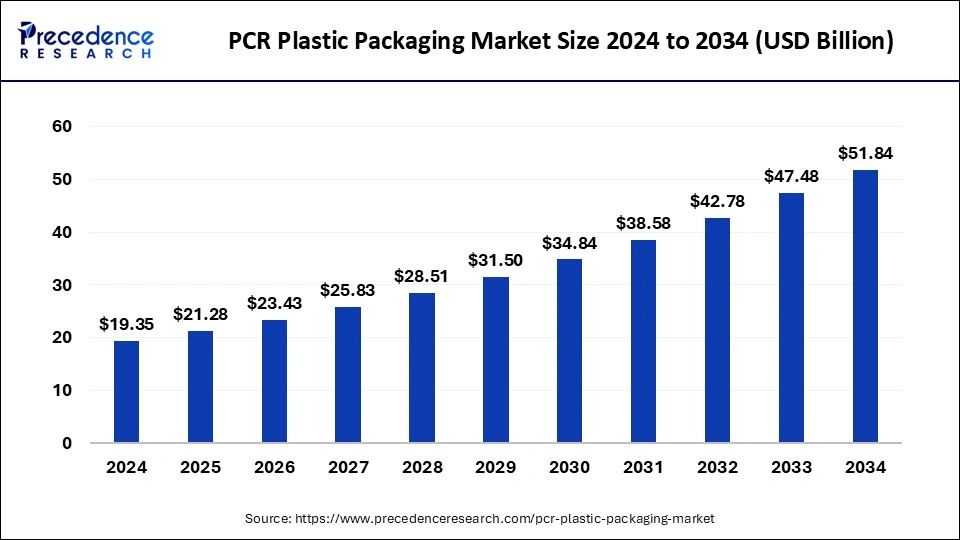

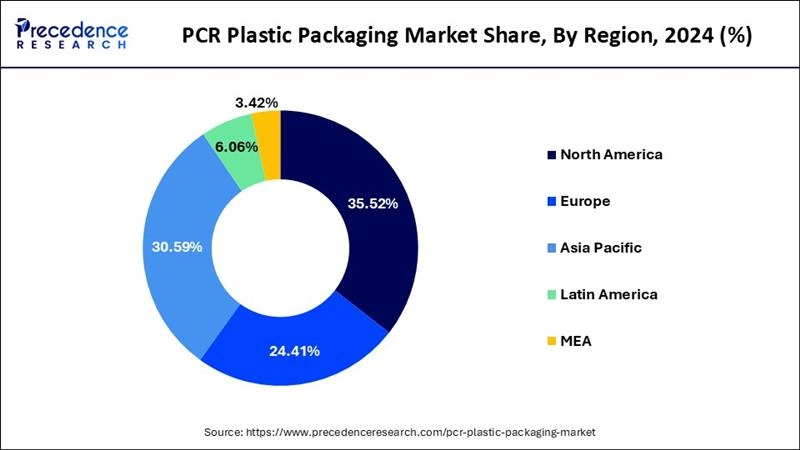

The global PCR plastic packaging market size accounted for USD 21.28 billion in 2025 and is forecasted to hit around USD 51.84 billion by 2034, representing a CAGR of 10.40% from 2025 to 2034. The North America market size was estimated at USD 6.87 billion in 2024 and is expanding at a CAGR of 9.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global PCR plastic packaging market size was estimated at USD 19.35 billion in 2024 and is predicted to increase from USD 21.28 billion in 2025 to approximately USD 51.84 billion by 2034, expanding at a CAGR of 10.40% from 2025 to 2034.

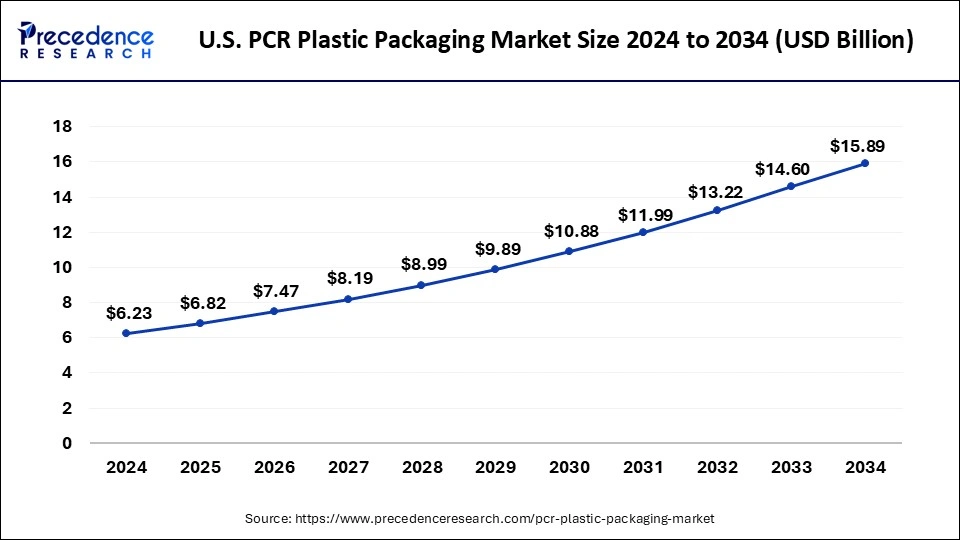

The U.S. PCR plastic packaging market size was evaluated at USD 6.23 billion in 2024 and is projected to be worth around USD 15.89 billion by 2034, growing at a CAGR of 9.86% from 2025 to 2034.

North America has held the largest revenue share 35.52% in 2024. In North America, the PCR (Post-Consumer Recycled) plastic packaging market is witnessing several noteworthy trends. Growing environmental awareness and sustainability concerns are driving increased demand for eco-friendly packaging solutions. Consumers and businesses alike are prioritizing products made from recycled plastics. Additionally, regulatory initiatives aimed at reducing plastic waste and promoting recycling are shaping the market. The region is also experiencing innovations in PCR plastic packaging design and materials, reflecting a strong commitment to environmentally responsible packaging solutions. These trends indicate a growing emphasis on sustainability in North America's packaging industry.

Asia Pacific is estimated to observe the fastest expansion. In Asia-Pacific, the PCR plastic packaging market is witnessing notable trends. Growing environmental awareness and government initiatives are driving demand for sustainable packaging solutions. Consumers are increasingly favoring brands that use PCR plastics. The region is experiencing a surge in e-commerce, boosting the need for eco-friendly packaging. Additionally, innovation in PCR technology and collaborations between manufacturers and recyclers are contributing to market growth. As Asia Pacific economies continue to expand, sustainable packaging practices remain at the forefront of consumer and industry preferences.

PCR (Post-Consumer Recycled) plastic packaging is a sustainable and eco-friendly packaging solution. It involves using plastic materials that have been previously used by consumers, collected through recycling programs, and then processed into new packaging products. PCR plastic packaging helps reduce the demand for virgin plastic production, conserving natural resources and energy while minimizing waste in landfills or oceans. This eco-conscious approach reduces the environmental footprint of packaging, making it a popular choice for companies and consumers committed to sustainability. PCR plastic packaging can vary in its percentage of recycled content, and higher percentages indicate a more environmentally friendly option.

Business opportunities in the PCR plastic packaging market include investing in circular economy initiatives. Companies can establish closed-loop systems where PCR plastic packaging is continuously recycled and reused, minimizing waste. Leveraging PCR plastic packaging also presents an opportunity for businesses to enhance their sustainability branding, attracting environmentally conscious consumers and solidifying their commitment to eco-friendly practices.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.40% |

| Market Size in 2025 | USD 21.28 Billion |

| Market Size by 2034 | USD 51.84 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Eco-friendly branding

Eco-friendly branding plays a pivotal role in the market. As consumers become increasingly environmentally conscious, they seek products and brands that align with their sustainability values. Businesses that prominently display their use of PCR plastic in packaging as part of their branding signal a strong commitment to environmental responsibility. This not only attracts eco-conscious consumers but also enhances brand loyalty and reputation. As a result, demand for PCR plastic packaging rises as more companies recognize the market advantage of eco-friendly branding.

Moreover, innovative packaging designs are driving demand by enhancing both functionality and aesthetics. Unique shapes, features, and user-friendly designs crafted from PCR plastics make products stand out on shelves and improve the overall consumer experience. Innovative designs can reduce material waste and create packaging that is not only eco-friendly but also visually appealing. As a result, businesses incorporating these designs can capture consumer attention and preference, further fueling the demand for PCR plastic packaging solutions. In essence, eco-friendly branding and innovative designs are powerful drivers that not only meet consumer expectations but also push the PCR plastic packaging market to new heights in response to evolving market trends.

Contamination concerns and processing costs

Contamination concerns have emerged as a significant constraint on the market demand for PCR (Post-Consumer Recycled) plastic packaging. The recycling process involves collecting used plastic materials from various sources, and ensuring the purity of this feedstock is a challenge. Contamination in the form of non-recyclable materials, different types of plastics, or impurities can compromise the quality and safety of the PCR plastic. This impacts the desirability of PCR plastic packaging for certain applications, especially those requiring stringent quality standards.

Moreover, processing costs present another restraint on the market demand for PCR plastic packaging. The recycling and purification of post-consumer plastics into high-quality PCR material can be resource-intensive and costly. Investments in advanced recycling technologies, sorting, and purification processes are necessary to meet industry standards and regulatory requirements. These costs, while essential for maintaining quality, can make PCR plastic packaging less competitive in price-sensitive markets compared to conventional plastics.

Innovative product development and sustainable branding

As manufacturers invest in research and development, they create innovative PCR plastic packaging solutions that not only meet environmental goals but also cater to evolving consumer preferences. These innovations include unique designs, functional features, and improved performance characteristics, making PCR plastic packaging highly competitive with traditional packaging materials. This product evolution enhances the market's appeal to a wider range of industries, thereby driving demand.

Moreover, companies that adopt PCR plastic packaging are increasingly leveraging it as a key component of their sustainable branding strategies. By prominently showcasing their commitment to eco-friendly packaging choices, businesses attract environmentally conscious consumers. Sustainable branding creates a strong emotional connection between the brand and its customers, fostering loyalty and trust. It also responds to the growing consumer demand for responsible consumption, further enhancing the market demand for PCR plastic packaging.

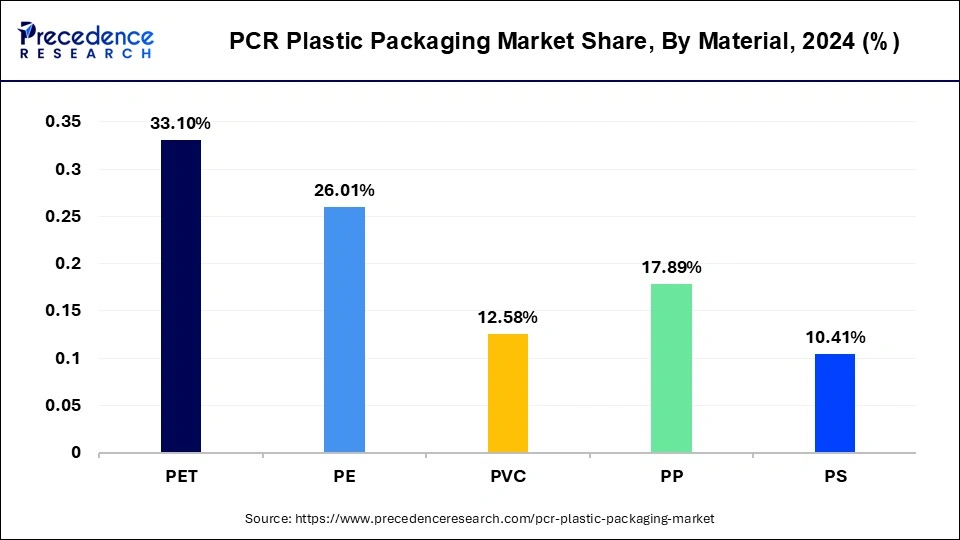

According to the material, the PET segment has held a 33% revenue share in 2024. PET (Polyethylene Terephthalate) is a commonly used thermoplastic polymer in the PCR plastic packaging market. It is valued for its durability, clarity, and recyclability. The trend in PET for PCR plastic packaging involves an increasing focus on using high percentages of recycled PET content to reduce the environmental impact. Brands and manufacturers are incorporating more PCR PET into their packaging to meet sustainability goals and consumer demand for eco-friendly options while maintaining product quality and safety.

The PVC segment is anticipated to expand at a significant CAGR of 12.58% during the projected period. PVC, or Polyvinyl Chloride, is a synthetic thermoplastic polymer widely used in various packaging applications. In the market, trends in PVC packaging involve an increased focus on sustainability. Manufacturers are transitioning toward using recycled PVC materials to reduce environmental impact. Additionally, PVC packaging innovations include improved recyclability, making it an eco-friendly choice, aligning with consumer preferences for sustainable packaging options.

Based on the product, the bottle segment held the largest market share of 42.78% in 2024. In the PCR plastic packaging market, the segment refers to a container typically made from post-consumer recycled (PCR) plastic material. These bottles are used to package various liquid or semi-liquid products, including beverages, cleaning agents, and personal care items. Trends in PCR plastic packaging bottles include the increasing use of higher PCR content, lightweight to reduce environmental impact, innovative shapes and designs for brand differentiation, and improved labeling techniques for clearer recycling information. Additionally, many brands are actively promoting the use of PCR bottles to meet sustainability goals and reduce plastic waste.

During the forecast period, the trays segment is observed to be the fastest growing at a CAGR of 10.66%. The expansion of the food and beverage sector is observed to boost the demand for PCR trays that can be considered as sustainable solutions for the food and beverage sector. Moreover, the presence of emerging technologies in recycling materials from the food industry is observed to grow the significance of the PCR trays. PCR trays are manufactured with stringent quality control measures to ensure uniform well size, shape, and spacing, reducing variability in experimental results. This consistency is vital for reproducibility and reliability in PCR experiments.

In 2024, the food and beverages segment had the highest market share of 57.18% on the basis of the installation. In the PCR plastic packaging market, the end-user category encompasses businesses involved in the production, packaging, and distribution of food and beverage products. This sector is witnessing a growing demand for PCR plastic packaging due to increased consumer awareness of sustainability. Key trends include the adoption of eco-friendly packaging solutions, including PCR plastic, to reduce environmental impact. Food safety and extended product shelf life are also driving the use of PCR plastic packaging, meeting the industry's evolving needs for both sustainability and functionality.

The cosmetic segment is anticipated to expand at the fastest rate over the projected period. Cosmetic products, including skincare, makeup, and personal care items, are the primary end-users of PCR (Post-Consumer Recycled) plastic packaging. In this market segment, the focus is on sustainability and eco-conscious packaging. Trends include the use of PCR plastic for cosmetic containers and bottles, emphasizing recyclability and reduced environmental impact. Brands are increasingly adopting PCR packaging to align with consumer demands for eco-friendly and responsible packaging choices, contributing to the growing market share of PCR Plastic Packaging in the cosmetics industry.

By Material

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

January 2025

January 2025