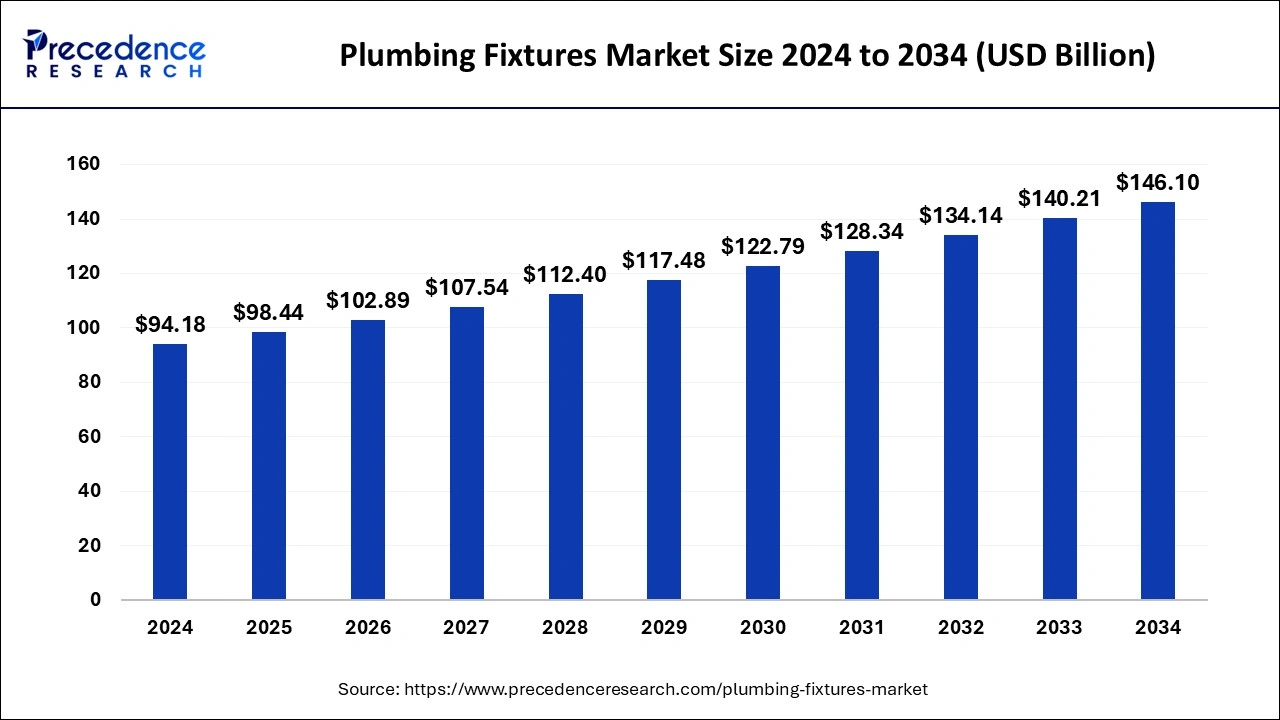

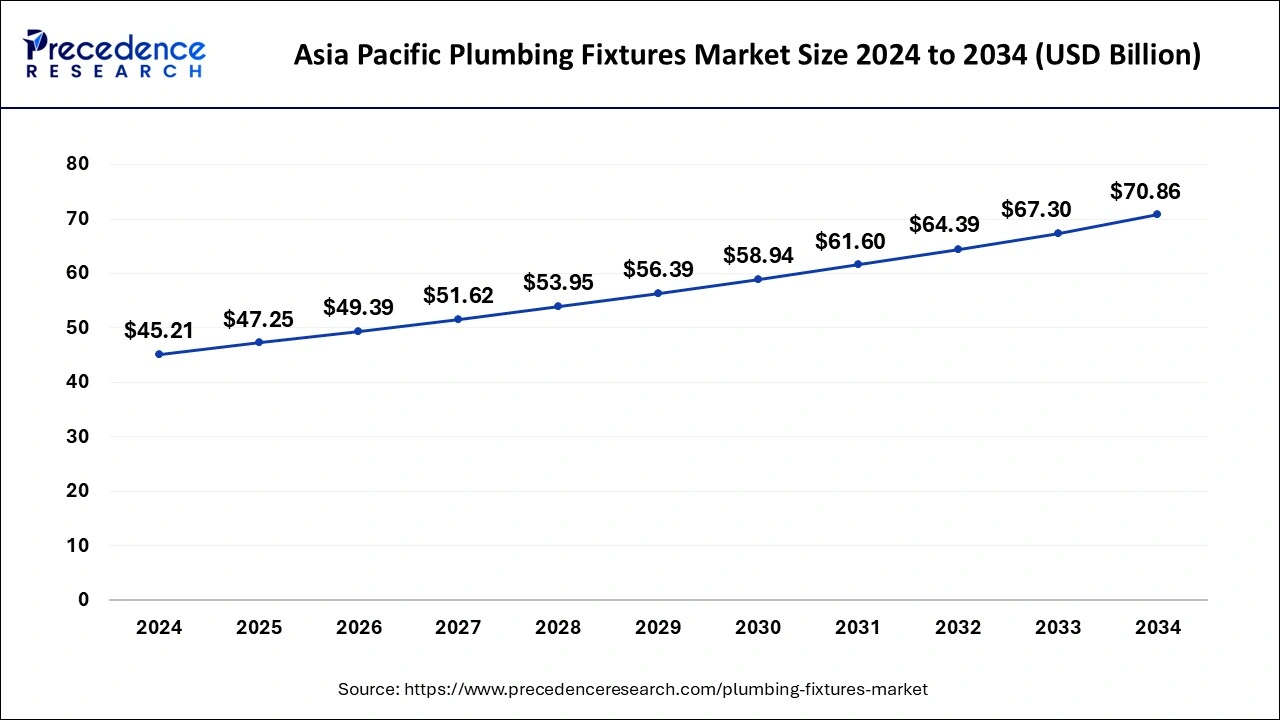

The global plumbing fixtures market size is calculated at USD 98.44 billion in 2025 and is forecasted to reach around USD 146.10 billion by 2034, accelerating at a CAGR of 4.49% from 2025 to 2034. The Asia Pacific plumbing fixtures market size surpassed USD 47.25 billion in 2025 and is expanding at a CAGR of 4.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plumbing fixtures market size was estimated at USD 94.18 billion in 2024 and is predicted to increase from USD 98.44 billion in 2025 to approximately USD 146.10 billion by 2034, expanding at a CAGR of 4.49% from 2025 to 2034. Global urbanization and infrastructural development are driving up demand for plumbing fixtures such as sinks, toilets, showers, and faucets.

The Asia Pacific plumbing fixtures market size was estimated at USD 45.21 billion in 2024 and is predicted to be worth around USD 70.86 billion by 2034, at a CAGR of 4.60% from 2025 to 2034.

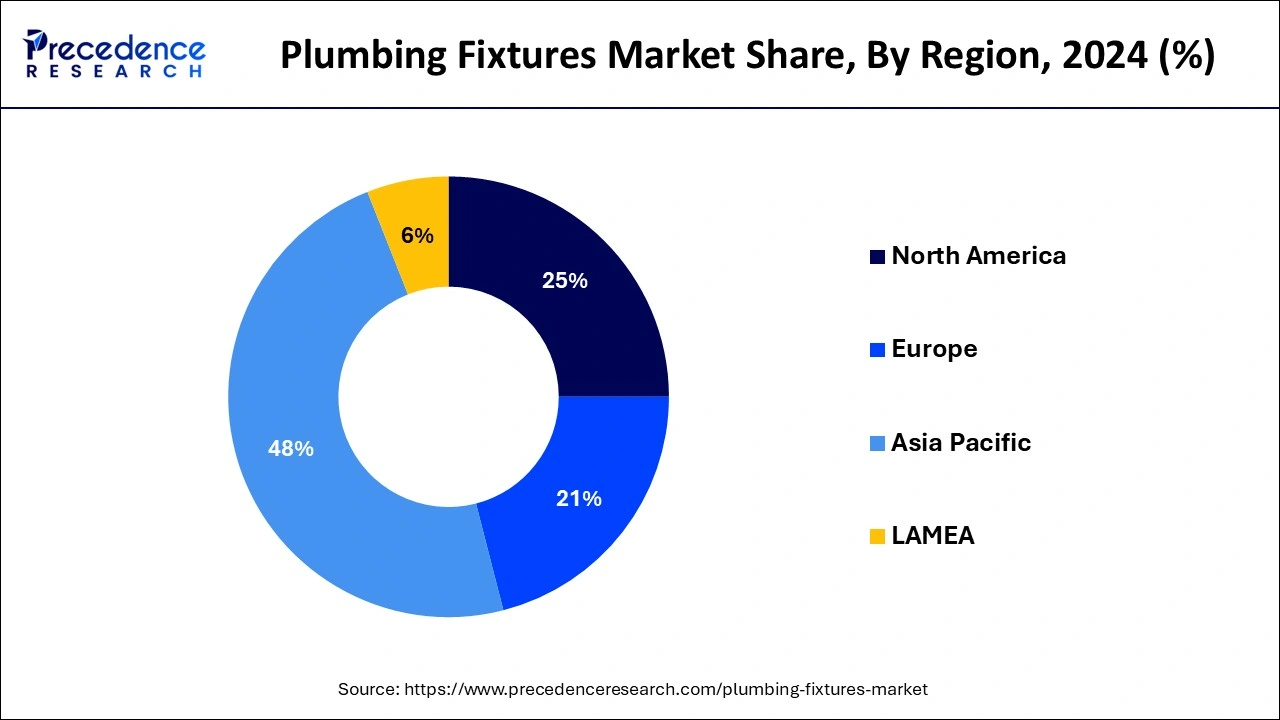

Asia Pacific held the largest share in 2024. This growth is attributed to a number of factors, including infrastructural development, urbanization, and rising disposable income. China, India, Japan, and South Korea are a few of the nations that have made significant contributions to the growth of this market. The Asia Pacific plumbing fittings industry is highly competitive, with both domestic and foreign companies fighting for market share. Local producers frequently concentrate on affordable options catered to local tastes, while global firms include cutting-edge technology and creative designs. Urbanization has been a major factor, increasing demand for residential and commercial real estate and, consequently, the demand for plumbing fixtures.

North America is observed to grow at a notable rate in the plumbing fixtures market during the forecast period. The market holds a sizable portion of the larger building and home improvement sector. It includes a large variety of items, such as bathtubs, showers, faucets, sinks, and other accessories for use in commercial, industrial, and domestic settings. Water-saving rules that are strict are what push people to choose eco-friendly plumbing fittings. The implementation of low-flow toilet, faucet, and showerhead rules by numerous North American jurisdictions has an impact on customer choice. The need for plumbing fittings is largely driven by the commercial sector, which includes hotels, restaurants, office buildings, and healthcare institutions. Large-scale building initiatives support market expansion.

The distribution and control of water in residential, commercial, industrial, and institutional facilities is accomplished by a broad range of goods found in the plumbing fittings industry. The plumbing fixtures market comprises accessories like drains, valves, and fittings, as well as fixtures, including sinks, faucets, toilets, showers, bathtubs, bidets, and urinals.

The market is driven by a number of factors, including the construction of new buildings, remodeling and renovation projects, shifting consumer preferences toward more aesthetically beautiful and efficient fixtures, technical developments, and growing public awareness of sustainability and water conservation. In addition, the market for plumbing fittings is expanding due to factors like population increase, urbanization, and improving economic situations in developing nations.

Numerous manufacturers, including major international firms and smaller regional firms, are in fierce competition with one another in this market. These manufacturers compete on various aspects of their products, including pricing, design, quality, brand reputation, and after-sales service. Regional differences further influence the market dynamics in building codes, consumer preferences, and construction methods. The market environment is also greatly influenced by laws and guidelines pertaining to safety, sanitation, and water efficiency.

An examination of the variables propelling market expansion, including population expansion, urbanization, rising disposable income, and the inclination towards smart homes and environmentally friendly construction methods. Analyzing the standards and legal frameworks controlling the production, installation, and usage of plumbing fittings, as well as any new laws that might have an effect on the plumbing fixtures market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.49% |

| Market Size in 2025 | USD 98.44 Billion |

| Market Size by 2034 | USD 146.10 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Deployment, By Location, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Renovation and remodeling

Plumbing fittings that are not only functional but also contribute to energy efficiency and aesthetic appeal are becoming more and more sought after by homeowners and businesses. Rising environmental concerns have spurred the use of environmentally friendly plumbing fixtures. In line with green building certifications, such as LEED, low-flow toilets, water-efficient faucets, and sustainable materials are more commonplace in restoration and remodeling projects. Upgrades to plumbing fixtures may become more popular due to changes in housing preferences, such as the rise in multi-family homes or the redevelopment of metropolitan neighborhoods. Touchless fixtures, antimicrobial surfaces, and other elements that support sanitation and health in residential and commercial environments have thereby gained popularity.

Rapid technological advancements

Water-saving solutions in the plumbing fixtures market have been pushed due to increased concerns about environmental sustainability and water shortages. Low-flow showerheads, faucets, and toilets from manufacturers use a lot less water without sacrificing functionality. The proliferation of smart home technology has also impacted plumbing fixtures. More and more smart toilets are coming equipped with built-in bidets, heated seats, and automated flushing. Plumbing fixtures are being pushed toward energy efficiency in addition to water saving. Recirculation pumps, insulated pipes, and energy-efficient water heaters all contribute to decreased energy use and utility costs. To accommodate different aesthetic tastes, manufacturers are providing a wide variety of styles, finishes, and customization possibilities, ranging from sleek and modern designs to vintage and classic styles.

Luxury and customization

Plumbing fixtures that may be altered to meet the unique needs and tastes of the consumer are in demand. This covers choices like alterable sizes, patterns, materials, and finishes. Prestige plumbing fixtures frequently include premium components like natural stone, copper, brass, and stainless steel. These materials give the room a sense of refinement and elegance while also extending the life and durability of the fixtures. Touchless technology, minimalist designs, and waterfall faucets are just a few examples of the innovative and imaginative ideas that manufacturers are continually inventing to blend style with practicality. Customers can match their luxury plumbing fittings to the overall design concept of their space thanks to the variety of finishes and colors offered.

The toilet segment held the largest share of the plumbing fixtures market in 2024 and is expected to continue this dominance during the forecast period. This expansion is attributed to various factors, including an increase in construction activity, renovation projects, and infrastructure development. Water-efficient toilets are becoming important as worries about environmental sustainability and water shortage develop.

To cut down on water usage, manufacturers are creating toilets with dual-flush systems, low-flow technologies, and other improvements. Beyond conventional ceramics, toilet materials have evolved to include more resilient and sustainable alternatives such as recycled materials, composite materials, and sophisticated polymers. With the advent of smart toilets with features like heated seats, bidet functions, air dryers, deodorizers, and even integrated entertainment systems, the rise of smart home technology has also reached the bathroom.

The faucets & taps segment is expected to show the fastest growth in the plumbing fixtures market during the forecast period. Taps and faucets are among the many goods that are part of the plumbing fittings sector. These fixtures serve practical and decorative uses in residential, commercial, and industrial environments, making them crucial parts of any plumbing system.

The market for environmentally friendly, water-saving faucets and taps that lower utility costs and preserve water is expanding. Smart faucets with features like water temperature control, touchless operation, and communication to smart home systems are becoming more and more popular. Trendy and adaptable designs are becoming more and more popular as customers look for fixtures that improve the aesthetic appeal of their homes. Based on variables such as customer preferences, building activity, and economic development, the demand for faucets and taps differs by location.

The commercial segment dominated the plumbing fixtures market during the forecast period. Products created especially for use in commercial environments, such as office buildings, hotels, restaurants, hospitals, schools, and other non-residential establishments, are referred to as products in the market's commercial segment. Compared to domestic sinks, these are heavier-duty and larger, and they frequently have many basins for added utility in busy settings like restaurant kitchens or industrial facilities. Commercial faucets are made to withstand heavy use in public restrooms and commercial kitchens. Therefore, they are usually stronger and have larger flow rates. These showers, which are made to resist excessive water flow and frequent usage, are frequently seen in hotels, gyms, and other business buildings.

The residential segment is expected to witness rapid growth in the plumbing fixtures market during the forecast period. Products intended for use in residences such as homes, apartments, condominiums, and other residential properties are included in the residential portion of the market. Numerous objects, including showers, bathtubs, toilets, sinks, faucets, and other plumbing accessories, are included in this category of fixtures. There is a direct correlation between the demand for plumbing fittings in the residential segment and the entire housing market. The demand for plumbing fixtures is driven by an increase in the building of new homes as well as remodeling and restoration projects. New product development and product uptake in the residential market are influenced by shifting consumer tastes, such as an increasing interest in water- and eco-efficient fixtures. The market is expanding as a result of technological advancements such as smart plumbing fixtures with automation capabilities and sensors that are becoming more and more common in residential settings.

The bathrooms segment holds the largest share of the plumbing fixtures market. Within the plumbing fixtures industry, there is a large variety of goods intended for use in residential, commercial, and industrial bathrooms that fall under the bathroom category. These fixtures offer comfort, functionality, and style, making them indispensable parts of any bathroom. Bathtubs are a common feature for soothing baths and come in a variety of sizes, styles, and materials, including fiberglass, acrylic, and steel with an enamel coating. For daily bathing, showers are a need in restrooms. They are available in a variety of styles with varying features and capabilities, including standalone showers, walk-in showers, shower bath combos, and steam showers. Towel bars, soap dishes, toilet paper holders, and shower caddies are examples of bathroom accessories that enhance convenience and organization while complementing the design and functioning of the room.

The kitchens segment is expected to gain a notable share of the plumbing fixtures market during the forecast period. Sinks, faucets, garbage disposals, and other fixtures and fittings necessary for kitchen plumbing are commonly included in the kitchen portion of the market. These fixtures have features including water supply, drainage, sanitation, and food waste disposal, and they are essential for both home and commercial kitchens. Innovations in design, technology, and materials have improved efficiency, durability, and aesthetics in kitchen plumbing fixtures.

In order to satisfy the increasing demand for sustainable solutions, manufacturers are concentrating on creating eco-friendly and water-efficient fixtures. Urbanization, population expansion, and rising disposable incomes are some of the factors driving the market for kitchen plumbing fittings. Additionally, remodeling and renovation projects in both commercial and residential buildings support market expansion.

The repair & remodel segment held the largest share of the plumbing fixtures market in 2024. In this sector, remodeling and repair entail updating or swapping out old fixtures to boost efficiency, functionality, and appearance. Recognize the several kinds of plumbing fixtures that are available, such as bathtubs, showers, toilets, sinks, and faucets. Learn about various models, brands, and features so that you can provide them with a wide range of choices. Remind clients of the value of durability and quality when suggesting fixtures. Long-term financial savings can be achieved by purchasing high-quality fixtures since they require less upkeep and replacement. Put the needs of your customers first by offering superior customer service, responding quickly to any issues, and standing behind the goods and workmanship. Growing your business in the cutthroat plumbing fittings market might be facilitated by positive evaluations and recommendations.

The new construction segment is expected to show the fastest growth in the plumbing fixtures market during the forecast period. The growing popularity of smart plumbing fixtures can be attributed to the Internet of Things (IoT). Convenience and efficiency are combined with the ability to detect leaks, control temperature, and flow, and monitor water usage in these fixtures. Exquisite and personalized plumbing fittings are popular in upmarket residential and business buildings.

This comprises premium components, elaborate designs, and features like personalized finishes and touchless operation. Plumbing fittings are now integrated into entire design schemes, not just useful components. Fixtures are being used as focus points by designers and architects to improve the visual appeal of places. An increasing number of people are looking for plumbing fittings that are accessible to people of all ages and abilities due to the aging population and accessibility awareness.

The offline segment led the global plumbing fixtures market in 2024. The plumbing fittings industry still heavily relies on offline distribution, even with the growth of internet sales channels. Plumbing fixtures continue to benefit from traditional offline distribution channels, including brick-and-mortar stores, specialty plumbing supply stores, and home improvement centers, since they are tangible objects that frequently require installation skills. Plumbing fixtures are widely distributed by major home improvement stores, including Home Depot, Lowe's, and Menards. Customers wishing to buy plumbing fixtures and other home improvement supplies can acquire them all from these stores in one convenient location.

Another significant route for the distribution of plumbing fixtures is through plumbing contractors, particularly for bigger projects like brand-new buildings or significant restorations.

In the plumbing fixtures market, the online segment is expected to show the fastest CAGR during the forecast period. Although brick-and-mortar establishments have historically dominated the market, online shopping's accessibility and convenience have drawn more and more customers to the plumbing sector. Online distribution platforms provide customers with the ease of shopping at any time and from any location. For busy builders and homeowners who might not have time to visit actual establishments during regular business hours, this accessibility is very enticing. Online merchants typically provide a wider selection of products than their physical store counterparts since they are not constrained by physical space. Many online shops provide fast shipping and delivery options, making it easier for customers to receive their plumbing fixtures right at their door.

By Product

By Deployment

By Location

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client