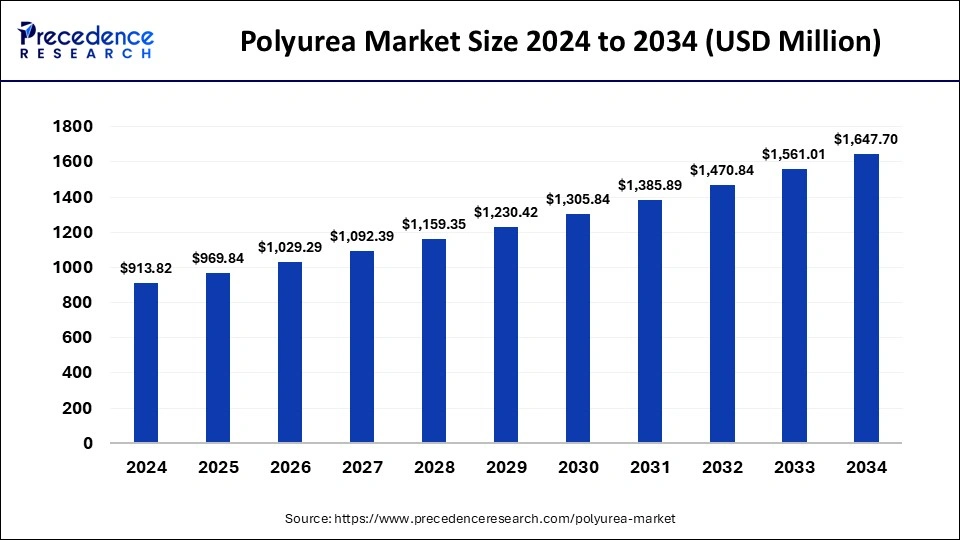

The global polyurea market size is calculated at USD 969.84 million in 2025 and is forecasted to reach around USD 1,647.70 million by 2034, accelerating at a CAGR of 6.07% from 2025 to 2034. The North America polyurea market size surpassed USD 374.67 million in 2024 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polyurea market size was estimated at USD 913.82 million in 2024 and is predicted to increase from USD 969.84 million in 2025 to approximately USD 1,647.70 million by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The growth of these end-use industries is expected to propel the growth of the polyurea market over the forecast period.

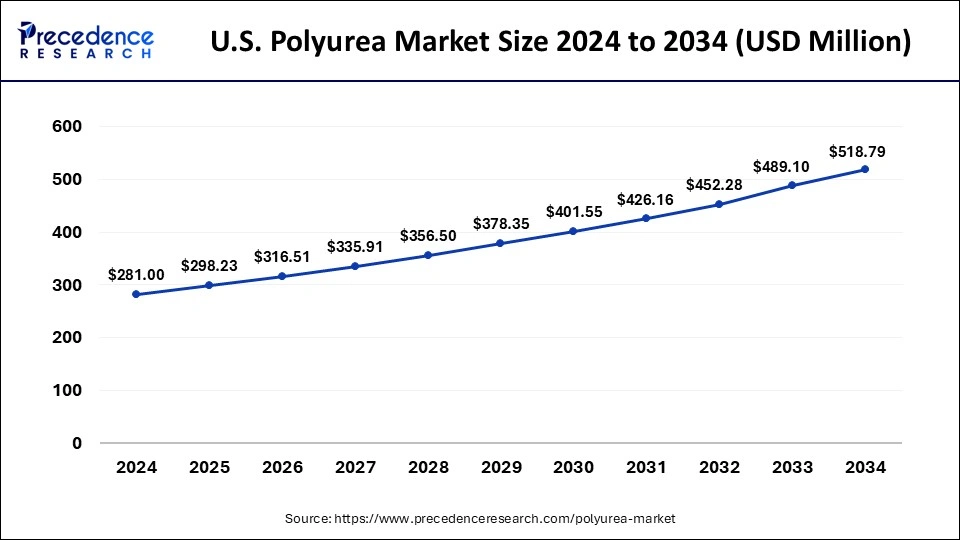

The U.S. polyurea market size surpassed USD 281 million in 2024 and is projected to attain around USD 518.79 million by 2034, poised to grow at a CAGR of 6.32% from 2025 to 2034.

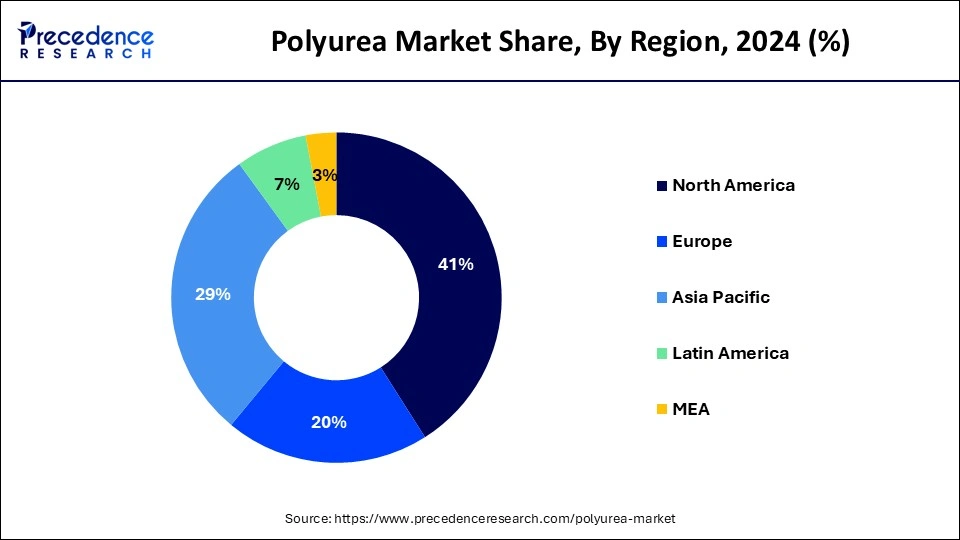

The polyurea market was dominated by North America in 2024. The increased spending on hydraulic fracturing in the U.S. and Canada led to improvements in the shale gas industry, which is expected to drive the demand for polyurea as coatings and lining systems. However, slow growth in the manufacturing sectors of developed countries, such as Canada and Mexico, along with rising utility costs, is anticipated to reduce the consumption of polyurea for sealants and coatings.

Asia Pacific is expected to host the fastest-growing polyurea market during the forecast period. The growing use of coatings and rising demand from the automotive sector are driving the growth of the region in the global polyurea market. Asia Pacific offers affordable raw materials, low production costs, and the ability to better serve the local developing market. Additionally, the region has seen an increase in the higher-middle-class population with significant purchasing power in recent years, which has substantially increased demand.

Polyurea is an elastomeric substance produced through the reaction of an aromatic or aliphatic isocyanate component with a synthetic resin blend via step-growth polymerization. It can exist in forms ranging from monomers to polymers or any other reaction product of isocyanate, quasi-prepolymer, or prepolymer. Polyurea is known for its exceptional elongation properties, high tensile strength, and tear resistance. Due to these qualities, it is widely used in the construction and industrial sectors.

Polyurea coatings, which are intrinsically superior to epoxy coatings, are increasingly replacing them in industrial and commercial buildings and infrastructure due to their versatility and high impact resistance. Furthermore, polyurea finds application in various fields, such as manufacturing and transportation, thanks to its unique characteristics, including rapid curing time, high thermal stability, and color consistency.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,647.70 Million |

| Market Size in 2025 | USD 969.84 Million |

| Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Environmentally friendly nature

The primary driver for this product is its environmentally friendly nature and compliance with the environmental standards regarding Volatile Organic Compounds (VOCs), as set by regulatory bodies. Increasing urbanization has expanded its applications in the transportation and construction sectors. Its coating solutions are commonly used in construction and automotive industries for repairing bridges and tunnels, constructing highways and roads, and coating vehicles. The rapid growth in infrastructure spending and focus on enhancing public transportation, building subways, and urban development are creating favorable conditions for industry.

High cost and toxic effects

Polyurea-based coatings are widely used across various sectors. However, their higher cost compared to other coatings is hindering the growth of the polyurea market. Coatings based on epoxy and acrylic are available at lower prices than polyurea coatings, leading to a notable decline in demand for polyurea-based coatings in recent years. Additionally, the raw materials used in producing polyurea-based products are toxic.

Increasing demand in medical facilities

In response to the COVID-19 pandemic, countries worldwide have initiated efforts to build more secure and advanced medical facilities. Concerns about safety in medical settings are expected to create favorable conditions for the expansion of polyurea coating manufacturers. Polyurea coatings are used in hospital flooring and as a waterproofing solution for various infrastructure elements. Many medical facilities have extensive flooring areas or miles of sidewalks that require large volumes of coatings. Hence, manufacturers of polyurea coatings are expected to experience significant demand for their products in medical facilities.

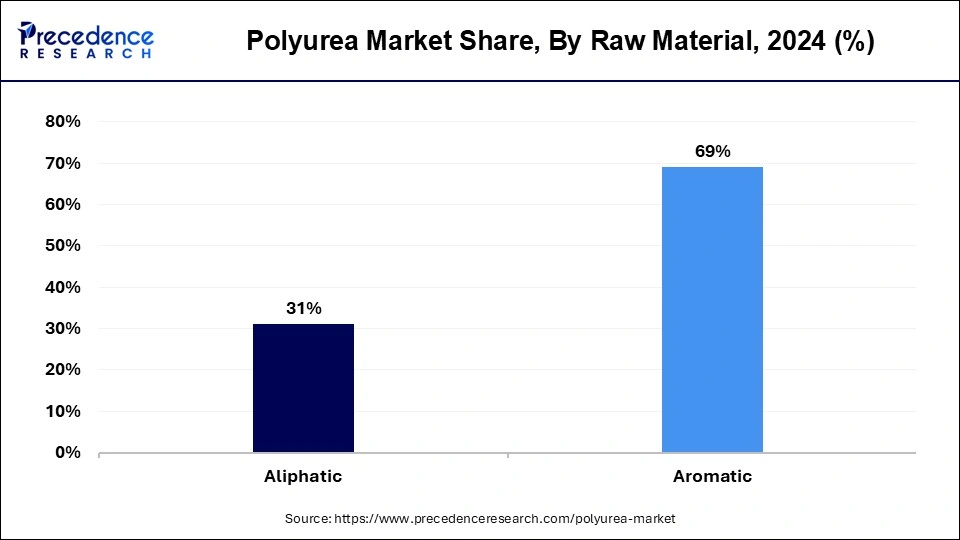

The aromatic segment dominated the polyurea market in 2024. These raw materials offer excellent physical properties and are easy to process. Therefore, aromatic systems are coated with aliphatic topcoats to achieve the desired color stability when exposed to UV light. Due to their outstanding flexibility, polyurea compounds based on aromatics are anticipated to be used in the construction and manufacturing industries of developed nations such as Germany, the UK, and Spain.

The aliphatic segment is expected to grow at the fastest rate in the polyurea market over the forecast period. Aliphatic polyurea is resistant to UV radiation and is excellent as a final coat. However, due to the high cost of its raw materials, it falls into the higher price range of polyurea products. Factors such as favorable demographics for production and a growing global population are expected to drive the aliphatic segment in the market.

The coating segment led the global polyurea market in 2024. The growing significance of polyurea coatings in the aerospace, construction, oil & gas, and automotive industries is fueling the expansion of coatings in the product segment of the polyurea market. Increased construction activity and urbanization have notably increased the demand for coatings in the market. These factors collectively drive the growth of coatings in the product segment of the polyurea market.

The lining segment will show rapid expansion in the polyurea market during the forecast period. Polyurea lining is ideal for corrosion control, immersion applications, and waterproofing. Items such as bed liners, pond liners, tank liners, and more are also included. It offers excellent adhesion to properly prepared surfaces.

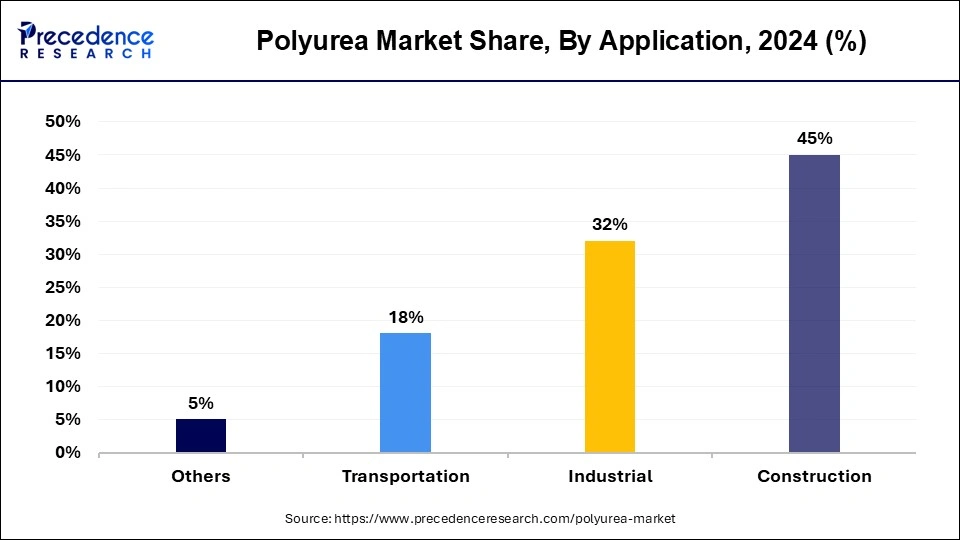

The construction segment dominated the polyurea market in 2024. The expanding use of polyurea in construction, including residential and commercial buildings and other infrastructures, is driving growth in the construction segment of the polyurea market. Polyurea is extensively used in the construction industry for coatings, adhesives, linings, and similar applications. Its excellent physical properties promote its widespread use across various industries.

The industrial segment is expected to grow at a significant rate in the polyurea market during the period studied. When applied as a liquid coating, it quickly cures to form a durable, waterproof barrier. It is also used for waterproofing roofs, foundations, decks, and other surfaces. Polyurea is a waterproofing material commonly used in industrial and commercial settings to protect surfaces from water damage.

By Raw Material

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client