December 2024

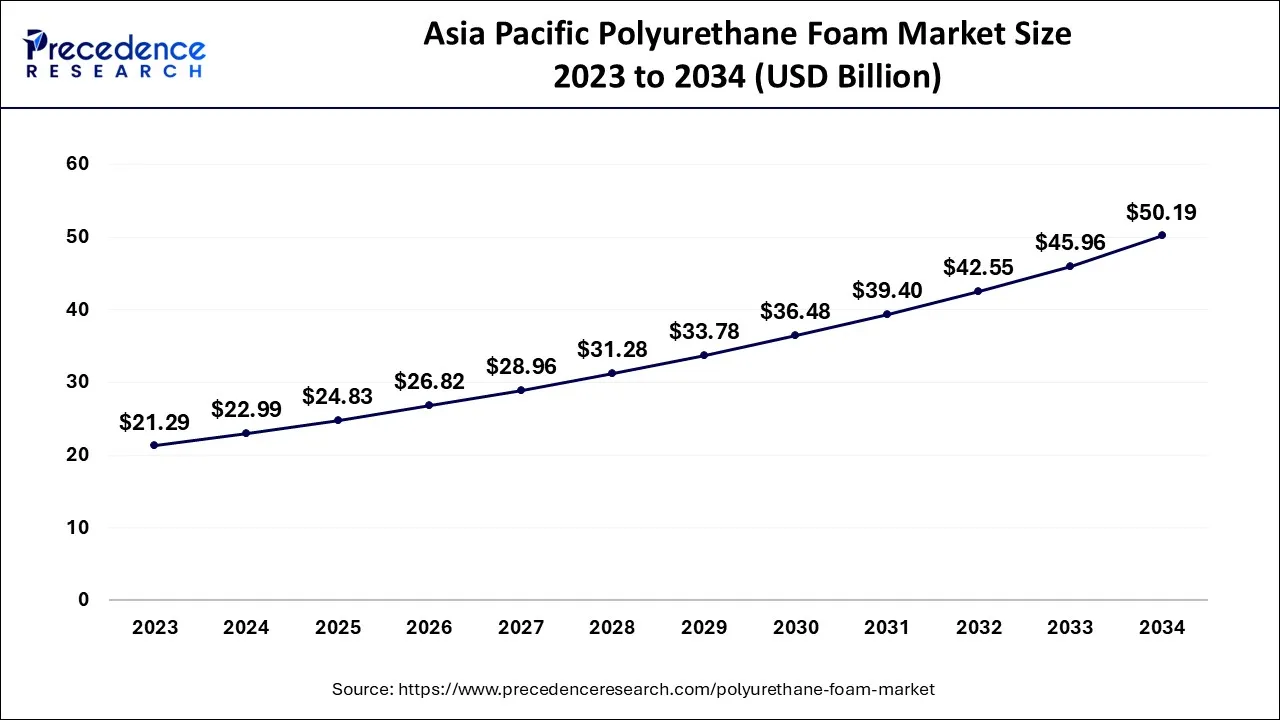

The global polyurethane foam market size accounted for USD 51.09 billion in 2024, grew to USD 55.18 billion in 2025 and is expected to be worth around USD 110.30 billion by 2034, registering a CAGR of 8% between 2024 and 2034. The Asia Pacific polyurethane foam market size is calculated at USD 22.99 billion in 2024 and is estimated to grow at a CAGR of 8.12% during the forecast period.

The global polyurethane foam market size is calculated at USD 51.09 billion in 2024 and is projected to surpass around USD 110.30 billion by 2034, growing at a CAGR of 8% from 2024 to 2034.

The Asia Pacific polyurethane foam market size is exhibited at USD 22.99 billion in 2024 and is projected to be worth around USD 50.19 billion by 2034, growing at a CAGR of 8.12% from 2024 to 2034.

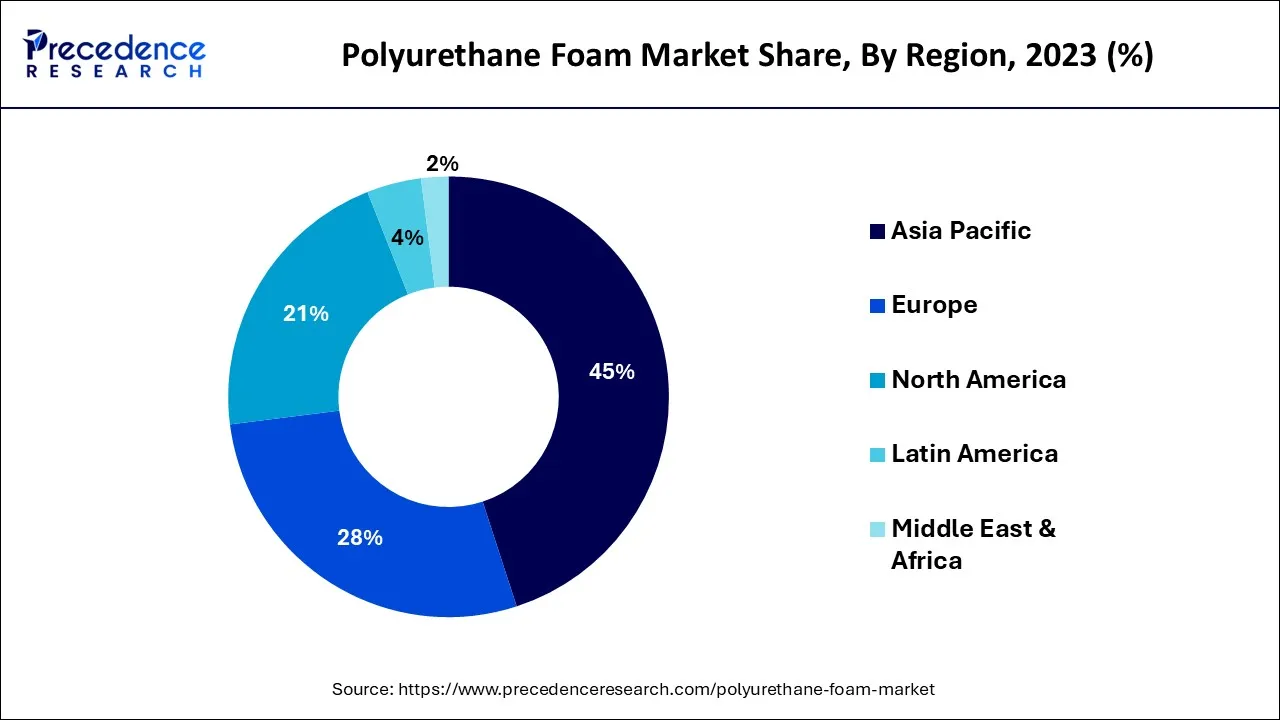

In 2023, Asia Pacific (APAC) held the largest revenue share. Factors such as increasing demand for polyurethane foams from various end-user industries and the expanding footprint of the global players dealing in polyurethane foams are anticipated to boost the polyurethane foam market growth in the region. Approximately 178,000 new houses are forecasted to be constructed in Australia in the fiscal year 2025. India has made significant progress in many Sustainable Development Goals (SDGs) and the per capita income of the country increased to ₹ 1,97,000 ($2,411.08) by the end of 2022. Thus, the rising count of houses and increasing per capita income boosts the demand for furniture & bedding in the Asia Pacific region.

In the coming years, Germany’s hotel industry is set to expand with 364 additional properties and 57,926 rooms. Hamburg, the home to Germany’s largest seaport, is all set to have 23 new hotels and 5,625 extra rooms in near future. In the capital city of Berlin, 19 hotels are expected to open, which will add up to 4,121 new rooms. The French hotel market is anticipated to have 96 additional properties and 15,485 rooms during the forecast period. Thus, expanding hotel industry creates significant demand for polyurethane foams required for freezers, beds, refrigerators, and hotel mattresses.

North America is estimated to be the fastest-growing market for polyurethane foam during the study period. North America is the most developed continent owing to the presence of nations with favorable economic policies, high gross domestic product (GDP), and early adoption of advanced infrastructures.

The immigrant population is rising notably in Canada since past few years. Canada’s population is rising at almost double the pace of each G7 country. Approximately 4/5th of the 1.8 million population rise from 2016 to 2021 was attributable to the new arrivals in Canada, either as temporary or permanent immigrants. While the pandemic of COVID-19 slowed the movement of people across the world, nearly 185,000 permanent immigrants arrived in Canada in the financial year 2020. Thus, the rising population in Canada is creating immense scope for the automobile industry. Thus, the rise in the demand for new vehicles creates a significant opportunity for polyurethane foam required in vehicles.

Polyurethane foam is a synthetic cellular-structured porous material derived from the reaction of polyols and diisocyanates. Its structure is a composite of a gas phase and a solid phase. The solid phase is prepared from polyurethane elastomer.

Polyurethane foam is a widely used polymer that is available in two forms i.e., flexible foam and rigid form. Rigid polyurethane foams are utilized for numerous insulation applications pertaining to construction and refrigeration.

Rigid polyurethane foam is energy efficient and helps in reducing energy costs. Flexible polyurethane foams are particularly used as a cushioning substance in various end-use industries such as furniture, packaging, transportation, bedding, automotive interiors, and carpet underlay. The use of flexible polyurethane foam is becoming popular as it can be created in almost any shape and variety. These flexible foams are also durable, light, comfortable, and supportive.

Automotive companies are using polyurethane forms for reducing the weight of electric vehicles (EVs). This makes the electric vehicle lighter and more efficient, which allows the passenger to travel longer distances per charge.

Government support in the form of subsidies and tax incentives is expected to encourage the manufacturing sector in countries such as India and China. This is anticipated to promote bio-based polyurethane to replace conventional polymers.

Environmental benefits of polyurethane foams include clean incineration and high recyclability for reduced wastage, pollutant filtration, and greater sustainability. However, several government authorities and federal agencies are concerned about the detrimental health effects of isocyanates used in polyurethane production.

The penetration of polyurethane foams is anticipated to increase owing to properties such as superior insulation that is ideal for walls and roofs in new homes. The use of polyurethane foams in buildings helps to reduce noise levels and maintain a uniform temperature. Increasing expenditure on construction in countries such as Indonesia, India, United Arab Emirates, Qatar, and South Korea due to rising urban population coupled with strong industrial sector growth is anticipated to fuel the market growth.

Growing population, infrastructure projects, loan facilities, increasing per capita income, and government support are the supporting factors that are expected to boost the construction market growth in the coming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 51.09 Billion |

| Market Size by 2034 | USD 110.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Polyurethane is a common polymer that is used to prepare foam, especially for furniture. Polyurethane foam is relatively soft and has an elastic open-cell structure which is preferable for lightweight and delicate items. Polyurethane foam is also used for those products that are very sensitive to vibration. FOAMplus®, polyurethane foam packaging is a highly popular packaging solution that tends to negate the requirement for large storage areas needed for pre-fabricated packaging.

Polyurethane foams are found in the armrests, seats, and headrests of many vehicles. The cushioning properties of polyurethane foams help in reducing the stress and fatigue usually associated with driving. As per CEIC Data, the sale of passenger cars in the U.S. was reported to be 3,350,050 units in December 2021. This figure is a notable rise from the previous figure of 2,302,989 units sold in June 2021. In developing countries, the construction of new roads further boosts the demand for private passenger cars. Thus, the rising production of vehicles boosts the requirement for particular polyurethane foams.

In January 2020, Covestro AG collaborated with Recticel NV/SA for developing mattresses from end-of-life mattresses. This collaboration was aimed to create a circular economy in the polyurethane foam market that would help both companies in decreasing the usage of raw materials involved in the production of polyurethane foams.

Wanhua Chemical Group Co., Ltd. acquired a 100% stake in Chematur Technologies AB for $134 million in August 2019. Chematur Engineering AB provides technologies for all major offerings in the polyurethane field. Owing to this acquisition, the position of Wanhua Chemical Group Co., Ltd. has strengthened in the polyurethane foam market. Such collaborations and acquisitions are expected to support the polyurethane foam market growth substantially from the supply side.

Based on type, the global polyurethane foams market is segmented into rigid foam, flexible foam, and spray foam. The flexible foam segment is expected to hold a significant market share during the forecast period. Flexible polyurethane foam is broadly utilized as a cushioning material in the production of seating, mattresses, and specialty items. Flexible polyurethane foam is produced by reacting a polyol blend (containing surfactants, catalysts, cell opener, blowing agent, etc.), with a Toluene Diisocyanate (TDI) and Methylendiphenyl Diisocyanate (MDI).

Rigid polyurethane foams are predominantly utilized in the insulating of buildings, doors, and appliances. Installers make use of rigid polyurethane foam for insulating garage doors and entry doors, and the process can be discontinuous or continuous. For appliances, rigid polyurethane foam is installed to insulate drink machines, ice machines, hot water heaters, and among other applications. Structural rigid polyurethane foams are can be used for architectural trim, floatation, chair backs, and signage.

The prominent construction uses for rigid polyurethane foams include concrete lifting, house sheathing, aforementioned ditch breaks, and pole setting. The foam is either injected or sprayed via a low-pressure gun delivery system.

In 2020, as per the Economic Impact Study commissioned by the Building Owners and Managers Association of the U.S. (BOMA), the establishment of business offices is increasing in the United States. Various governments in the Middle East region emphasize developing the real estate industry through numerous commercial and residential projects. Thus, expanding commercial and residential construction activities boost the demand for furniture, which enhances the requirement for respective polyurethane foams.

Based on application, the global polyurethane foams market is segmented into bedding & furniture, transportation, packaging, automotive, construction, electronics, footwear, and other applications. The construction segment had the highest revenue share in 2023, and it is expected that it would continue to dominate the market during the study period as a result of the growing residential real estate sector.

As per the analysts, the turnover in the real estate industry in Germany in 2021 reached a record high of € 337 billion ($381.61 billion). The residential sector in China is predicted to expand at a promising rate in near future. As of 2022, the urbanization rate in China was 64.7% and this rate is predicted to reach 75-80% by 2035. In February 2022, banks in almost 90 cities in China cut mortgage rates in order to boost the sales and buying power of the purchaser in the residential property market in the country. Thus, the expanding construction sector improves the demand for polyurethane foams required in buildings and houses.

Polyurethane foam is most often used in freezers and refrigerators that are responsible for maintaining thermal isolation with respect to exterior environments. Rigid polyurethane foam is applied particularly between the outer metal casing of freezers and the inner liner made of polyethylene. In 2020, Gorenje decided to build a new production hall for freezers and refrigerators. This new hall is expected to increase the freezer and refrigerator production capacity by an additional 750,000 units per year.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

August 2024

October 2024