August 2024

Pharma 4.0 Market (By Technology: Cloud Computing, Artificial Intelligence, Big Data Analytics, Internet of Things; By Application: Drug Discovery and Development, Clinical Trials, Manufacturing; By End-User: Pharmaceutical Companies, Biotechnology Companies, CROs and CMOs) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2032

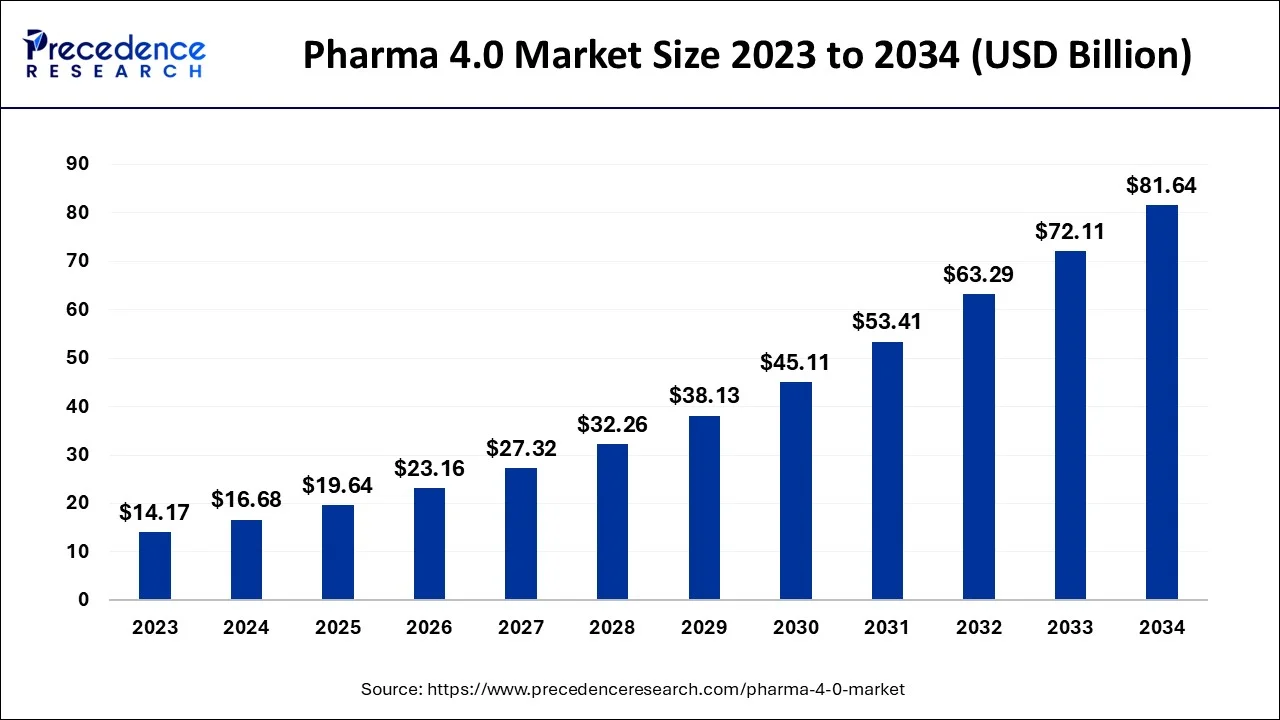

The global pharma 4.0 market size was estimated at USD 14.17 billion in 2023 and it is predicted to reach around USD 63.29 billion by 2032, growing at a CAGR of 18.1% during the forecast period from 2024 to 2032.

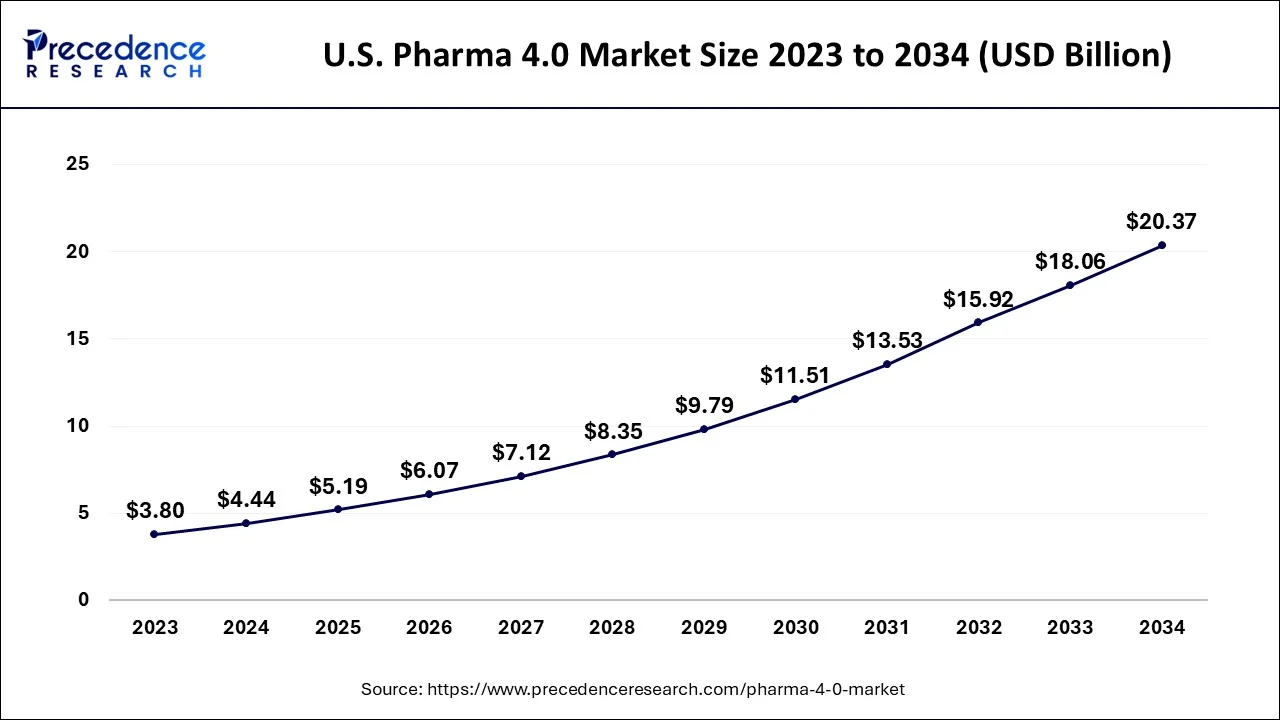

The U.S. pharma 4.0 market size was valued at USD 3.8 billion in 2023 and is anticipated to reach around USD 15.92 billion by 2032, poised to grow at a CAGR of 17.3% from 2024 to 2032.

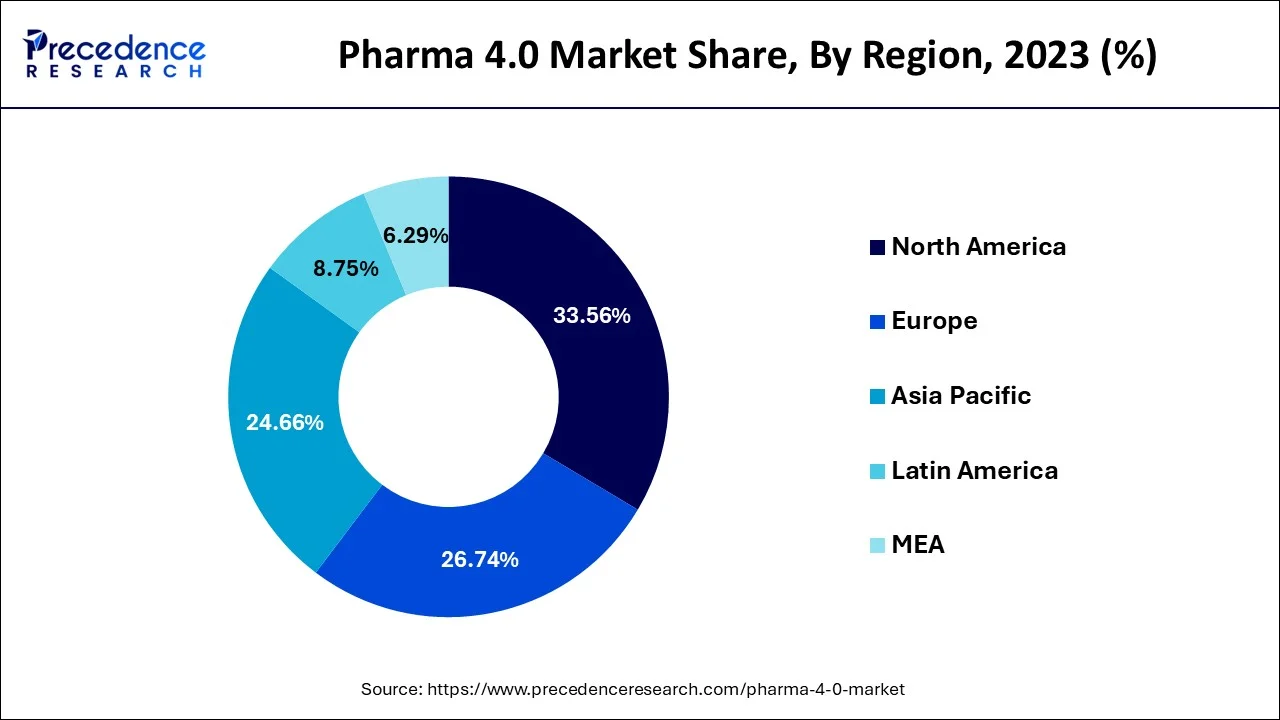

North America dominated the market with the largest market size in 2023, the region is anticipated to maintain its position throughout the forecast period. The region has actively participated in the adoption of advanced technological solutions in almost every field. The focus and substantial potential for technological innovation in the pharmaceutical sector across the region along with the availability of investors for the same highlight the factors for the market’s expansion in North America. Enormous demand for drug discovery in the region promotes the accpetance of various technologies to improve the overall operative capabilities of the firms. This factor promises a bright future for the pharma 4.0 market in North America.

Moreover, the food and drug administration (FDA) of the United States has already stated the known importance of advanced technologies for the pharmaceutical as well as biotechnology industries, this element acts as a growth factor for the market by boosting the rate of adoption for such technologies.

Asia Pacific is expected to witness significant growth in the market during the forecast period. The region is currently experiencing a rapid acceptance of advanced technologies while addressing potential issues with the traditional operation systems. This element highlights the growth of the market in Asia Pacific. The improving infrastructure of pharmaceutical industry and rising requirements for novel drug development promote the growth of the market in the region. Multiple pharmaceutical companies in potential countries, such as India, South Korea, Japan and China are focusing on automation of tasks for lowering the overall time consumed at the firms. This is another factor to fuel the growth of the market in Asia Pacific in the upcoming years.

Pharma 4.0 is also referred to as applied industry 4.0 or smart factories developed especially for the pharmaceutical industry. The major objective for applying Industry 4.0 in the pharmaceutical sector is to provide guidance for projecting regulatory practices to speed up the operations in the industry. Pharma 4.0 majorly works on the development of pharmaceutical organizations and applies the full potential to integrate digitization in order to provide faster innovation in therapeutics and enhance the production process.

Pharma 4.0 is the revolution in the pharmaceutical industry which carries multiple technological advancements, such as digitization, and automation to meet complex product cycles and portfolios in the pharmaceutical industry. With the emergence of digitization and automation, the pharma 4.0 market offers services to connect and develop latest insights fpr the pharmaceutical industry with precise adaptability and transparency. The pharma 4.0 technology also promises to enhance the capabilities of decision-making and provide real-time and in-line control over business, quality, operations, and regulatory compliance.

Pharma 4.0 technology is observed to get accelerated in the upcoming years with the emergence of processing interconnectivity, big data analytics, artificial intelligence, collaborative robotics, and distributed cloud-based service architectures. Due to the revolutionary technology of pharma 4.0, the future of pharmaceutical manufacturing is aimed to be more connected, efficient, and agile. Several pharmaceutical manufacturers are shifting towards the adoption of pharma 4.0 technology for better workflow and increased productivity.

The pharmaceutical industry across the globe is focusing on digital transformation by shifting traditional laboratories into smart laboratories and factories. By adopting 4.0 technology it is possible to avail faster decision-making process and real-time systems operations. As the digitization grows in the pharmaceutical industry, the market for pharma 4.0 is expected to grow.

The transformation to the pharma 4.0 technology will reduce the time between the market and consumers, it will also reduce the time as well as the cost of the operations. It is a new culture in manufacturing that aims for effortless integration of the system resulting in a higher quality of products and services for customer satisfaction. All these factors contribute to the growth of the Pharma 4.0 market.

| Report Coverage | Details |

| Market Size in 2023 | USD 14.17 Billion |

| Market Size by 2032 | USD 63.29 Billion |

| Growth Rate from 2024 to 2032 | CAGR of 18.1% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2023 To 2032 |

| Segments Covered | By Technology, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver:

Digital transformation in the pharmaceutical industry

Businesses in the pharmaceutical and life sciences sector can benefit significantly from implementing pharma 4.0. Organizational adjustments are needed in order to adopt to the pharma 4.0 paradigm. Infrastructure and pharmaceutical production techniques must both be completely redesigned. It can help you achieve the highest standards of production quality. The pharmaceutical industry is still in the early stages of digitization. The effectiveness of pharmaceutical companies' facilities could be increased in a variety of ways with the aid of a digital transformation strategy.

Multiple pharmaceutical companies are focusing on digital transformation to collect data, analyze and have access to it for future reference. All these activities along with the requirement for standardized processes in the pharmaceutical industry can be fulfilled with the integration of 4.0 technology. The 4.0 technology is capable of offering real-time insights related to the data. Thus, digital transformation in the pharmaceutical industry is observed to act as a driver for the market.

Restraint:

Higher cost of installation and maintenance

Along with multiple benefits of having pharma 4.0 technology, there are few obstacles that hamper the adoption of the technology in the pharmaceutical industry. The transformation to this new technology can be expensive for the pharmaceutical industry. As compared to the traditional system, the installation cost of 4.0 technology in much higher. Small or medium-scale pharmaceutical industries cannot handle the expenses, which limits the adoption of the technology. Along with this, the maintenance of such systems with advanced technology can be hefty. The regular maintenance of the system can create a requirement for skilled professionals. Thus, the installation cost and maintenance requirements for the 4.0 technology create a restraint for the market.

Opportunity:

Integration of big data analytics

With the integration of big data analytics, pharmaceutical firms will be able to create manufacturing processes that are more reliable and flexible, with fewer interruptions, flaws, and greater levels of quality monitoring. Big data analytics and effective cross-company communication can enhance process monitoring performance and discover and decrease material waste, overproduction, and energy use. As a result of integration of big data analytics solutions, the pharmaceutical manufacturing facility is observed to be transformed into a reconfigurable industry with a advanced production line that can mass-customize individualized medications to meet various needs. Thus, the integration of big data analytics is observed to create a set of opportunities for the market.

The Internet of Things (IoT) segment held the largest share of 44.70% in the pharma 4.0 market in 2023. IoT-enabled continuous monitoring and feedback loops enable continuous process improvement in Pharma 4.0 operations. By capturing and analyzing real-time data, identifying inefficiencies, and implementing corrective actions, pharmaceutical companies can iteratively optimize processes, enhance product quality, and reduce waste and variability. This continuous improvement mindset aligns with the principles of Pharma 4.0, which emphasizes agility, adaptability, and innovation in response to changing market dynamics and customer needs.

Through IoT-enabled platforms and dashboards, stakeholders can remotely access real-time data, track performance metrics, and make data-driven decisions from anywhere at any time. This capability is particularly beneficial for decentralized manufacturing facilities, global supply chains, and remote clinical trials, where real-time visibility and control are essential for ensuring regulatory compliance and product quality.

By application, the manufacturing segment dominated the market with the largest share of 54.61% in 2023. Pharma 4.0 technologies enable real-time monitoring and control of manufacturing processes, leading to enhanced quality assurance and regulatory compliance. Automated systems can detect deviations from predefined quality standards and alert operators to take corrective actions promptly. Pharma 4.0 emphasizes the integration of data from various sources, including manufacturing equipment, supply chain systems, and quality management systems, into a unified digital platform. Advanced analytics, machine learning, and artificial intelligence (AI) algorithms analyze this data to identify patterns, predict potential issues, and optimize manufacturing processes in real time.

Global Pharma 4.0 Market, By Application, 2020-2023 (USD Million)

| Application | 2020 | 2021 | 2022 | 2023 |

| Drug Discovery and Development | 2,450.49 | 2,885.68 | 3,401.05 | 4,015.29 |

| Clinical Trials | 1,487.80 | 1,746.78 | 2,052.60 | 2,416.06 |

| Manufacturing | 4,813.46 | 5,632.47 | 6,596.35 | 7,738.24 |

Pharmaceutical companies dominated the market with the largest market share in 2023, the segment is predicted to sustain its position during the forecast period. The growth of the segment is attributed to the rising adoption of advanced technologies in the pharmaceutical companies for improving the efficiency of operations and quality of the product as well as services.

Adoption of pharma 4.0 technology in the pharmaceutical industry will enhance productivity by lowering the chances of defects. The 4.0 technology in such companies also aims to offer higher quality management. With the rising demand for drugs and therapeutics, the pharmaceutical companies across the globe mainly focus on reducing the time and expenses consumed in the overall drug development process. This element offers a significant growth factor for the segment to grow.

Segments Covered in the Report:

By Technology

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024