February 2025

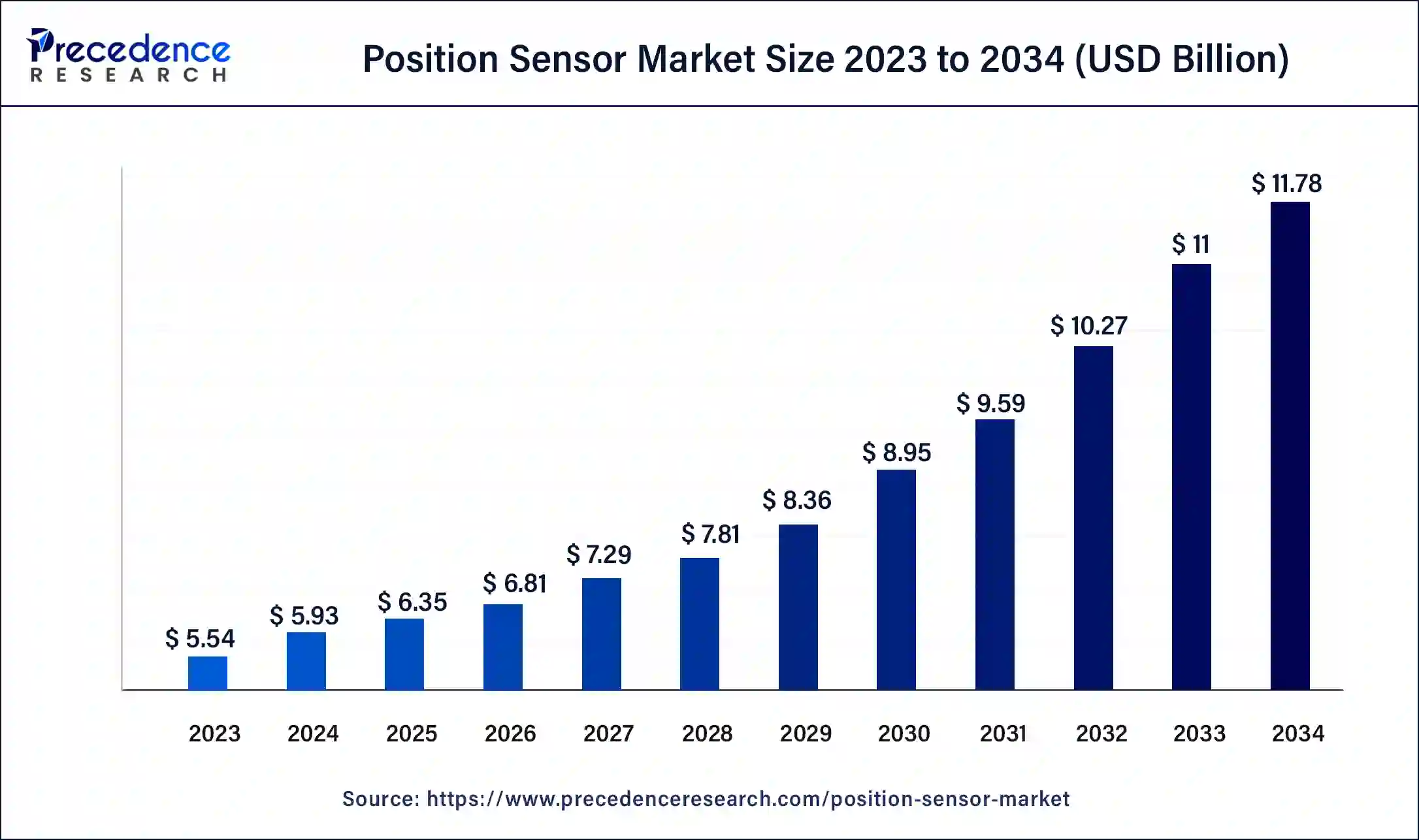

The global position sensor market size was USD 5.54 billion in 2023, calculated at USD 5.93 billion in 2024 and is expected to be worth around USD 11.78 billion by 2034. The market is slated to expand at 7.09% CAGR from 2024 to 2034.

The global position sensor market size is projected to be worth around USD 11.78 billion by 2034 from USD 5.93 billion in 2024, at a CAGR of 7.09% from 2024 to 2034. Rising trends towards automation in industries like automotive, packaging, military & aerospace, etc., contribute to the market’s growth.

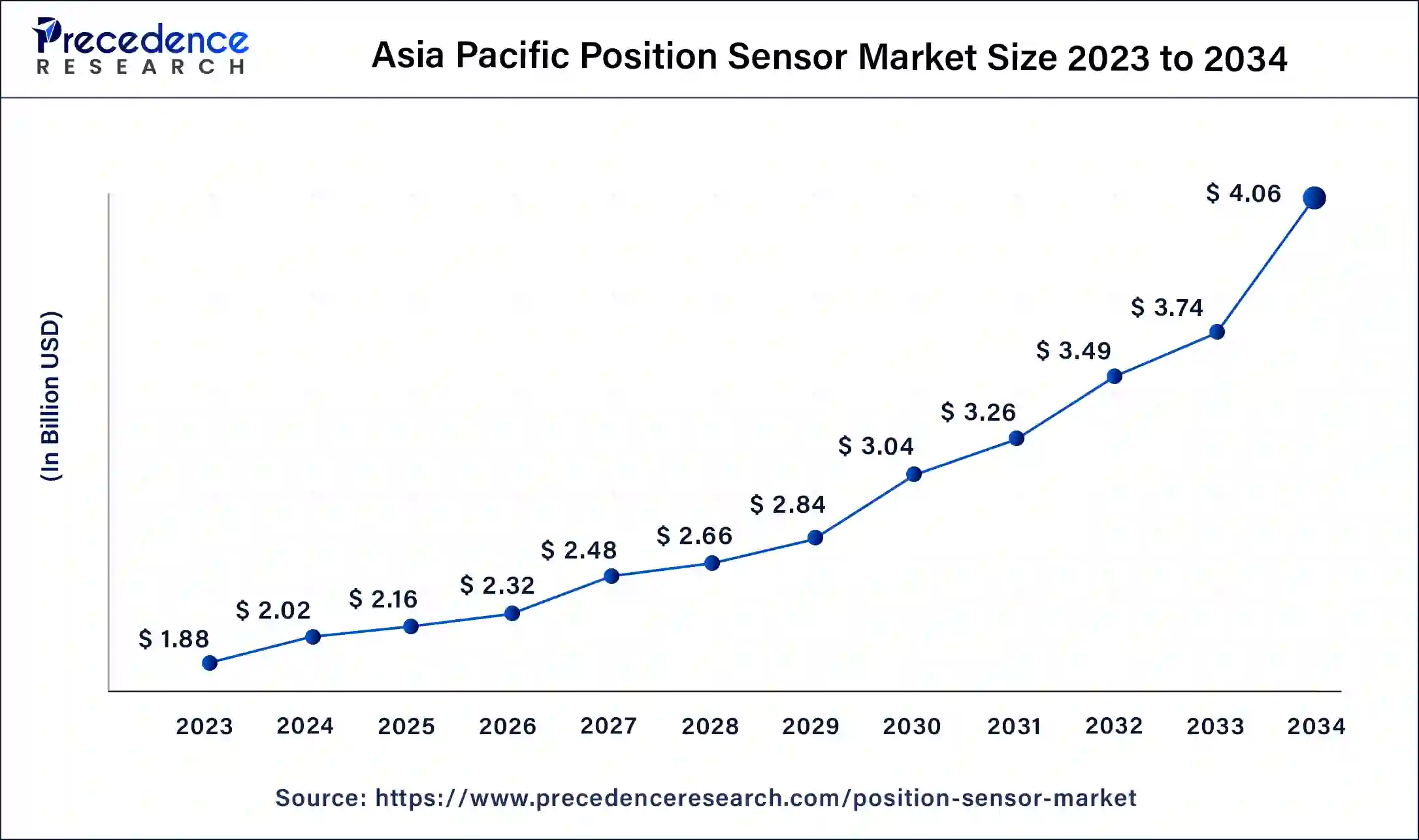

The Asia Pacific position sensor market size was exhibited at USD 1.88 billion in 2023 and is projected to be worth around USD 4.06 billion by 2034, poised to grow at a CAGR of 7.25% from 2024 to 2034.

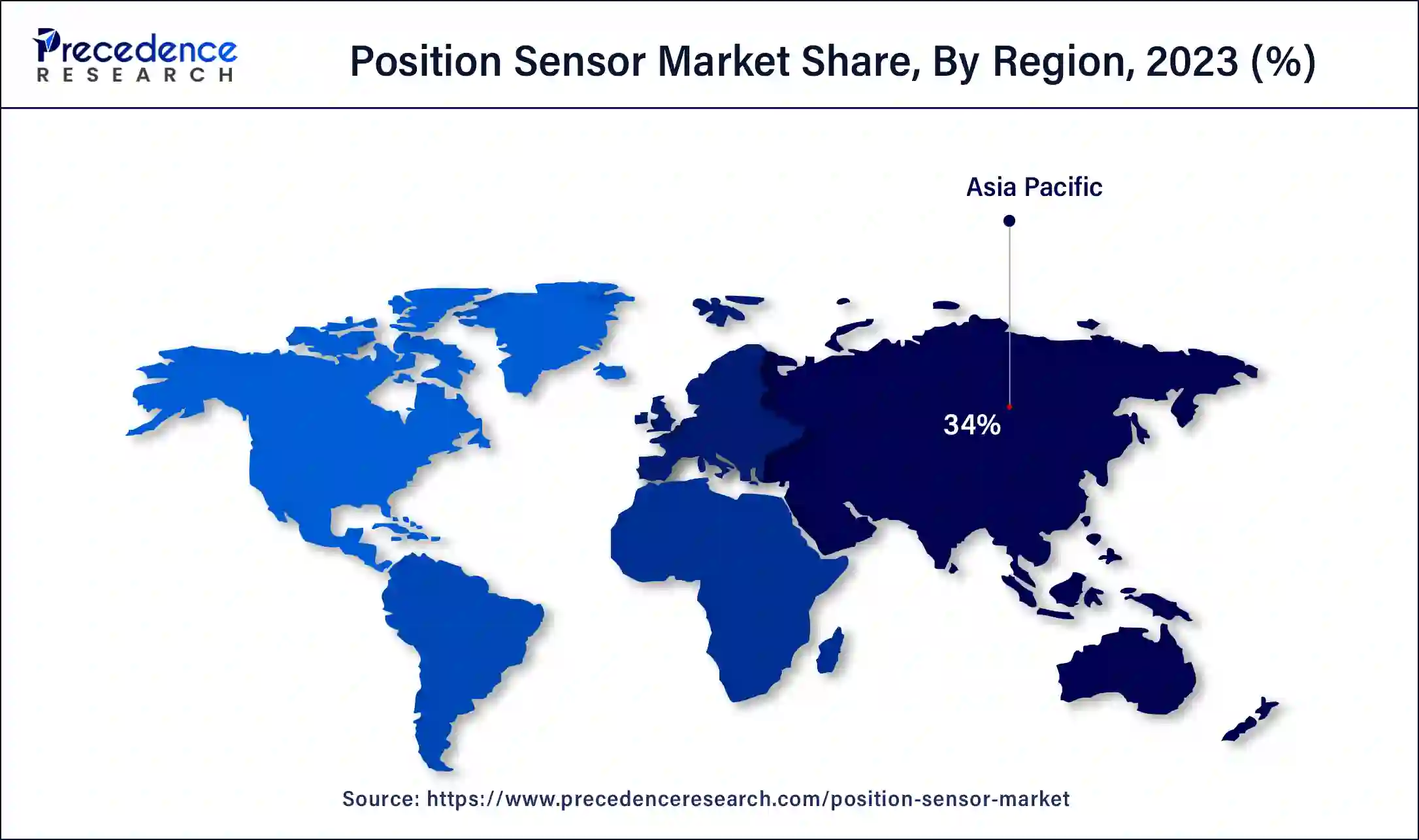

Asia Pacific dominated the position sensor market in 2023. Increasing industrial manufacturing and increasing industries for consumer electronics devices like laptops and smartphones in the Asia Pacific region are leading the market’s growth. Low cost of manufacturing, high quality, accuracy sensors, and equipment contribute to the growth of the market in the Asia Pacific region.

North America is estimated to be the fastest-growing during the forecast period of 2024-2034. There is increasing competition in the North American region as many key players are consistently coming up with cutting-edge products to develop industrial needs. The increasing trend towards wireless sensor technology adoption helps to the growth of the position sensor market.

The position sensor market refers to a position sensor service provider, which is an electrical device that measures position, distance, length, or displacement to monitor, test, or automate processes. A position sensor is a device that measures mechanical position. It may indicate the absolute location (position) or relative displacement (position) in terms of three-dimensional, linear travel, or rotational angle. The common types of position sensors include sensors that can detect the absence or presence of an object, proximity-type position sensors, and contact-type position sensors. These factors help to the growth of the market.

What are the benefits of AI in the Position Sensor?

The benefits of artificial intelligence (AI) in the position sensor include scalability, improved classification accuracy, greater situational accuracy, eliminated operated workload, and consistent, reliable operation. AI improves sensor systems. Advanced sensors are capable of multi-dimensional information detection, as well as the detection of the human brain, like a computation device for data processing.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.78 Billion |

| Market Size in 2023 | USD 5.54 Billion |

| Market Size in 2024 | USD 5.93 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.09% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for the automotive industry and the trend towards automation for production process

The rising demand for the automotive industry and the trend towards automation for production processes are driving the growth of the position sensor market. In the automotive industry, market benefits include high durability, precision, reliability, and non-contact measurement. They perform vehicle efficiency, performance, and safety by providing precision provisional data. Position sensors are essential components designed to measure the angles of engines, monitor the position of the motor, measure seat position, record clutch position, etc., contributing to the growth of the market.

Limitations of position sensors

The limitations of the position sensors can hamper the growth of the position sensor market. It includes limitations of high expenses for high precision and accuracy requirements, sensitivity to extreme temperatures, dust, and wear & tear, physical size limitations, less sensing angle, wear out because of moving parts, low repeatability, limited frequency, and low accuracy. The output signal created by the position sensor may be interrupted by magnetic and electrical materials.

Opportunities in the sensor technologies

The opportunities in the military & aerospace, and automotive industries contribute to the growth of the position sensor market. Sensor technologies are driving the future of electronics. The 5G-enabled sensors enhance data transmission, augmented reality sensors improve the user experience, biometric sensors improve authentication and security, AI-enabled sensors contribute to new opportunities, wearable sensors allow healthier lives, smart sensors generate new applications, and IoT-enabled sensors demand continues to rise.

The proximity sensors segment dominated the position sensor market in 2023. Proximity sensors are highly used in manufacturing and industrial applications, mainly in the areas of safety and stock management. It is used for object placement, inspection, counting, and identification in an automated production line. These are also used for consumer electronics. The features of only metal detection are short sensing range, long life, short response time, high precision, usability in severe environments, and non-contact detection.

The proximity sensor advantages include being helpful in many security problems; in terms of power usage, a capacitive sensor is helpful, has power consumption and low cost, operates in critical environmental conditions, has a high switching rate and high speed, has good stability, and also it can detect metals and also non-metals. Applications of proximity sensors include agriculture food manufacturing and processing, level detection, process control, quality assurance and inspection, transportation, logistics, supply chain, and standard object position detection.

The photoelectric sensors segment is expected to be the fastest-growing during the forecast period. The photoelectric sensor emits light from the transmitter, which consists of light-emitting elements.

The types of photoelectric sensors include diffusive sensors, retro-reflective sensors, and through-beam sensors. The photoelectric sensor features include simple optical axis adjustment and wiring. It is not affected by object inclination, color, or gloss and is easy to adjust. The long life of sensors and no contact with objects reduces chances of physical damage, has a high resolution, has a fast response time, and can detect any object, including liquid, wood, plastic, or glass, and long sensing distance.

The automotive segment dominated the position sensor market in 2023. The position sensors are important components designed to measure the angle of the engines, monitor the motor position, measure seat position, record clutch position, select the gear position, the pedal position of the accelerometer and brakes, track the steering wheel angle, and check the level of fuel. It is used for steering angle detection, brushless motor control, fuel injection, ignition timing, low noise measurement, resilience to shock and vibration, high linearity, and no hysteresis, measuring motor position, seat position, clutch position, gear position, brake pedal position, steering wheel angle, fuel level, and throttle angle.

The automotive, electronics & semiconductors sectors segment is anticipated to be the fastest-growing during the forecast period. Position sensors in automotive, electronics & semiconductors sectors applications offer many benefits, including use for steering angle detection, brushless motor control, fuel injection, ignition timing, etc. In electronics, position sensors are used to provide counting, motion control, and encoding tasks by determining the absence or presence of a target or by detecting its distance, motion, speed, or direction. It also includes the benefits of the potentiometric sensors being highly accurate and inexpensive; optical sensors have high resolution and are highly accurate, which helps to position sensor market growth.

Segments Covered in the Report

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

October 2024

January 2025