March 2025

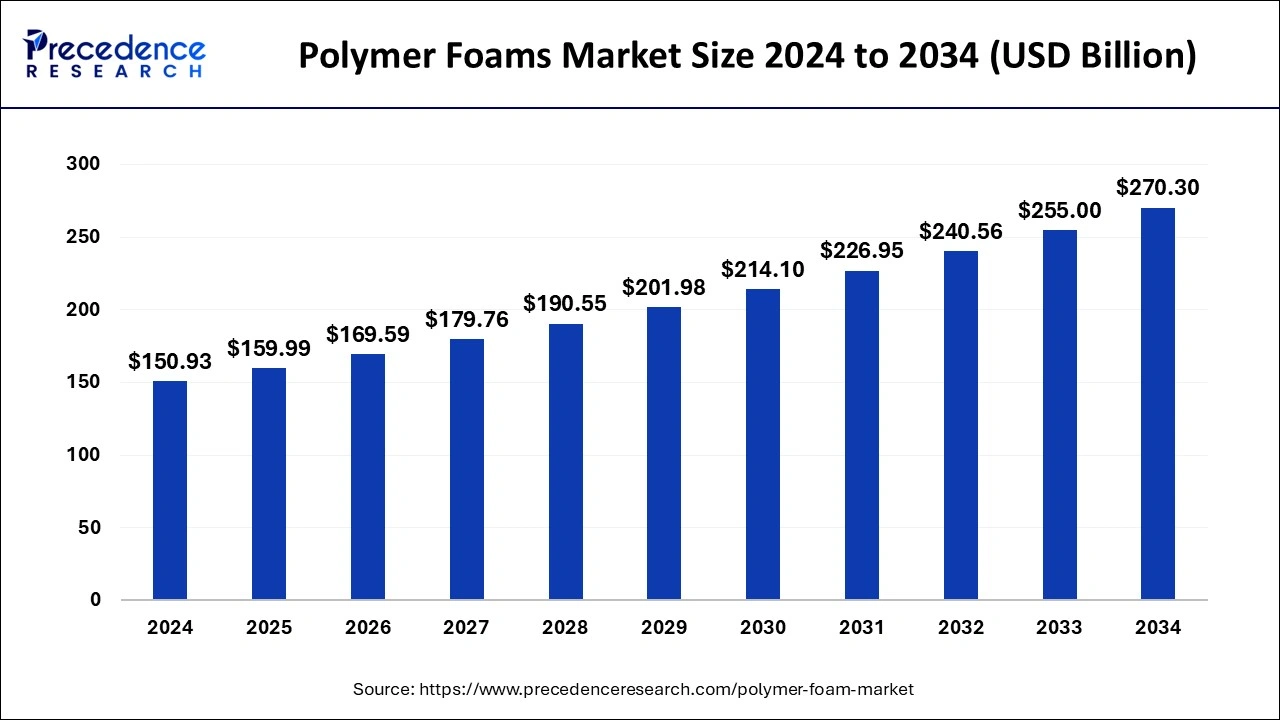

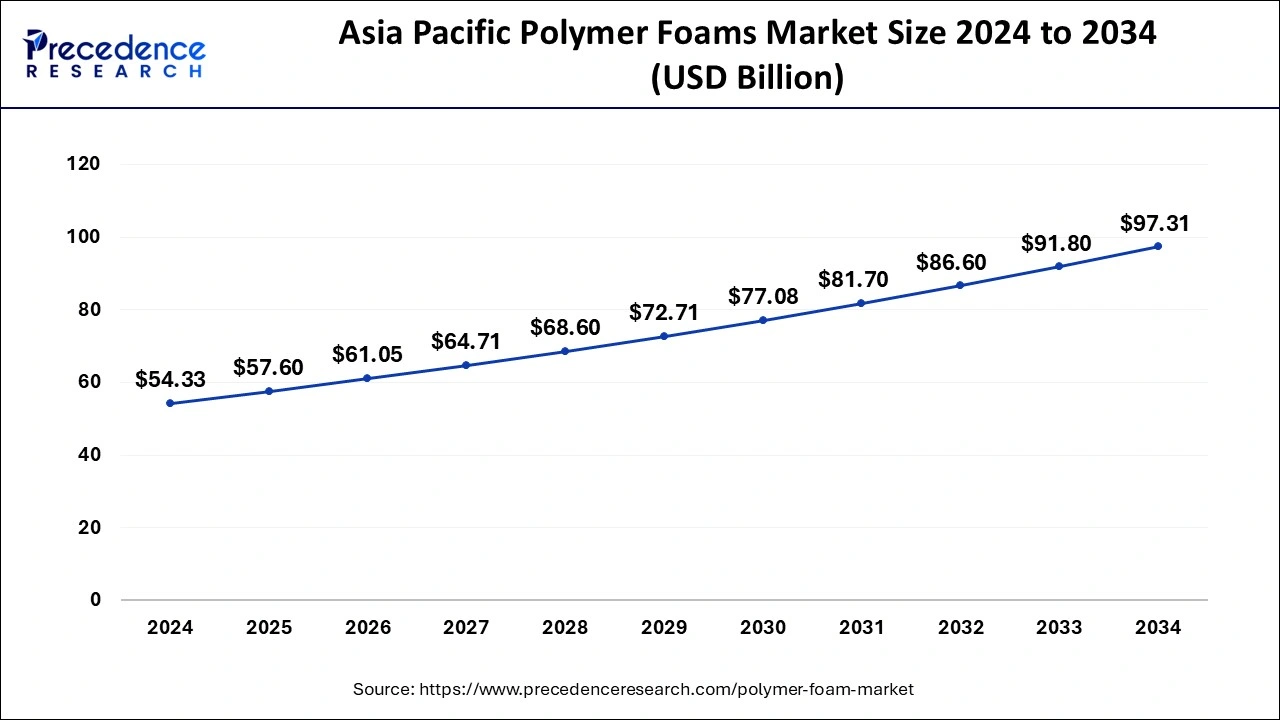

The global polymer foams market size is calculated at USD 159.99 billion in 2025 and is forecasted to reach around USD 270.3 billion by 2034, accelerating at a CAGR of 6% from 2025 to 2034. The Asia Pacific polymer foams market size surpassed USD 57.6 billion in 2025 and is expanding at a CAGR of 6.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polymer foams market size accounted for USD 150.93 billion in 2024 and is expected to be worth around USD 270.30 billion by 2034, at a CAGR of 6% from 2025 to 2034. The rising adoption of polymer foams in the construction, footwear, and automotive sectors and the growing demand for environmental sustainability boost the polymer foams market.

Integrating artificial intelligence (AI) can help researchers in designing polymers by combining different materials to increase their strength and durability. AI and machine learning (ML) can also predict material properties and optimize polymer formulations. AI can aid in designing customized polymer foams based on the requirements of diverse sectors. The polymer foam properties required for different sectors vary. This reduces the time taken to design and develop polymer foams with desired properties. AI and ML play a vital role in streamlining the manufacturing process of polymer foams. They increase productivity, improve efficiency, and reduce the overall cost of production.

The Asia Pacific polymer foams market size was estimated at USD 54.33 billion in 2024 and is predicted to be worth around USD 97.31 billion by 2034, at a CAGR of 6.2% from 2025 to 2034.

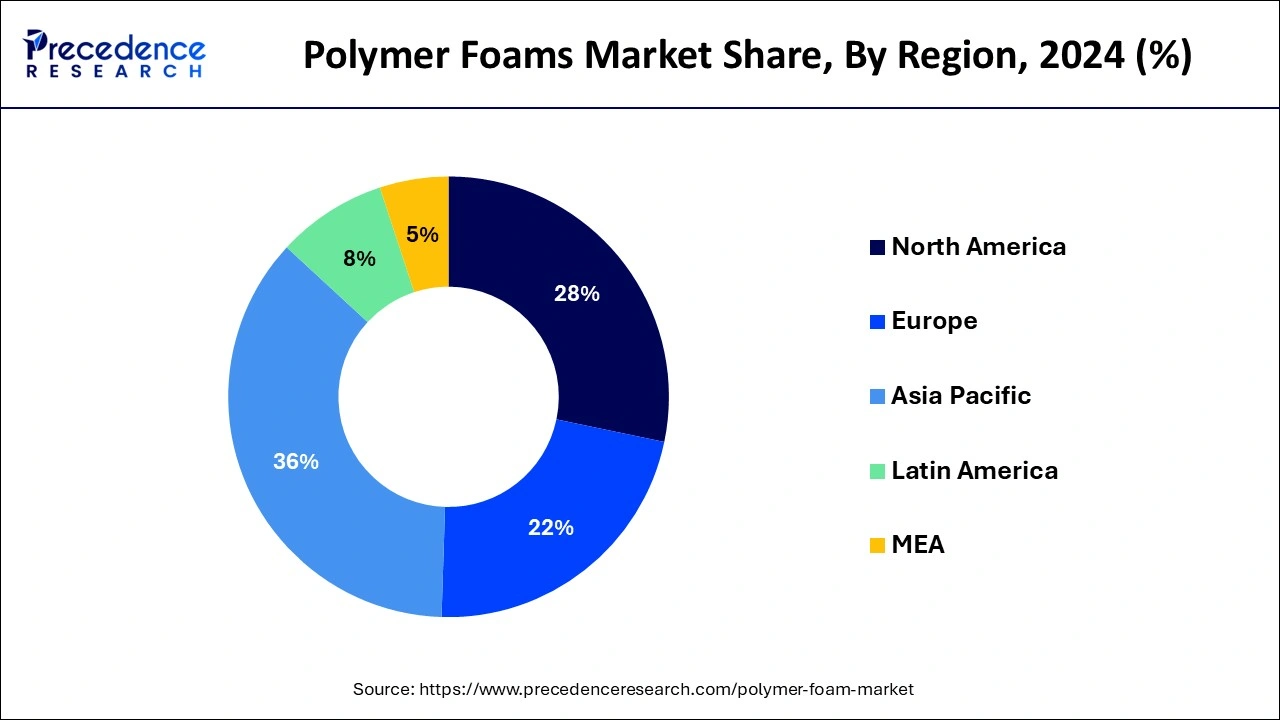

The research report offers key drifts and prospects of polymer foams products across diverse geographical regions such as North America, Latin America, Europe, Asia-Pacific, and Middle East and Africa.

Asia Pacific described biggest share of total revenue generated by market in 2024 on account of huge demand in packaging and construction sectors. The developing economies in Asia Pacific are obtaining numerous foreign equipment; therefore, refining the production competence. Furthermore, industry participants implemented numerous business expansion policies, which further enhanced the complete production capacity in this region. One of the prevalent applications of polyolefin foams is in the construction sector. These foams are perceiving a larger level of reception in the construction and buildings industries along with the aerospace sector. This influence is the utmost contributor to the growth of polymer foam market in the Asia Pacific as developing countries from this region are undergoing speedy growth in infrastructure creation and construction activities.

China:

India:

Japan:

Polymer foam is a vital polymer material also recognized as a porous polymer material. It has polymer matrix that comprises a large number of tiny foam holes within. In comparison with bulky polymer materials, polymer foam offers several advantages including good heat insulation, low density, good sound insulation effects, good resistance to corrosion and high specific strength. Currently, polymer foam is one of the most extensively employed polymer materials and plays a very significant part in the polymer sector. Polymer foams are extensively utilized in construction, packaging, footwear, furniture & bedding, automotive, sports & recreational sectors.

However, during COVID-19 pandemic, decline in per capita income led to inferior demand for several electronics products, recreational and sports equipment; therefore, negatively affecting the growth of the polymer foam market. Additionally, on account of prolonged lockdown, huge number of construction ventures is on delayed for few months period. Such fluctuations negatively affected the demand of polymer foams for numerous insulation applications.

| Report Highlights | Details |

| Market Size in 2024 | USD 150.93 Billion |

| Market Size by 2034 | USD 270.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

In 2024, polyurethane foam conquered the global polymer foam market in terms of revenue and is anticipated to uphold its governance during the estimate period. This type of foam is employed in numerous applications such as cushions, furniture, and carpets. Expanded polystyrene foam is lightest materials and due to its high strength to weight ratio, it finds application for packaging because it offers in less fuel consumption and transport price saving.

Polymer foams find widespread usage in the construction sector for pipe-in-pipe, forging, doors, roof board, and slabs. It has small heat conduction coefficient, less density, moderately good mechanical strength, low water absorption, and good insulating characteristics that are useful in the construction industry. However, COVID-19 pandemic has impacted many end-use sectors, and almost all segments of the supply chain endure to be pretentious that also involve the construction sector.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

December 2024

November 2024