April 2025

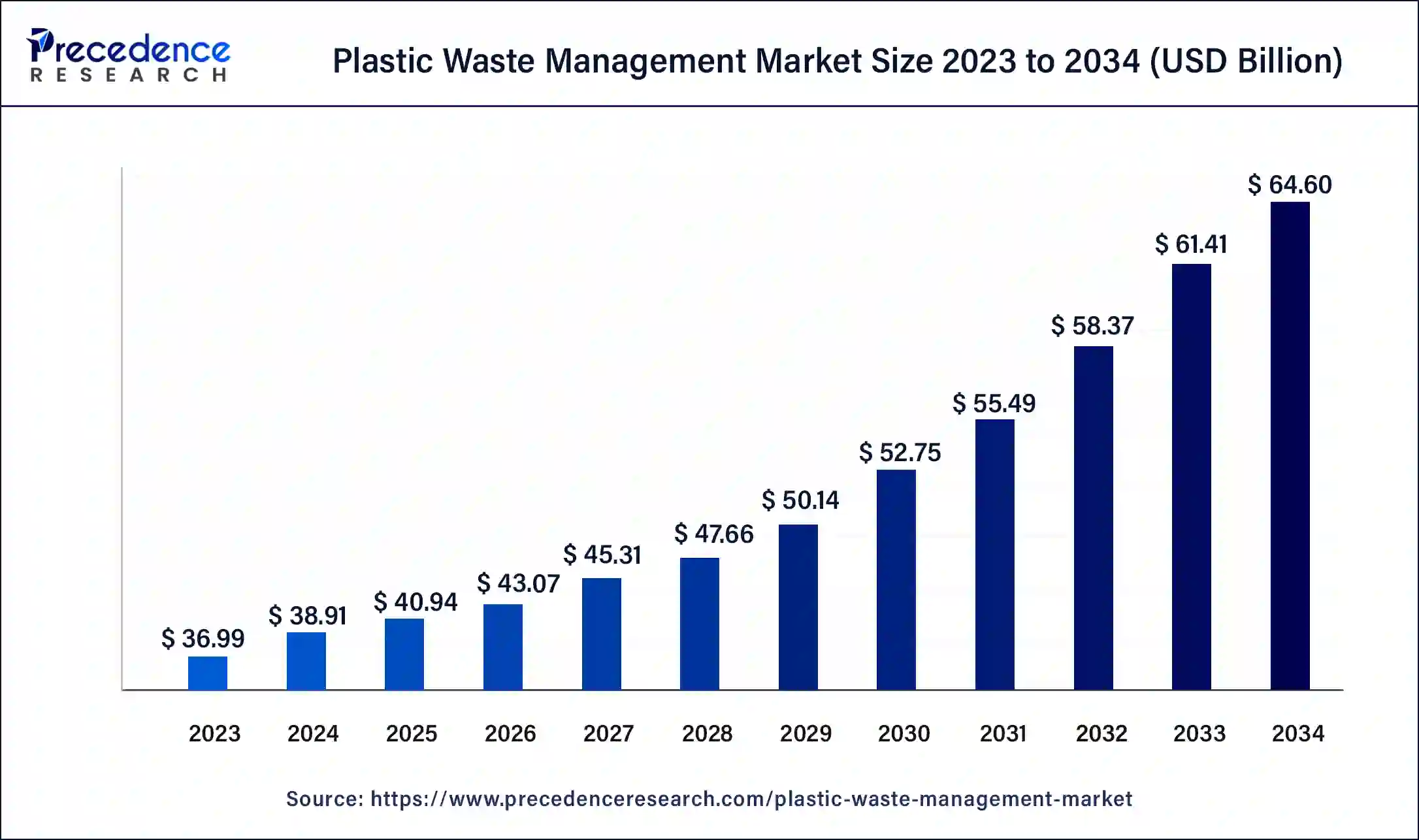

The global plastic waste management market size was USD 36.99 billion in 2023, calculated at USD 38.91 billion in 2024 and is expected to reach around USD 64.60 billion by 2034, expanding at a CAGR of 5.2% from 2024 to 2034.

The global plastic waste management market size accounted for USD 38.91 billion in 2024 and is expected to reach around USD 64.60 billion by 2034, expanding at a CAGR of 5.2% from 2024 to 2034.

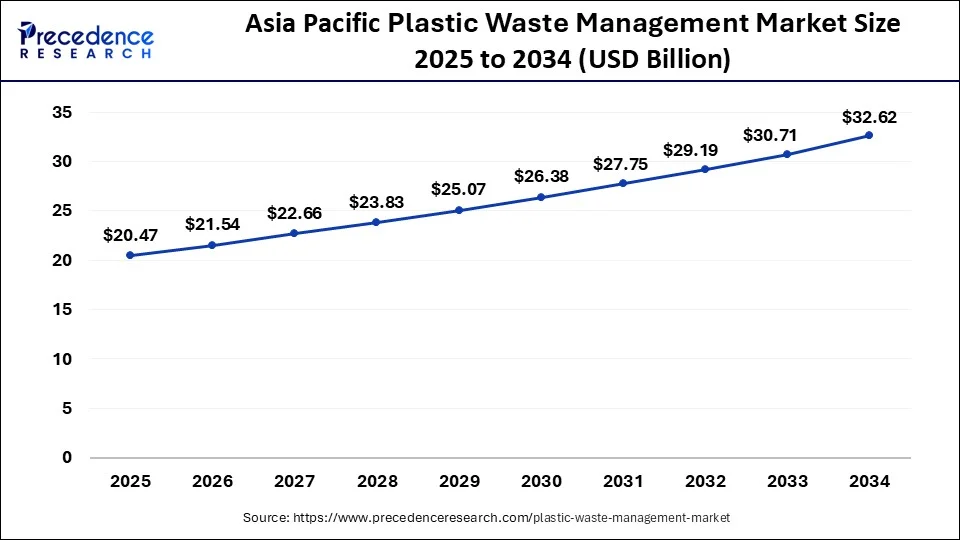

The Asia Pacific plastic waste management market size was estimated at USD 12.95 billion in 2023 and is predicted to be worth around USD 22.61 billion by 2034, at a CAGR of 5.4% from 2024 to 2034.

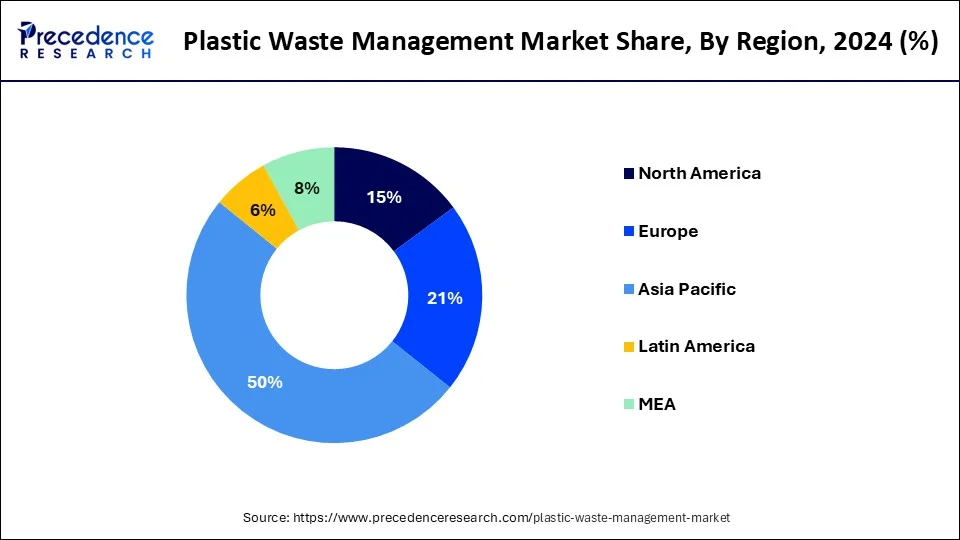

Asia-Pacific dominated the plastic waste management market in 2023. This is due to increasing industrialization and the application of severe legislation pertaining to plastic waste management and disposable processes. North America is expected to develop at the fastest rate during the forecast period and to reach at a CAGR of 15.5%. This is attributed to rising awareness of the need to reduce the carbon impact caused by plastic waste.

Plastic recycling contributes to the value-added advantages of plastic by reducing its toxicity. Recycled plastic can also be used to make bottles, containers, bags, films, and other packaging products that are environmentally friendly. The reprocessing waste materials and waste plastics is growing owing to the numerous benefits associated with it, including a reduction in the amount of waste transported to landfills and incinerators, conservation of natural resources, and prevention of pollution.

Due to supportive policies and growing public awareness about the dangers of plastic waste, the plastic waste management program is widely used in North America and Europe. The increased recycling rates are predicted to give an exceptional opportunity for developing and emerging economy activities and employment creation all around the world. Furthermore, it is projected to provide a better plastic waste management system, cut fossil fuel usage, and minimize greenhouse gas emissions.

Machine learning and big data are paving the way for new growth opportunities in the plastic waste management industry. These technologies can save time and allow for more efficient resource planning. As a result, the overall cost of operation would be reduced. In addition, satellite-based identification of ocean plastic debris could pinpoint the specific location of densely populated places. Companies are saving time and resources by utilizing such devices to gather plastic trash.

Plastic garbage output has increased as a result of factors such as economic expansion, increasing urbanization, industrialization, and people’s changing lifestyles, posing an increasing threat to the environment. With advances in consumer education and rising knowledge about health and the environment, there has been a substantial increase in awareness regarding plastic waste management. The plastic waste management sector has seen new prospects as the population and income levels of individuals have risen.

Plastic recycling is a critical need in society because it not only ensures energy recovery but also reduces carbon emissions. For every ton of recycled plastic, roughly seven yards of land may be saved form landfills, and over 80% of energy can be saved for the creation of brand-new plastic material. Plastic is a very inexpensive and flexible material that is used to make a wide range of products, including carpets, garbage bags, textiles, films, bottles, and containers. Over the projected period, this plastic recycling technique will be enhanced to boost the plastic waste management market.

Furthermore, one of the major factors driving the plastic waste management market is the rise in government initiatives aimed at building an effective integrated waste management system for the conservation of natural resources and the protection of soil from contamination. Government and other regulatory authorities are increasingly contributing to the development of an effective waste management infrastructure facility around the world, resulting in the development of an efficient waste disposal management system. This is propelling the plastic waste management market even further.

The lack of skilled professionals and lack of knowledge of plastic waste management systems such as gathering, dispensing, and removal of plastic trash, storage control, transportation, and allocation are the factors limiting the growth of the global plastic waste management market. The plastic waste management system poses a significantly difficulty. Furthermore, the high cost of recycling and the presence of hazardous compounds are regarded as market limitations.

| Report Coverage | Details |

| Market Size in 2023 | USD 36.99 Billion |

| Market Size in 2024 | USD 38.91Billion |

| Market Size by 2034 | USD 64.60 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service, Polymer, Source, End Use, and Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

In 2023, the recycling segment dominated the plastic waste management market. This is attributed to tight government policies and a huge increase in recycling infrastructure. The recycled plastic has variety of applications.

The collection segment is predicted to develop at the quickest rate in the future years. The most vital as well as the most difficult service is collection. The residential, commercial, and industrial plastic garbage collection services are provided by key market players in the plastic waste management market.

The polypropylene segment dominated the plastic waste management market in 2023. Polypropylene is readily available, inexpensive, and adaptable to a variety of production techniques, making it ideal for both domestic and industrial uses.

The low-density polyethylene segment is expected to witness growth at a CAGR of 18% in 2023. The garbage can liners, floor tiling, furniture, trashcans, compost bins, and paneling are all made from recycled low-density polyethylene.

In 2023, the residential segment dominated the plastic waste management market. Plastics are an important part of everyday life and are widely employed in domestic applications.

The commercial segment, on the other hand, is predicted to develop at the quickest rate in the future years. The growing commercial spaces around the world including malls, office buildings, retail stores, and restaurants are expected to fuel plastic demand, resulting in a large volume of garbage.

The packaging segment accounted revenue share of around 45% in 2023. This is due to the rising demand for plastics in product packaging to protect, preserve, convey, and display data.

The consumer product segment is fastest growing segment of the plastic waste management market in 2023 and reach at a CAGR of 3.5%. This is owing to the widespread use of plastic in consumer goods around the world.

The mergers and acquisitions, partnerships, new product development, business expansions, collaborations, supply contracts, agreements, and contracts are some of the important marketing strategies used by the major market players to maintain their market position.

Segments Covered in the Report

By Service

By Polymer

By Source

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024