August 2024

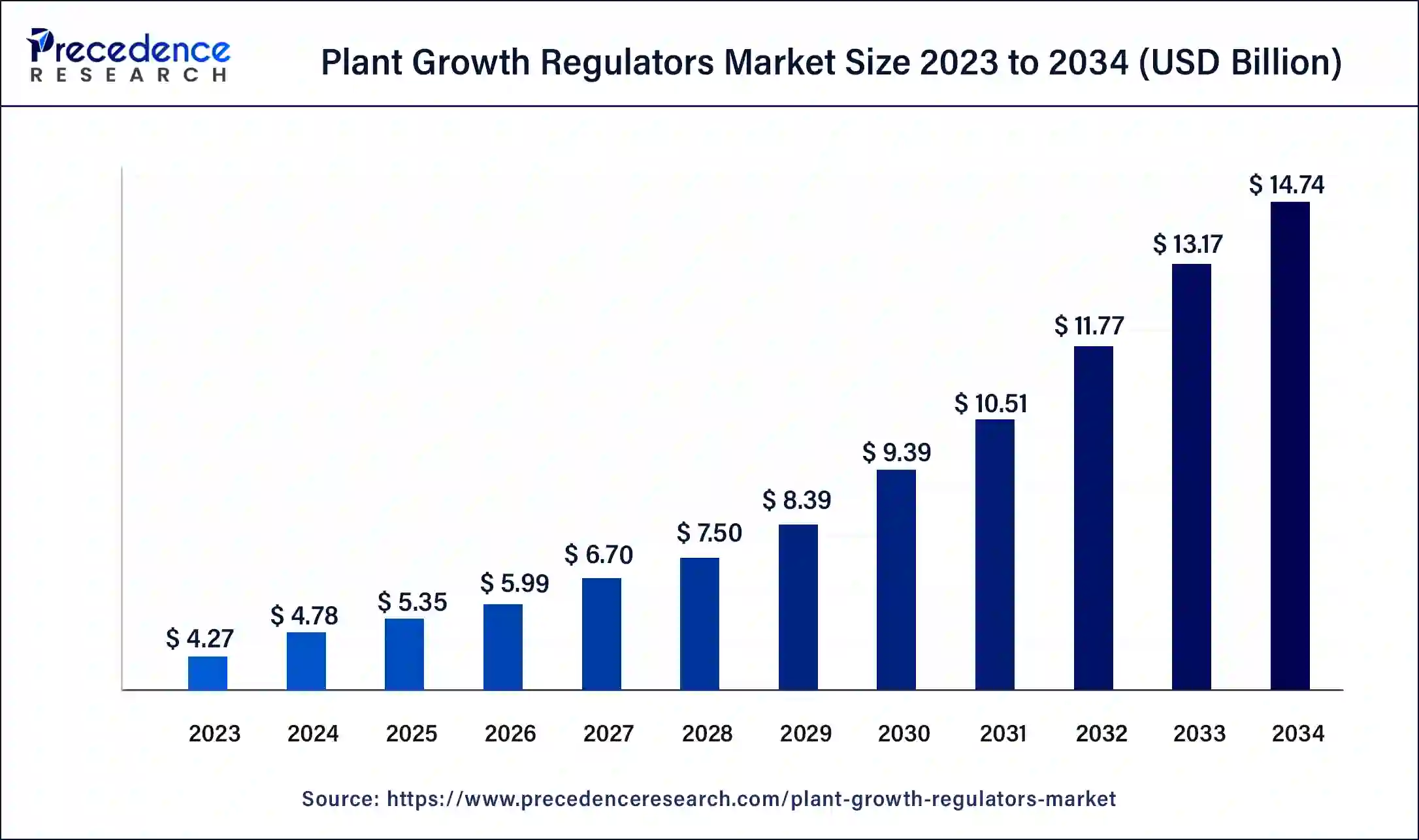

The global plant growth regulators market size was USD 4.27 billion in 2023, calculated at USD 4.78 billion in 2024 and is anticipated to reach around USD 14.74 billion by 2034. The market is slated to expand at 11.92% CAGR from 2024 to 2034.

The global plant growth regulators market size is projected to be worth around USD 14.74 billion by 2034 from USD 4.78 billion in 2024, at a CAGR of 11.92% from 2024 to 2034. Decreasing agricultural areas along with increasing demand for organic food is likely to be one of the key trends in the plant growth regulators market growth.

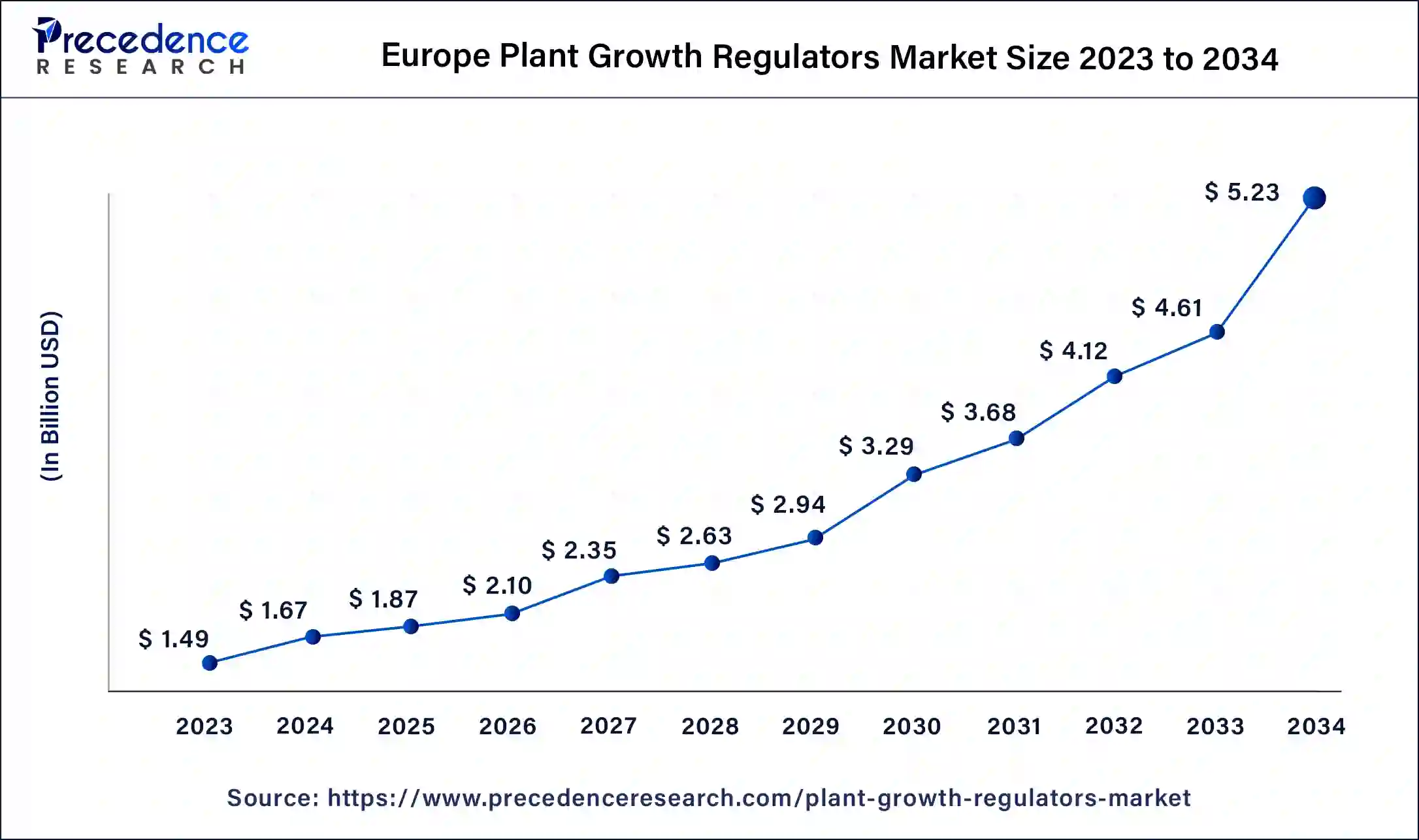

The Europe plant growth regulators market size was exhibited at USD 1.49 billion in 2023 and is projected to be worth around USD 5.23 billion by 2034, poised to grow at a CAGR of 12.09% from 2024 to 2034.

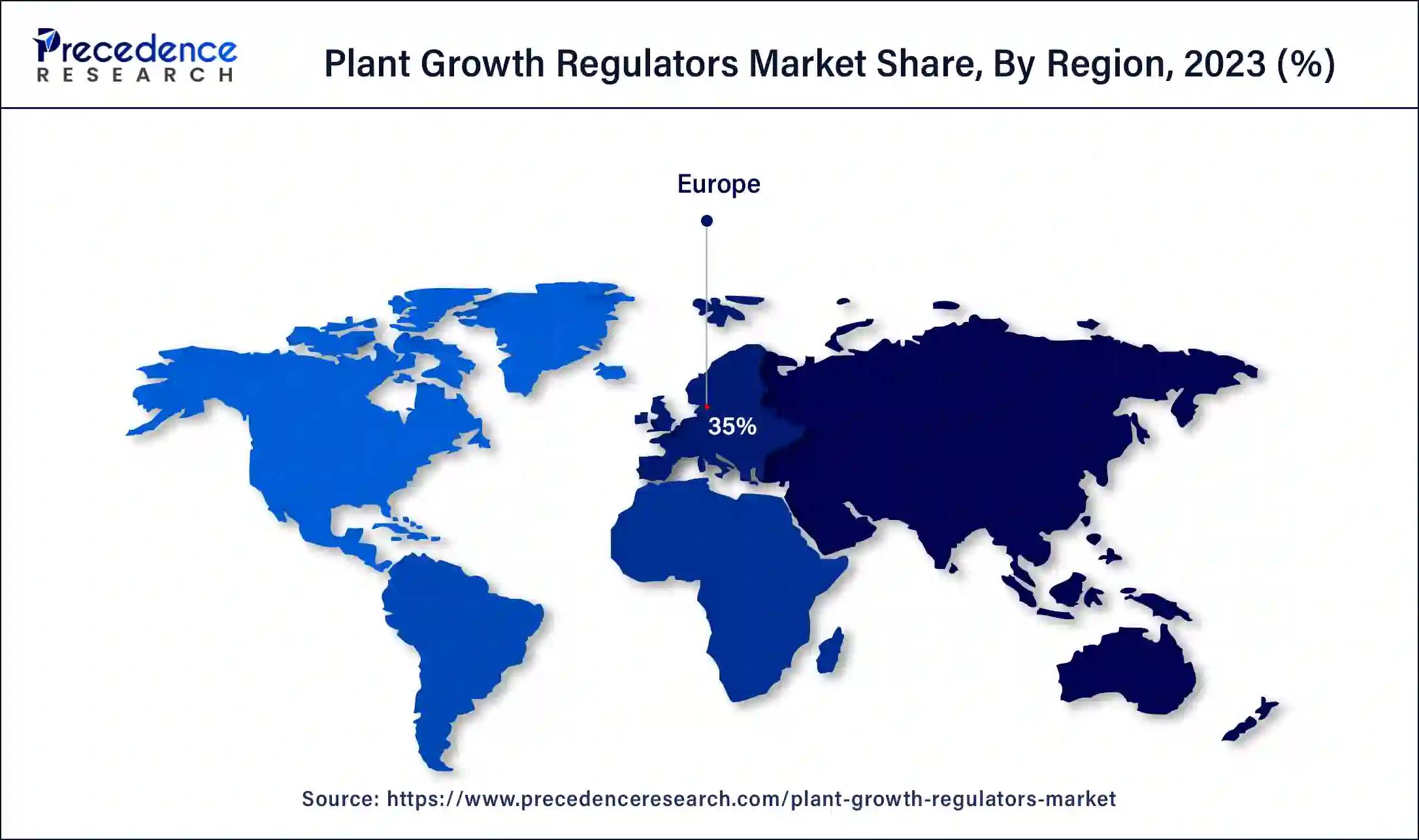

Europe dominated the global plant growth regulators market in 2023. The region's dominance is linked to the innovative agricultural practices carried out since the technological advancement in this sector. The region’s dominance is due to the adoption of plant growth regulators by many farmers to enhance the quality and yields. Furthermore, the country's favorable regulatory conditions, rising emphasis on sustainable agriculture, and advanced R&D activities are driving the growth of the region's market.

Additionally, the rising demand for high-value crops and higher consumption of natural plant regulators systems in agriculture sector have promoted the expansion of the market in Europe. Most of the pesticide manufacturers and dealers such as Bayer is headquartered in Europe. This has significant potential for the market to grow in European countries.

Asia Pacific is expected to grow at the fastest rate in the plant growth regulators market over the forecast period. The region is experiencing strong growth due to rising food requirements and the adoption of modern agricultural practices. Also, the growing population in the region has driven the demand for food, fueling the market's growth further. China, India, and Japan are the key market contributors in the region due to significant investments made by the governments of the respective countries in advanced agricultural practices.

List of 10 Leading Agricultural States in India (2024)

| S.No | State | Major Crops Grown |

| 1. | Punjab | Wheat, Rice, Cotton |

| 2. | Uttar Pradesh | Wheat, Sugarcane, Rice, Maize |

| 3. | Maharashtra | Sugarcane, Cotton, Rice |

| 4. | Madhya Pradesh | Soybean, Wheat, Rice |

| 5. | Rajasthan | Bajra, Wheat, Pulses, Oilseeds |

| 6. | Bihar | Rice, Wheat, Maize |

| 7. | Andhra Prades | Rice, Sugarcane, Chilies, Oilseeds |

| 8. | Karnataka | Coffee, Sugarcane, Rice, Oilseeds |

| 9. | Tamil Nadu | Rice, Sugarcane, Banana, Oilseeds |

| 10. | West Bengal | Rice, Jute, Pulses, Oilseeds |

Plant growth regulators are synthetic chemicals that mimic the hormones that plants naturally make. They usually do this by controlling and modifying plants' physiological processes to get desired results like enhancement in yield and quality. Some examples of this plant's growth regulators are auxins, cytokinins, and gibberellins. These chemicals also impact the overall development of plant cells, organs, and tissue. In the plant growth regulators market, growth inhibitors can increase crop productivity substantially, which can lead to high-yield formation in a short period.

Role of AI in the Plant Growth Regulators Market

The integration of innovative imaging technologies with AI has launched as a powerful technique for real-time and non-invasive monitoring of plant health technologies such as deep learning and neural networks, along with pattern recognition, enabling the automated analysis of large datasets, which improve the precision and speed for plant stress detection. Furthermore, the ability of AI in plant stress physiology and its capability to overcome the limitations of conventional methods can transform the plant growth regulators market in the upcoming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.74 Billion |

| Market Size in 2023 | USD 4.27 Billion |

| Market Size in 2024 | USD 4.78 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.92% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for food due to growing population

increasing demand for food due to rising global population growth is one of the key factors driving the plant growth regulators market growth. The demand for food is rising in proportion to the increase in population worldwide, and to fulfill this need, it is important to cultivate more quality crop yields, which can only be possible by adapting to efficient agricultural practices. Additionally, plant growth regulators are extensively used in the farming sector to improve the quality of yield and protect crops from diseases and pests, which can propel market growth further.

Farmers' low awareness and education

Farmers might be unaware of the proper usage, benefits, and utilization of plant growth regulators, and there are some differences in their understanding of these tools. This can hurt the adoption rate, particularly with conventional and small-scale farmers. Moreover, Concerns related to the effect of the environment on plant growth regulators can hinder the plant growth regulators market growth soon.

Growth in the pharmaceutical industry

The growth in the pharmaceutical industry is the latest trend in the plant growth regulators market. The sector is mainly driven by unhealthy eating habits, changing lifestyles, and an aging population. Which then can lead to the prevalence of chronic diseases. Furthermore, this growth in the pharmaceutical market is also accomplishing the greater demand for herbal medicines, which is a substitute for expensive allopathy medicines. Key pharma companies are also investing in R&D to develop plant-derived medicines and tackle the growing need for herbal medicines. This trend is expected to create lucrative opportunities for the market in upcoming years.

The cytokinin segment dominated the plant growth regulators market in 2023. The growth of the segment can be attributed to the rising consumer awareness regarding the positive effects of delaying senescence, branching, nutrient remobilization, and growth of flowers & seeds. Cytokinins are plant hormones that maintain different processes of plant growth, such as cell division & differentiation, delay of senescence, shoot & root, and fruit & seed development. Moreover, it delays the natural aging process, which causes death in plants. It is also used to cure the wounded part of the plant.

The auxins segment is expected to experience notable growth in the plant growth regulators market during the forecast period. Auxins are plant hormones responsible for cell elongation and promote root and fruit growth. Auxins are used extensively in the farming sector to increase crop cultivation and enhance plant growth. The rising need for food because of a growing population is anticipated to propel the growth of the auxins segment throughout the forecast period.

Segments Covered in the Report

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024

July 2024

August 2024