January 2025

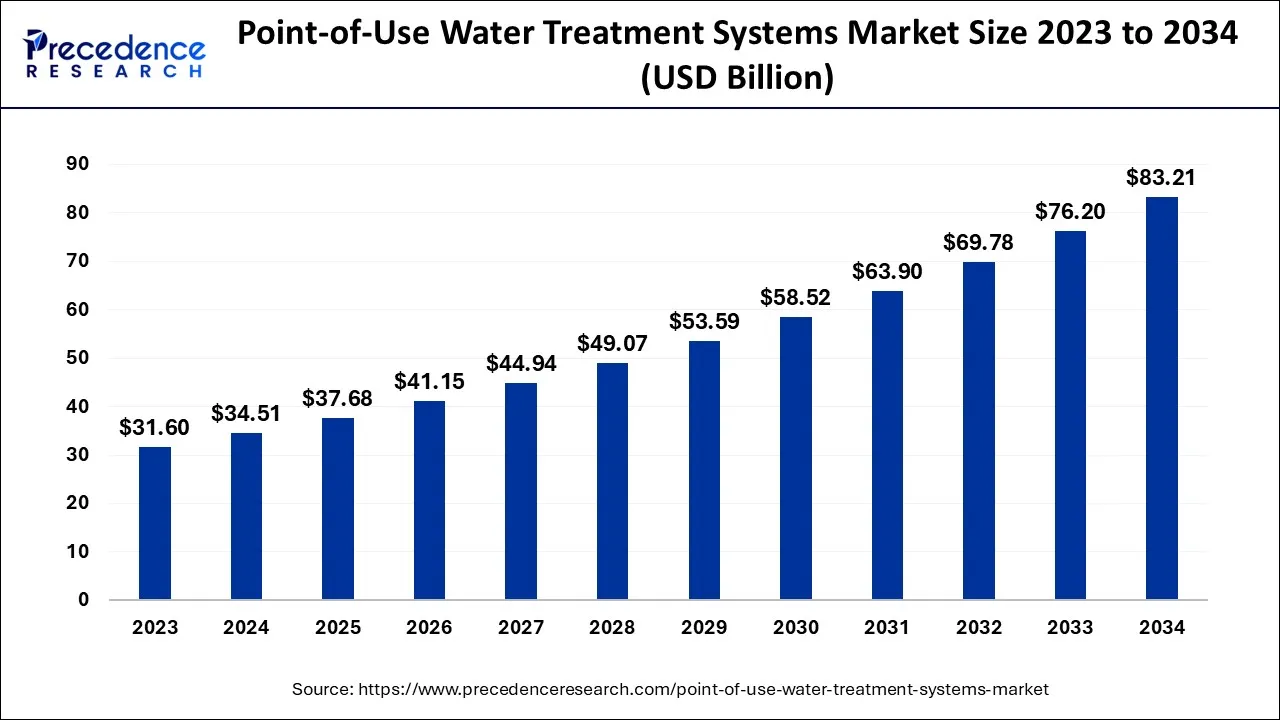

The global point-of-use water treatment systems market size is calculated at USD 34.51 billion in 2024, grew to USD 37.68 billion in 2025, and is predicted to hit around USD 83.21 billion by 2034, expanding at a CAGR of 9.2% between 2024 and 2034. The Asia Pacific point-of-use water treatment systems market size accounted for USD 12.77 billion in 2024 and is anticipated to grow at the fastest CAGR of 9.35% during the forecast year.

The global point-of-use water treatment systems market size is worth around USD 34.51 billion in 2024 and is anticipated to reach around USD 83.21 billion by 2034, growing at a CAGR of 9.2% over the forecast period from 2024 to 2034.

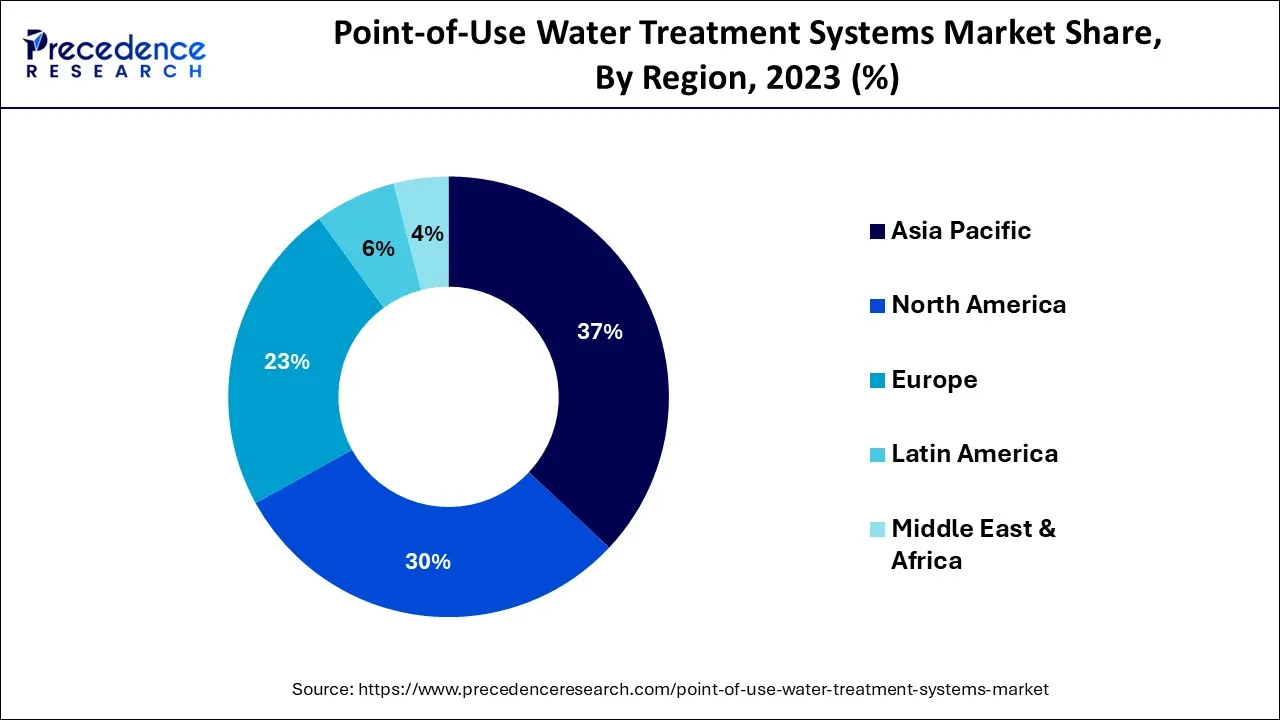

On the basis of geography, the point-of-use water treatment systems market is further segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa. Asia Pacific had the largest market share and is expected to grow the fastest during the forecast period. The region's rapid urbanisation creates lucrative growth opportunities for point-of-use water treatment systems. According to World Bank data, East Asia and the Pacific are the world's fastest urbanising regions, with a rate of 3% per year. This region is home to one-third of the world's urban population. Due to increased awareness of the benefits of water treatment systems, China is the largest consumer of water treatment systems, followed by Japan. In the future, India is expected to have the highest growth rate.

Water treatment systems are most widely used in Japan, South Korea, and Australia. As a result, Asia Pacific is expected to maintain its market dominance during the forecast period. Europe came in second, with Germany leading the way, followed by the United Kingdom. The rising demand for point-of-use water treatment systems in this region would result from rising household water consumption. According to the European Environment Agency, households in Europe consume more than 12% of total water consumption. On a daily basis, 144 litres of water are distributed per person. According to the European Commission, the average tap water consumption per person in Germany and the United Kingdom in 2015 was 122 litres and 150 litres, respectively.

The point-of-use water treatment systems market refers to the industry that manufactures and sells water treatment systems designed for use at individual water access points, such as at home, in businesses, or in public spaces. These systems typically use technologies such as reverse osmosis, ultraviolet (UV) disinfection, or activated carbon to purify or filter water to remove impurities, contaminants, and potentially harmful substances. These systems are installed at a single water connection, commonly beneath the counter in bathrooms, kitchens, and other locations with showers and faucets. These systems are thought to be the best option for the last stage of water filtration in small commercial buildings or at home due to the lower volume treatment. These systems work in tandem with point-of-entry water treatment systems to provide total purification, including the removal of hazardous pollutants and water softening.

| Report Coverage | Details |

| Market Size in 2024 | USD 34.51 Billion |

| Market Size by 2034 | USD 83.21 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.2% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Category, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness towards water-borne diseases – People are infected and caused waterborne diseases by Pathogens such as protozoa, bacterial, virus, algae, parasitic worm or other metal pollutants. Drinking water which has been contaminated with pathogens and metals can cause illnesses such as typhoid, chlorella, diarrhoea, campylobacteriosis, lead poisoning, malaria or any other diseases. Consumption of untreated raw or water contaminated beverages, use of showers, wash hands and eat food may spread these illnesses. Awareness and information on waterborne diseases and pollution have increased, as people are more concerned about the health of their own bodies while they choose clean drinking water to prevent severe illnesses.

The surge in the number of water borne disease is expected to boost the size of the market. For instance, according to the report of the Centers for Disease Control and Prevention, U.S. waterborne pathogens cause 7,000 deaths, 120,000 hospitalizations, 7 million illnesses, and $3 billion in healthcare costs in U.S. alone. In addition, efforts to improve water availability in both developed and developing countries are being stepped up by a number of environmental organisations which aim at raising awareness about the advantages of drinking clean water for health. Point of use water treatment systems are able to reduce the incidence and severity of waterborne illnesses and disease, as well as improving the quality of drinking water. As awareness of waterborne diseases increases, the demand for such systems continues to grow worldwide.

Rising water contamination - Water contamination happens when pollutants are either directly or indirectly dumped into the water without proper treatment to eliminate dangerous substances. The most important water pollutants produced by humans are microbial infection, nutrients, heavy metals, continuous organic matter, suspended sediment, pesticides and oxygen depleting compounds. The heat could be a cause of contamination, because it warms the water. Degradation of water quality is usually due to pollutants.

A series of measures, such as filtration, disinfection or chemical treatment, are carried out in order to remove this water before it is given to different residential and commercial establishments for consumption. Unfortunately, even when point-of-use water treatment systems remove some pathogenic microbes and inorganic substances from the water, others still remain. Moreover, such water pollutants are rising on a day-to-day basis, and water which needed to be treated is expected to surge the point-of-use water treatment systems market.

Government regulations and guidelines - Governments around the world have implemented regulations and guidelines for water quality, which has led to increased demand for point of use water treatment systems to meet these standards. For instance, U.S. has the Safe Drinking Water Act that sets standards for drinking water quality. The law regulates contaminants such as lead, arsenic, and nitrate, and requires public water systems to regularly test their water and make the results available to the public. The Drinking Water Directive is a European Union law that sets minimum requirements for drinking water quality. The law regulates contaminants such as bacteria, viruses, and chemicals, and requires public water systems to regularly test their water and make the results available to the public. The National Primary Drinking Water Regulations are a set of guidelines issued by the Chinese government that set standards for drinking water quality. The guidelines regulate contaminants such as bacteria, viruses, and chemicals, and require public water systems to regularly test their water and make the results available to the public. Such regulations and guidelines regarding water quality are expected to propel the demand for the market.

High Cost - Despite the fact that water treatment has several benefits, point-of-use water treatment system installation is expensive. A water softener, for example, which is used to turn hard water into soft water, can cost between USD 2,000 and USD 4,000. The cost of installing a water softener is considerable because professionals and installers are needed. Some of the point-of-use water treatment systems have substantial operating and maintenance expenses. For instance, the energy used for cooling and heating in the distillation systems is significant. In some Asian and African nations, these issues are particularly prominent. The delivery and storage of water are also lacking in underdeveloped nations in Asia and Africa. Consumers can restrain from installing point-of-use water treatment systems owing to such high cost which can hold back the growth of the market.

Environmental impact - Some point of use water treatment systems, such as reverse osmosis, can produce wastewater that may contain high levels of contaminants. Disposing of this wastewater can have environmental implications and may contribute to water scarcity in some regions. Along with these, Wastewater discharge, Energy consumption, Filter disposal, and water scarcity can hamper the growth of the market. Some point of use water treatment systems, such as reverse osmosis and distillation systems, can generate wastewater that may contain high levels of contaminants. This wastewater must be disposed of properly to prevent environmental contamination. If the wastewater is not treated and disposed of properly, it can pollute local water sources and harm wildlife. Some point of use water treatment systems, such as reverse osmosis and distillation systems, can generate wastewater that may contain high levels of contaminants. This wastewater must be disposed of properly to prevent environmental contamination. If the wastewater is not treated and disposed of properly, it can pollute local water sources and harm wildlife. Such harm of the product is expected to hamper the growth of the market.

Technological advancements: Advancements in water treatment technologies such as reverse osmosis (RO), ultraviolet (UV) disinfection, and activated carbon have made point of use water treatment systems more effective and efficient. RO is a water filtration technology that uses a semi-permeable membrane to remove dissolved solids, contaminants, and impurities from water. RO systems have become more efficient and affordable in recent years, making them a popular choice for point of use water treatment systems. UV disinfection uses ultraviolet light to kill bacteria, viruses, and other pathogens in water. UV systems have become more compact and affordable, and are often used in combination with other treatment technologies such as carbon filtration or RO.

Activated carbon filters use a porous carbon material to remove organic compounds, chlorine, and other impurities from water. Advances in carbon filtration technology have led to more effective filters that can remove a wider range of contaminants. Such technological advancements is expected to further propel the demand for the point-of-use water treatment systems market.

Clean water scarcity: Some of the countries in Asia-Pacific such as Bangladesh, Pakistan, and Nepal and most African countries such as Nigeria, Ghana, and Ethiopia suffer enormous challenges connected to clean water. Many undeveloped and emerging nations lack the financial stability necessary to give access to clean drinking water. According to the WHO, diarrhoea, which is brought on by tainted water, kills 8.5% and 7.7% of people worldwide each year in Asia and Africa, respectively. Additionally, it claims that countries like Argentina, Bangladesh, India, Chile, and Mexico drink water that contains arsenic, which damages the skin.

On the basis of type the point-of-use water treatment systems market is segmented into pitcher filters, faucet-mounted filters, under the counter filters, countertop filters, and others. The market is being dominated by the countertop filters segment. These countertop devices don't require intricate plumbing connections for operations, are straightforward to install, and are carefully built to gain little room. They also provide water of a high standard. These systems use ceramic or activated carbon filters, which are regarded as the best filter medium for removing impurities while preserving water's flavour. In 2021, the market's second-largest product category was under-the-counter filters. Often, these devices are mounted beneath the kitchen counter. These systems have faster flow rates, so the water distributes more quickly and takes less time to fill the bottle. Also, mounting these filters doesn't involve a lot of changes and saves space over the kitchen counter.

Based on the category the point-of-use water treatment systems market is segmented into gravity filters, UV filters, RO filters, and others. The RO filters market category, out of these, had the biggest revenue share in 2023. RO systems are extremely sophisticated membrane filtering technologies that can produce water with the same quality as bottled water by eliminating 99% of pollutants. As a result, these systems are widely used to purify water. They are regarded as the ideal method for treating hard water. In addition, these systems cost more money, take longer to treat water, and eliminate necessary minerals like calcium, magnesium, sodium, and iron that affect the flavour of the water.

The gravity filters segment is the second-largest segment owing to its simplicity and ease of installation. As all water purification relies on gravity force, they don't need power. Also, these systems may be installed anywhere in the house and require less upkeep. However in order for gravity filters to work well, filter media must be changed frequently.

On the basis of application, the market is segmented into residential, light-commercial, and non-residential. The residential segment accounted for the largest share on the basis of application in 2023 and is expected to maintain its dominance during the forecast period. Water consumption is higher in residential buildings than in light commercial buildings. According to estimates from the United States Environmental Protection Agency, the average American family uses more than 300 gallons of water per day. Showers account for approximately 20% of indoor water use, while faucets account for 19% and washing clothes account for 17%. Light commercial buildings include banks, restaurants, small shopping centres, offices, educational premises and others of the same type. Large scale water purification systems, which offer similar benefits to residential compact water filtration systems, are installed in light commercial buildings.

Segments Covered in the Report:

By Type

By Category

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

September 2024

March 2025