May 2025

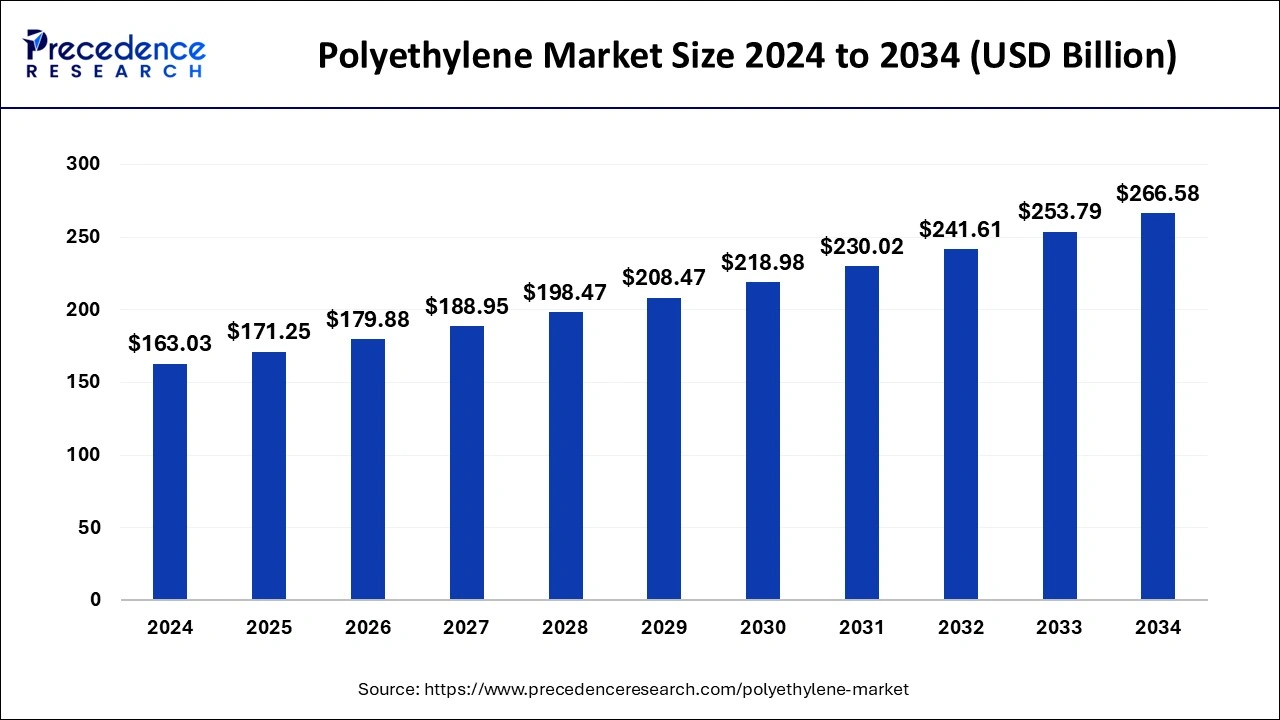

The global polyethylene market size is calculated at USD 171.25 billion in 2025 and is forecasted to reach around USD 266.58 billion by 2034, accelerating at a CAGR of 5.04% from 2025 to 2034. The Asia Pacific market size surpassed USD 83.15 billion in 2024 and is expanding at a CAGR of 5.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polyethylene market size was calculated at USD 163.03 billion in 2024 and is predicted to reach around USD 266.58 billion by 2034, expanding at a CAGR of 5.04% from 2025 to 2034. The growing demand for cost-effective and lightweight products boosts the development of the polyethyene market.

AI plays a significant role in the development of the polyethylene market as it supports the manufacturing of error-free products. With the incorporation of AI in this industry it becomes easy for market players to bring advancement in the manufacturing of a variety of products from various sectors such as healthcare, cosmetics, food & beverages, and many others. It comprises technologies such as machine learning which is useful in the production process. It tracks the real-time condition of the product and predicts its durability which attracts a huge number of customers towards this market.

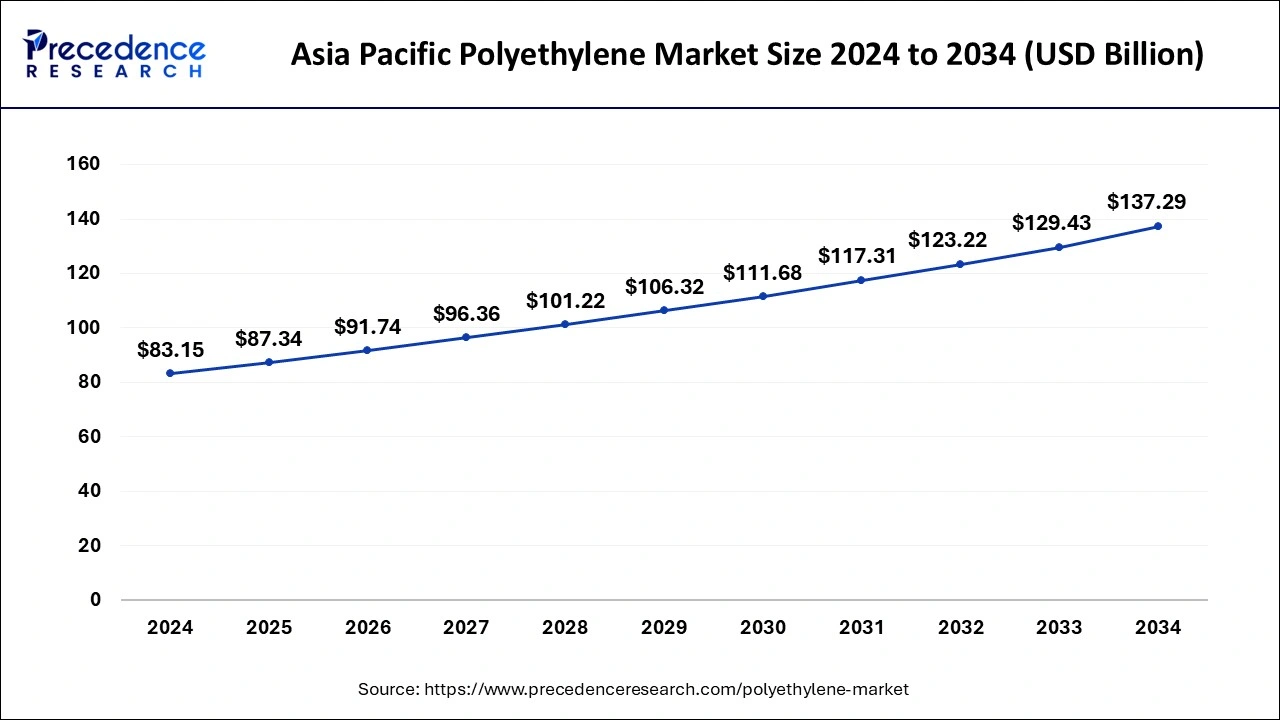

The Asia Pacific polyethylene market size was exhibited at USD 83.15 billion in 2024 and is projected to be worth around USD 137.29 billion by 2034, growing at a CAGR of 5.14% from 2025 to 2034.

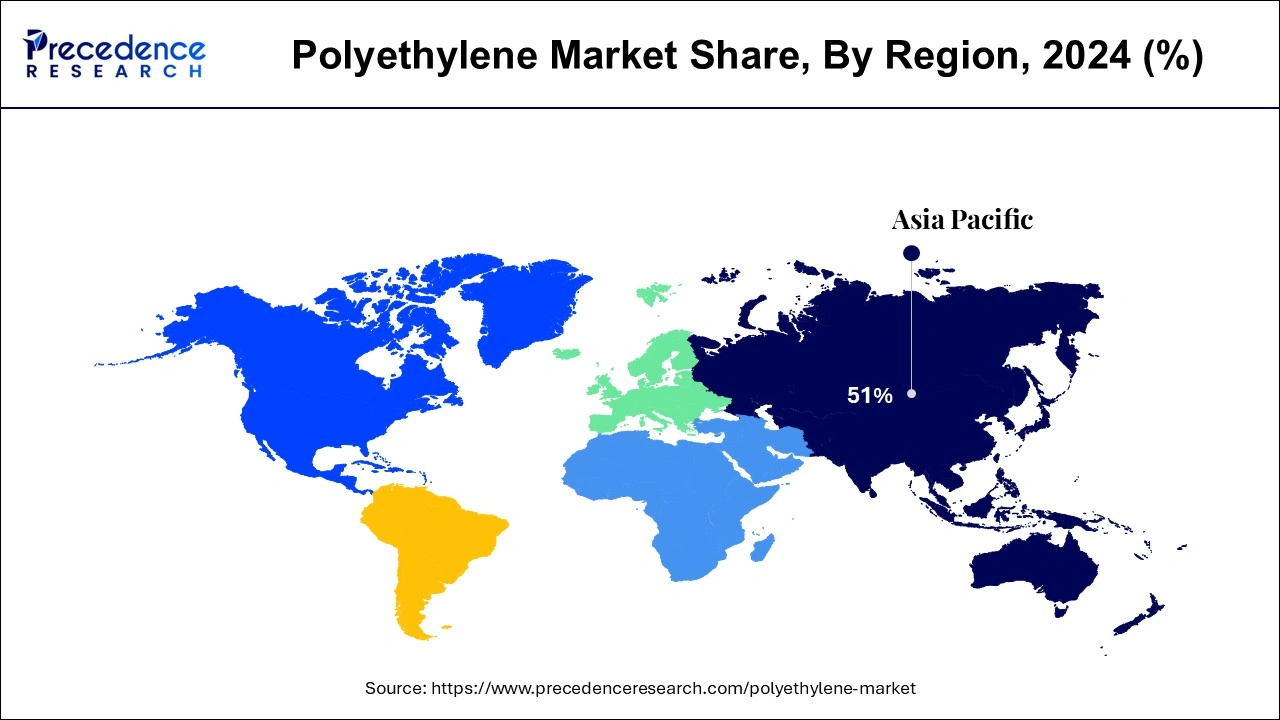

Asia Pacific was the dominating segment in 2024 and is expected to be the fastest-growing segment throughout the forecast period. This is attributable to the rapidly growing nature of various industries in the region such as pharmaceutical, healthcare, construction, automotive, consumer goods, and packaging owing to the presence of huge consumer base.

Moreover, the rapid industrialization and rapid urbanization of the Asia Pacific region is significantly propelling the demand for the polyethylene market. The rapidly growing penetration of the various e-commerce platforms such as Amazon, Flipkart, Zomato, and Wal-Mart is expected to drive the polyethylene market growth. The rising investments in expanding the manufacturing facilities of various consumer electronics in the region is further fueling the demand. The huge demand for the polyethylene in the construction industry in the developing nations like China, India, Indonesia, and Philippines is offering a lucrative growth opportunities to the market players operating in the Asia Pacific polyethylene market.

North America is expected to grow significantly in the polyethylene market during the forecast period. The increasing use of electronics as well as automotives is enhancing the use of polyethylene in North America. At the same time to various new approaches are also being developed to enhance the use of recycled plastics. This, in turn, also increases the use of various technologies to develop biodegradable materials as well as for the recycling of polyethylene. This is further supported by the government as well as various private companies. Thus, all these factors enhance the market growth.

Europe is expected to show lucrative growth in the polyethylene market during the forecast period. The healthcare sector in Europe is advancing with the rising demands of drugs as well as with the utilization of various advance technologies. This in turn, increases the need for polyethylene packaging facilities for keeping the medications safe from various factors. Hence, its development is enhanced as well as research to make them more reliable, safe, and biodegradable. Thus, this promotes the market growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 171.25 Billion |

| Market Size in 2034 | USD 266.58 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.04% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The HDPE segment dominated the polyethylene market in 2024. The major factor behind its dominance is the low production cost of the HDPE. Moreover, along with the low cost, the high temperature resistance and higher strength and density of the HDPE has exponentially propelled the growth of the HDPE segment. The extensive usage of the HDPE in preparing bottles, caps, chemical resistant pipes, ballistic plates, and a variety of other products has boosted the growth of the HDPE segment in the past. The growing need for controlling cost and increasing profitability across various industry verticals is expected to boost the demand for the HDPE in the forthcoming years.

The LLDPE is estimated to be the most opportunistic segment during the forecast period. The growing popularity of the metallocene catalyst technology that significantly enhances the performance of resins is anticipated to drive the demand for the LLDPE segment during the forecast period. The LLDPE has higher tensile strength and higher puncture resistance properties as compared to that of the LDPE, which is a major growth driver of the LLDPE and the adoption of the LLDPE is expected to surpass the LDPE segment in the upcoming future.

Based on the application, the packaging was the most dominant segment in 2024. This is simply attributed to the increased adoption of the polyethylene in the packaging industry for packing a wider variety of goods across the globe. The PET derived from the polyethylene offers a moisture resistant and protectives structure to the products that makes it the highly demanded material in the packaging industry. The rising demand for the consumer electronics, food and beverages, automotive vehicles, and the growing penetration of the e-commerce platforms across the globe is expected to significantly drive the growth of the polyethylene market in the forthcoming future.

The construction is expected to be the fastest-growing segment in the foreseeable future. The increasing adoption of the polyethylene in the under-construction sites for protecting the various construction materials from moisture and water is expected to drive the market growth. Moreover, the HDPE is used to protect the ground water from getting toxic during the oil drilling process.

Key Developmental Strategies

The various developmental strategies adopted by the market players in the polyethylene market significantly contributes towards the market growth and helps the players to gain market share and competitive edge. The polyethylene market is fragmented owing to the presence of numerous market players across the globe and the various competitors are adopting various developmental strategies such as acquisitions, mergers, collaborations, new product launches, and partnerships in order to gain market share and exploit the prevailing market opportunities.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

January 2025

June 2025

June 2025