May 2024

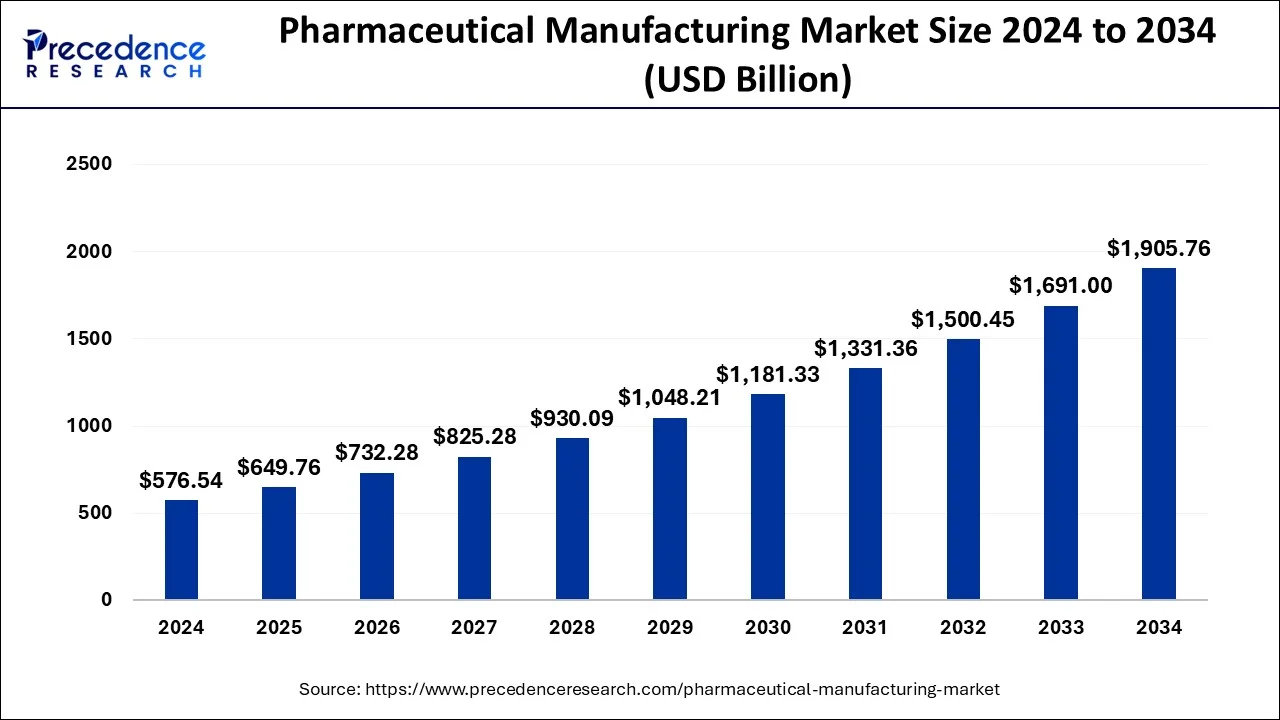

The global pharmaceutical manufacturing market size was USD 576.54 billion in 2024, calculated at USD 649.76 billion in 2024 and is projected to surpass around USD 1,905.76 billion by 2034, expanding at a CAGR of 12.7% from 2024 to 2034. The North America pharmaceutical manufacturing market size was estimated at USD 184.49 billion in 2024 and is expected to grow at a fastest CAGR of 12.88% during the forecast year.

The global pharmaceutical manufacturing market size accounted for USD 576.64 billion in 2024 and is anticipated to reach USD 1,905.76 billion by 2034, at a CAGR of 12.7% from 2024 to 2034. The rising demand for potent medications, advancements in manufacturing technologies and need for precision medicine is driving the growth of pharmaceutical manufacturing market.

Pharmaceutical manufacturing industries can streamline processes with the integration of AI and machine learning tools. AI tools can be significantly applied in drug discovery & development, production and supply chain management to improve product end-quality and outputs while adhering to the stringent regulatory requirements. They can also aid in redefining precision medicine by providing tailored treatment plans specific to the individual patient characteristics. Furthermore, AI can detect safety risks to people as well as the pharmaceutical businesses thereby changing the landscape for pharmaceutical manufacturing market.

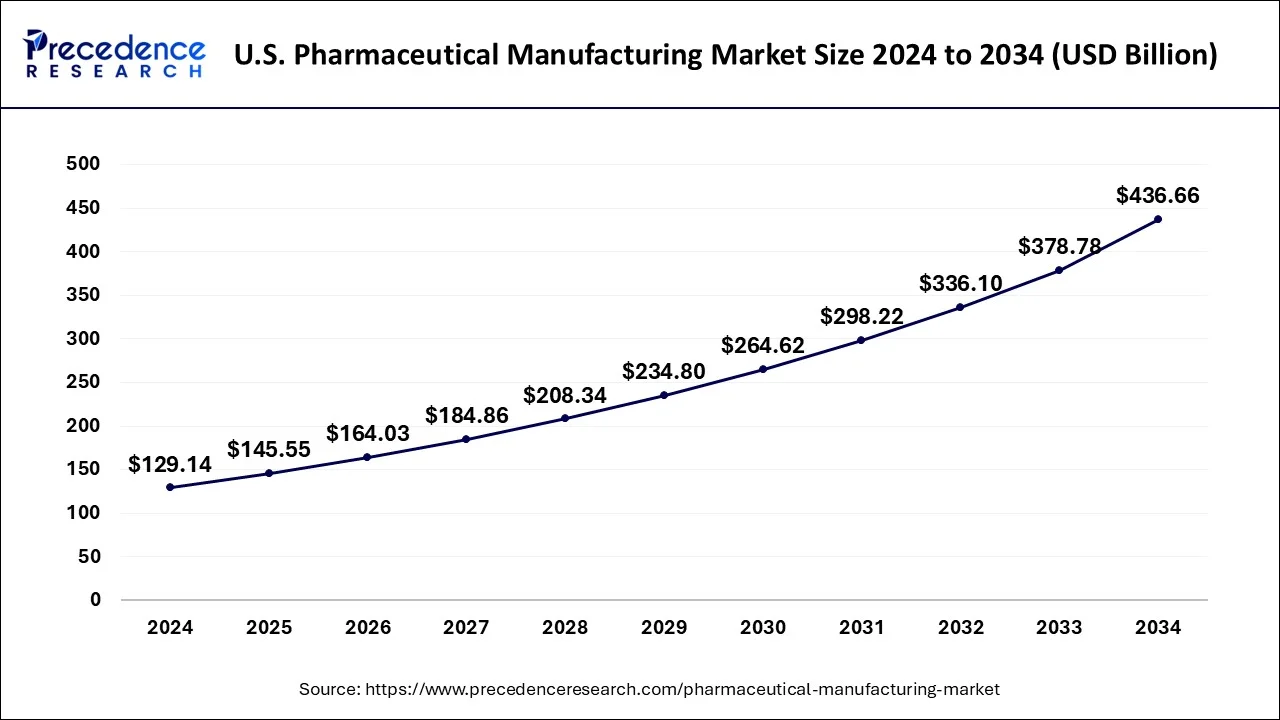

The U.S. pharmaceutical manufacturing market size was estimated at USD 129.14 billion in 2024 and is predicted to be worth around USD 436.66 billion by 2034, at a CAGR of 12.96% from 2024 to 2034.

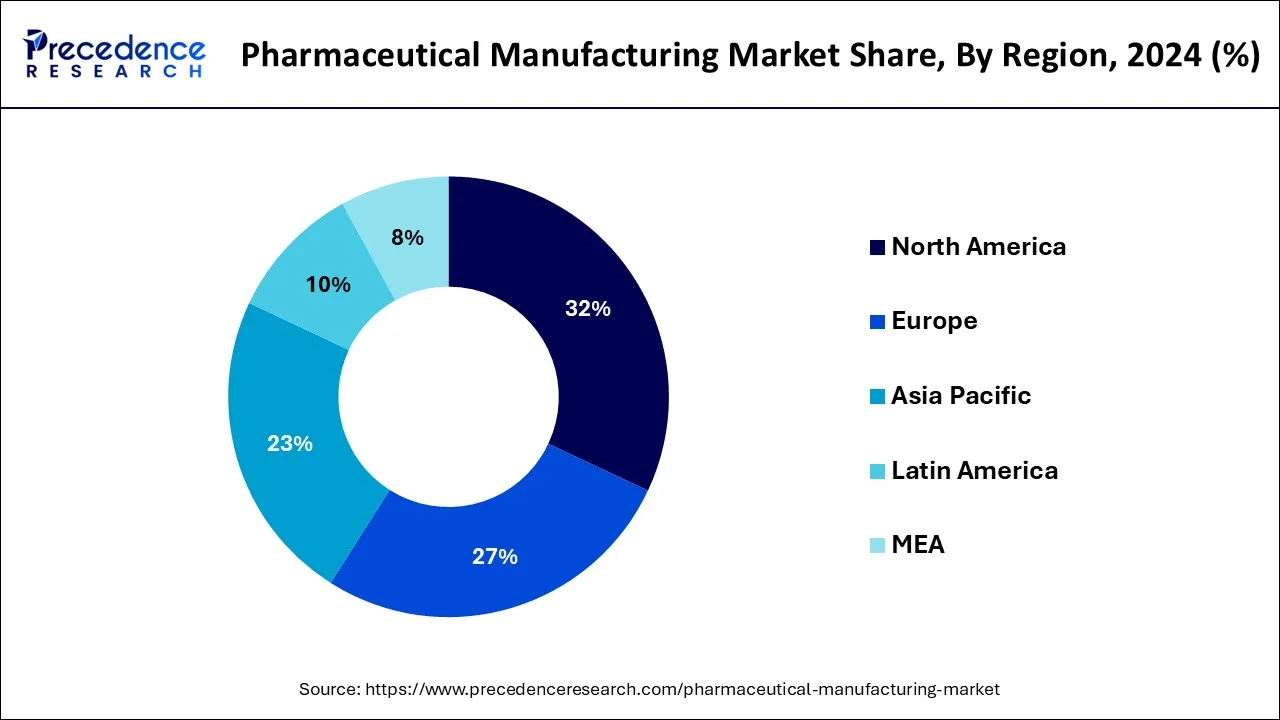

North America dominated the pharmaceutical manufacturing market in 2024. The rapid advancements in clinical trials, development of novel therapies, presence of advanced healthcare infrastructure and the rising support from government regulatory agencies for promoting the drug development and manufacturing processes is driving the market growth of this region.

U.S. Pharmaceutical Manufacturing Market Trends

The growing use of biopharmaceuticals in the population, outsourcing to CDMOs for manufacturing by pharmaceutical businesses and cutting-edge facilities for advancing healthcare infrastructure to improve patient life outcomes is promoting the growth of U.S. pharmaceutical market.

The Asia Pacific region is expected to witness the fastest growth over the forecast period. This growth can be attributed to the factors such as presence of large and diverse population pools, rising disease burden, growth in clinical trials development and regulatory flexibility which are expected to promote the pharmaceutical manufacturing market growth over the forecast period in this region.

India Pharmaceutical Manufacturing Market Trends

The Indian pharmaceutical manufacturing market is expected to grow during the forecast period owing to the rising government support in taking initiatives for promoting pharmaceutical manufacturing. The production linked incentive (PLI) scheme providing incentives to active pharmaceutical ingredients (API) manufacturing companies and launch of Jan Aushadhi scheme for proving affordable generic medicines in the country are boosting the market growth. Furthermore, the adherence to U.S. FDA guidelines for drug manufacturing by the Indian pharmaceutical companies is promoting the sales and distribution of the medications across the world.

Pharmaceutical manufacturing is described as the method of commercial-scale coalescence of medications by the pharmaceutical companies. Medication manufacturing services are outlined by a core assurance to meeting the user’s objectives with the finest quality while sustaining the most effective use of time and regulating costs. The pharmaceutical industry has the repute of being watchful about applying new technology and very slow to carry out changes. The cautious approach of pharma industry is because of the regulatory obligations to verify that any procedure modifications will not exhibit a harmful effect on the product quality. However, the monitoring agencies along with pharma industry are attempting to adopt procedures and technologies that will advance quality and production efficiency. Moreover, there is also a consciousness that more adjustments will be required to further acclimatize to new manufacturing methods, such as continuous manufacturing, personalized medicine, and Industry 4.0,along with subsidiary technologies, such as procedure analytics and innovative process control. Leading pharmaceutical manufacturers are exploiting advanced technologies for streamlining manufacturing processes. For example, GSK is evolving world-class manufacturing modernization for bringing drugs and other healthcare products to persons who want them all over the world. The company is employing progressive technologies to advance the skill within manufacturing, installing virtual reality devices and touch screens to preserve a sterile atmosphere and bolster apparatus maintenance.

Future of Pharmaceutical Manufacturing

In order to deal with the challenges that advanced therapeutics, pricing burdens, and worldwide supply chains exhibit, the implementation of latest digital solutions has become vital for pharmaceutical manufacturers. It includes leveraging artificial intelligence, Big Data, machine-learning, and industrial internet of things (IIoT) for a consequential impact on pharmaceutical manufacturing process to improve quality. Contract manufacturing is expected to bring about the much-required transformation in the pharmaceutical manufacturing business.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.7% |

| Market Size in 2024 | USD 576.54 Billion |

| Market Size by 2034 | USD 1,905.76 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Development, Route of Administration, Formulation, Therapy |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Technological advancements

Technological advancements enable more efficient and precise production processes, leading to improved product quality and reduced manufacturing costs. Automation, robotics and digitization enhance manufacturing accuracy and consistency, minimizing human error. Analytical technologies help in real-time monitoring and quality control, ensuring adherence to strict regulatory standards. Moreover, advanced techniques like 3D printing and continuous manufacturing enable faster production and customization of pharmaceuticals. Overall, these innovations enhance productivity, reduce time-to-market, and contribute to the growth of the pharmaceutical manufacturing industry. Thus, such technological advancements are observed to act as a driver for the growth of pharmaceutical manufacturing market.

Complexities in adopting new technologies

The pharmaceutical industry often deals with complex processes, stringent regulations and hig standards for product safety along with maintaining efficacy. In such situations, introducing new technologies can be challenging for the market. The complexities in adopting new technologies are caused by the need for validation, ensuring compatibility and potential risk of disrupting the existing system of manufacturing. Moreover, the industry is a little conservative, which concerns data security and financial investment. This factor also limits companies from investing in new technologies. Thus, such complexities in adopting new technologies are observed to act as a restraint for the market’s expansion.

Rising demand for personalized medicine

The rising demand for personalized medicine presents a significant opportunity for the pharmaceutical manufacturing market. Personalized medicine involves tailoring medical treatment to individual patients based on genetic, molecular and clinical information. This approach allows for more effective and precise treatments, potentially reducing adverse effects and improving patient outcomes. For the pharmaceutical manufacturing market, this trend drives the need for specialized manufacturing processes to produce customized drugs, diagnostics and therapies. It also requires multiple advanced technologies, such as 3D printing, targeted delivery systems and gene editing.

Manufacturers can optimize opportunity by developing flexible production processes that can accommodate small batch sizes and rapid changes in formulation, which are often required for personalized medicine. Thus, the rising demand for personalized medicine is expected to offer multiple opportunities for the market to grow.

Supply chain disruptions

Pharmaceutical manufacturing processes require a range of raw materials. Many of which are sourced globally. Disruptions in the supply of these materials, whether due to natural disasters, geopolitical issues or manufacturing problems, can lead to production delays or even stoppages. Pharmaceutical manufacturing involves intricate processes and a sequence of steps. If any component or intermediate product is delayed or unavailable, it can disrupt the entire production process, leading to potential shortages. Thus, supply chain disruptions are observed to pose a challenge for the market.

The conventional drugs (small molecules) segment dominated the market with the largest share in 2024. The growth of this segment in pharmaceutical manufacturing is attributed to the rising disease burden, advanced manufacturing infrastructure for API production, increasing global population, ongoing R&D, consumer demand and support from government.

The biologics & biosimilars (large molecules) segment is expected to show the fastest growth over the forecast period. The increasing demand, robust product pipeline and the surge in global clinical trials for development and manufacturing of these large molecules is driving the market. Moreover, the proven safety and efficacy of treatments and novel therapies with minimum risks and side effects has been increasing the popularity of biologic and biosimilars among pharmaceutical industries as well as the patients. These factors are expected to fuel the market growth of this segment during the predicted timeframe.

The in-house drug development segment dominated the market in 2024. The presence of in-house infrastructure with cutting-edge facilities and industrial experts in big pharma companies helps in securing their proprietary novel molecules and innovations, focusing on drug development and creating robust product pipeline which ultimately boosts the market growth of this segment. Furthermore, the rising mergers, collaborations and acquisition by pharmaceutical to expand their portfolio and strengthen market presence is retaining the dominance of in-house drug development segment.

The outsource drug development segment is anticipated to grow rapidly over the forecast period owing to the growing popularity of pharmaceutical Contract Development and Manufacturing Organizations (CDMOs). CDMOs assist in the pharmaceutical supply chain while offering a wide range of services such as for formulation development, in clinical trials, manufacturing of drugs with streamlined processes thereby increasing efficiency, ensuring quality control and regulatory compliance, reducing production costs and eliminating or mitigating the risks associated with expansions and upgrades for pharmaceutical organizations.

The oral route of administration segment is dominating the market share in 2024. Oral drugs and formulations are the most prescribed and dispensed medications due to their ease of availability, affordability and widespread acceptance. Oral medications are largely manufactured by almost all the pharmaceutical industries owing to their broad spectrum of applications, advanced facilities with streamlined development and production process and the support from government regulatory bodies for manufacturing biologics, biosimilars and generic medicines. Moreover, the rising demand for oral drugs to treat vast-array of disease is fuelling the market growth of this segment.

Parenteral segment is anticipated to show the fastest growth in the market over the forecast period. Parenterals eliminate the risk of first-pass metabolism offering widespread bioavailability and rapid onset of action. They are widely used in patients with digestive system problems, coma patients and in chronic illnesses to provide necessary nutrition and effective administration of medications. Furthermore, the growth in manufacturing parenterals such as vaccines, biosimilars, injectables and biopharmaceuticals for developing safe, effective and personalized treatments as well as expanding the product portfolio of pharmaceutical manufacturing industries is expected to drive the market growth in the upcoming years. For instance, in Dec 2024, Baxter International Inc., a global leader in injectables, anaesthesia and drug compounding upgraded their portfolio declaring the launch of five new pharmaceutical injectable products in the U.S. which is the second launch by the company after previous five launches in April in 2024 which will help to address critical patient needs.

The tablets segment dominated the market with the largest share in 2024. Tablets are the most widely dispensed formulation in the pharmaceutical industry owing to the factors such as ease of administration, versatility for different purposes, patient acceptance, durability and longer shelf life. Furthermore, the adoption of end-to-end processes, advanced formulation designing tools, sophisticated coating techniques and adherence to strict quality control measures while following current Good Manufacturing Practices

(cGMP) is streamlining the tablet manufacturing process in the pharmaceutical industry thus promoting the market dominance of this segment.

The sprays segment is expected to show the fastest growth over the forecast period. Sprays provide rapid onset of action, are non-invasive, easy to use, can be self-administered and effectively disperse the medication at the site of action with increased bioavailability. They are available in various compact designs, with precise dispersion systems complying with the comfort of the patients making them a popular opinion. Additionally, they enhance the product stability of certain medications, offer advantage over traditional medications and increase shelf life of formulations due to which this segment is expected to fuel the market growth over the forecast period.

Based on therapy, the cancer segment dominated the market with the largest share in 2024. The rising investments in R&D of cancer therapies, robust product pipelines, increasing collaboration among industries and research institutions are fuelling the market growth of this segment. Moreover, the surge in clinical trials, manufacturing of biosimilars and generic drugs as well as in cell and gene therapies for treating cancer and improving patient life quality is boosting the market. For instance, in Oct 2024, TreeFrog Therapeutics, a French-based regenerative medicine biotech entered into a research collaboration with University of Pittsburgh which will be focusing on the future of tertiary lymphoid structures (TLS) in immune-oncology by using its proprietary C-Stem 3D cell encapsulation technology with the aim of pioneering 3D immunology.

The prescription medicines segment dominated the market share in 2024. The widespread availability and affordability of prescription drugs dispensed by the increasing number of pharmacies across the globe is driving the market growth of this segment. Furthermore, the increased manufacturing of biosimilars and generic medicines with reduced costs, government initiatives supporting the manufacturing and distribution of prescription medicines and pharmacies updating their inventory with these medicines increasing accessibility to the patients is fuelling the market growth of this segment.

Over-the-counter (OTC) medicines segment is expected to grow rapidly over the forecast period. These medications are easily available without any prescriptions at pharmacy stores offering cost and time efficiency to consumers. OTC medicines are provided by pharmacists to naive patients in case of emergencies and as prophlyaxis for certain conditions or injuries. As the patent of huge number of OTC medications is expired, they are widely manufactured and marketed by small scale and mid-scale pharma companies which is expected to drive the market growth of this segment in the upcoming years.

The geriatric segment held the largest market share in 2024. According to the United Nations World Population Prospects, almost 10.3% of the world's population was aged 65 or older in 2024. Older people undergo changes in their bodies and organs with aging which creates the need of developing and manufacturing formulations suiting this special population to decrease the morbidity rate. The approach for developing medicines should be patient centric, with convenient route of administration, examining the drug-drug interactions and user-friendly packaging for geriatric patients. These factors are promoting the market growth of this segment.

The children & adolescents segment is expected to show the fastest growth over the forecast period. This growth can be attributed to rising incidences of disorders and diseases in the young population driving the need for manufacturing drugs and formulations with safe and effective outcomes. Moreover, the development of Orphan Drugs for rare diseases and genetic disorders frequently observed in the children with support of government regulatory bodies such as U.S. FDA granting Orphan Drug Designation for accelerated development of novel drugs to treat and improve patient life outcomes in rare disease scenarios is accelerating the market growth of this segment.

The retail segment accounted for the largest market share in 2024. In pharmaceutical manufacturing, the retail segment addresses to the direct sale of pharmaceutical products to consumers through retail pharmacies, drug stores and online platforms. The retail distribution is conveyed via diverse channels ensuring the sufficient and timely distribution of medications to the consumers. Furthermore, the availability of prescription drugs and OTC medicines at most of retail settings which provide medication counselling and support to the patients is driving the market growth of this segment.

Non-retail segment is expected to grow swiftly over the forecast period. In the non-retail setting, drugs are directly distributed to various healthcare institutions such as hospitals, clinics, primary health centres and government facilities. The sales and marketing team of pharmaceutical companies directly approach healthcare providers for selling and distribution of drugs in large volumes directly thereby reducing the cost, resources and time required compared to the traditional way of going to retail pharmacies which is expected to expand the market growth of this segment over the forecast period.

In Decmeber 2024, Malema, a leading provider of flow meter technologies for use in industrial and semiconductor applications announced the launch of the new Malema CIFM-88 Series DuraMassFlow PFA Coriolis Industrial Flow Meter which is suitable for chemical processing, pharmaceutical manufacturing, food and beverage applications among others. Bob Lauson, General Manager for Malema said that, “The updated Coriolis flow meter embodies Malema's commitment to customer satisfaction, setting a new standard for industrial applications that demand precise control of chemical processes. The CIFM-88 Series represents an advancement in flow measurement with its innovative design that handles corrosive chemicals while maintaining exceptional accuracy.”

By Molecule Type

By Drug Development Type

By Route of Administration

By Formulation

By Therapy

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

April 2025

February 2025

September 2024