September 2024

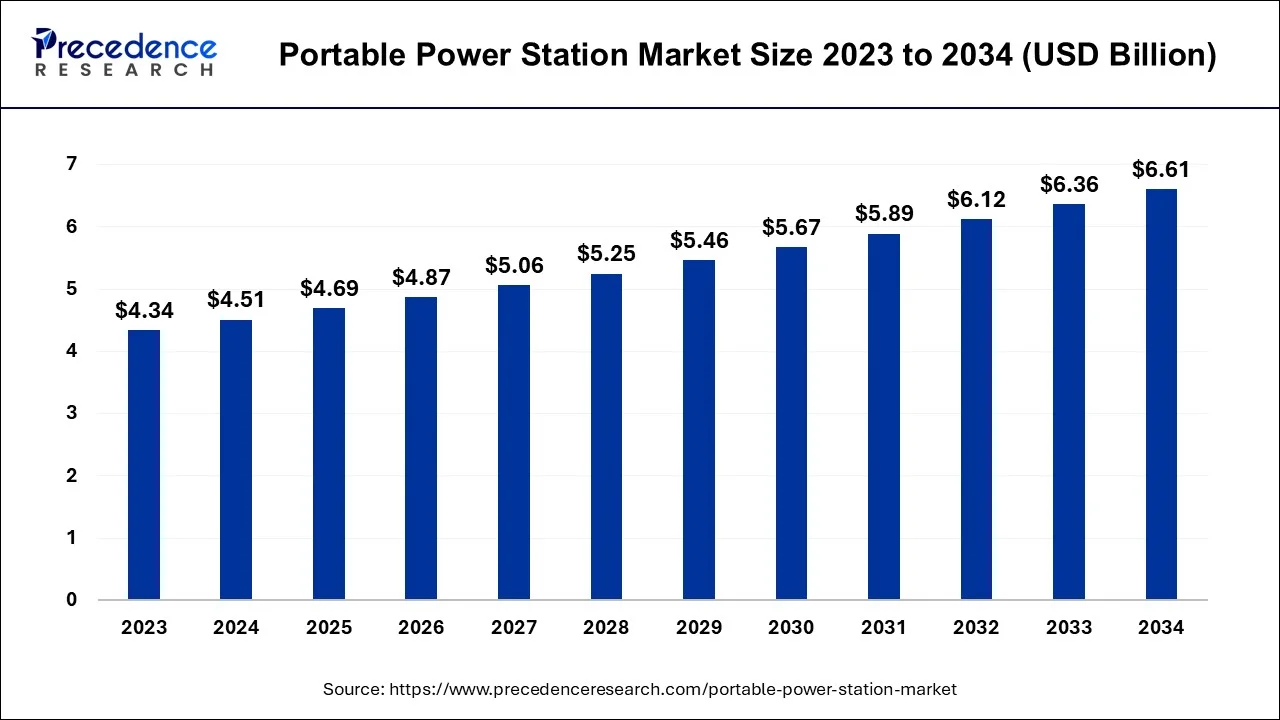

The global portable power station market size is estimated at USD 4.51 billion in 2024, grew to USD 4.69 billion in 2025 and is predicted to hit around USD 6.61 billion by 2034, expanding at a CAGR of 3.90% between 2024 and 2034.

The global portable power station market size accounted for USD 4.51 billion in 2024 and is anticipated to reach around USD 6.61 billion by 2034, growing at a CAGR of 3.90% between 2024 and 2034.

The portable power station market refers to the industry and market segment associated with the development, manufacturing, and sale of portable power stations. Portable power stations are compact and versatile devices designed to provide electrical power on the go. They typically include built-in batteries, inverters, charging ports, and various outlets to power or recharge electronic devices, appliances, and tools.

The portable power station market has witnessed substantial expansion in recent years, primarily propelled by the heightened demand for off-grid and backup power solutions. These compact, rechargeable units serve as versatile sources of electricity for an array of electronic devices and appliances, making them particularly sought-after for outdoor adventures, emergencies, and remote locales.

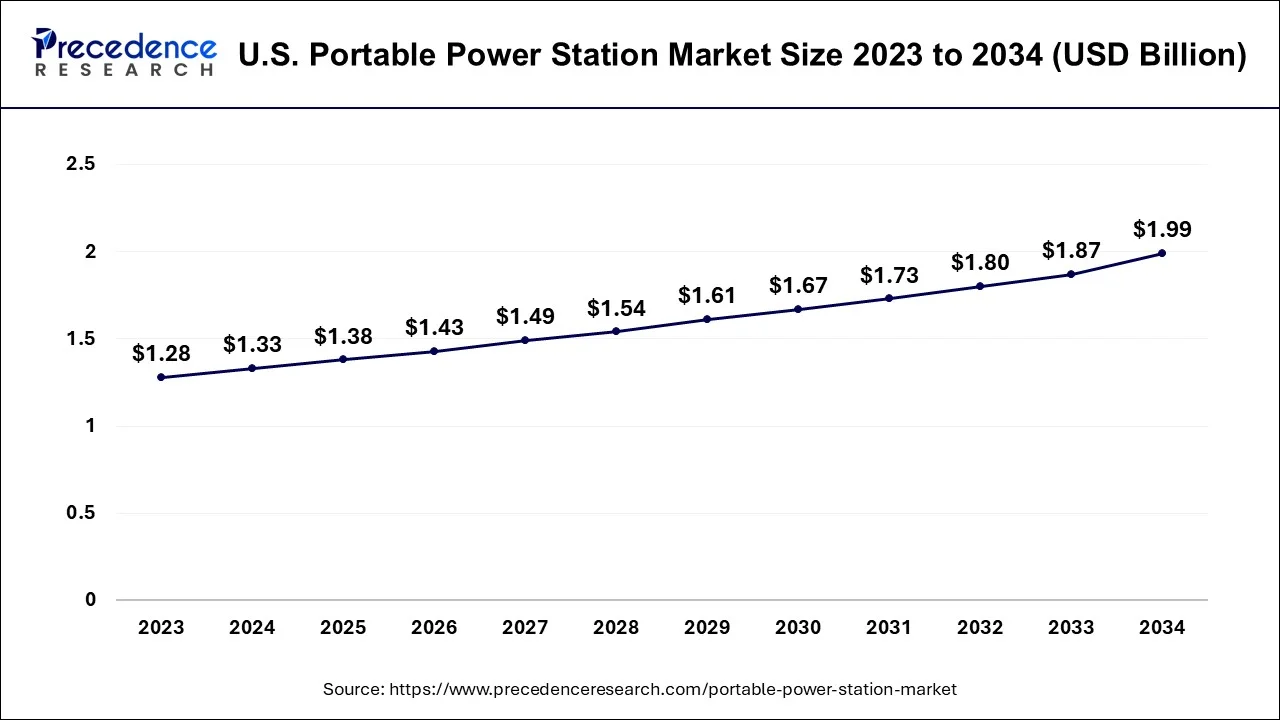

The U.S. portable power station market size is estimated at USD 1.33 billion in 2024 and is expected to be worth around USD 1.99 billion by 2034, rising at a CAGR of 4.11% from 2023 to 2034.

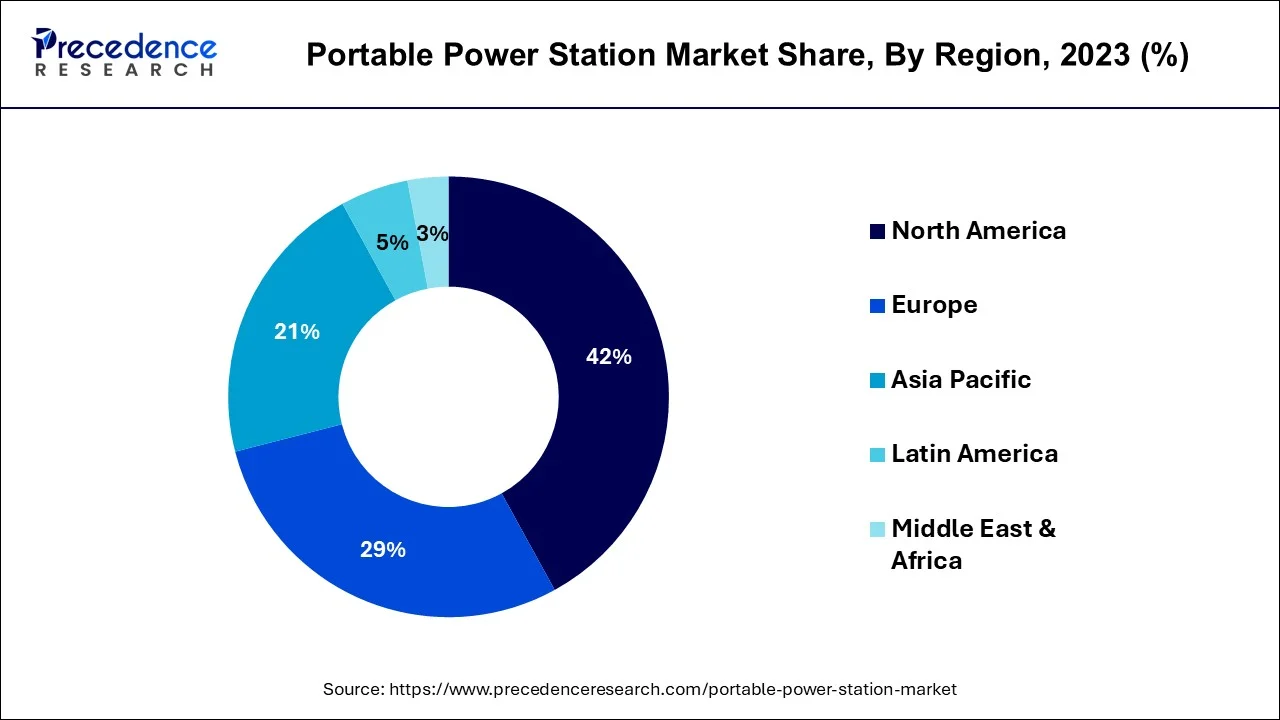

North America has held the largest revenue share of 42% in 2023. North America commands a significant share in the portable power station market due to several factors. The region's growing awareness of environmental sustainability has boosted the demand for clean energy solutions. Frequent natural disasters have increased the need for reliable backup power sources. High outdoor activity participation, including camping and RV travel, drives sales of portable power stations. Advanced battery technology and the popularity of electric vehicles have further bolstered the market.

North America's stable economy, tech-savvy consumer base, and robust e-commerce infrastructure have facilitated market growth, making it a dominant player in the global portable power station industry.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands a substantial share of the portable power station market for several reasons. First, the region experiences high demand for off-grid power solutions due to unreliable or limited access to electricity in many areas. Second, the increasing adoption of outdoor and recreational activities, coupled with a surge in natural disasters, fuels demand for these devices.

Additionally, Asia-Pacific hosts a significant manufacturing hub for portable power stations, resulting in competitive pricing. Finally, growing awareness of environmental sustainability and government initiatives promoting clean energy solutions have further boosted the market in the region.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.51 Billion |

| Market Size by 2034 | USD 6.61 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Outdoor activities

The portable power station market is experiencing notable growth, primarily due to the increasing popularity of outdoor recreation and camping activities. Outdoor enthusiasts are recognizing the value of portable power stations as reliable sources of electricity in remote settings. These devices provide power for lighting, cooking, charging electronic devices, and more, enhancing the overall camping experience. As people seek to stay connected and enjoy modern conveniences while spending time in nature, the demand for portable power stations has surged. Their portability, ease of use, and ability to charge essential gadgets have made them an essential camping accessory.

Limited energy capacity

The constrained energy storage capacity of portable power stations serves as a notable impediment to the market's expansion. These devices are engineered to be compact and easily transportable, which necessitates limitations in the volume of energy they can store. While they excel at charging small gadgets or powering low-energy appliances, their constrained capacity can pose challenges for applications demanding more substantial power reserves. Consumers with requirements for powering multiple appliances or sustaining power-hungry devices over extended durations might find the limited capacity of portable power stations to be a drawback.

This limitation becomes particularly acute during protracted power outages or when operating high-wattage equipment in remote, off-grid environments. The limitation of energy capacity also influences the suitability of portable power stations for specific industrial or commercial uses where a resilient and uninterrupted power supply is essential. Consequently, the key to broadening the market's potential and catering to the diverse energy requisites of consumers across various sectors lies in addressing these capacity constraints through innovations in battery technology and product design.

Expansion of renewable energy integration

The burgeoning integration of renewable energy sources presents a substantial window of opportunity within the portable power station market. In a world that cares more and more about using clean energy, portable power stations work really well with renewable sources, especially solar panels. This integration facilitates the efficient capture and storage of clean energy. The potential lies in positioning portable power stations as a pivotal link between renewable energy generation and immediate energy consumption. Users can harness solar power during daylight hours, store it within these stations, and then access it during nighttime or off-grid situations.

This dynamic proves particularly advantageous for outdoor excursions, events, and emergency power backup. It not only diminishes reliance on fossil fuels but also offers a mobile and environmentally responsible energy alternative. Furthermore, governmental incentives and environmental advocacy further encourage consumers to incorporate portable power stations into their renewable energy strategies. With the continued advancement of renewable energy technologies, the harmonious interplay between these technologies and portable power stations ushers in a realm of market expansion and innovation.

Impact of COVID-19

According to the type, the 501-1000Wh segment has held 44% revenue share in 2023. The 501-1000Wh segment holds a significant share in the portable power station market due to its versatile capacity. This range strikes a balance between portability and power output, making it ideal for a wide array of applications. It can efficiently charge multiple devices, run small appliances, and provide extended backup power during emergencies. This versatility caters to various consumer needs, from outdoor enthusiasts to those seeking reliable home backup solutions. It offers a sweet spot between capacity and portability, contributing to its prominent market share in meeting the diverse power requirements of users across different scenarios.

The more than 1500Wh segment is anticipated to expand at a significantly CAGR of 4.8% during the projected period. The more than 1500Wh segment holds a substantial growth in the portable power station market due to its capacity to cater to a broader spectrum of power-hungry applications. Users in need of prolonged and high-wattage power rely on these larger-capacity units for activities such as running appliances, medical equipment, and even small off-grid residences. The versatility and extended runtime these models offer make them an attractive choice, particularly in scenarios requiring continuous power supply and where smaller capacity units may fall short, solidifying their significant market growth.

Based on the application, the emergency power generator segment is anticipated to hold the largest market share of 48% in 2023. The emergency power segment dominates the portable power station market due to its critical role in ensuring a reliable backup power source during unforeseen outages and disasters. These versatile units offer a lifeline for charging essential devices, medical equipment, and sustaining communication in times of crisis.

The increasing frequency of natural disasters and a growing awareness of disaster preparedness have fueled the demand for emergency power solutions. Moreover, the COVID-19 pandemic heightened the need for home-based emergency power as remote work and online learning became prevalent, solidifying the emergency power segment's significant share in the portable power station market.

On the other hand, the automotive segment is projected to grow at the fastest rate over the projected period. The dominant growth of the automotive segment in the portable power station market can be attributed to its strong compatibility with electric vehicles (EVs). Portable power stations offer a practical and adaptable solution for EV users, facilitating on-the-go vehicle charging, especially in regions with sparse charging infrastructure.

This symbiotic relationship between portable power stations and EVs has significantly driven market expansion, coinciding with the continuous growth of the electric vehicle industry. Furthermore, the automotive sector's influence extends to the provision of power for an array of devices and tools during road journeys and outdoor adventures, underscoring its pivotal role in the portable power station market.

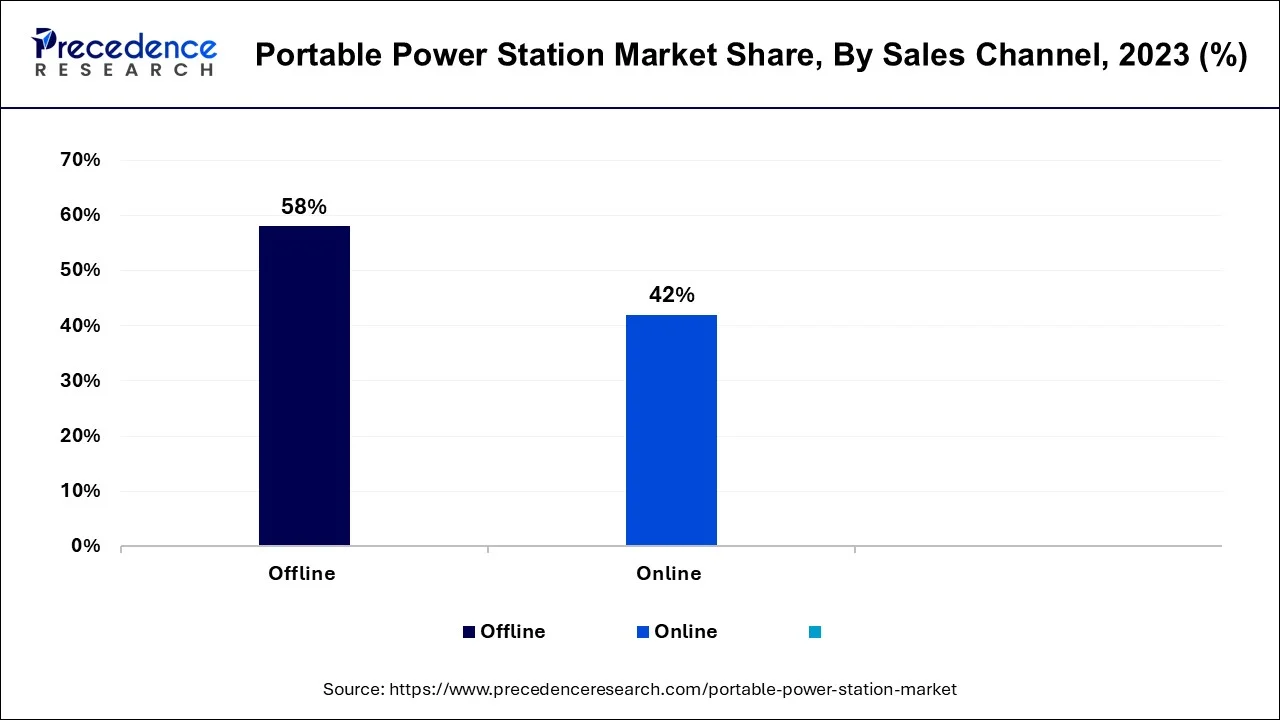

In 2023, the offline segment had the highest market share of 58% on the basis of the sales channel. The offline segment holds a major share in the portable power station market primarily due to the well-established network of brick-and-mortar retail stores, including electronics shops, home improvement centers, and department stores. Consumers often prefer to physically inspect and purchase these products, ensuring product quality and compatibility.

Additionally, in-store experiences allow potential buyers to receive expert advice and recommendations, instilling a sense of trust. As portable power stations are considered valuable investments, the offline segment capitalizes on this tactile and consultative approach, making it the dominant distribution channel, although the online segment is also growing rapidly.

The online segment is anticipated to expand at the fastest rate over the projected period. The online segment holds a major growth in the portable power station market due to several key factors. Online platforms offer consumers a wide array of product options, enabling easy comparison and research. This digital landscape fosters convenience, allowing users to make informed decisions.

Additionally, the online market provides access to a global customer base, eliminating geographical limitations. E-commerce platforms also offer competitive pricing, discounts, and user reviews, building trust and boosting sales. The rapid growth of online shopping, especially during the COVID-19 pandemic, has further propelled the dominant growth of the online segment in the portable power station market.

Segments Covered in the Report

By Type

By Application

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2024

August 2024

December 2024