October 2024

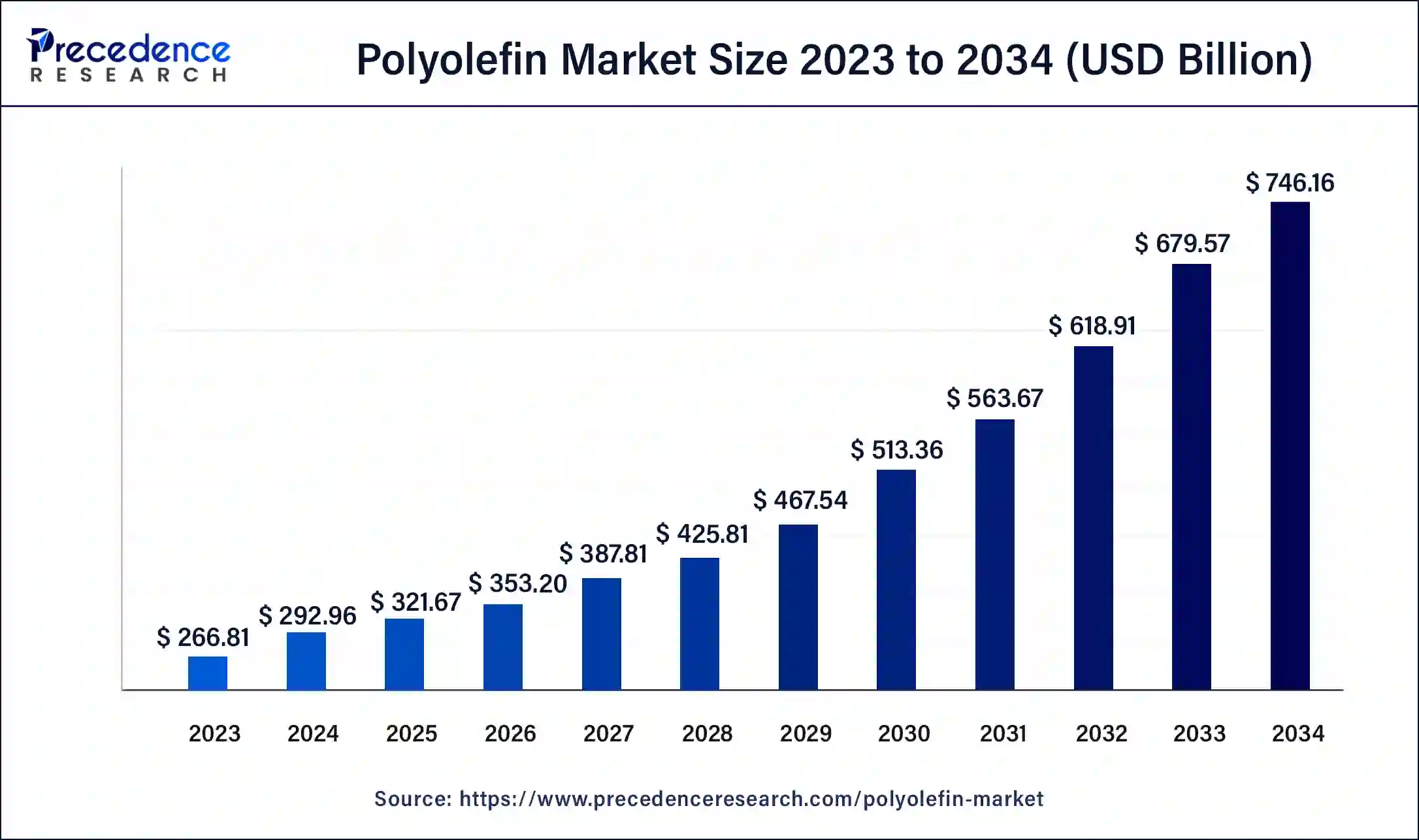

The global polyolefin market size was USD 266.81 billion in 2023, calculated at USD 292.96 billion in 2024 and is projected to surpass around USD 746.16 billion by 2034, expanding at a CAGR of 9.8% from 2024 to 2034.

The global polyolefin market size accounted for USD 292.96 billion in 2024 and is expected to be worth around USD 746.16 billion by 2034, at a CAGR of 9.8% from 2024 to 2034.

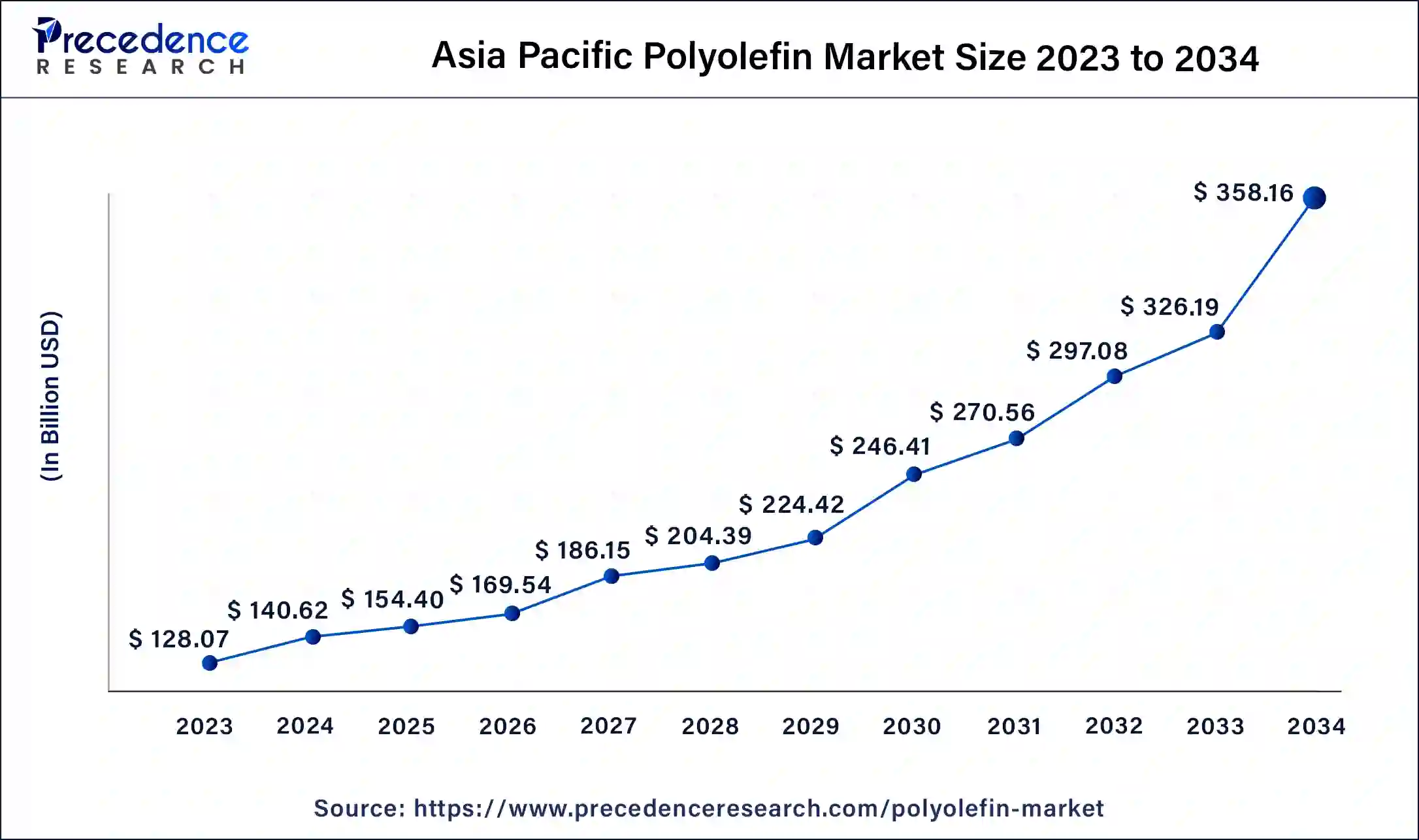

The Asia Pacific polyolefin market size was estimated at USD 128.07 billion in 2023 and is predicted to be worth around USD 358.16 billion by 2034, at a CAGR of 10% from 2024 to 2034.

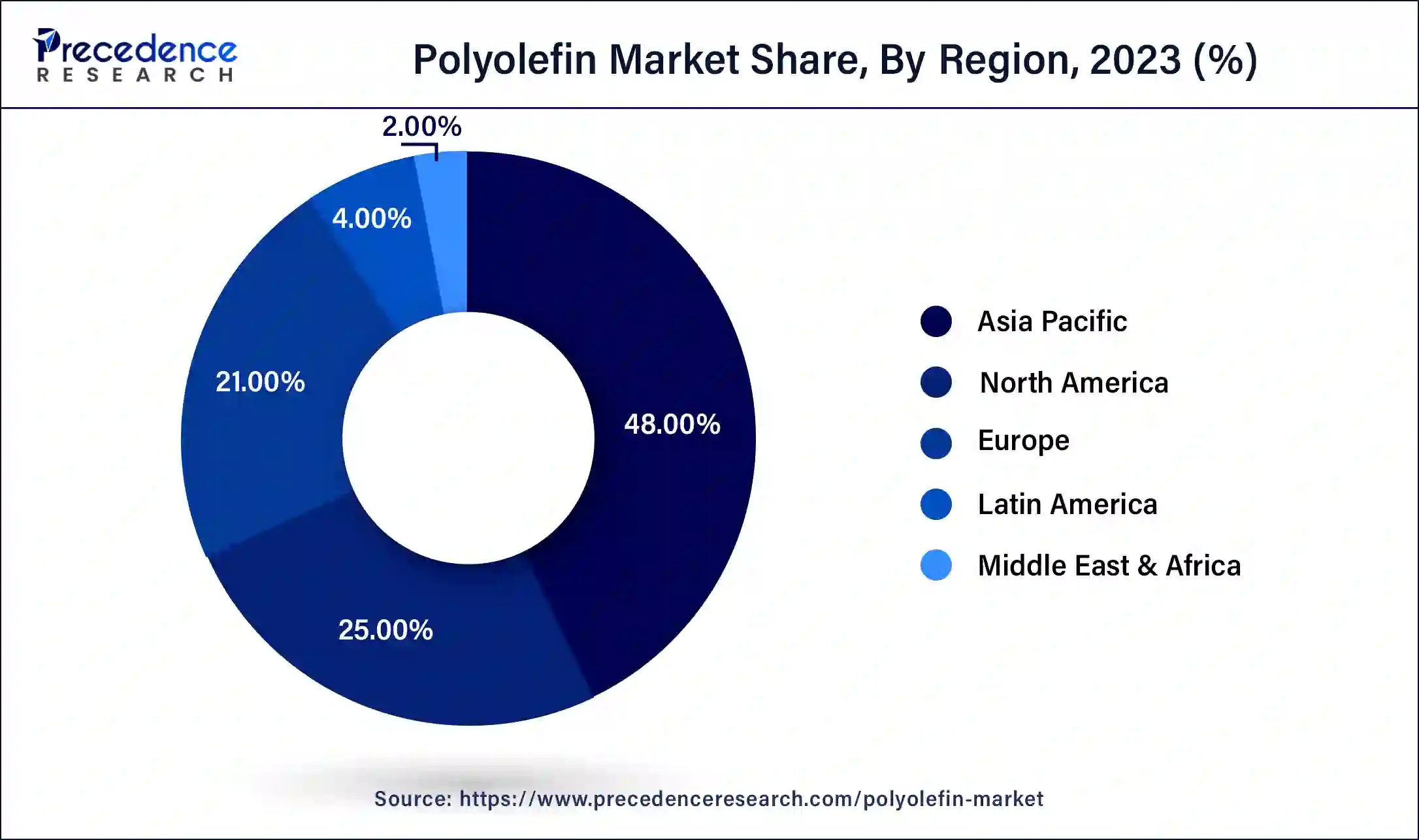

Asia Pacific dominated the polyolefin market and accounted for the largest revenue share of 48% in 2023. Asia Pacific is the dominating and the fastest-growing market for polyolefin. The rapid industrial growth of economies such as China, India, and Indonesia is boosting the consumption of polyolefin in the region. The construction and building, automotive, food and beverages, and pharmaceutical industries in the Asia-Pacific is growing and expanding at a significant pace and is responsible for the exponential growth of the global polyolefin market.

The growth of the polyolefin market in North America and Europe is attributable to the consumer goods, transportation, and construction industries. Moreover, the consumers in Europe and North America are much concerned with deteriorating environmental issues and this factor is anticipated to propel the demand for the bio-based polyethylene.

Polyolefin is extensively used as polymer in various industries such as textiles, packaging, and consumer goods. The growing demand for polyolefin in the packaging industry and solar power industry is driving the growth of the market. The polyolefin can be easily converted to fibrous structures such as non-woven fabrics, knitted fabrics, and yarns. Hence, it is commonly used in the textile industry. The growth of the textile industry across the globe is fostering the demand for the polyolefin. Moreover, growing research and developmental activities by the market players may result in the potential use of polyolefin with the nanotechnologies that can be used across various industries.

Advancements and innovations in the polyolefin fibers is expected to grow its application in the medical field. It is also used in the production of hygiene related products like pads. Furthermore, the growing demand for sheets and films from the construction & building, transportation, and agricultural industries is anticipated to augment the market growth during the forecast period. In agriculture, the polyolefin films is used to protect the fruits and vegetables from pests, insects, rain, and frost. It also helps in efficient water utilization in agriculture by reducing evaporation of water. Hence, these factors are the driving force of the polyolefin market around the globe.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.8% |

| Market Size in 2023 | USD 266.81 Billion |

| Market Size in 2024 | USD 292.96 Billion |

| Market Size by 2034 | USD 746.16 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

By Type, in 2023, the polyethylene dominated the market with around 35% share in terms of revenue of the total market. The demand for the polyethylene is higher due to its wide application in the packaging industry. Affordable prices coupled with easy availability of polyethylene has perfectly augmented the segment growth in the recent years. The development and growing adoption of bio-degradable polyethylene owing to the rising environmental concerns is expected to drive the segment growth in the forthcoming years.

On the other hand, the polypropylene is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising consumption of polypropylene in the production of fibers, films, sheets, and raffia due to its tensile strength. The adoption of polypropylene in manufacturing lightweight automotive vehicles is boosting its demand. Lightweight vehicles are fuel efficient and due to rising fuel prices and environmental concerns, the demand for light vehicles is on the rise.

By Application, in 2023, the film & sheet dominated the market with around 45% share in terms of revenue of the total market. The films and sheet are extensively used in the food and beverages sector, agricultural sector, cosmetics sector, and industrial packaging sector. The films and sheets are available in various ranges depending on the thickness. The films and sheets are commonly used in production of beverage bottles, for packing food items, and for making packages for cosmetic products. Moreover, new developments in the films and sheets include protection from UV rays of the sun, fluorescent films, and NIR blocking films. Therefore, growing application along with product advancements is fueling the growth of the segment.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved polyolefin. Moreover, they are also focusing on maintaining competitive pricing.

In September 2020, Borealis launched Bornewables, a new portfolio of polyolefin products manufactured using renewable raw materials which was derived from wastes. These developments will provide growth opportunities along with sustainability in the upcoming years.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024