October 2024

Perovskite Solar Cell Market (By Structure: Planar Perovskite Solar Cells, Mesoporous Perovskite Solar Cells; By Product: Rigid Perovskite Solar Cells, Flexible Perovskite Solar Cells; By Method: Solution Method, Vapor-Assisted Solution Method, By Application: Smart Glass, Perovskite in Tandem Solar Cells, Solar Panel, Portable Devices, Utilities, BIPV; By End Use; By Type) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032

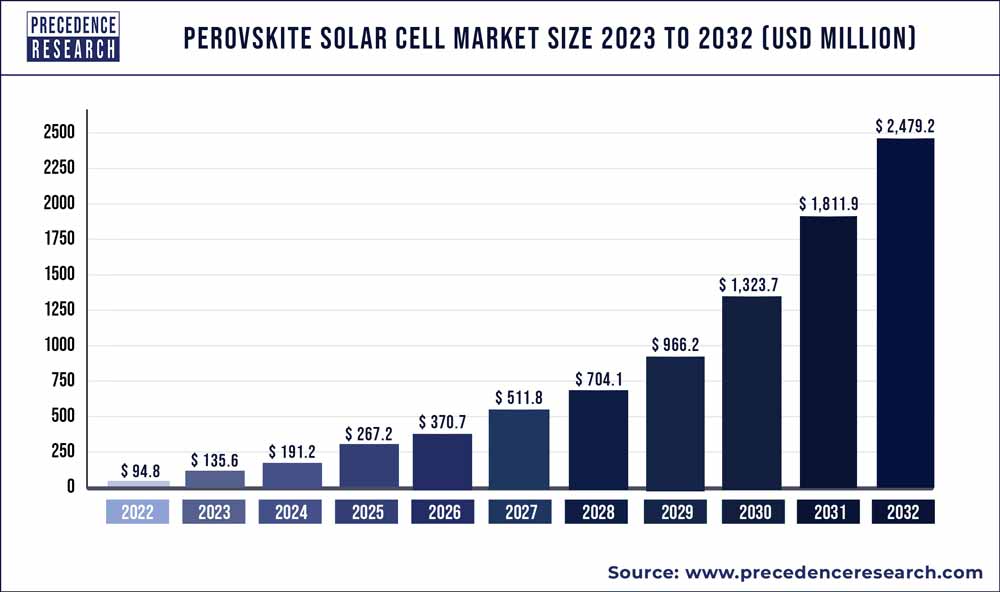

The global perovskite solar cell market size was estimated at USD 94.8 million in 2022 and is expected to hit around USD 2,479.2 million by 2032 with a registered CAGR of 38.1% from 2023 to 2032.

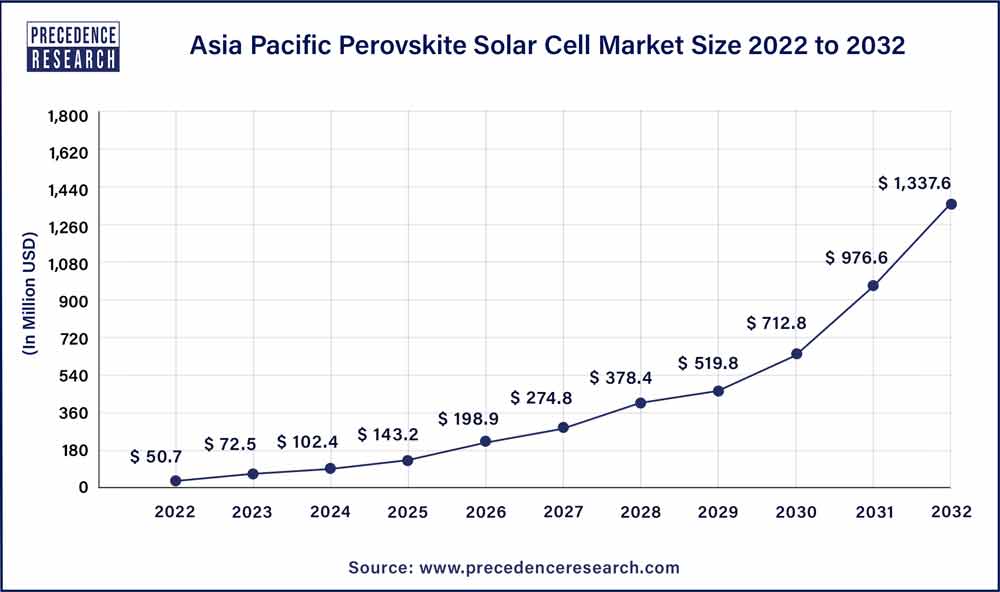

The asia pacific perovskite solar cell market size accounted for USD 50.7 million in 2022 and is estimated to reach around USD 1,337.6 million by 2032, growing at a CAGR of 38.2% from 2023 to 2032.

The Asia Pacific industry's revenue growth is anticipated to accelerate considerably during the projection timeframe. Due to the region's fast urbanization, the requirement for alternative energy to minimize reliance on fossil fuels, & government initiatives backing, the Asia Pacific region dominates the global industry in terms of share of the revenue.

Furthermore, the region's market is growing due to the region's well-developed consumer electronics sector. Due to the region's strong automotive industry, rising end-use sector demand, and the presence of major market players competing in North American nations, North America held the second-largest marketplace share in the global crystalline solar cell market in 2022.

Perovskite-structured material serves as the active layer in perovskite solar cells (PSCs). Superior charge-carrier magnetic moments and absorption coefficient are provided by these materials. The term "perovskite solar cell" refers to a type of solar cell where the warm white active material is primarily made of a mixture of organic-inorganic lead. Perovskite solar panel installations and demand have both decreased since the start of lockdown events since they are depending on the solar power industry. Obstacles in the solar sector include a lack of skilled labor, adherence to socially unacceptable norms, a shortage of raw resources, a lack of construction tools, and operational constraints that cause projects to be delayed. As the administration and its ministries continue to implement strategies to maintain the pace of economic activity, the market recovery is anticipated to follow.

The Ministry of New and Renewable Energy in India has expanded exemptions for companies working in the sector of solar energy to carry out installations projects, movement of construction materials as well as other supplies required for the overall functioning of both domestic non-commercial as well as commercial developments.

According to information provided by the International Renewable Power Association, the African Union Council (AUC) and IRENA inked an agreement in April 2020 for the development of solar panels farms or other renewable technology incorporating decentralized systems. Moreover, to improve the continent of Africa's access to electricity. To ameliorate the state of the water supply, healthcare, and educational sectors and pull the country away from the pandemic's chaos, the cooperation aims to establish alternative energy sources. Such initiatives will boost solar energy requirements, which then in turn bodes well for cutting-edge technology like polycrystalline cells.

| Report Coverage | Details |

| Market Size in 2023 |

USD 135.6 Million |

| Market Size by 2032 |

USD 2,478.2 Million |

| Growth Rate from 2023 to 2032 | CAGR of 38.1% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Structure, Product, Method, Application, End Use, Type, and Geography |

| Companies Mentioned | Alfa Aesar (US), Dyenamo AB (Sweden), Energy Materials Corp, Fraunhofer ISE (Germany), Frontier Energy Solution, FrontMaterials Co. Ltd. (Taiwan), FUJIFILM Wako Pure Chemical Corporation (US), G24 Power Ltd. (UK), Greatcell Energy (Australia), IDTechEx Ltd (UK), Microquanta Semiconductor Co. Ltd. (China), Oxford PV (UK),Panasonic Corporation (Japan), Saule Technologies (Poland), Sekisui, Solaronix SA (Switzerland), Solliance solar research (Netherlands), Swift Solar, Tandem PV, Inc. (US), Toshiba Corporation (Japan), WonderSolar |

One of the newest types of photovoltaic cells that are flexible and lightweight is the perovskite solar cell. The light-harvesting active material of a solar cell with perovskite is made up of a perovskite-structured chemical, tin inorganic substance, and composite organic-inorganic leads. Due to ongoing advancements in renewable radiation, perovskite solar cells have a high performance in systems utilizing them and have seen major improvements in recent years. Additionally, these perovskite cells are employed as light absorbers due to their capacity for a wide range of light wavelengths, which enables them to transform solar power into energy and facilitates construction. The combining of solar cells using perovskite with silica is called a tandem cell.

Perovskite cells are projected to be used in a variety of applications because of their versatility and low weight. Gold is presently the accepted electrode element for photovoltaic devices. Due to the usage of gold as the electrocatalyst, perovskite solar cells are more expensive than conventional solar cells. The main obstacle for the perovskite solar panel business is the existence of the hazardous element lead (Pb). The market for solar cells with perovskite is being constrained by the hazardous substance employed in them, which also impacts the environment.

Perovskite solar cells are more advantageous than commercialized silica and other organic or inorganic solar energy because of their high effectiveness and low cost of production procedures and ingredients. In addition, these cells make it possible to increase the energy conversion efficiency beyond that which is possible with silicon solar cells. In 2020, the energy conversion effectiveness of solar cells utilizing metal bromide polycrystalline had achieved 25%. Therefore, it is anticipated that the market will rise due to polycrystalline solar cells' growing performance.

Key Market Drivers:

Key Market Challenges:

Key Market Opportunities

The sector with the major revenue shares in 2022 was planer perovskite solar cells, and over the projected timeframe, it is anticipated to experience much higher revenue growth rates. Due to its application in thin-film photoelectric structures and remarkable electrical and optical properties, the sector of layered structure has experienced rapid expansion. It may be produced without a high-temperature method and is employed in mesoporous structures when the breadth of the layer is zero.

By 2032, the market value for mesoporous perovskite solar cells is anticipated to exceed USD 1.2 billion due to its widespread application in product manufacture and higher than 20% efficiency in power conversion. The category of flat solar cells using perovskite is predicted to drive market expansion due to rising demand.

Global Perovskite Solar Cell Market, By Structure, 2022-2032 (USD Million)

| By Structure | 2022 | 2023 | 2027 | 2032 |

| Planar Perovskite Solar Cells | 46.0 | 65.9 | 250.3 | 1,220.8 |

| Mesoporous Perovskite Solar Cells | 48.8 | 69.6 | 261.5 | 1,258.4 |

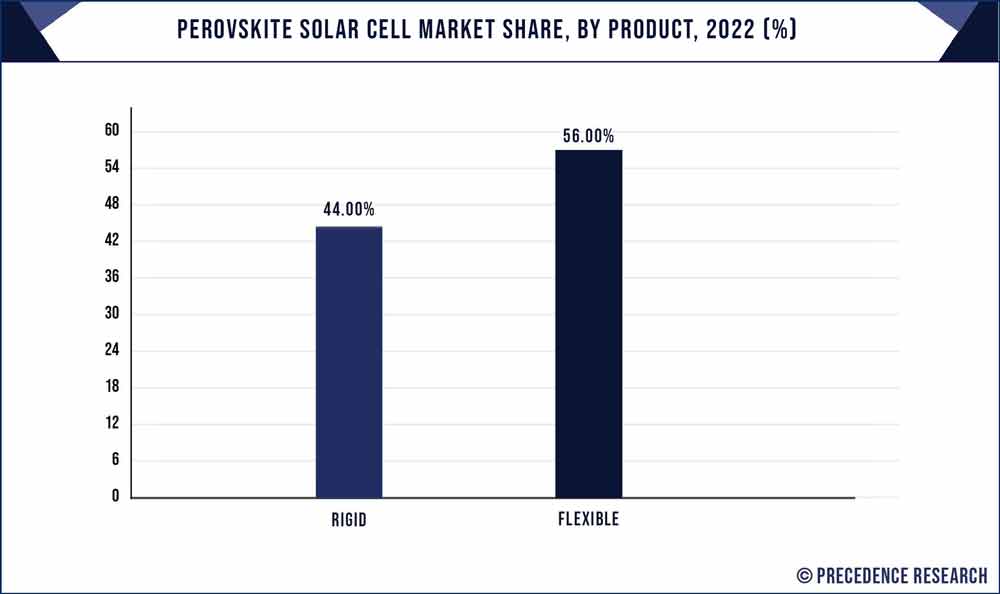

Due to its increasing demand across a range of applications, the inflexible modules segment is anticipated to hold a disproportionately large share of the market. Due to several technical developments, the flexible module market is also anticipated to expand rapidly.

In 2022, the stiff perovskite-based- based solar cell market is expected to grow at the fastest CAGR, while the flexible perovskite-based solar cell sector had the largest proportion.

Due to the increasing demand for solar cells using perovskite in constructing buildings and parts of construction materials, such as roofs, windows, or facades, among others, the Building Integrating PVs group is estimated to grasp the major market segment. By 2030, the consumer devices (portable media players) category is anticipated to outgrow the whole market.

Global Perovskite Solar Cell Market, By Application, 2022-2032 (USD Million)

| By Application | 2022 | 2023 | 2027 | 2032 |

| Smart Glass | 24.6 | 35.3 | 133.6 | 649.7 |

| Solar Panel | 37.0 | 53.0 | 202.2 | 990.2 |

| BIPV (Building-Integrated Photovoltaics) | 33.2 | 47.3 | 176.0 | 839.3 |

Due to the increase in the need for wearable technology, the consumer technology sector is expected to exhibit the greatest CAGR throughout the forecast period. However, the energy sector dominated the share in terms of revenue, accounting for over two-fifths of the worldwide perovskite solar panel industry. This is because there is a growing need for sustainable, renewable energy sources.

Given that mixed PSCs are among the most widely used, they are predicted to hold the biggest market share of about 51%. Due to their rising demand in the field of wearable power sources and assimilation with architectures as well as several other benefits like portability, flexibility, lightweight, and compatibility with non-standard electronic goods, flexible PSCs are predicted to expand at the highest CAGR from around 29.9%.

Global Perovskite Solar Cell Market, By Type, 2022-2032 (USD Million)

| By Type | 2022 | 2023 | 2027 | 2032 |

| Hybrid PSCs | 60.1 | 86.1 | 326.8 | 1,593.5 |

| Multi-Junction PSCs | 34.7 | 49.4 | 185.0 | 885.8 |

Segments Covered in the Report:

By Structure

By Product

By Method

By Application

By End-Use

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024