April 2025

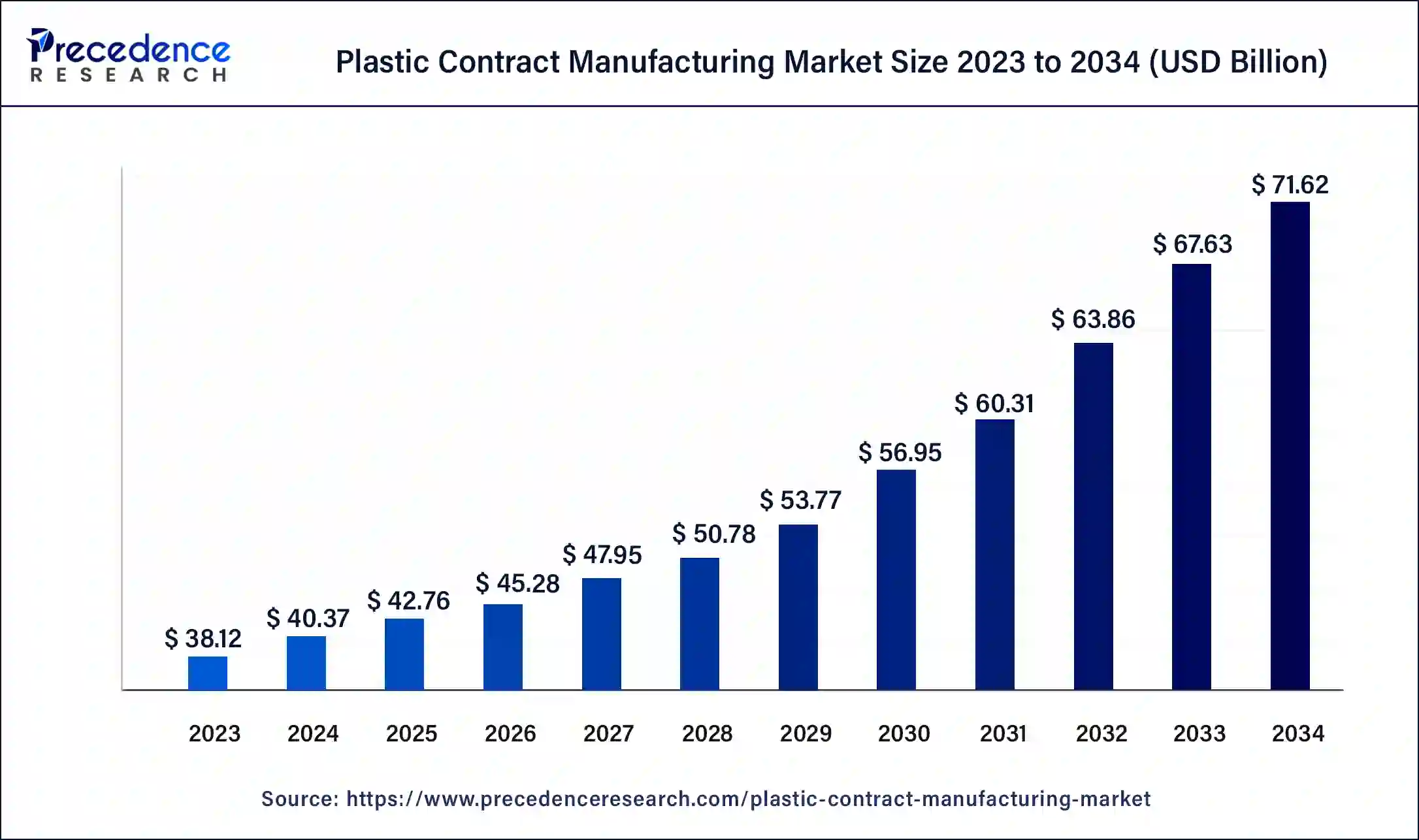

The global plastic contract manufacturing market size was USD 38.12 billion in 2023, calculated at USD 40.37 billion in 2024 and is expected to reach around USD 71.62 billion by 2034, expanding at a CAGR of 5.9% from 2024 to 2034.

The plastic contract manufacturing market size accounted for USD 40.37 billion in 2024 and is expected to reach around USD 71.62 billion by 2034, expanding at a CAGR of 5.9% from 2024 to 2034.

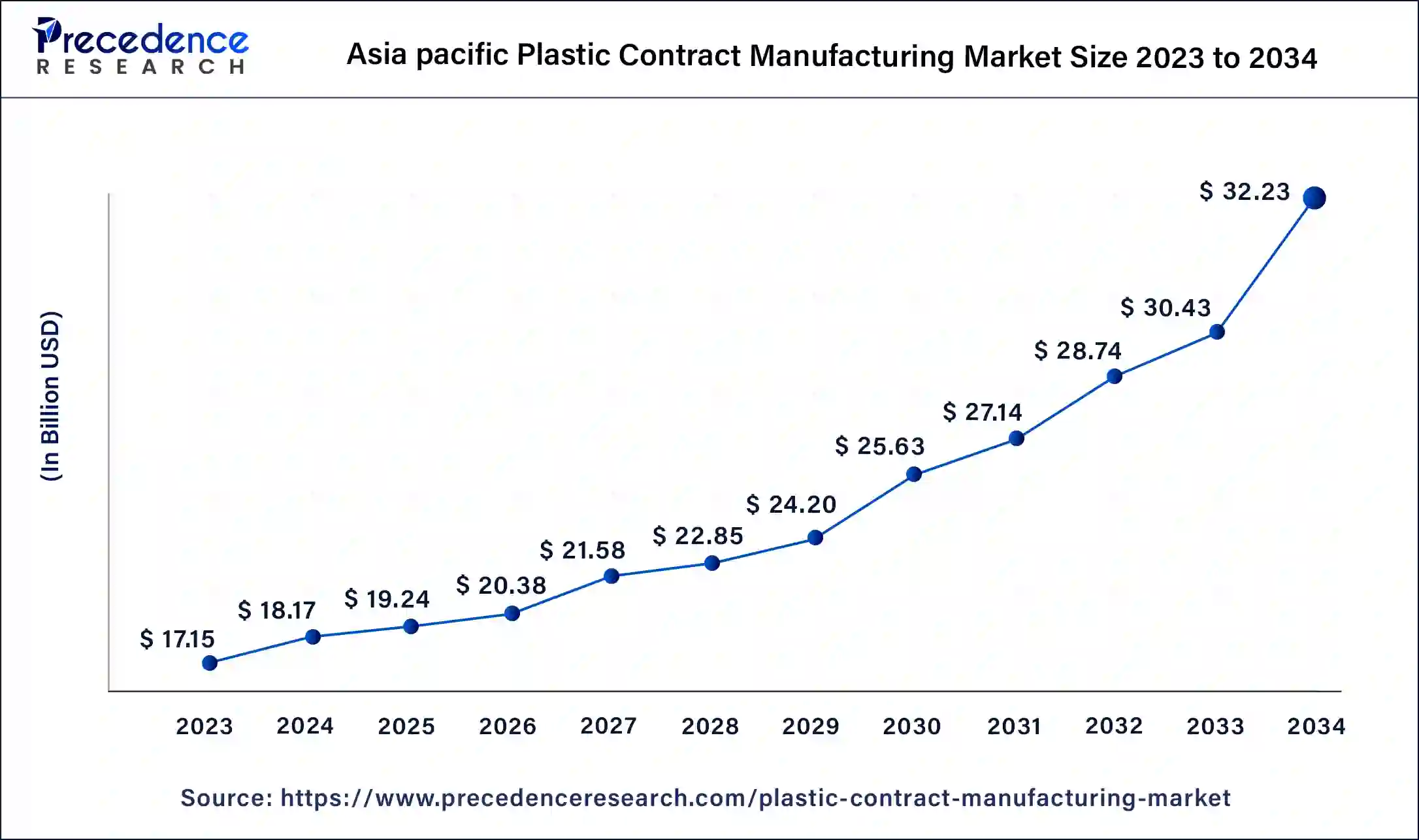

The Asia Pacific plastic contract manufacturing market size was estimated at USD 17.15 billion in 2023 and is predicted to be worth around USD 32.23 billion by 2034, at a CAGR of 6.1% from 2024 to 2034.

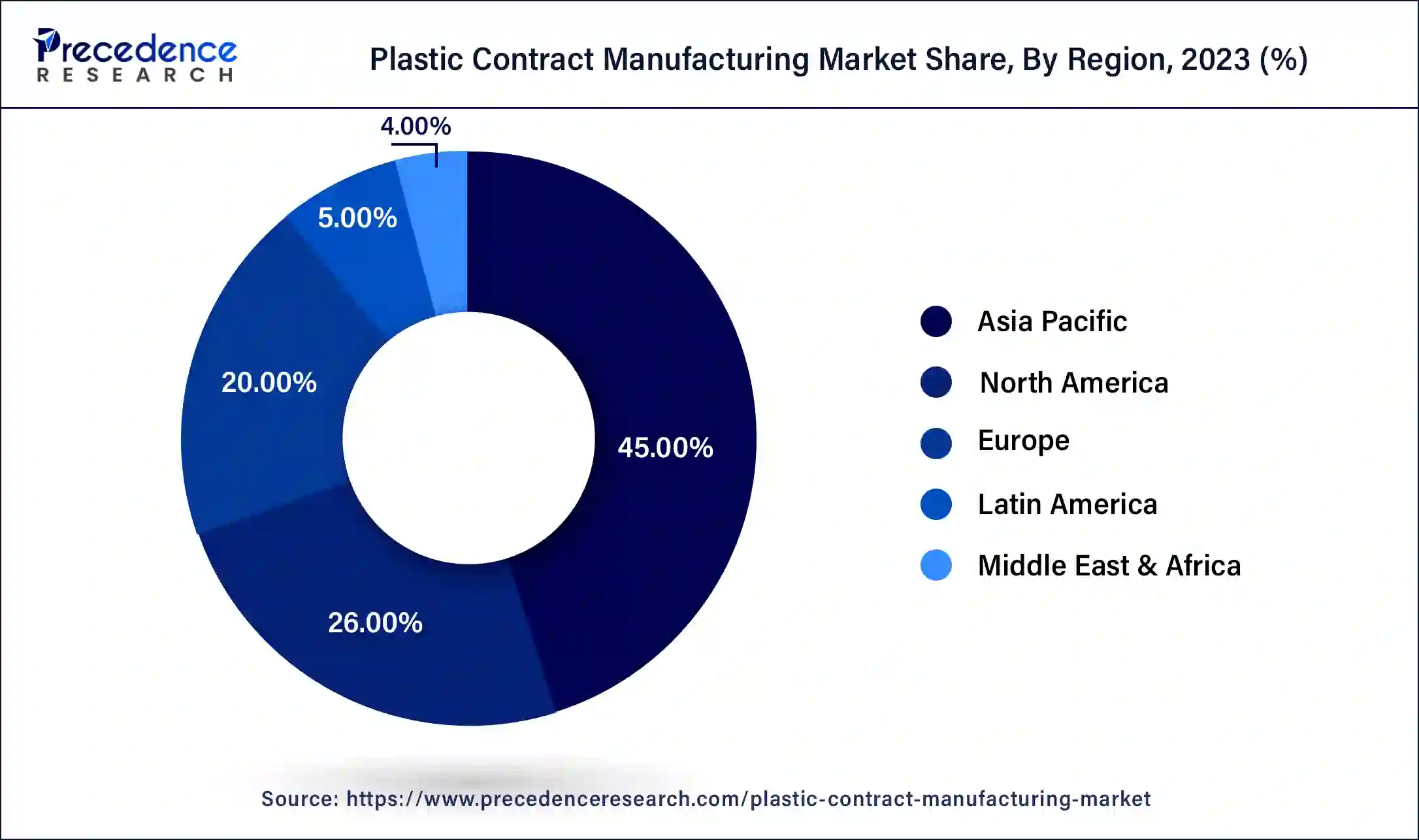

Asia-Pacific region dominated the market and accounted with a revenue share of 45% in 2023. Plastics are produced and used in significant quantities throughout the region. It is also the world’s largest manufacturer of home appliances. The domestic demand for appliances is expected to expand rapidly as a result of rising disposable incomes and a growing population in the region, which will benefit the market.

Europe is expected to develop at the fastest rate during the forecast period. One of the primary factors likely to contribute to the increased demand for plastic contract manufacturing in the UK is the presence of several small-scale market operators with limited technical competence.

The plastic contract manufacturing is a safe and healthy way of manufacturing plastic on large scale. The plastic contract manufacturer offers to provide a few plastic production services based on the customer’s needs in this process. In most cases, the brands from whom plastic products are purchased are not the same as the companies that produce full products. The plastic contract manufacturers are used by product brands and companies to outsource their plastic production. The multiple plastic contract manufacturers could be involved in the full process of plastic contract manufacturing at times.

An original equipment manufacturers capacity to find and purchase required materials and components, mold and assemble plastic components, package, and transport the finished product is known as contract manufacturing. The original equipment manufacturers collaborate with molders to complete projects, allowing them to concentrate more on strategy, sales, and other key capabilities in order to grow their businesses.

The contract manufacturing is a cost-effective outsourcing method that keeps overhead and operating costs low. The contracting with outside manufacturers allows businesses to attain high levels of efficiency and production. The businesses can concentrate on what they do best rather than bothering about manufacturing. Due to the specialized workforce, bulk purchasing, and reduced errors, plastic contract manufacturing lowers the cost of final products. In the end, this will cut the price for clients, resulting in increased sales.

The manufacturing companies specialize in designing certain items so that they can launch a high-volume manufacturing line and adopt cost cutting strategies for a corporation. This frees firms on more vital tasks without fear of making mistakes for which they lack the necessary training and experience. The major manufacturing companies have the abilities and equipment to improve and change the product, if necessary, without making costly mistakes at a pivotal point.

The aerospace, telecommunications, defense, automotive, medical, electronics, pharmaceuticals, and industrial utilize services and solutions in the global plastic contract manufacturing market. In order to improve their user experience and acquire a wider customer base, the key market players in the global plastic contract manufacturing market are providing a variety of services.

The expansion of the global plastic contract manufacturing market is being driven by the surge in the demand for electronic products such as wearables, smartphones, and smartwatches as well as an increase in disposable income. Furthermore, increased complexities in engineering and layout of items as well as rise in surgeries have resulted in increased demand for medical equipment. During the forecast period, this factor is expected to play a significant role in boosting the growth of the plastic contract manufacturing market.

Clinical device production is expensive, and there is fierce competition among plastic contract manufacturing market players. Thus, there is a rise in a adoption of methods that can lower manufacturing costs, boosting the growth of the plastic contract manufacturing market. In addition, the plastic contract manufacturing market is expected to benefit from increased demand for consumer electronics such as computers, video recorders, smartphones, cameras, and televisions over the projected period.

The increased need for better healthcare services, technological improvements, and infrastructure development are expected to enhance the medical equipment industry, which will surge the demand for plastic contract manufacturing. The plastic contract manufacturing provides benefits such as expertise, job shifting, and costs savings. The plastic contract manufacturers collaborate with customers to choose raw materials, design parameters, timelines, and certification requirements. The producers can customize and expand products to meet specific requirements. The end users save money by outsourcing a portion of the manufacturing process. As a result, all these factors contribute to the growth of the global plastic contract manufacturing market during the forecast period.

The high capital investments and higher requirements for establishing solid relationships with raw material suppliers, on the other hand, are projected to limit the new entrants to the plastic contract manufacturing market. As a result, the risk of new entrants is predicted to be low. One of the options available to major market players is in-house manufacturing. The high capital required to establish plastic molding facilities as well as continuously changing manufacturing technology, are projected to boost the expansion of the global plastic contract manufacturing market over the projected period.

| Report Coverage | Details |

| Market Size in 2023 | USD 38.12 Billion |

| Market Size in 2024 | USD 40.37 Billion |

| Market Size by 2034 | USD 71.62 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In 2023, the polypropylene segment accounted revenue share of 35%. The polypropylene is mostly utilized in the automotive and medical industries to manufacture components. The polypropylene’s qualities including as sterilization and impact resistance are projected to boost its use in the medical business.

The polyethylene segment, on the other hand, is predicted to develop at the quickest rate in the future years. The polyethylene is utilized in medical and equipment devices and components packing bags. The increased use of plastic in pouches is likely to boost demand for the product during the forecast period.

The consumer goods and appliances segment dominated the market in 2023 with a revenue share of 27%. Increasing reliance on household appliances as a result of the growing working population, combined with rising disposable income levels, is predicted to fuel demand for this equipment and propel the plastic contract manufacturing market.

The automotive segment is fastest growing segment of the plastic contract manufacturing market in 2023. The plastics are used in electrical components, chassis, powertrains, interior and exterior furnishings in the automobile and automotive industries.

The existence of many contract manufacturers around the world characterizes the plastic contract manufacturing market. The consumer goods and appliances, medical, automotive, agriculture, industrial, and telecommunication applications drive the demand of product. The plastic contract manufacturing market’s competitive landscape is fueled by technological advancements in production processes. The major market players are substantially spending research and development as well as equipment development in order to optimize production methods, improve process efficiency, and create complicated components.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024