What is the Pharmaceutical CDMO Market Size?

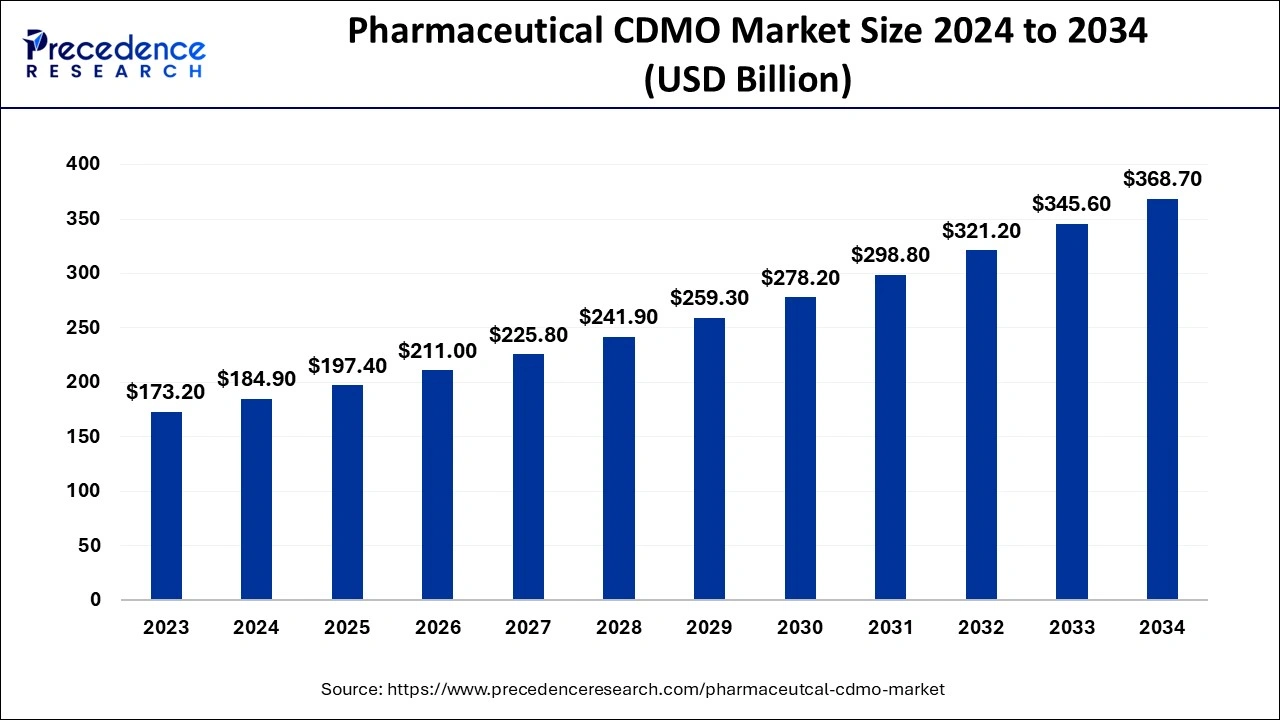

The global pharmaceutical CDMO market size is valued at USD 197.40 billion in 2025 and is predicted to increase from USD 211 billion in 2026 to approximately USD 392.67 billion by 2035, expanding at a CAGR of 7.12% from 2026 to 2035.

Pharmaceutical CDMO Market Key Takeaways

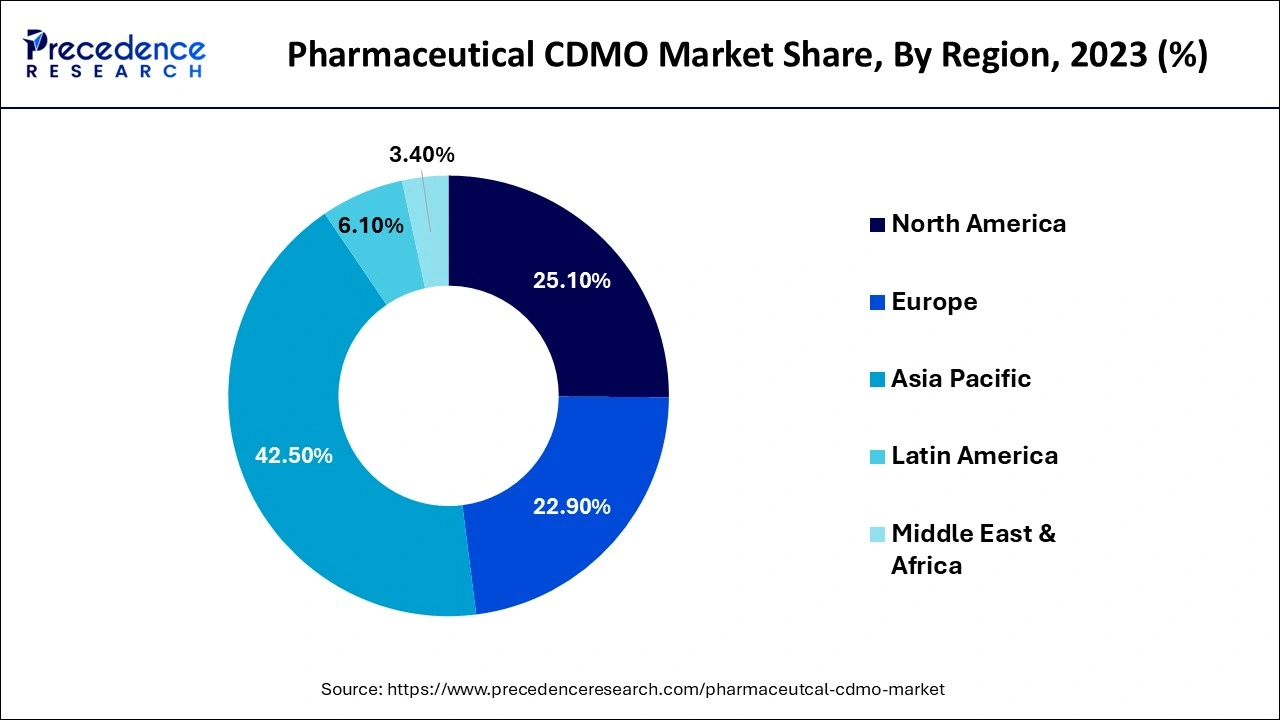

- Asia Pacific led the market with the largest market share of 42.43% in 2025.

- Europe is expected to grow at a CAGR of 7.7% over the projected period.

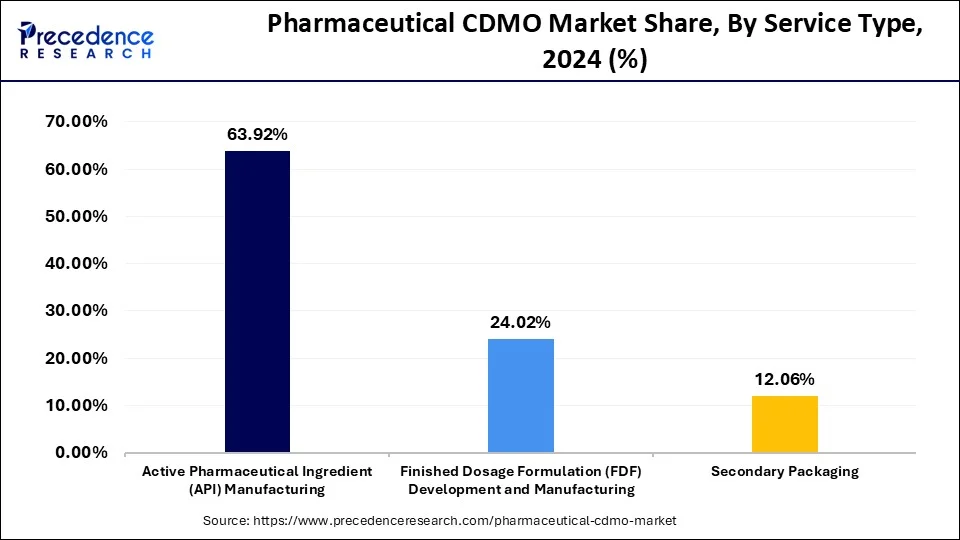

- By service type, the active pharmaceutical ingredient (API) manufacturing segment captured a 63.92% share of in 2025.

- By service type, the finished dosage formulation (FDF) development and manufacturing segment is predicted to grow a CAGR of 7.9% from 2026 to 2035.

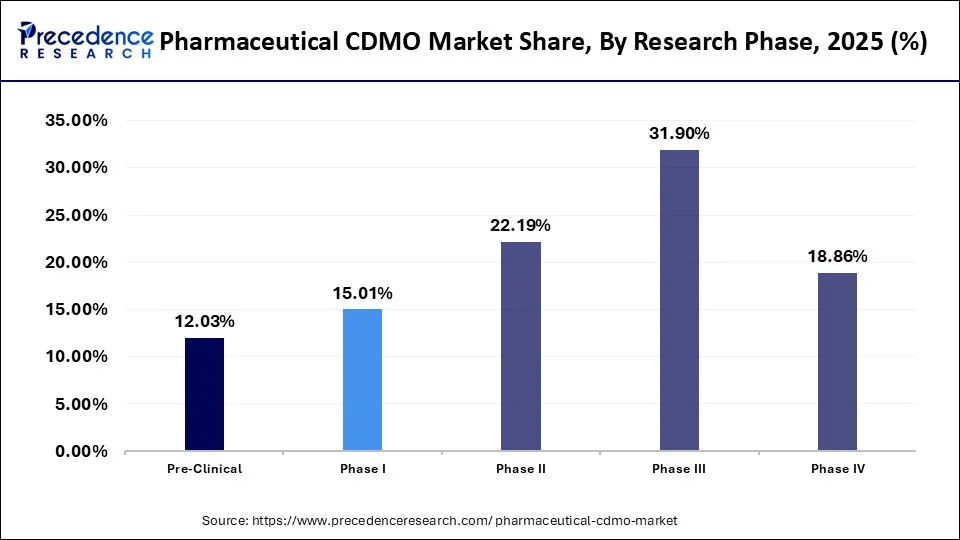

- By research phase, the phase IIIsegment held the highest market share of 31.90% in 2025.

- By research phase, the phase II segment is expected to grow at a CAGR of 7.5% over the projected period.

Market Overview

Many pharmaceuticals industry are struggling with the manufacturing of drug substances, and the handling of pharmaceutical applications like manufacturing of the drug, pharmaceutical industry, keeping expenses in mind and also reducing the cost of the drug, higher need for equipment with affordable cost, to keep an eye on all these pharmaceutical industrial factors the Contract Development and manufacturing organization (CDMO) comes in partnership with the pharmaceutical industries to form innovative formulas and products into the market without investing additional expenses or infrastructure to support.

The Pharmaceutical CDMO handles the outsourcing of drug substances and works with innovation and development program that occurs before manufacturing one. The Pharmaceutical CDMO is one of the most important factors for the positive substantial growth of the healthcare industry.

Impact of AI on the Pharmaceutical CDMO Market

AI has the potential to transform the pharmaceutical CDMO market. AI can automate manufacturing processes by analyzing vast datasets to identify potential drug candidates, improving drug discovery and development processes. It also accelerates the R&D process, allowing CDMOs to bring products to market quickly. AI enhances quality control, ensuring final products meet regulatory standards. It is essential in personalized therapeutic approaches. It provides CDMOs with individual patient data, allowing the development of more targeted therapies. Moreover, AI helps CDMOs in supply chain management.

Pharmaceutical CDMO Market Growth Factors

- Partnership Between Pharmaceutical Companies and CDMOs: Pharmaceutical companies often partner with CDMOs to outsource the manufacturing process. This allows pharmaceutical companies to focus on core areas and reduce production costs.

- High Costs of Drug Development: High costs associated with drug development encourage pharmaceutical companies to seek cost-effective solutions. However, services offered by CDMOs help reduce costs incurred in the drug development process.

- Regulatory Compliance: CDMOs are adept at navigating regulatory environments, encouraging pharmaceutical and biotechnology companies to collaborate with them to ensure compliance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 197.40 Billion |

| Market Size in 2026 | USD 211 Billion |

| Market Size by 2035 | USD 392.67 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.12% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Research Phase, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

An increase in chronic disease treatment will likely to drives the market

The contract development and manufacturing organization is work with the development and production of the drug as well as the technological advancements in the pharmaceutical industry. The increasing prevalence of chronic diseases in the population will end up on the increase in the need for advanced and effective treatment for the quick and better cure of people. The rise in chronic diseases like cancer is driving the market. Cancer causes the largest amount of death over the decades. The rising need for the advancement of treatment and increasing demand for the treatment of cancer will drive the pharmaceutical and contract development and manufacturing organization market.

Furthermore, the growth in generic medicines and personalized medicine will also have a positive impact on the contract development and manufacturing organization market. Technological advancement of the healthcare industry, finished drug formulation. Increasing collaboration among pharmaceutical industries, rising research and development investments, increase in old aged population will result in higher market growth of the pharmaceuticals CDMO market.

Restraints

Lower profit share for the pharmaceutical industry

The Involvement of the outsourcing firm in the production of pharmaceutical drugs and technological advancement for the healthcare industry would result in a lower profit share for the pharmaceutical industry. The factors like raw materials, the number of purchased orders, labor force will affect the investment done by the pharmaceuticals industry. In outsourcing production like Pharmaceutical CDMO, there is an issue in visibility into the manufacturing process as compared to the in-house manufacturing process. If there are any manufacturing and production defects done by Pharmaceutical CDMO, the pharmaceuticals industry would be responsible for the problem and there is reputational damage to the firm.

Opportunities

Technological advancement in the CDMO

Pharmaceutical contract development and manufacturing organization (CDMO) carries innovative operational technologies. The increase in the demand for precision medicine and generics medicines will result in future growth opportunities in the contract development and manufacturing organization market. Technological advancements such as deployment of artificial intelligence, block chain, cloud computing and machine learning are expected to offer lucrative opportunities for the market's growth during the forecast period.

The pharmaceutical CDMO is setting goals towards technology leadership and is projected to increase in the upcoming decades. The rising merger and acquisition in the contract development and manufacturing organization will expand the market growth.

Segment Insights

Service Insights

Why Did the API Manufacturing Segment Dominate the Market in 2025?

The active pharmaceutical ingredient (API) manufacturing segment captured a 63.92% share of the market in 2025. This is mainly due to a significant rise in demand for generic drugs. Active pharmaceutical ingredients play a crucial role in generic drugs, as they enhance the efficacy of drugs. Small molecules are an essential class of APIs that are widely used in various therapies due to their effectiveness and versatility. Although small molecules are cost-effective, their production process is complex. However, CDMOs boast expertise in API production. Pharmaceutical companies can reduce overall manufacturing costs and ensure quality and compliance by outsourcing API production to CDMOs.

The finished dosage formulation (FDF) development and manufacturing segment is expected to expand at a CAGR of 7.9% during the forecast period, owing to the increasing demand for solid dosage. With the increasing burden of various diseases worldwide, the demand for solid dosages, such as tablets and capsules, is increasing due to their long shelf life and efficacy in managing symptoms without any side effects. This significantly boosts the need for solid dosage formulations. However, CDMOs help pharmaceutical companies develop new formulas without investing in additional infrastructure, further accelerating the drug development process.

Global Pharmaceutical CDMO Market Size, By Service Type 2022-2024 (USD Billion)

| Service Type | 2022 | 2023 | 2024 |

| Active Pharmaceutical Ingredient (API) Manufacturing | 103.7 | 110.4 | 117.6 |

| Finished Dosage Formulation (FDF) Development and Manufacturing | 39.4 | 42.3 | 45.4 |

| Secondary Packaging | 19.4 | 20.6 | 21.8 |

Why Did the Phase III Segment Hold a Significant Market Share in 2025?

The phase III segment accounted for a 31.90% share of the market in 2025 due to the rising drug development. Phase III research is essential as it provide final confirmation about the efficacy and safety of drugs. However, this lengthy procedure requires a substantial investment that encourages pharmaceutical companies to rely on CDMOs. By outsourcing phase III clinical trials to CDMOs, pharmaceutical companies can focus on core areas and save resources to a certain limit.

The phase II segment is projected to expand at the fastest CAGR of 7.5% during the forecast period. Phase II research is essential to monitoring how a drug is metabolized and gathering initial data on efficacy. According to the WHO, more drugs are currently in phase II clinical trials than phase III. Partnering with CDMOs during the phase II trial allows pharmaceutical and biotechnology companies to save resources and reduce costs associated with ongoing trials.

Global Pharmaceutical CDMO Market Size, By Research Phase 2022-2024 (USD Billion)

| Research Phase | 2022 | 2023 | 2024 |

| Pre-clinical | 19.6 | 20.9 | 22.3 |

| Phase I | 24.4 | 26 | 27.8 |

| Phase II | 36.3 | 38.8 | 41.5 |

| Phase III | 51.7 | 55.1 | 58.7 |

| Phase III | 30.5 | 32.4 | 34.5 |

Regional Insights

What is the Asia Pacific Pharmaceutical CDMO Market Size?

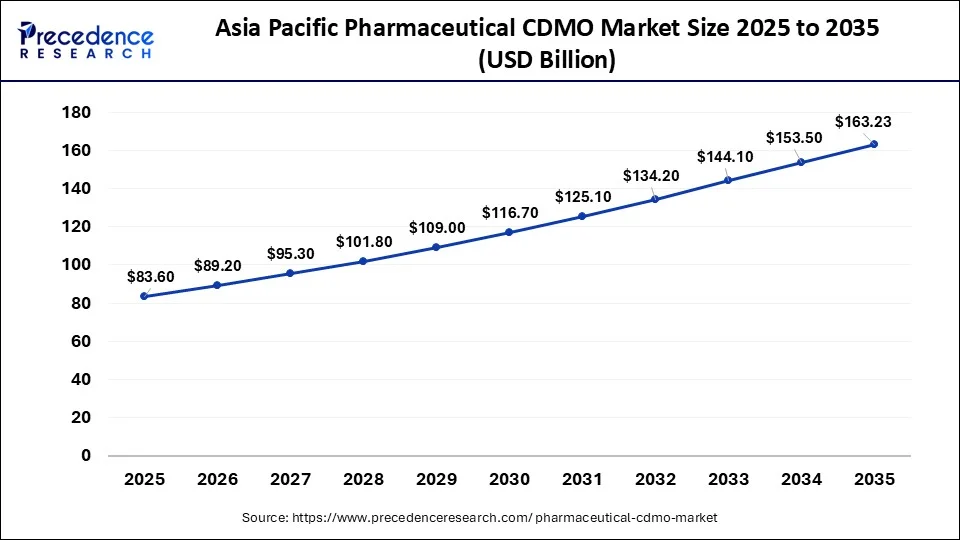

The Asia Pacific pharmaceutical CDMO market size is evaluated at USD 83.60 billion in 2025 and is anticipated to reach USD 163.23 billion by 2035, with a CAGR of 6.92% from 2026 to 2035.

Asia Pacific held the largest market share of 42.43% in 2025. The growth of the region is majorly driven by the increasing investment in improving healthcare infrastructure, the rising number of clinical trials registered, the supportive Government framework, the rising incidence of chronic diseases, increasing demand for injectable drugs, notably in cancer research and rising demand for cell and gene therapies. The rising trend of pharmaceutical companies outsourcing drug development and manufacturing due to robust government support and attractive incentives that lure foreign investments, driving the expansion of the market in the region. Countries such as China and Japan are the major contributors to the market.

The pharmaceutical CDMO market in China is anticipated to grow significantly during the forecast period due to the presence of sophisticated healthcare infrastructure, rising demand for outsourcing services, the rapid adoption of innovative technology, growing R&D capabilities, the rising availability of medical experts, the rising prevalence of chronic disorders, and increasing partnership agreements between CDMO and pharmaceutical companies. For instance, In January 2024, Celltrion company signed a business agreement with China's WuXi XDC to accelerate its development of antibody-drug conjugates. WuXi XDC, a 60:40 joint venture between WuXi Biologics and WuXi STA, is a Chinese pharmaceutical company that provides contract research and development manufacturing organization services, mainly on ADCs and bioconjugates. The latest agreement is an extension of a contract development and manufacturing organization deal, in which the two companies agreed to cooperate with the development of Celltrion's two ADC drugs.

China Pharmaceutical CDMO Market Trends

China has emerged as an attractive destination for outsourcing pharmaceutical manufacturing and development activities. Several prominent international pharmaceutical companies are increasingly looking towards China for cost-effective solutions without compromising on compliance and quality. Such factors are contributing to the overall growth of the pharmaceutical CDMO market in China.

- Initiatives such as the “Made in China 2025” plan and the Belt and Road Initiative have boosted the pharmaceutical industry's growth by offering technology transfer, infrastructure development, and international collaborations.

Japan Pharmaceutical CDMO Market Trends

Over the years, the Japanese pharmaceutical CDMO market is increasingly become an attractive location for drug development and manufacturing. The Japan pharmaceutical CDMO market is expected to grow at a considerable growth rate in the coming years due to the presence of prominent pharmaceutical companies, rising investment in R&D efforts, supportive Government framework, rising adoption of advanced manufacturing technologies, rapid advancements in drug delivery technology, rising prevalence of chronic disorders, rise in aging population, and increasing partnership agreements between CDMO and pharmaceutical companies for outsourcing services.

For instance, AGC Biologics, a CDMO, and BioConnection, a CMO, agreed to partner to provide end-to-end biopharmaceutical development and manufacturing capabilities for drug substances and drug products using the development and manufacturing expertise of AGC Biologics and the specialized aseptic filling capabilities of BioConnection.

Europe is anticipated to grow at a CAGR of 7.7% in the pharmaceutical CDMO market during the forecast period. The European CDMO market comprises companies providing outsourced drug development and manufacturing services. European Pharmaceutical companies are heavily outsourcing their development & manufacturing activities to CDMOs intending to reduce costs, get access to specialized expertise, and accelerate time-to-market. The growth of the region is mainly attributed to the presence of well-established healthcare infrastructure, availability of skilled personnel, growing demand for injectable drugs, increasing cases of chronic diseases, rising investment in R&D to develop new drugs by pharmaceutical companies, and stringent regulatory requirements.

Germany Pharmaceutical CDMO Market Trends

The pharmaceutical CDMO market in Germany is anticipated to expand notably during the forecast period owing to the presence of WHO-cGMP-compliant facilities, the availability of skilled personnel, the rising number of chronic diseases, the rise in healthcare expenses, favorable Government framework, and expanding manufacturing capabilities.

- In October 2023, Vetter Pharma, a contract development and manufacturing organization (CDMO), announced its plan to invest USD 243 million into its new production building, which is currently under construction at its global corporate headquarters site in Ravensburg, Germany.

France Pharmaceutical CDMO Market Trends

The pharmaceutical CDMO market in France is expected to grow significantly in the coming years The growth of the market in the country is primarily driven by the increasing demand for pharmaceutical products such as drugs and vaccines, the presence of WHO-cGMP-compliant facilities, rapid adoption of cutting-edge technologies, rising incidence of chronic diseases, rising demand for cell and gene therapies, and rising investment in R&D activities. CDMOs actively support pharmaceutical companies at all stages of the process of making medicines, anticipated to contribute to market growth.

Pharmaceutical CDMO MarketCompanies

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Samsung Biologics

- Laboratory Corporation of America Holdings

- Siegfried Holding Ag

- Catalent, Inc

- Lonza Group AG

- Recipharm Ab

- Piramal Pharma Solutions

- Cordenpharma International

- Cambrex Corporation

- Wuxi Apptec

Recent Developments

- In June 2024, Lupin, a pharmaceutical company, established a new subsidiary named “Lupin Manufacturing Solutions (LMS)” to enter the Contract Development and Manufacturing Organization (CDMO) business.

- In October 2024, Samsung Biologics, a leading contract development and manufacturing organization (CDMO), signed a contract manufacturing deal with an Asia-based pharmaceutical company. The disclosed deal, worth USD 1.24 billion, is the largest contract signed by these companies to bring effective, high-quality biopharmaceuticals to the global market.

- In December 2023, Bushu Pharma announced that it has received the 2023 Japan Contract Development and Manufacturing Customer Value Leadership Award from Frost & Sullivan, a leading research and consulting firm.

Segments Covered in the Report:

By Service Type

- Active Pharmaceutical Ingredient (API) Manufacturing

- Small Molecule

- Large Molecule

- High Potency (HPAPI)

- Finished Dosage Formulation (FDF) Development and Manufacturing

- Solid Dose Formulation

- Tablets

- Others (Capsules, Powders, etc.)

- Liquid Dose Formulation

- Injectable Dose Formulation

- Solid Dose Formulation

- Secondary Packaging

By Research Phase

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting