What is the PEM Water Electrolyzer Market Size?

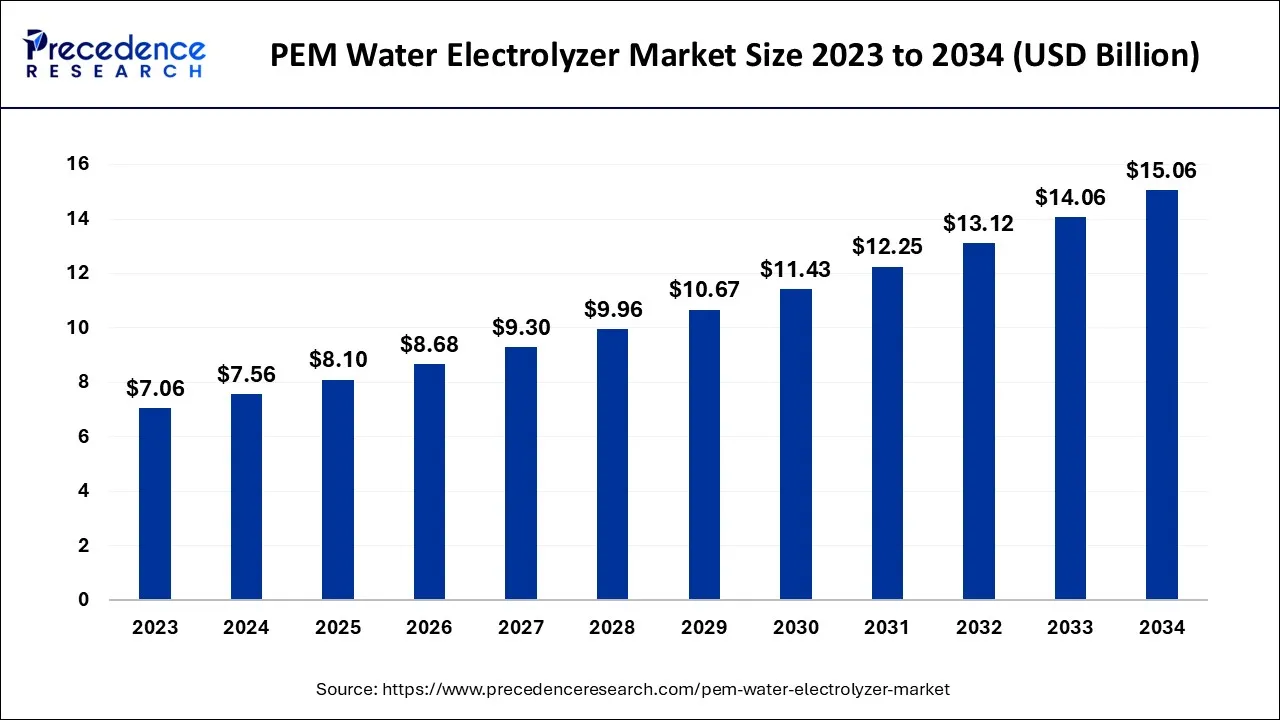

The global PEM water electrolyzer market size is calculated at USD 8.10 billion in 2025 and is predicted to increase from USD 8.68 billion in 2026 to approximately USD 16.02 billion by 2035, growing at a CAGR of 7.06% from 2026 to 2035. The growing shift towards cleaner and more sustainable energy sources propelled thePEM water electrolyzer market demand.

PEM Water Electrolyzer Market Key Takeaways

- North America is predicted to genarate the maximum market share between 2026 and 2035.

- By Type, the middle scale type segment recorded the largest market share in 2025.

- By Application, the energy storage or fueling for FCEVs segment contributed the highest market share in 2025.

Strategic Overview of the Global PEM Water Electrolyzer Industry

The PEM (Proton Exchange Membrane) water electrolyzer market refers to the market for devices that use PEM technology to split water into its constituent parts, hydrogen and oxygen, through electrolysis. PEM electrolyzers are a type of electrolyzer that use a solid polymer electrolyte membrane to conduct protons from the anode to the cathode while preventing the mixing of the gases.

The market for PEM water electrolyzers has been growing rapidly in recent years due to increasing demand for hydrogen as a clean energy source for various applications, including fuel cells, energy storage, and transportation. PEM electrolyzers have several advantages over other electrolyzers, including high efficiency, low maintenance requirements, and fast response times, making them well-suited for various industries.

Furthermore, the market for PEM water electrolyzers is expected to grow in the coming years, driven by increasing demand for hydrogen as a clean energy source and technological improvements that make PEM electrolyzers more cost-effective and efficient. Also, advances in PEM electrolyzer technology have increased efficiency, lower costs, and improved performance, making them more attractive for commercial and industrial applications. This includes the development of new catalysts, improved membranes, and better system integration.

However, high initial costs, limited infrastructure, and dependence on renewable energy sources are anticipated to impede market growth. The initial capital costs of installing a PEM electrolyzer system can be high, which can be a barrier to adoption for some potential customers. While the costs are decreasing, they may still be prohibitively expensive for some applications. Also, PEM electrolyzers face competition from other technologies for hydrogen production, such as alkaline electrolysis and solid oxide electrolysis. These technologies may be more suitable for certain applications or have a lower cost of ownership, which could limit the market share of PEM electrolyzers.

The COVID-19 pandemic have highlighted the need for cleaner and more sustainable energy sources and the importance of reducing carbon emissions. This has increased interest in hydrogen as a clean energy carrier and a growing demand for PEM electrolyzers, particularly in transportation. In addition, the pandemic has accelerated the shift towards remote work and digital communication, which has led to an increased demand for data centers and other energy-intensive infrastructure. PEM electrolyzers can provide a reliable and sustainable backup power source for these facilities.

Artificial Intelligence: The Next Growth Catalyst in PEM Water Electrolyzer

Artificial Intelligence (AI) is fundamentally transforming the PEM water electrolyzer industry by shifting operations from reactive monitoring to autonomous optimization of green hydrogen production. Machine learning algorithms now enable predictive maintenance by analyzing real-time voltage and pressure fluctuations to detect membrane degradation before failure, significantly extending the operational life of expensive iridium-based components. AI-driven "digital twins" are being utilized to synchronize electrolyzer power loads with the intermittent nature of renewable energy grids, maximizing efficiency and lowering the levelized cost of hydrogen (LCOH).

Market Outlook

- Market Growth Overview: The PEM water electrolyzer market is expected to grow significantly between 2026 and 2035, driven by the global decentralization efforts, government support and investment, and integration with renewables.

- Sustainability Trends:Sustainability trends involve the precious metal reduction and substitution, circular economy, material recycling, and green hydrogen certification and transparency.

- Major Investors: Major investors in the market include Venture Capital Leaders, Prelude Ventures, and Fenice Investment Group.

- Startup Economy:The startup economy is focused on ultra-high efficiency, reduced precious metal usage, and modular and scalable systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.10 Billion |

| Market Size in 2026 | USD 8.68 Billion |

| Market Size by 2035 | USD 16.02 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.06% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increasing demand for clean energy to brighten the market prospect

As the world continues to shift towards cleaner and more sustainable sources of energy, there is a growing demand for hydrogen as a clean and versatile energy carrier that can be used for various applications, including power generation, fuel cells, transportation, and others. PEM electrolyzers are a key technology for producing hydrogen through electrolysis. They have several advantages over other electrolyzers, including high efficiency, low maintenance requirements, and fast response times, making them well-suited for use in various industries.

Governments worldwide are also implementing policies and incentives to promote hydrogen as a clean energy source, further driving demand for PEM electrolyzers. This includes funding for research and development, subsidies for the purchase of electrolyzers, and tax incentives for the production and use of hydrogen. Thus, the increasing demand for clean energy is a major driver for the growth of the PEM water electrolyzer market. This development is anticipated to continue in the coming years as the world shifts towards a more sustainable energy future.

Government support and incentives

Governments worldwide are implementing policies and incentives to promote the use of hydrogen as a clean energy source and to encourage the adoption of PEM electrolyzers for hydrogen production. These policies and incentives include funding for research and development, subsidies for the purchase of electrolyzers, tax incentives for the production and use of hydrogen, and other measures to support the development of a hydrogen economy. For example, in Europe, the European Commission has set a target to produce up to 10 million tonnes of renewable hydrogen by 2030, which is expected to drive significant investment in PEM electrolyzers.

Furthermore, the United States Department of Energy has launched several initiatives to support the development of a domestic hydrogen industry, including the H2@Scale program, which aims to accelerate the deployment of hydrogen technologies across multiple sectors. The program includes funding for research and development, pilot projects, and public-private partnerships to advance the adoption of PEM electrolyzers and other hydrogen technologies. Similar initiatives are also being implemented in countries such as Japan, South Korea, China, and Australia, which are expected to drive significant PEM water electrolyzer market growth in the coming years.

Thus, government support and incentives drive demand for the PEM water electrolyzer market. They provide funding and regulatory frameworks that support the development and adoption of this technology for hydrogen production.

Key Market Challenges

High capital cost is causing hindrances to the market

PEM (proton exchange membrane) water electrolyzers are a relatively new technology that involves complex engineering and specialized materials. As a result, the production costs are higher than traditional electrolysis technologies. Moreover, the high capital costs of the equipment may not be feasible for small-scale applications or individuals, limiting the market demand for large-scale industrial applications. The initial investment costs may also deter investors and companies from entering the market, leading to limited supply and higher prices.

However, there are ongoing efforts to reduce the capital costs associated with PEM water electrolyzers, including the use of lower-cost materials, optimization of production processes, and technological advancements. These efforts may help expand the demand for PEM water electrolyzers, particularly as the demand for clean and sustainable energy solutions continues to increase.

Key Market Opportunities

Growth of the fuel cell vehicles

The growth of fuel cell vehicles presents a significant opportunity for the PEM water electrolyzer market. As fuel cell vehicles rely on hydrogen as a fuel source, there is a growing demand for hydrogen fueling infrastructure. PEM water electrolyzers can play a critical role in producing hydrogen for fuel cell vehicles, particularly in applications such as hydrogen refueling stations. With the increasing adoption of fuel cell vehicles, there will be a need for more hydrogen fueling stations, driving the demand for PEM water electrolyzers.

In addition, the increasing focus on decarbonization and the transition to renewable energy sources is also driving the growth of the PEM water electrolyzer market. PEM water electrolysis is an attractive option for producing hydrogen using renewable energy sources, such as wind and solar power. As the demand for clean energy continues to grow, the demand for PEM water electrolyzers is expected to increase as well.

Moreover, government initiatives and investments in the development of hydrogen infrastructure and technologies are also driving the growth of the PEM water electrolyzer market. Many governments around the world have set targets for reducing carbon emissions and promoting the adoption of hydrogen as a clean energy source. These initiatives are expected to drive the demand for PEM water electrolyzers, as they are a key component of the hydrogen production process.

Green hydrogen production

The PEM water electrolyzer market is expected to experience significant growth opportunities due to the increasing demand for green hydrogen production. PEM water electrolyzers are an essential component of green hydrogen production, which involves the use of renewable energy sources, such as wind and solar, to produce hydrogen without generating carbon emissions.

Governments worldwide are investing heavily in the development of green hydrogen infrastructure, and the increasing focus on reducing carbon emissions is driving the demand for green hydrogen. This, in turn, is driving the demand for PEM water electrolyzers, which are the most efficient and cost-effective technology for green hydrogen production.

The PEM water electrolyzer market is also benefiting from the decreasing cost of renewable energy, making the production of green hydrogen more cost-competitive with traditional hydrogen production methods. As a result, industries such as transportation, power generation, and chemical production are expected to increase their demand for green hydrogen, further driving the growth of the PEM water electrolyzer market.

Growing industrial applications

The industrial sector is one of the major end-users of PEM water electrolyzers. These electrolyzers are used for various industrial applications such as the production of chemicals, electronics, and metals. The increasing demand for green and sustainable industrial processes is creating huge growth opportunities for PEM water electrolyzers in the industrial sector.

The use of hydrogen produced by PEM water electrolyzers in industrial applications has the potential to reduce greenhouse gas emissions and increase energy efficiency. Industries are increasingly looking for ways to reduce their carbon footprint and meet their sustainability goals, which is creating opportunities for the growth of the PEM water electrolyzer market in the industrial sector.

In addition, the increasing adoption of renewable energy sources such as wind and solar power is projected to raise the demand for PEM water electrolyzers over the forecast period. These electrolyzers can be used to store excess renewable energy in the form of hydrogen, which can then be used as fuel in industrial processes.

Segment Insights

Type Insights

The PEM water electrolyzer market is divided into middle-scale type, large-scale type, and small scale type, with the middle-scale type segment accounting for most of the market. These systems have a higher capacity than small-scale systems and are typically used in larger industrial applications. They are more expensive than small-scale systems but offer higher efficiency and production rates. The demand for middle-scale PEM water electrolyzers is driven by the increasing adoption of green hydrogen production in the industrial sector. The industrial sector is gradually shifting towards green hydrogen production to reduce their carbon footprint, which is driving the demand for middle-scale PEM water electrolyzers.

Application Insights

The PEM water electrolyzer market is divided into industrial gases, energy storage or fueling for FCEVs, steel plants, electronics and photovoltaics, power plants, and others, with energy storage or fueling for FCEVs accounting for most of the market. This is due to PEM water electrolyzers can be used to produce hydrogen fuel for fuel cell vehicles, which have the potential to replace traditional combustion engines and reduce greenhouse gas emissions.

The driving factors for this segment include the increasing demand for renewable energy sources, government incentives and subsidies for clean energy, and the need to reduce carbon footprint, increasing demand for high-purity hydrogen gas for sever applications. In addition, the rising demand for fertilizers, chemicals, and transportation fuels is another factor bolstering the growth of this segment.

Regional Insights

What Made North America the Dominant Region in the PEM Water Electrolyzer Market?

North America dominates the market, primarily driven by technological advancements, government support, and increasing demand for clean and sustainable energy solutions. Also, North America has been investing heavily in the research and development of PEM water electrolyzers, which has led to technological advancements and cost reductions. Thus, the North American PEM water electrolyzer market is expected to experience growth in the coming years, driven by increasing demand for clean and sustainable energy solutions, government initiatives to promote hydrogen infrastructure and the growing adoption of fuel cell electric vehicles (FCEVs).

U.S. PEM Water Electrolyzer Market Trends

U.S. integration of AI-driven digital twins and low-iridium catalysts is further optimizing efficiency and addressing critical material scarcity. Consequently, the U.S. has solidified its position as a primary hub for green hydrogen innovation, transitioning from pilot projects to large-scale industrial production.

Why is Europe Considered a Significant Market for PEM Water Electrolyzers?

Europe is a significant market for PEM water electrolyzers, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is due to the increasing demand for hydrogen in various applications such as energy storage, industrial gases, and transportation. Furthermore, the European PEM water electrolyzer market has witnessed several initiatives and projects promoting the adoption of hydrogen as a clean energy source. For instance, the European Union has set a target of producing 40 GW of renewable hydrogen by 2030, which is expected to drive the demand for PEM water electrolyzers in the region.

Germany PEM Water Electrolyzer Market Trend

Germany's pivotal government strategy and funding, rapid industrial adoption, and integration with abundant renewables. The market is leveraging AI and digital platforms for optimized energy management and predictive maintenance. Siemens Energy, a key domestic player, integrates its electrolyzers with digital energy platforms to create smart, efficient hydrogen production systems.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is anticipated to have the greatest CAGR. The market is driven by increasing demand for clean and sustainable energy solutions, government initiatives to promote hydrogen infrastructure, and the growing adoption of fuel cell electric vehicles (FCEVs). In addition, The Asia-Pacific PEM water electrolyzer market has witnessed several initiatives and projects promoting the adoption of hydrogen as a clean energy source. For instance, China has set a target of producing 1 million fuel cell vehicles and building 1,000 hydrogen refueling stations by 2030, which is expected to drive the demand for PEM water electrolyzers in the region.

India PEM Water Electrolyzer Market Trend

The National Green Hydrogen Mission and specific production-linked incentives (PLI). Major domestic conglomerates like Reliance and Adani are successfully localizing manufacturing to reach a 3 GW annual capacity, significantly reducing reliance on imported iridium and platinum components. The industrial sector, led by green steel and ammonia, remains the primary demand driver, leveraging India's 223 GW renewable capacity to produce low-cost, high-purity hydrogen.

Why is the MEA PEM Water Electrolyzer Market Gaining Momentum?

The Middle East & Africa (MEA) PEM water electrolyzer market is accelerating as the region advances green hydrogen as a pillar of long-term energy diversification and decarbonization programs. Saudi Arabia, the UAE, Oman, and Namibia are investing heavily in large-scale renewable energy projects, and PEM electrolyzers are a perfect fit for intermittently running on solar and wind power. Hydrogen roadmaps, export initiatives, and projects are being announced and financed through government-sponsored initiatives and public-private partnerships. In the region, international electrolyzer manufacturers are seeking to support megaproject deployment through joint ventures, localized service hubs, and technology alliances.

What Potentiates the Latin American PEM Water Electrolyzer Market?

The Latin American PEM water electrolyzer market is driven by the availability of renewable energy sources, the government's favorable environment, and the importance of exporting green hydrogen. Countries such as Chile, Brazil, and Colombia are capitalizing on robust solar, wind, and hydropower potential to become competitive in producing green hydrogen and derivatives. The region's low-cost renewable electricity also increases the economic feasibility of PEM technology, particularly for distributed and flexible operations. Energy companies and electrolyzer manufacturers are working with local utilities and developers to scale up demonstrations to commercial scale.

Value Chain Analysis of the PEM Water Electrolyzer Market

Raw Material Sourcing

This stage involves sourcing metals, titanium, stainless steel, membranes, and power electronics for manufacturing PEM electrolyzers.

- Key players: Johnson Matthey, Umicore, BASF, 3M, DuPont

Component Fabrication and Machining

Membranes, bipolar plates, catalyst-coated electrodes, and stacks are manufactured by manufacturers through precision coating and machining of their components.

- Key Players: Nel ASA, ITM Power, Plug Power, Siemens Energy, Cummins

Stack Assembly and Engineering

This stage involves assembling individual cells into a "stack," which is the primary engine of the electrolyzer.

- Key Players: ITM Power, Nel ASA, Ohmium International, Elogen, and Sunfire GmbH.

System Integration and Balance of Plant (BoP)

System integrators package the electrolyzer stack with the necessary power electronics, water purification units, and cooling systems to create a functional plant.

- Key Players: Siemens Energy, Cummins (Accelera), Plug Power, John Cockerill, and McPhy Energy.

End-Use Application and Project Development

The final stage involves deploying these systems across various sectors like heavy industry, energy storage, and transportation.

- Key Players: Air Liquide, Linde Group, Reliance Industries, Adani Green Energy, and BP.

Distribution and Sales

PEM electrolyzer systems are sold and marketed by OEMs and channel partners to industrial, energy, and hydrogen project developers.

- Key players: Nel ASA, ITM Power, Plug Power, Siemens Energy, Bloom Energy

Top Companies in the PEM Water Electrolyzer Market & Their Offerings

- Proton On-Site (a Nel ASA company): As a pioneer in PEM technology, they provide high-performance, modular electrolyzers ranging from lab-scale units to large industrial systems.

- Teledyne Energy Systems:This company leverages decades of experience in power systems to manufacture specialized PEM electrolyzers designed for harsh environments and aerospace applications.

- Suzhou Jingli (SJH):A leader in the Chinese market, this company specializes in large-scale hydrogen generation equipment and has significantly expanded its PEM manufacturing capacity to meet global demand.

- Hydrogenics (now Accelera by Cummins):As a major technology provider, they design and manufacture heavy-duty PEM fuel cells and electrolyzers for power-to-gas and mobility projects.

- McPhy Energy:McPhy specializes in the design and integration of hydrogen production and distribution equipment, offering "Augmented" PEM electrolyzers. They are a key player in the European market, focusing on delivering turnkey hydrogen stations and large-scale electrolysis plants for industrial clusters.

- Areva H2Gen (now Elogen):Now operating as Elogen, these firm designs and manufactures high-efficiency PEM electrolyzers with a focus on modularity and ease of integration.

- ITM Power:This company is a global leader in manufacturing large-scale PEM electrolyzer stacks optimized for rapid response to fluctuating renewable energy inputs. They operate one of the world's largest gigafactories to drive down costs through mass production and standardized stack modules.

- Elchemtech:Based in South Korea, Elchemtech specializes in the research and development of core PEM components, including advanced electrodes and high-performance stacks.

- Siemens Energy:Siemens Energy is a primary driver of the PEM market through its Silyzer platform, which is engineered to handle multi-megawatt power loads.

- Toshiba:Toshiba contributes to the market through its H2One™ hydrogen energy system and advanced PEM stack research aimed at high-durability performance.

Recent Developments

- In March 2025, Bosch is launching containerized modular PEM electrolyzers featuring two 1.25 MW units designed for rapid deployment in industrial and maritime hubs. This new Hybrion PEM electrolyzer was stacked at the Hannover Messe 2025. (Source: linkedin.com)

- In March 2025, BASF & Siemens Energy, these partners commissioned a 54 MW water electrolyzer plant capable of producing 8,000 metric tons of hydrogen annually for chemical manufacturing. These electrolyzers are designed for producing zero-carbon hydrogen. The electrolyzer is connected to a load of 54 megawatts and has the capacity to supply the main plant. (Source: basf.com)

- In February 2025, Accelera by Cummins won a contract to deliver a 100 MW PEM electrolyzer system to the bp Lingen Green Hydrogen Project in Germany, consisting of 20 HyLYZER 1000 units produced at its new plant in Guadalajara, Spain. The project is expected to generate up to 11,000 tons of green hydrogen annually and is the largest deployment of electrolyzers to date by Cummins, reinforcing the industrial decarbonization of Europe. (Source: investor.cummins.com)

- In February 2025, Air Liquide and TotalEnergies announced two major electrolyzer projects in the Netherlands to enhance renewable and low-carbon hydrogen generation. They include the 200 MW ELYgator project in Maasvlakte, with a capacity of up to 23000 tons per year, and a joint-venture electrolyzer in Zeeland of up to 250 MW to serve refinery and mobility purposes. (Source: airliquide.com)

- In November 2023, Air Liquide and Siemens Energy opened a joint gigawatt-scale PEM electrolyzer factory in Berlin, Germany. The plant is projected to reach a maximum production capacity of 3 GW by 2025, enabling the mass implementation of PEM electrolyzers coupled with renewable energy sources. (Source: airliquide.com)

- In March 2019, ITM Power, a UK-based company that designs and manufactures PEM electrolyzer systems, signed a strategic partnership with Linde, a global industrial gas company, to collaborate on developing and promoting hydrogen solutions.

- In September 2019,Nel ASA, a Norwegian company that produces PEM electrolyzer systems, announced a partnership with Haldor Topsoe, a Danish catalyst company, to offer integrated solutions for green hydrogen production.

- In October 2019,Cummins Inc., a global power technology company, announced the acquisition of Hydrogenics Corporation, a Canadian company that designs and manufactures PEM electrolyzer systems, to expand its portfolio of hydrogen technologies.

- In January 2021,Plug Power, a US-based company that produces PEM electrolyzer systems and hydrogen fuel cells, announced a partnership with Renault to develop and manufacture hydrogen fuel cell commercial vehicles for the European market.

- In March 2021,Ballard Power Systems, a Canadian company that produces PEM electrolyzer systems and fuel cells, announced a strategic partnership with Linamar Corporation, a diversified Canadian manufacturing company, to develop and manufacture fuel cell powertrains for light-duty vehicles.

Segments Covered in the Report

By Type

- Small Scale Type

- Middle Scale Type

- Large Scale Type

By Application

- Power Plants

- Steel Plant

- Electronics and Photovoltaics

- Industrial Gases

- Energy Storage or Fueling for FCEVs

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344