What is Polypropylene Market Size?

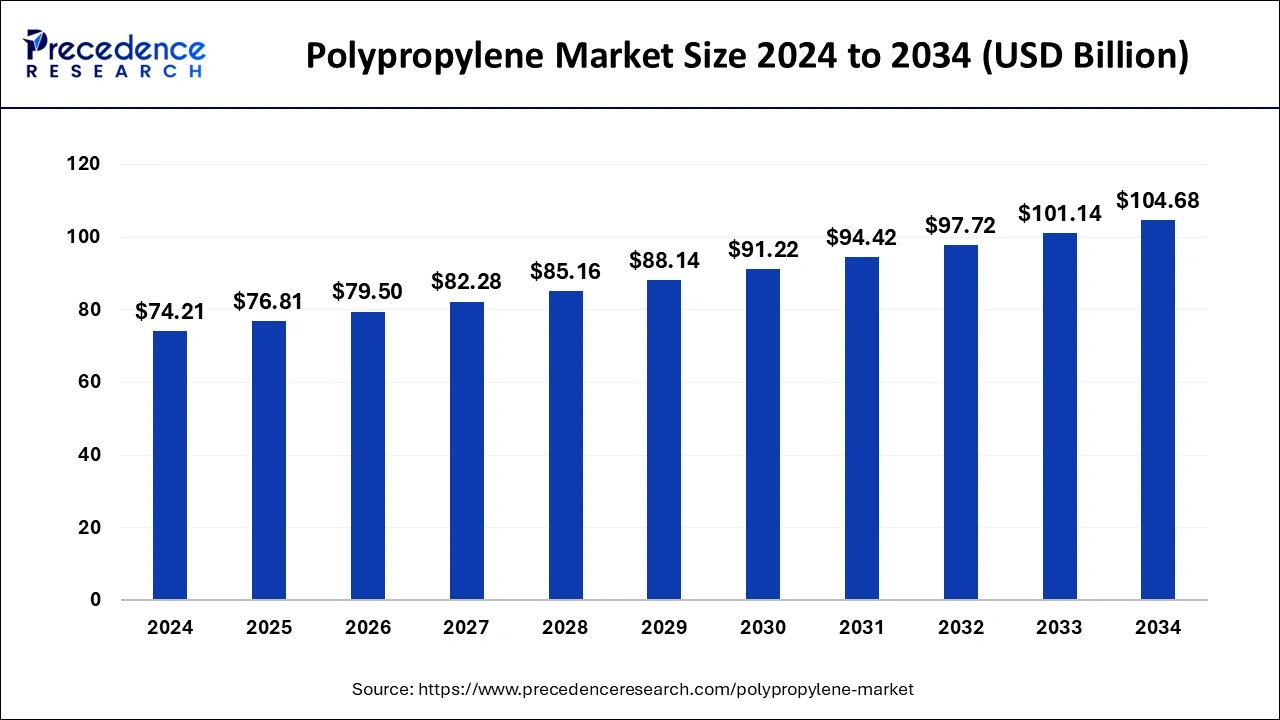

The global polypropylene market size accounted for USD 193.91 billion in 2025 and is predicted to increase from USD 202.25 billion in 2026 to approximately USD 293.54 billion by 2035, expanding at a CAGR of 14.35% from 2026 to 2035. The growth of the polypropylene market can be attributed to its low costs, ease of processing, broad spectrum of applications, increasing demand in various industries and innovative breakthroughs in polypropylene development.

Polypropylene Market Key Takeaways

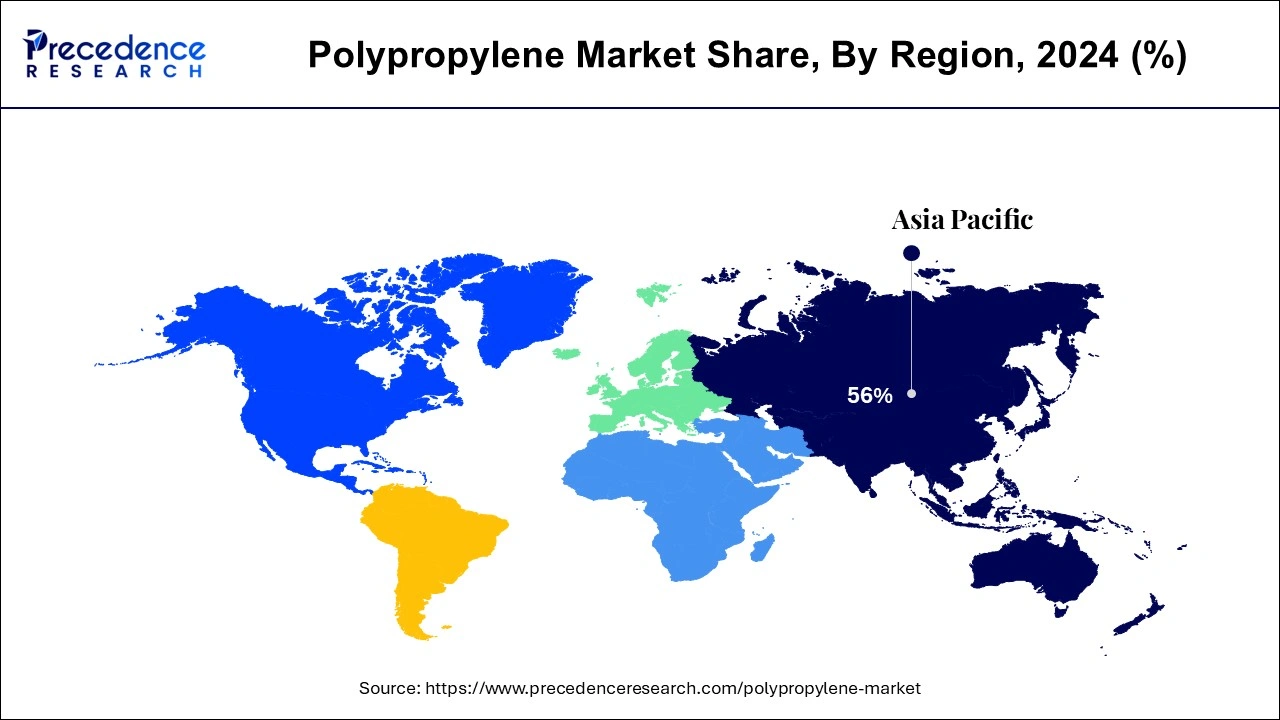

- Asia Pacific led the global market with the highest market share of 56% in 2025.

- By polymer type, the homopolymer segment was the highest revenue holder in 2025.

- By process, the injection molding segment accounted highest revenue share in 2025.

- By end-use, the automotive segment has held biggest revenue share in 2025.

- By applications, the film and sheet segment accounted for a highest revenue share in 2025.

When AI Meets Polypropylene: Transforming the Polypropylene Market

The integration of artificial intelligence AI can be applied for recycling polypropylene such as for differentiating various types of propylene for precise sorting, in quality control for examining manufacturing defects, for characterization of polymer by analysing data from analytical techniques, in predictive maintenance and for design optimization of polypropylene products thereby improving their functionality and reducing development costs.

Polypropylene Market Growth Factors

The increasing application of polypropylene across various end-use industries including automotive, packaging, medical, building & construction, and many others drives the demand for the product over the upcoming years. Polypropylene is a light weight material that offers broad range of superior properties such as high tensile strength, low moisture resistance, staining resistance, and resistant to various chemical solvents, acids, & bases because of which it is largely preferred in the aforementioned industries.

Shifting trend towards lighter materials in automotive sector in order to improve the fuel efficiency and curb the pollution rate act as a booming factor for the market growth of polypropylene in the industry. Similarly, it is highly preferred as a packaging solution in food & beverage industry owing to its excellent moisture resistance property that increases the life of the packaged food and prevents it from degradation.

On the other hand, lockdown imposed by different governments to control the spread of COVID-19 pandemic has significantly impacted to the consumption of polypropylene as well as its demand has declined rapid across various end-use industries. Manufacturers are facing difficulties while running production lines because of insufficient supply of raw material and restrictions on logistics along with limitations for the movement of people that further cascade negative impact towards the product demand. Besides this, increasing requirement for specialized polypropylene particularly in the healthcare sector in order to manufacture medical gowns, masks, and other safety equipment expected to propel the demand for the product in the upcoming years.

Shaping Tomorrow: Polypropylene Market Outlook

- Industry Growth Overview: The growing demand from the automotive and packaging industries is driving the industrial growth of the market. Moreover, a growth in the healthcare, electronics, and construction sectors is also contributing to this growth.

- Sustainability Trends: The sustainability trends focus on enhancing the recycling methods to implement a circular economy model and increasing the shift towards biobased polypropene derived renewable sources to meet the regulatory standards.

- Major Investors: Large integrated energy and chemical corporations and major asset management firms are the major investors in the market. SABIC, ExxonMobil Chemical Company, Braskem, and Sinopec are some of the major investors in the market.

Polypropylene Market Trade Analysis

- Due to their hydrocarbon resources and petrochemical production facilities, the Middle East has a unique strategic position as an exporter of polypropylene.

- Furthermore, producers in the Middle East take advantage of competitively priced propylene feedstocks, ensuring a constant stream of polypropylene exports to Europe, Africa, and South Asia. Long-term supply contracts and regional port-based logistics hubs will only enhance the region's position as an exporter.

- As a significant portion of the European Union's polypropylene imports comes from outside Europe, there are many external suppliers that deliver polypropylene to the automotive, packaging, and consumer goods sectors.

- The flow of Trade into the EU is significantly affected by environmental regulations, import tariffs, and energy costs, which further reduce producers' ability to compete against EU-based producers.

- Comparatively, North America has a relatively balanced trade profile for polypropylene exports, which are primarily supported by the country's shale-based feedstock advantage and strong domestic consumption of polypropylene.

Major Polypropylene Market Trends

- Recyclable and Circular Polypropylene Solutions Continue to Become Prominent: One of the fastest growing trends on the market currently is the rise of circular and recyclable polypropylene solutions. There has been an influx of manufacturers investing in both mechanical and chemical recycling technologies and producing high-quality recycled polypropylene that meet performance standards for the packaging, automotive, and consumer goods markets.

- Lightweight Material Substitution Will Continue to Shape the Market: Lightweight material substitution will shape the market as a significant trend in the automotive and transportation sectors. Typically found as heavy materials (metal and glass), polypropylene is being used as a replacement for such materials because of its excellent strength to weight ratio, high chemical resistance, and great cost effectiveness.

- Polymer Modification and Catalyst Advancements are Driving Additional Market Evolution: Advancements in polymer modification and catalyst technologies continue to drive market evolution. For example, factories have begun developing metallocene-based catalysts and producing improved impact-modified polypropylene grades that are capable of providing greater material flexibility, toughness, and thermal resistance than previously offered polypropylenes.

MarketScope

| Report Highlights | Details |

| Market Size in 2025 | USD 193.91 Billion |

| Market Size in 2026 | USD 202.25 Billion |

| Market Size by 2035 | USD 293.54Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.40% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Type Insights

Homopolymer dominated the global polypropylene market and accounted highest revenue share in the year 2024. Increasing demand for homopolymer polypropylene in the manufacturing of different components that include prosthetic & orthotics devices, secondary containments, pump components, and storage tanks, for different end-use sectors, for example automotive, healthcare, and construction anticipated to prosper the growth of the segment during the analysis period.

However, the counterpart of homopolymer, copolymer polypropylene is comparatively softer, though has high strength and is more durable compared to homopolymer. Because of its toughness at low temperature along with higher stress crack resistance, the demand for copolymer expected to witness significant growth over the forecast timeframe.

Application Insights

Film & sheet accounted for the highest revenue share in the global market for polypropylene in 2024. The growth of the segment is mainly attributed to the rising demand for polypropylene in boxes, binders, packaging materials, and portfolios due to its high temperature stability, excellent chemical resistance, better chemical resistance, high temperatures stability, excellent moisture barrier, and exceptional contact clarity.

Prominent growth of the packaging sector, mainly in countries that include China and India, because of growing penetration of e-commerce platform to purchase products projected to impact positively on the growth of the segment over the forthcoming years.

Fiber estimated to be the second largest application segment accounting for a value share of around 30% in 2023. Rising demand from automotive industry in seat cover construction, pull straps, automotive flooring, and seam reinforcement predicted to bolster the demand for polypropylene in the forthcoming years.

Regional Insights

What is the Asia Pacific Polypropylene Market Size?

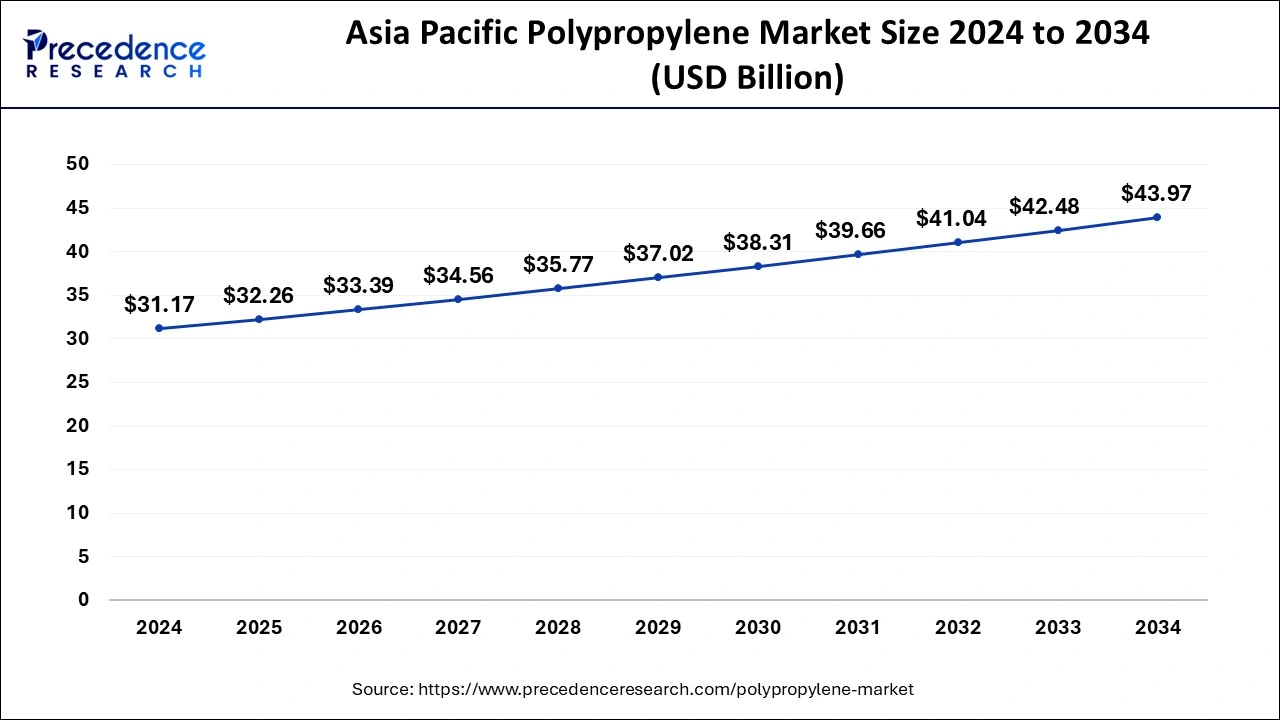

The Asia Pacific polypropylene market size is estimated at USD 77.56 billion in 2025 and is predicted to be worth around USD 119.29 billion by 2035, at a CAGR of 4.4% from 2026 to 2035.

Asia Pacific Dominates: Driving Polypropylene Market Growth Through Industry Demand

The Asia Pacific emerged as the market leader and accounted for a largest revenue share of 56% in the year 2025. Furthermore, the region also predicted to grow at a prominent rate over the predicted time period. Increasing demand for polypropylene particularly from the packaging and automotive sectors, predominantly in countries such as China, India, and Japan anticipated to thrive the market growth in the region. Additionally, the region is a home of market leaders such as LG Chem, China Petrochemical Corporation, Formosa Plastics Group, and Sumitomo Chemical that accounted as the another prime factor to augment the market size during the coming years.

China Polypropylene Market Trends

China dominated the polypropylene market in the Asia Pacific region owing to the huge presence of vehicle production industries. Furthermore, the rising demand from packaging industries and outsourcing for manufacturing products in China by various companies across the globe is driving the market growth.

North America Polypropylene Market Accelerates: Demand soars with Packaging and Automotive Growth

North America grow at fastest CAGR during forecast period. Owing to its rising application for packaging in the food & beverage industry. In addition to this, rising number of R&D centers coupled with increasing demand for lightweight automobiles and their parts estimated to propel the demand for polypropylene in the region.

U.S. Polypropylene Market Trends

The U.S. polypropylene market is expected to witness a substantial growth over the forecast period. The growth of the polypropylene market can be attributed to the development of medical and electrical industries, wide range of applications in various industries and recent advances in recycling technologies.

Rising Packaging Need Drives the Polypropylene Demand in South America

South America is expected to host significant growth in the polypropylene market during the forecast period, due to a growth in the packaging industry, which is increasing the use of polypropylene as a flexible and rigid packaging solution. At the same time, the growth in the retail chains and e-commerce is also increasing their use, where a growth in the automotive production is also increasing their use as a bumper or dashboard due to their durability and light weight. Additionally, the growing construction industry is increasing its use for insulation or pipes, where all the factors are enhancing the market growth.

Packaging Powerhouse: Propelling the demand for Polypropylene in Brazil

Due to the presence of large packaging industries in Brazil, the use of polypropylene is increasing for developing bottles, containers, or flexible films. At the same time, the growing vehicle production is also increasing their use in the automotive sector, where the rapid urbanization is also increasing their use for large-scale construction projects. Moreover, they are also being used in textiles and medical supplies, where growing investments are driving their production rates.

Europe Polypropylene Market Set to Grow: Packaging, Automotive, and Advanced Technologies Driving Demand.

Europe is expected to grow significantly in the polypropylene market during the forecast period. The packaging as well as automotive industries are increasing the demand for the use of polypropylene in Europe. At the same time, due to their recycling properties, their use in various sectors is also rising. This, in turn, is supported by the advanced technologies as they are being used to enhance their quality, efficiency, and production. Thus, this promotes the market growth.

UK Polypropylene Market Trends

The use of polypropylene in the automotive industry in the UK is rising as they are being used in the development of battery cases, bumpers, etc, due to their durability and lightweight properties. At the same time, to enhance their production rates, the use of AI is also increasing.

- In Germany, the use of polypropylene is growing as it can be recycled. Thus, they are being used in the packaging industry, where their use is also being encouraged by the government.

Middle East & Africa Polypropylene Market Expands: Rising Industrial Demand and Infrastructure Development

The Middle East and Africa polypropylene market is growing due to rising demand from the packaging, automotive, and construction sectors. Rapid industrialization, urbanization, and infrastructure development in countries like the UAE, Saudi Arabia, and South Africa are boosting consumption. Additionally, increased production capacity, easy availability of raw materials, and government initiatives supporting petrochemical growth further propel market expansion in the region.

UAE Polypropylene Market Trends

The UAE polypropylene market is expanding due to growing demand from the packaging, automotive, and construction industries. Rapid urbanization, industrial growth, and infrastructure development are driving consumption. Supportive government policies, availability of raw materials, and investment in advanced production technologies further boost the market, making the UAE a key hub for polypropylene in the Middle East.

Mapping the Journey: Polypropylene Market Value Chain Analysis

- Feedstock Procurement

Sourcing propylene monomer from major oil and gas companies and chemical producers is involved in the feedstock procurement of polypropylene.

Key players: SABIC, ExxonMobil Company, LyondellBasell Industries - Quality Testing and Certification

The quality testing and certification of polypropylene involves the mechanical, chemical, and physical tests as per the set standards.

Key players: SGS SA, Bureau Veritas, Intertek Group plc. - Regulatory Compliance and Safety Monitoring

The regulatory compliance and safety monitoring of the polypropylene focuses on compliance with the stringent national and international standards set by regulatory bodies.

Key players: LyondellBasell Industries, SABIC, SGS SA, Intertek Group plc.

The Innovations Leaders: Polypropylene Market Key Players' Offering

|

Companies |

Headquarters |

Products |

|

LyondellBasell Industries |

U.S. |

Purell, Hostalen, Hystron |

|

SABIC |

Saudi Arabia |

SABIC PP |

|

ExxonMobil Company |

U.S. |

ExxonMobil PP |

|

LG Chem |

South Korea |

Various PP resins |

Polypropylene Market Companies

- Lyondellbasell Industries Holdings B.V.: One of the largest suppliers of PP worldwide, LyondellBasell supplies numerous different grades of propylene homopolymers, random copolymers, and impact copolymers for use in a variety of end-use applications, including packaging, automotive, and industrial.

- Exxon Mobil Corporation: Chemical has developed advanced, high-performance polypropylene resins that have excellent durability, stress resistance, ease of processing, and demonstrate enhanced strength, rigidity, and thermal/stress resistance characteristics of automotive, healthcare, and consumer products.

- SABIC: Offers higher-performing and more sustainable solutions to industrial and consumer markets (including circular and bio-based products).

- BASF SE: A major German chemical producer offering a wide range of plastics and performance materials, including high-performance thermoplastics and engineered polymers used in automotive, construction, and consumer goods applications.

- LG Chem: South Korea's leading chemical firm, providing petrochemicals and specialty polymers such as ABS, SAN, PVC, polyolefins, and polypropylene for use in automotive, electronics, packaging, and industrial sectors.

- Trinseo S.A.: U.S. based materials company supplying plastics and engineered resins, including polypropylene, ABS, SAN, PC/ABS blends, and recycled content polymers for automotive, packaging, electronics, and construction markets.

- Total S.A: Global energy and chemicals company producing polypropylene, polyethylene, polystyrene, and circular/recycled polymers for diverse applications in automotive, packaging, medical, and construction industries.

- Westlake Chemical Corporation: U.S. petrochemical manufacturer offering polyolefin thermoplastics, including polypropylene and polyethylene, plus fluoropolymers and engineered materials for industrial, chemical processing, and consumer applications

Other major Key Players

- China Petrochemical Corporation

- Eastman Chemical Company

Latest Announcements

- In November 2024, Highland Plastics, a leader in innovative polymer solutions announced the launch of its breakthrough Kelvinite 2100 halogen-free flame-retardant polypropylene (HFFR PP) which will fulfill the demands of automotive suppliers and other industries affected by recent ban of China on antimony exports. Ben Simmons, CEO of Highland Plastics said that, “Kelvinite 2100 not only eliminates the sourcing challenges associated with antimony—it also provides unmatched performance that legacy FRPP materials simply cannot provide. With Kelvinite 2100, manufacturers can confidently meet flame-retardancy and environmental standards without compromising on quality or reliability. And, we can deliver with a 4-week lead time to meet immediate demand.”

- In September 2024, Braskem, a global market leader and innovative producer of biopolymers announced the launch of its pioneering bio-circular polypropylene (PP) which will serve as a sustainable solution for restaurant and snack food industries. Bill Diebold, Vice President, Braskem America Polyolefins, said that, “Our bio-circular PP is currently being supplied to various converters which support the Quick Service Restaurant (QSR) industry. Ideal users include QSR chains, retail food suppliers, traditional restaurants, and snack food companies especially those seeking to enhance circularity from their cooking oil usage. This versatile material is suitable for a wide range of applications, including food packaging, flexible packaging (such as films), and consumer goods.”

Recent Developments

- In November 2024, Copper Standard expanded its product portfolio with the introduction of its groundbreaking FlexiCore Thermoplastic Body Seal which acts a sustainable, fully recyclable lightweight plastic alternative doorframe seal for vehicle bodies over the conventional metal carriers without compromising performance.

- In September 2024, Dangote Refinery announced to begin the production of propylene by the end of October 2024 which will significantly reduce Nigeria's dependence on imported polypropylene.

Segments Covered in the Report

By Process

- Blow Molding

- Extrusion

- Injection Molding

- Others

By Type

- Copolymer

- Homopolymer

By Application

- Film & Sheet

- Raffia

- Fiber

- Others

By End-use

- Building & Construction

- Electrical & Electronics

- Automotive

- Medical

- Packaging

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting