February 2025

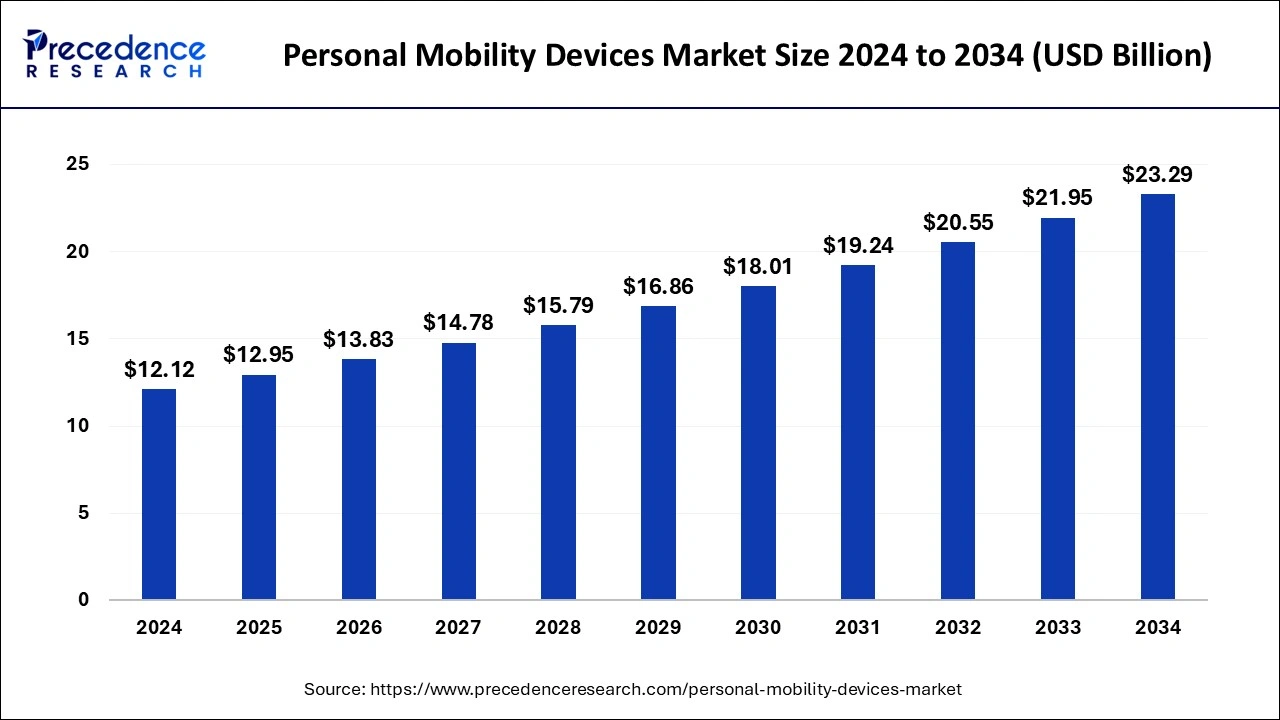

The global personal mobility devices market size is calculated at USD 12.95 billion in 2025 and is forecasted to reach around USD 23.29 billion by 2034, accelerating at a CAGR of 6.75% from 2025 to 2034. The North America personal mobility devices market size surpassed USD 4.36 billion in 2024 and is expanding at a CAGR of 6.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global personal mobility devices market size was estimated at USD 12.12 billion in 2024 and is predicted to increase from USD 12.95 billion in 2025 to approximately USD 23.29 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034. As the world's population ages, elderly people are becoming increasingly in need of mobility aids. This drives the growth of the personal mobility devices market.

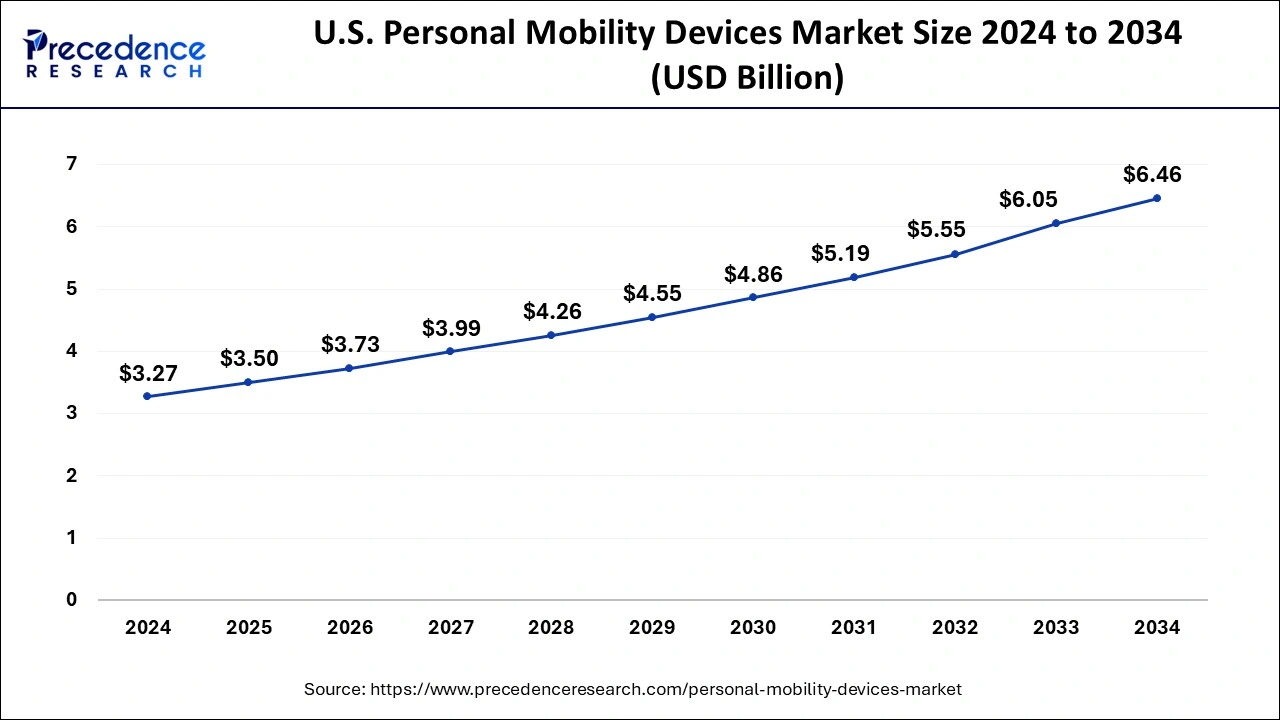

The U.S. personal mobility devices market size was estimated at USD 3.27 billion in 2024 and is predicted to be worth around USD 6.46 billion by 2034 with a CAGR of 7.05% from 2025 to 2034.

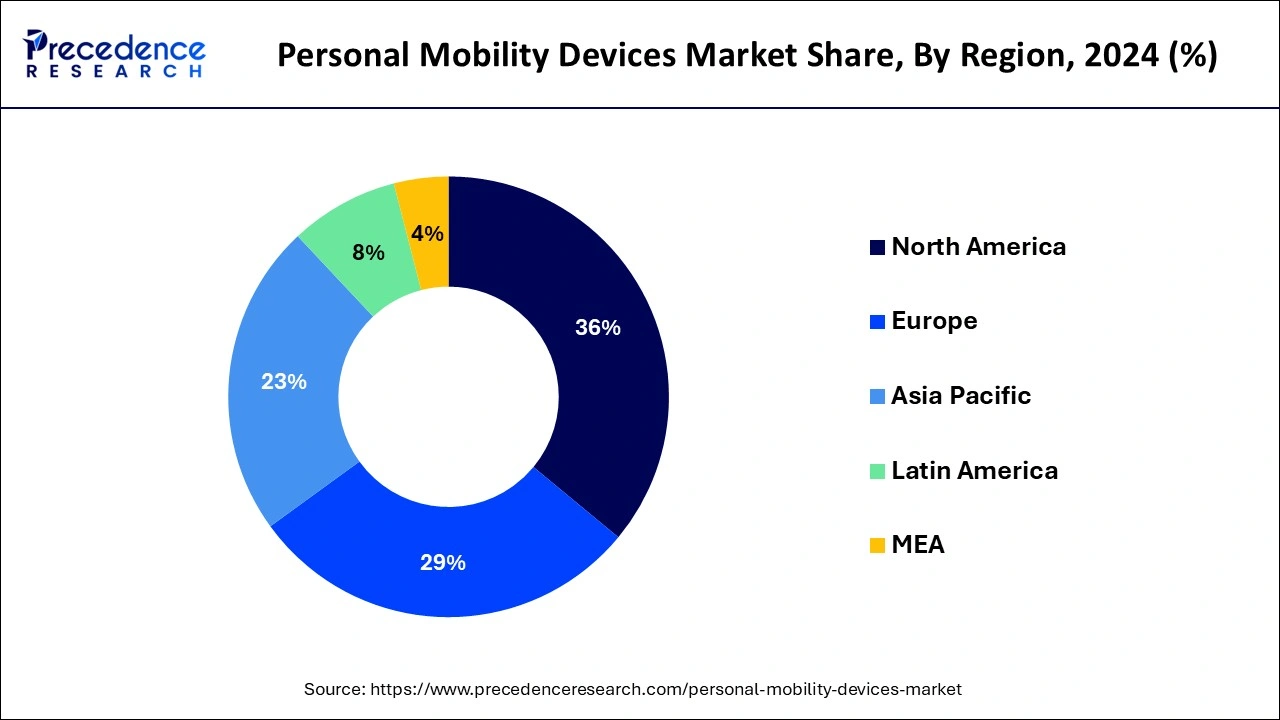

North America dominated the personal mobility devices market in 2024. The personal mobility devices market in North America has experienced notable expansion in recent times due to various factors, such as an aging population, a rise in the incidence of disabilities, technological advancements, and an increasing recognition of the significance of accessibility and mobility. Wheelchairs, mobility scooters, walking aids, and other assistance equipment are examples of the many goods that fall under the category of personal mobility devices. In order to satisfy the wide range of demands and preferences of consumers, manufacturers are placing an increased emphasis on providing individualized and adaptable mobility solutions. In the market for personal mobility devices, manufacturers are putting more of an emphasis on sustainability and creating goods that have less environmental impact.

Asia Pacific is expected to hold the fastest-growing personal mobility devices market during the forecast period. The region's personal mobility devices market has grown significantly in recent years. Electric scooters, mobility scooters, electric wheelchairs, and other assistive devices that improve personal mobility for those with impairments or those looking for easy urban transit options are just a few of the many products available in this sector. The need for assistive technology and mobility aids to help older people keep their independence and mobility is rising as a result of the aging populations in several of the region's nations. Consumers of all ages are becoming more and more in need of personal mobility devices due to changing lifestyles that place more value on health and fitness as well as accessible and adaptable transportation alternatives.

The personal mobility devices market refers to the industry that deals with the production and commercialization of products that aid personal mobility and other related services. These devices can either be manually moved or propelled electrically and are generally used by impaired individuals to move around. Depending on the kind of gadget, the market can be divided into different groups, such as those for wheelchairs, mobility scooters, walkers, canes, and crutches. Furthermore, an expanding market exists for electric-powered equipment such as electric scooters and wheelchairs.

Healthcare facilities, medical equipment stores, specialized shops, and internet retail platforms are some of the outlets by which personal mobility devices are sold. Because they are so accessible and convenient, online sales have increased significantly. Also, the need for personal mobility devices to help seniors maintain their independence and mobility is growing as the world's population ages.

The personal mobility devices market is expanding rapidly in these nations due to factors such as better healthcare facilities, rising disposable income, and fast urbanization. The market for personal mobility devices is anticipated to rise due to several factors, including continued technical breakthroughs, increased healthcare infrastructure investment, and expanding public awareness of accessibility and disability rights. Different regions have different regulatory norms and restrictions, affecting how personal mobility device makers create, manufacture, and market their products.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.95 Billion |

| Market Size by 2034 | USD 23.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.75% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Health and wellness trends

Since they can be adjusted to suit different needs and preferences and lower the chance of musculoskeletal problems, devices with adjustable features like handlebars, seats, and footrests are becoming increasingly popular. Users can obtain individualized health data, get real-time feedback, and even take part in virtual coaching sessions or fitness challenges thanks to integration with smartphone apps and wearable technology. This connectedness encourages users to remain active and involved, which cultivates a sense of community and accountability. Personal mobility devices are increasingly being included with basic safety features like anti-tip mechanisms, autonomous braking systems, and collision detection technology. These developments not only keep people safe but also give them confidence, which motivates them to go outside and be active.

Perception and stigma

Personal mobility gadgets have not traditionally been viewed as lifestyle items but rather as medical aids. People's desire to use these gadgets and their self-image when utilizing them may be impacted by this impression. The way people perceive personal mobility gadgets is becoming more and more influenced by their appearance. Stylish and adaptable designs can promote greater acceptance of these devices and lessen stigma. Even with initiatives to advance accessibility and diversity, social stigma around personal mobility devices persists. Users might experience discomfort, sympathy, or even discrimination from others, which could make them feel embarrassed or self-conscious. Perceptions of personal mobility devices might be influenced by gender norms since certain designs and characteristics may be associated with a particular gender more than another.

Urbanization and last-mile connectivity

In recent years, the personal mobility devices market has been greatly impacted by urbanization and last-mile connections. The need for effective and practical short-distance transit options is rising as cities get denser and traffic congestion gets worse. Electric scooters, electric bikes, and electric skateboards are a few examples of personal mobility gadgets that have gained popularity as answers to these problems. Cities are growing denser as a result of more people relocating there, which causes traffic jams and longer commutes. In order to overcome the inefficiencies of public transportation and reduce dependency on conventional forms of transportation, personal mobility devices provide a quicker and more flexible option for short-distance travel.

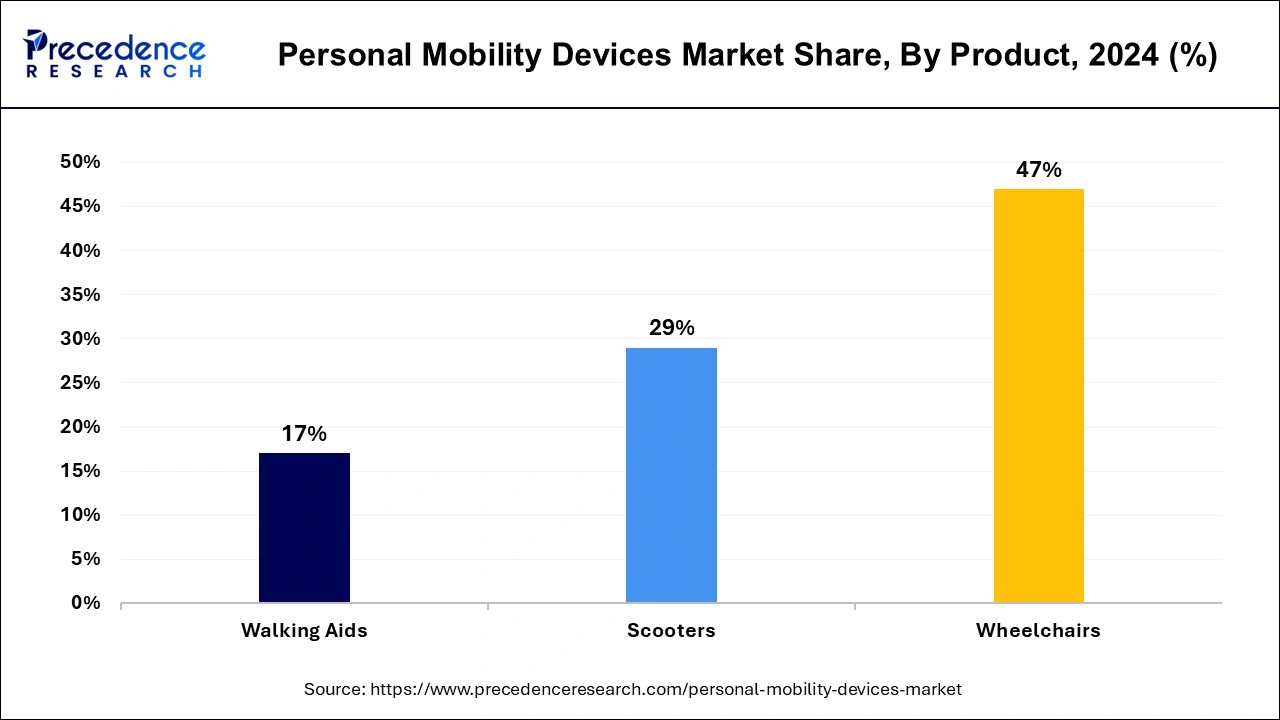

The wheelchair segment held the largest share of the personal mobility devices market in 2024. Within the personal mobility devices market, the wheelchair category includes a broad range of items intended to help people with disabilities or mobility impairments move about. These are the most popular kinds of wheelchairs, which can be pushed by a caregiver or used by the user themselves. Generally speaking, they are portable, lightweight, and available in a variety of configurations to meet the demands of different users. Wheelchairs intended for sports, outdoor activities, or traversing rough terrain fall under this category. For maximum comfort and performance, they could include upgraded suspension systems, all-terrain tires, or unique seating arrangements. Wheelchair manufacturers may now customize wheelchairs to meet specific needs and tastes by adding features like footrests, armrests, and seating that can be adjusted.

The scooters segment is expected to grow rapidly in the personal mobility devices market during the forecast period. Compact and effective forms of transportation are becoming more and more necessary as cities get denser with population. For short-distance commuting, scooters offer a practical option, particularly in crowded cities. Scooters bridge the gap between ultimate destinations and public transportation hubs, providing a practical way to travel short distances that are difficult to reach by other methods. Scooters provide a more cost-effective choice for short-distance commuting when compared to car ownership or even frequent use of ride-sharing services. They are appealing to a broad spectrum of customers because of their price. The desire for better lifestyles and worries about air pollution and traffic congestion has led to a cultural movement towards alternative forms of transportation.

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

April 2025

January 2025