November 2024

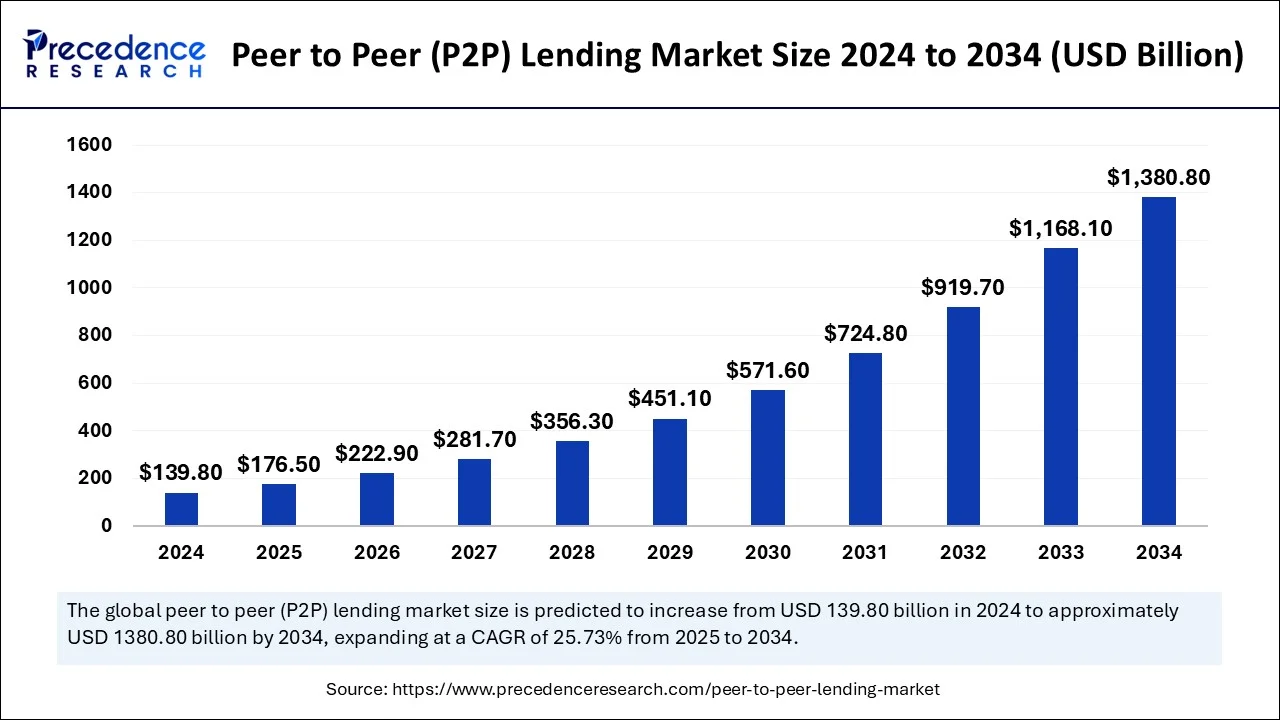

The global peer to peer (P2P) lending market size is calculated at USD 176.5 billion in 2025 and it is forecasted to hit around USD 1,380.80 billion by 2034, representing a solid CAGR of 25.73% from 2025 to 2034. The North America market size was estimated at USD 52.4 billion in 2024 and is expanding at a CAGR of 25.52% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global peer to peer (P2P) lending market size was estimated at USD 139.8 billion in 2024 and is predicted to increase from USD 176.5 billion in 2025 to approximately USD 1,380.80 billion by 2034, expanding at a CAGR of 25.73% from 2025 to 2034. The growth of the peer-to-peer (P2P) lending market is attributable to the increasing requirement for education loans and healthcare financing. Owing to the high gross domestic product (GDP), favorable economic policies, and early adoption of the latest financial alternatives, the peer-to- peer (P2P) lending market is predicted to grow remarkably.

P2P lending is typically done through AI platforms that match borrowers with potential lenders. P2P lending offers secured lenders and unsecured lenders. However, most loans in P2P lending are unsecured personal loans. Secured loans are rare in the industry and are usually secured by luxury goods. Technologies like artificial intelligence (AI) and machine learning (ML) help increase the efficiency of P2P lending.

AI is revolutionizing peer-to-peer lending by improving risk assessment and matching borrowers with lenders. Advanced AI systems can even be used to reach and engage customers. With technologies like voice chat AI, peer-to-peer lending companies can manage phone calls and attract customers at a larger and smaller scale. This will lead to the growth of the peer-to-peer (P2P) lending market through the use of AI-driven technologies like WIZ to facilitate customer crystallization and dissemination.

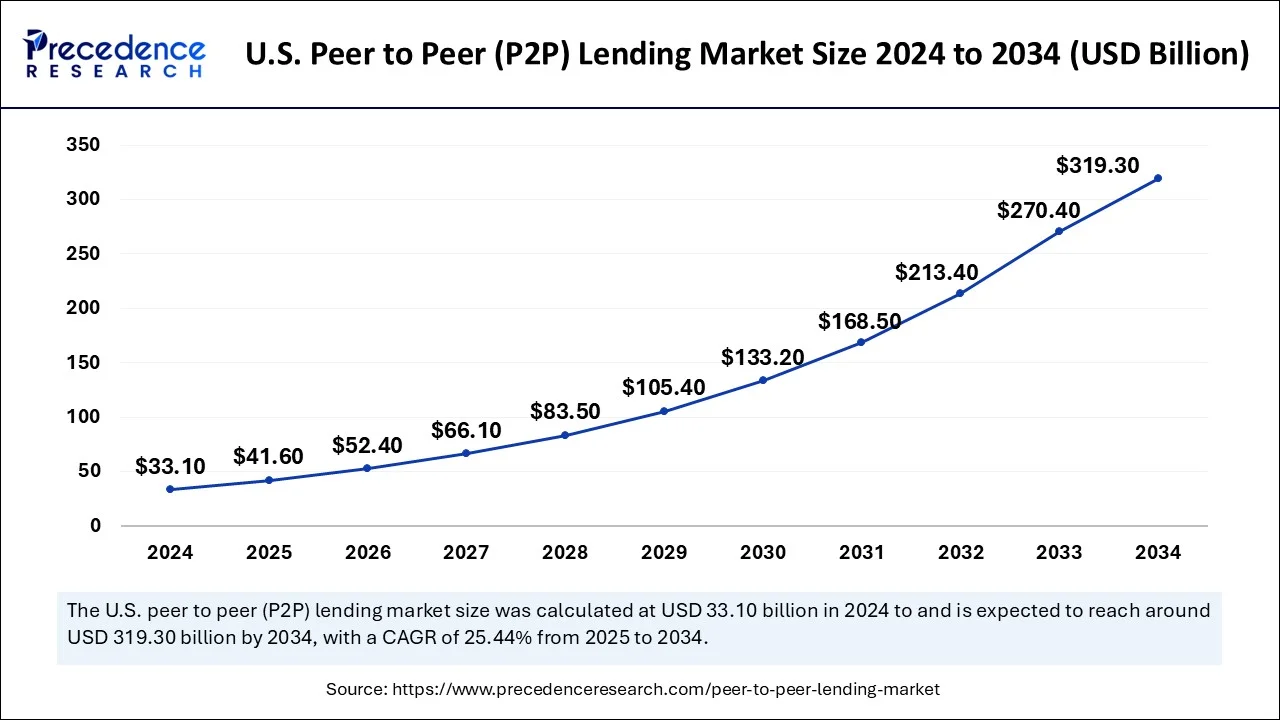

The U.S. peer to peer (P2P) lending market size was exhibited at USD 33.1 billion in 2024 and is projected to be worth around USD 319.3 billion by 2034, growing at a CAGR of 25.44% from 2025 to 2034.

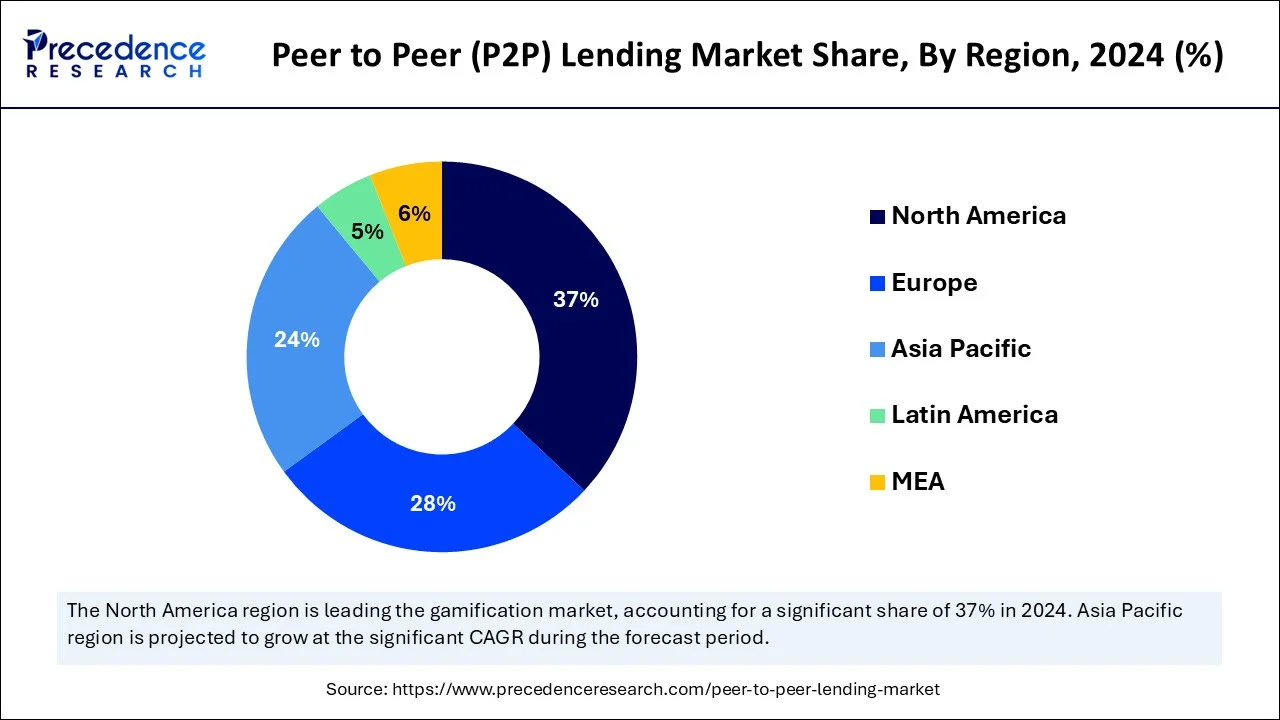

North America led the peer to peer (P2P) lending market in 2024 by holding 37% of the market share. North America generally has a more conducive regulatory environment for P2P lending compared to other regions. Regulatory clarity and frameworks that facilitate lending activities have allowed platforms to operate more smoothly and attract both borrowers and investors.

North America generally has a more conducive regulatory environment for P2P lending compared to other regions. Regulatory clarity and frameworks that facilitate lending activities have allowed platforms to operate more smoothly and attract both borrowers and investors. North America has a well-established credit infrastructure, including credit bureaus and scoring systems, which facilitates the assessment of borrower creditworthiness. This infrastructure reduces the risk for lenders participating in P2P lending platforms and encourages investor participation.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China dominates the peer to peer (P2P) lending market in Asia-Pacific region. The peer to peer (P2P) lending market is growing in Asia-Pacific region due to growing number of small and medium sized enterprises. The government of emerging nations such as China and India are constantly taking efforts for the promotion of cashless technologies. This factor is boosting the growth of peer to peer (P2P) lending market in the region.

| Report Coverage | Details |

| Market Size in 2024 | USD 139.8 Billion |

| Market Size in 2025 | USD 176.5 Billion |

| Market Size by 2034 | USD 1,380.80 Billion |

| Growth Rate from 2025 to 2034 | 25.73% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End User, Business Model, and Geography |

| Companies Mentioned | Avant LLC, Zopa Bank Limited, Funding Circle, Social Finance Inc., Kabbage Inc., RateSetter, Lending Club Corporation, Prosper Funding LLC, LendingTree LLC, OnDeck |

Flexible Investment Options

Depending on their interests and risk tolerance, investors can manually search through the loans that are accessible on the platform and select which ones to invest in. As a result, investors have complete control over their financial choices and can customize their portfolios to meet certain needs or tastes. To spread risk and possibly boost rewards, investors can distribute their money among a number of loans.

Additionally, some platforms provide investors with the opportunity to divide their investment into multiple loans of lesser amounts by offering the option to invest in fractional loan parts. Investors can continually reinvest their profits without human interaction thanks to the automatic reinvestment options offered by many platforms. Thereby, the emergence of flexible investment options act as a driver for the peer to peer (P2P) lending market.

Credit Risk Concentration

In peer to peer (P2P) lending market, credit risk concentration is the extent to which a platform's loan portfolio is exposed to a limited number of borrowers or a certain category of borrowers. Should a substantial percentage of loans be originated in a certain geographic area, the platform would be vulnerable to regional legislative changes or economic downturns. The platform may be subject to industry-specific risks if loans are concentrated within a certain industry. For instance, in the event of a downturn in the technology industry, a platform that extends loans primarily to borrowers in that industry may be more vulnerable.

Social Impact Investing

Lending to people or companies that support good social change or have a social mission may be the primary focus of social impact investors. This factor is observed to offer opportunity for the peer to peer (P2P) lending market. This can entail making loans to small companies in marginalized areas, encouraging the development of sustainable energy sources, sponsoring programs for education, or offering microloans to company owners in developing nations.

Platforms that offer clear parameters for assessing the social or environmental impact of investments are frequently given preference by social impact loan investors. Platforms that have strong social and environmental standards, actively engage with borrowers to understand their needs and impact, and are open and honest about their lending methods may be given priority.

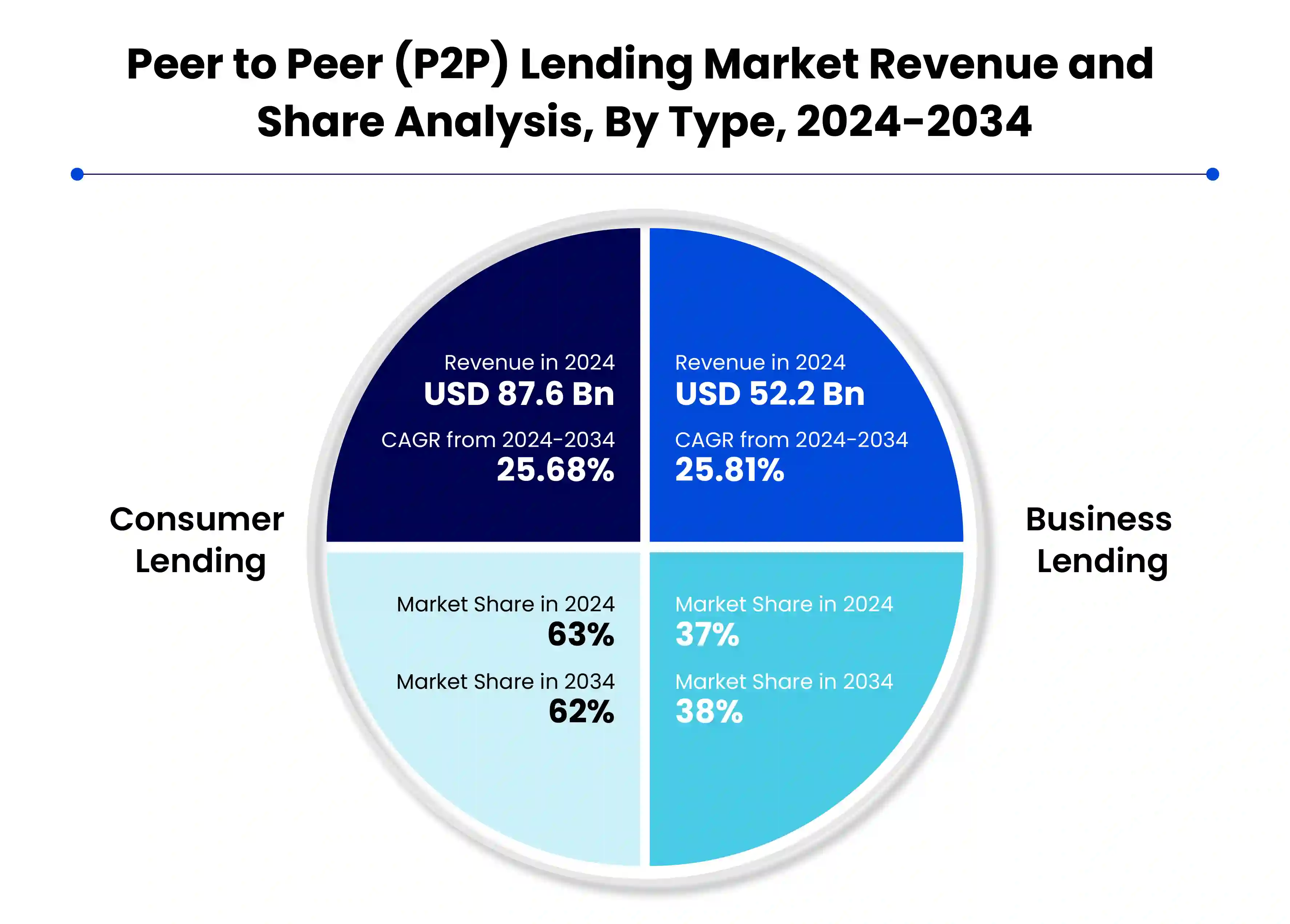

The consumer lending segment held the largest share in peer-to-peer lending market in 2024. In the peer to peer (P2P) lending market, consumer lending is the act of people borrowing money from other people or organizations online without going through traditional financial institutions like banks. Under this concept, lenders or investors who are willing to fund loans to borrowers are put in direct contact with each other. Both lenders and borrowers sign up on a peer-to-peer lending network. The loan amount, purpose, interest rate that the borrower is prepared to pay, and the length of the loan are all specified in the loan listings that the borrower creates. On the site, borrowers create loan listings with information on the loan amount, purpose, interest rate, and period. After looking over these listings, investors select which loans to support in accordance with their investment standards and risk tolerance.

In order to ascertain borrowers' creditworthiness, P2P lending platforms frequently carry out credit assessments and risk evaluations on them. This aids investors in choosing the right loans to fund with knowledge. Investors might make contributions to a loan after it is up for sale. A single loan is usually financed by a number of investors, distributing the risk among them. The borrower accepts the loan amount upon loan funding completion and undertakes to return the loan in accordance with the terms outlined in the loan agreement. Regular repayments from borrowers, often made on a monthly basis, are disbursed to the investors who provided the loan's funding. These repayments usually include principle as well as interest.

The business lending segment is observed to witness the fastest rate of expansion. The business lending segment is observed to expand at a significant rate owing to the emergence of multiple small and medium-scale businesses, especially in developing countries. Multiple governments across the globe have started supporting startups to boost the production of goods within the nation. This factor is observed to act as a major growth factor for the segment’s expansion in the peer to peer (P2P) lending market.

Peer to Peer Lending (P2P) Market Revenue US$ Bn), By Type, 2022 and 2023

| Type | 2022 | 2023 |

| Consumer Lending | 55.2 | 69.5 |

| Business Lending | 32.8 | 41.3 |

The consumer credit loan segment dominated the peer to peer (P2P) lending market in 2024. Consumer credit loans are perceived to be less risky as compared to other loans, such as small business loans or personal loans for entrepreneurs. This perception often attracts more lenders to participate in the segment. Consumer credit loans generally offer more predictable returns to investors or lenders due to the regular repayment schedules and lower default rates compare to other types of loans.

Advancements in technology and data analytics allow such platforms to assess borrowers’ creditworthiness more accurately, mitigating the risk associated with consumer credit loans. The segment also caters to wide range of borrowers, from those with excellent credit scores to those with subprime credit, offering lucrative opportunities for lenders and investors.

The student loans segment is observed to witness the fastest rate of expansion during the forecast period. Student loans often come with longer repayment period compared to other types of loans, offering lenders with a steady stream of income over an extended period. In many countries, governments offer support for student loans, reducing the risk for lenders. The demand for student loans is high due to the rising cost of education, especially higher education. This creates a significant market for lenders to tap into.

Peer to Peer Lending (P2P) Market Revenue US$ Bn), By End User, 2022 and 2023

| End User | 2022 | 2023 |

| Consumer Credit Loans | 31.0 | 39.0 |

| Small Business Loans | 23.5 | 29.6 |

| Student Loans | 19.1 | 24.0 |

| Real Estate Loans | 14.4 | 18.2 |

The traditional lending segment held the largest market share in 2024. Traditional lenders benefit from strong brand recognition and extensive marketing efforts, which can attract borrowers seeking loans and investors looking for investment opportunities. Traditional lenders generally have access to larger pools of capital, including deposits and institutional funding, enabling them to offer a wider range of loan products and more competitive interest rates compared to peer to peer platforms that rely on individual investors’ funds.

Traditional lenders, such as banks and credit unions typically have long-standing reputations and established trust with consumers. This makes borrowers more inclined to seek financing from these institutions rather than from relatively new peer to peer platforms.

Peer to Peer Lending (P2P) Market Revenue US$ Bn), By Business Model, 2022 and 2023

| Business Model | 2022 | 2023 |

| Marketplace Lending | 38.7 | 48.8 |

| Traditional Lending | 49.3 | 62.1 |

Segments Covered in the Report

By Type

By End User

By Business Model

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

August 2024