April 2025

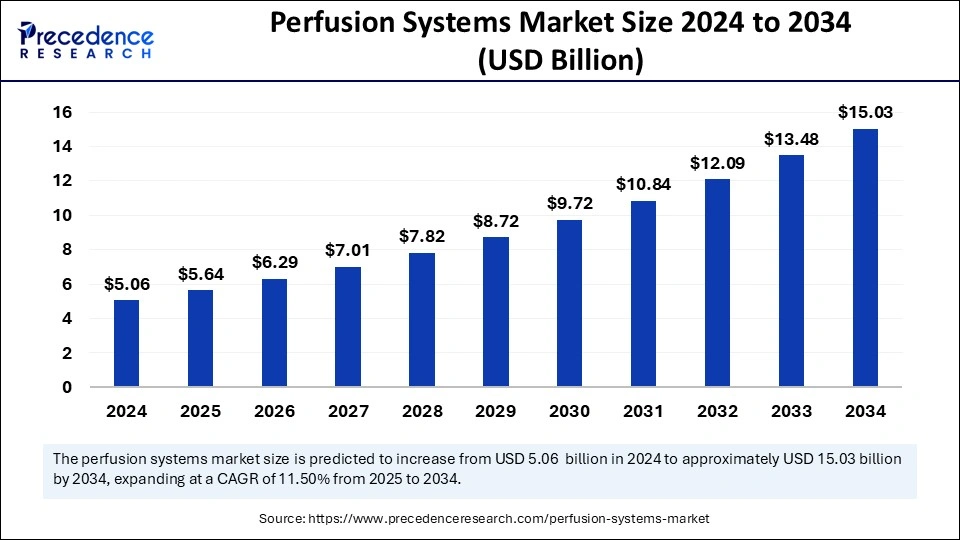

The global perfusion systems market size is calculated at USD 5.64 billion in 2025 and is forecasted to reach around USD 15.03 billion by 2034, accelerating at a CAGR of 11.50% from 2025 to 2034. The North America market size surpassed USD 1.97 billion in 2024 and is expanding at a CAGR of 11.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global perfusion systems market size accounted for USD 5.06 billion in 2024 and is predicted to increase from USD 5.64 billion in 2025 to approximately USD 15.03 billion by 2034, expanding at a CAGR of 11.50% from 2025 to 2034. Worldwide health infrastructure improvements, rising transplant volumes, increasing cardiovascular diseases, and research in pharmaceutical medicine sustain the consistent development of the market.

The perfusion systems market transforms through technological development, which brings artificial intelligence systems to enhance precision and efficiency and achieve predictive accuracy. The integration of AI-powered perfusion systems allows for real-time monitoring while delivering automated decision systems, which provides substantial improvements in organ preservation and transplantation results. AI-driven perfusion systems operate in biomanufacturing by processing tasks automatically, which leads to increased consistency while raising production levels. Medical professionals can use AI to analyze data in real time, which boosts their ability to make decision-oriented choices for individualized treatments.

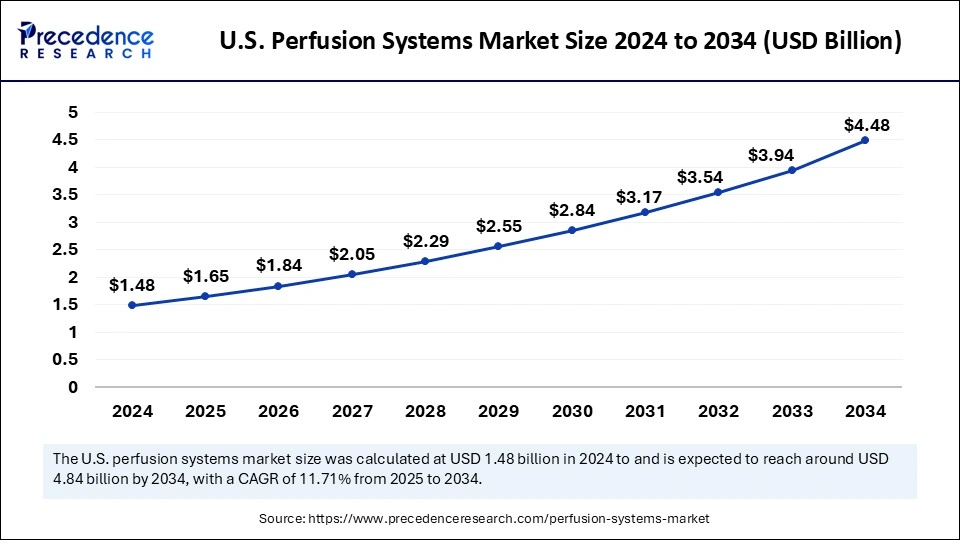

The U.S. perfusion systems market size was exhibited at USD 1.48 billion in 2024 and is projected to be worth around USD 4.48 billion by 2034, growing at a CAGR of 11.71% from 2025 to 2034.

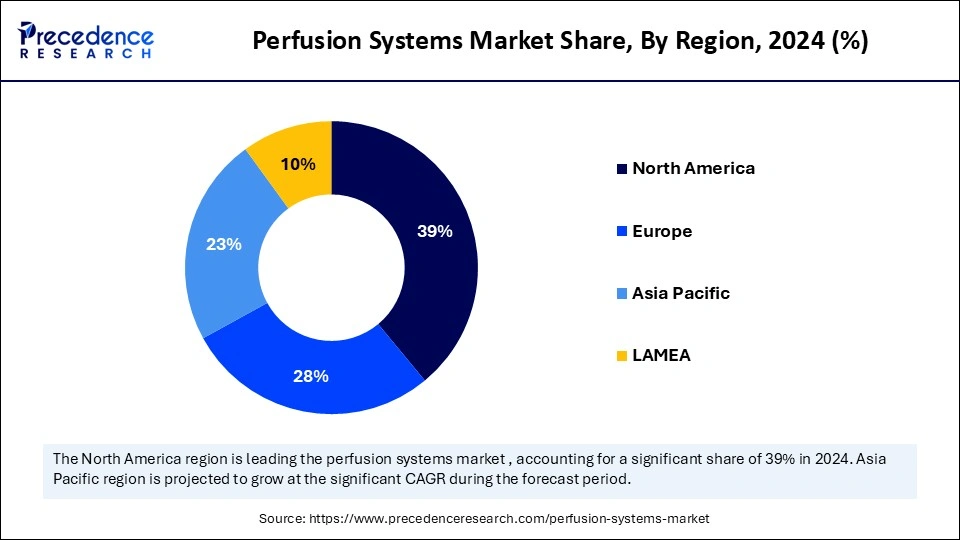

North America held the dominating share of the perfusion systems market in 2024, primarily due to the rising demand for organ transplants and cardiothoracic surgeries. The growth of the market received support from government programs focusing on organ donation awareness. North American control over the market will continue into the coming decade because of rising healthcare funding and acceptance of modern treatment methods.

The U.S. maintained its position as the primary North American market leader for perfusion systems in 2024 because of its notable industry leaders, together with high rates of chronic diseases in the country. Market growth benefits from both government-supported organ donation campaigns and NGO backing, as well as increased biomedical research financing and increasing sector biologics industries.

United States market became possible.

Asia Pacific is expected to witness the fastest rate in the perfusion systems market during the predicted timeframe. The growing population pattern in the region drives the need for advanced healthcare solutions that incorporate perfusion systems. The growing number of cardiac and respiratory diseases in China, India, and Japan is propelling the market need for perfusion machines in surgical and research environments. The market expands due to ongoing reforms that focus on medical infrastructure improvement, increasing COPD rates, and an expanding population.

The medical device industry development in China meets increased government funding for healthcare innovation, which results in the rising adoption of advanced perfusion technologies in the country. Market growth in China will be supported by driving factors, which include rising organ transplantation knowledge and better surgical techniques.

The European perfusion systems market demonstrates steady growth because the public as well as private sectors keep increasing their research and development funding, and healthcare facilities actively seek more advanced equipment to treat rising chronic diseases. Cardiovascular and respiratory diseases continue to be major healthcare issues in Europe, which results in elevated surgeries that need perfusion systems support. Increasing health research and well-developed healthcare systems throughout the region create greater industry demand for perfusion technologies. The countries Germany, France, and the United Kingdom take leadership positions in creating robust medical devices and conducting innovative transplant-related research.

Perfusion systems enable the precise dissemination of blood substances with nutrients and oxygen to organic tissues and cells. The duplicate natural biological processes in controlled systems allow proper organ functioning during transplantation procedures, medical experiments, and surgical interventions. Medical systems need development due to growing cardiovascular diseases, organ failures, and chronic illness conditions. Technological advancements in perfusion methods integrate sensors and automated systems to boost system performance, thereby expanding their medical and research value.

A growing demand for perfusion systems exists within medical markets because cardiovascular disease and respiratory conditions keep rising. The perfusion systems market continues to grow because pharmaceutical companies, laboratories, and medical professionals utilize perfusion systems for developing drugs, regenerative medicine, and personalized patient therapy. The ongoing demand for perfusion systems stems from increased funding of infrastructure development by private and government bodies with rising education about chronic diseases.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.03 Billion |

| Market Size by 2025 | USD 5.64 Billion |

| Market Size by 2024 | USD 5.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.50% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | product type, age group, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing chronic illnesses

The rising numbers of cardiovascular disease patients, respiratory conditions, kidney diseases, and liver diseases directly enhance the need for organ transplant procedures. Organ life expectancy increases thanks to these systems, which bring fresh solution that helps reduce tissue damage from ischemia and improves transplantation success rates.

Organ viability prediction accuracy and automated assessment performance improve because AI-driven perfusion systems introduce automation processes. The combination of rising patient knowledge about perfusion systems alongside improved technological solutions and rising numbers of chronic disease patients will promote organ transplantation device adoption, thereby delivering better clinical results and expanded market opportunities.

High costs allied with perfusion systems

Market expansion faces substantial difficulties due to high expenses related to perfusion systems, especially in developing economies. Cardiopulmonary bypass devices and organ preservation technologies become more expensive for multiple reasons, including their new functionality integration, implementation of automatic systems, and artificial intelligence-based monitoring tools.

Healthcare facilities create substantial additional financial responsibility to handle the costs of installation, maintenance, and running expenses of these systems. The limited budgets of research institutions and hospitals create challenges for obtaining sufficient resources to invest in perfusion systems, thus preventing market development. Healthcare institutions delay purchasing expensive devices if they lack specifications about equipment effectiveness through formal standards.

Rising mergers and acquisitions

The perfusion systems market expands through mergers and acquisitions, which help companies acquire technical superiority and improved market share. Leading industry players benefit from high consolidation rates, which improve their manufacturing operations and generate stronger development capabilities as well as quicker innovation trends. The technological advancements lead to expected new opportunities in customized medicine as well as regenerative medical treatments and organ preservation methods.

Further market expansion in perfusion systems will occur through companies that merge resources to enhance performance and reduce costs through M&A activities. The market competition is enhanced when new research and clinical capabilities use this technology, resulting in more accessible perfusion technology for research institutions and medical facilities. The increasing number of strategic partnerships between companies will reshape the market by producing substantial potential for upcoming business expansion.

The cardiopulmonary perfusion system segment donated the largest perfusion systems market share in 2024. The medical requirement for cardiac surgeries such as coronary artery bypass grafting (CABG) and heart valve replacement procedures rises due to heart failure, coronary artery disease, and valvular disorders. Cardiopulmonary perfusion systems are crucial surgical tools because they promote stabilized physiological conditions, which decreases complications and enhances patient healing outcomes.

Healthcare infrastructure improvements, particularly in developing nations, create more opportunities for enhanced medical technology access, which drives the demand for these systems. Technological progress allowed manufacturers to create tighter and more functional cardiopulmonary perfusion devices, which improved surgical usability. The market advances because healthcare spending continues upward while medical technology continually develops new surgical methods.

The extracorporeal membrane oxygenation segment is anticipated to show considerable growth over the forecast period. Market growth has substantially accelerated because healthcare facilities rapidly began using ECMO machines and promoting patient understanding regarding these devices. The ECMO equipment delivers essential life support for intensive care patients who have heart and breathing conditions through its improved emergency and surgical treatment outcomes.

ECMO machine applications increased their use in various surgical and intensive care settings through recent technological progress in hollow pumps, oxygenators, and heparin-coated cannulas. Medical facilities and technology developers remain committed to investing in critical care infrastructure development by enhancing ECMO technology.

The adult segment generated the biggest perfusion systems market share in 2024. The public healthcare demand increases because cardiac conditions and organ failure cases rise in frequency among adults. Medical conditions that require heart surgeries and renal transplants are increasing because of coronary artery disease, heart failure, and persistent kidney disease, and these factors drive up demand for perfusion systems.

The growth of perfusion technology usage in adult care stems from better patient outcomes brought about by healthcare system upgrades, sophisticated medical equipment, and minimally invasive surgical approaches. The improved technology boosts the functionality of adult perfusion systems together with reduces operating costs, specifically for cardiac and organ transplantation procedures.

On the other hand, the pediatrics segment is expected to grow at a solid CAGR during the forecast period. Advanced perfusion techniques are in high demand because of rising child heart diseases and cardiovascular disorders. This sector’s expansion gets a significant push from increased government support and enhanced pediatric healthcare financing.

The capabilities of pediatric perfusion systems have advanced because of continuous technological development and investments in neonatal critical care and pediatric critical care. Research advances in pediatric cardiovascular medicine create growing requirements for advanced and precise perfusion systems, which will expand neonatal and infant surgery markets, thus establishing the pediatric segment as a primary market development opportunity.

The hospitals and ASC’s segment captured the biggest perfusion systems market share in 2024. Medical technologists now work extensively in hospitals because advanced cardiac and organ transplant surgeries are on the rise. The rising incidence of cardiovascular diseases, coupled with organ failure, leads hospitals to choose complicated perfusion technology that optimizes surgical operations and patient protection systems.

New minimally invasive surgical protocols require innovative perfusion systems that work with smaller incisions, thus matching the surgical needs process. Higher access to sophisticated medical technologies, better hospital diagnostic abilities, and a growing trend of chronic diseases will likely increase segment revenues through rising patient hospital visits.

The specialty clinics segment is expected to grow at the fastest rate during the forecast period due to the increasing patient preference for specialized healthcare services. Specialty clinics provide patients with better quality care, quicker appointments, and individualized attention, which drives patients to select them over bigger hospital facilities for cardiac and transplant care. Specialty clinics use perfusion systems to enhance their management of cardiovascular and organ-related disorders, which are increasing in popularity.

Specialty clinics serve as a better option than traditional hospital-based surgeries because of their increased need for compact portable perfusion devices related to outpatient surgery procedures. Public and private healthcare investments in infrastructure development have helped expand specialty clinics, especially throughout developed nations.

By product type

By age group

By end user

By region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

March 2024