May 2024

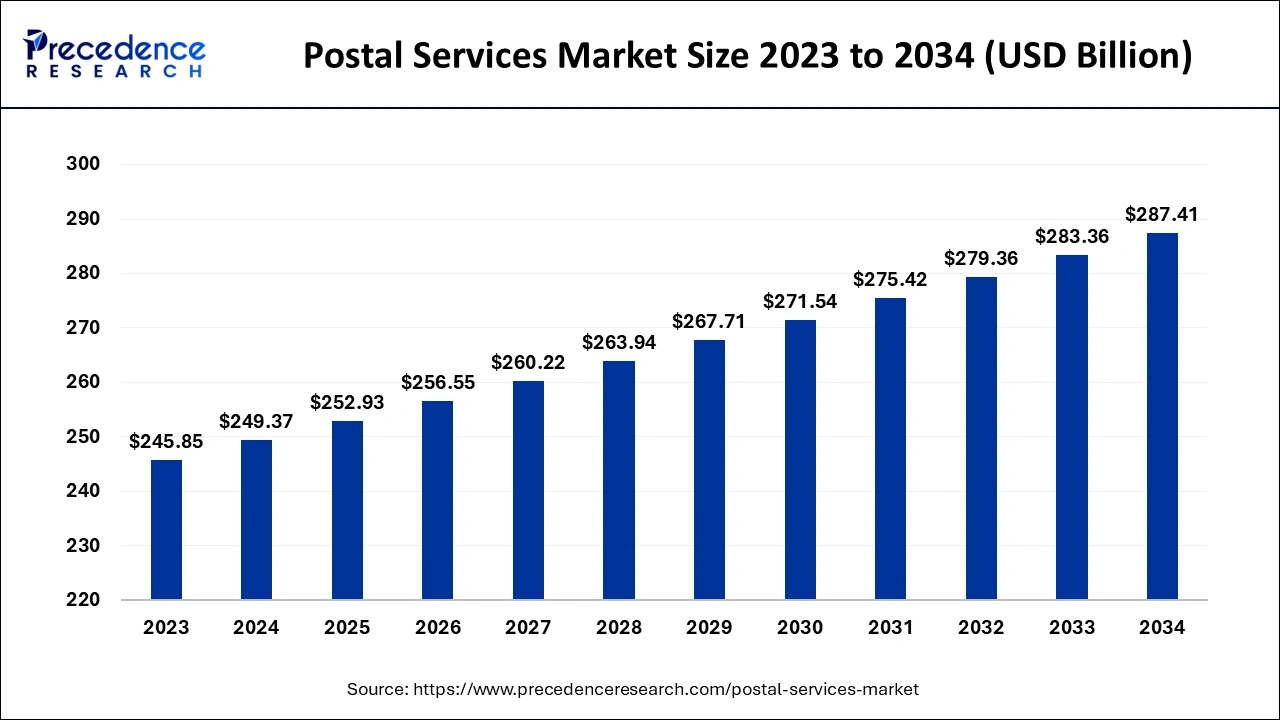

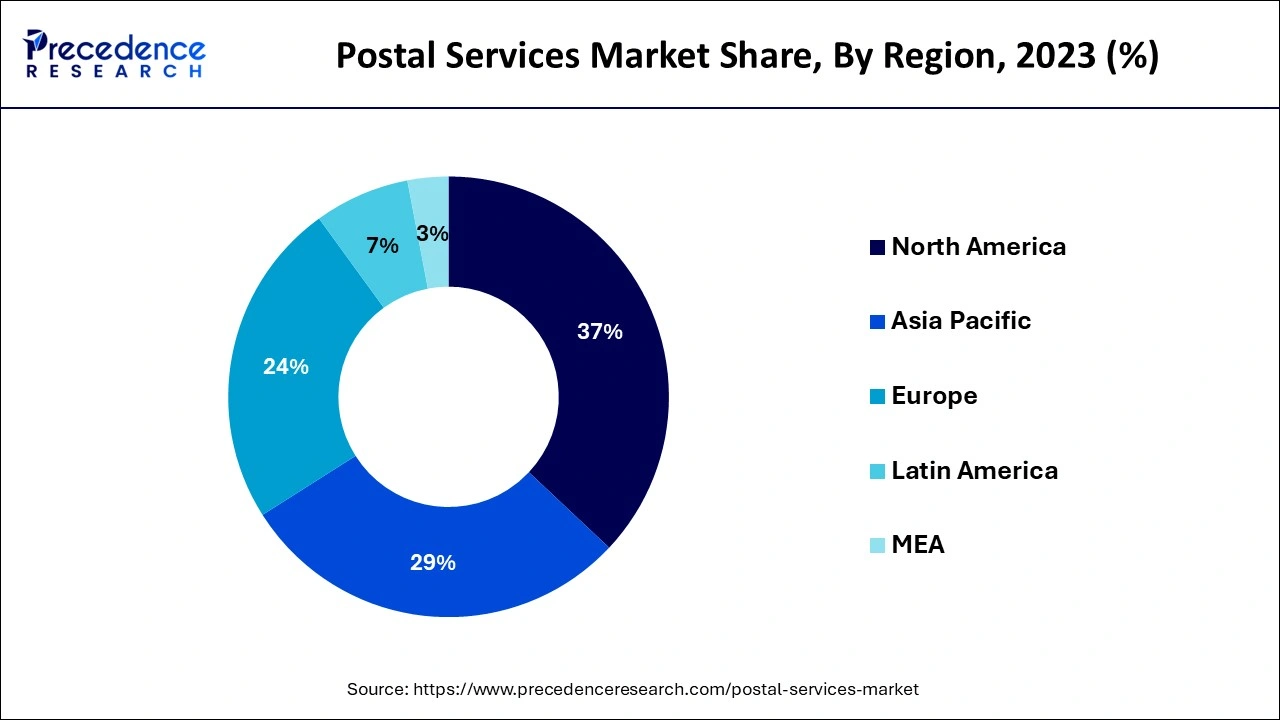

The global postal services market size is calculated at USD 249.37 billion in 2024, grew to USD 252.93 billion in 2025 and is predicted to hit around USD 287.41 billion by 2034, expanding at a CAGR of 1.43% between 2024 and 2034. The North America postal services market size is evaluated at USD 92.27 billion in 2024 and is expected to grow at a CAGR of 1.55% during the forecast year.

The global postal services market size is worth around USD 249.37 billion in 2024 and is anticipated to reach around USD 287.41 billion by 2034, growing at a CAGR of 1.43% from 2024 to 2034. The postal services market growth is attributed to the increasing demand for faster and more efficient delivery solutions.

Artificial intelligence is facilitating the postal services market by providing a new tool that improves the speed and accuracy of functioning. Automated means ensuring that delivery routes are efficient and that transit time and fuel costs are minimized. Demand forecasting is improved by predictive analytics as postal companies deal with the management of resources. Computer programs improve efficiency in sorting through packages and optimize procedures necessary to manage many packages. Chatbots and virtual assistants enhance customer relations since they offer real-time tracking information and respond to queries on motor vehicle tracking systems promptly.

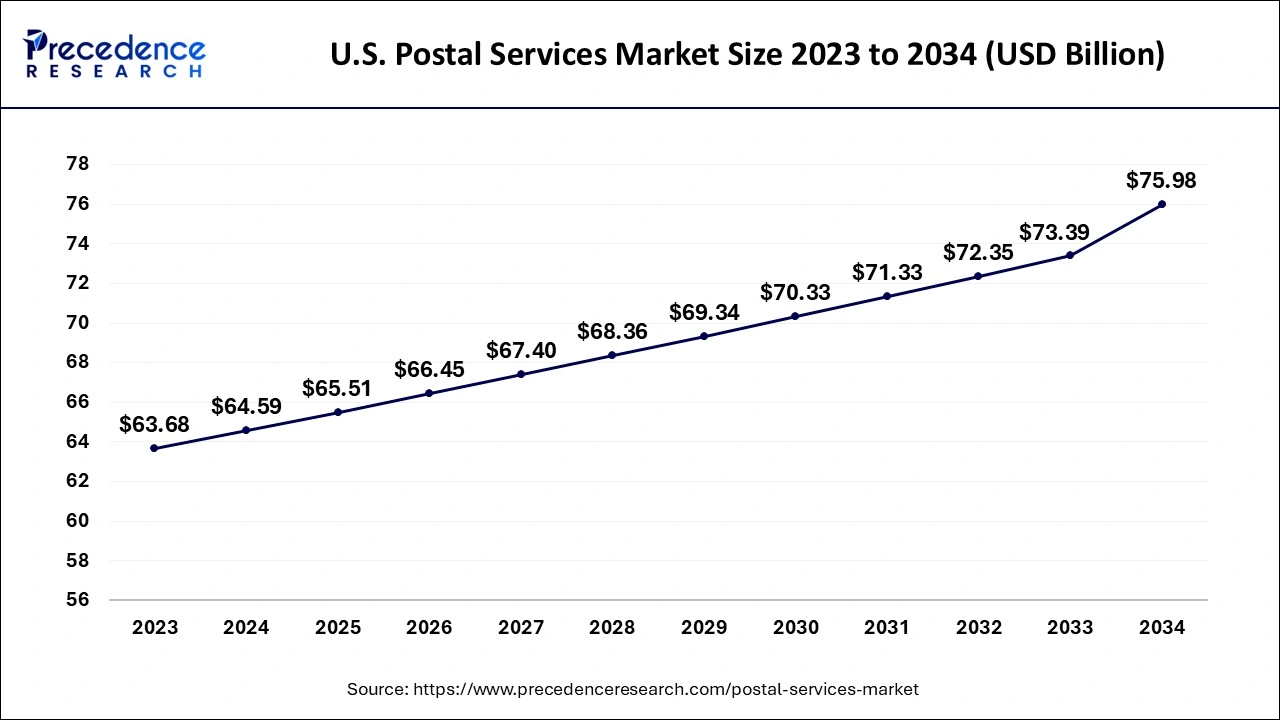

The U.S. postal services market size is exhibited at USD 64.59 billion in 2024 and is projected to be worth around USD 75.98 billion by 2034, growing at a CAGR of 1.62% from 2024 to 2034.

North America dominated the global postal services market in 2023. USPS, UPS, and FedEx private carriers have also been experiencing a rise in revenue out of parcels, especially with the coronavirus outbreak. North American area is expected to sustain growth, particularly as the commercial industry rolls out sustainable delivery models, including electric cars and drones. Additionally, the growth of the urban micro-fulfillment canters, including the increase in delivery availability times.

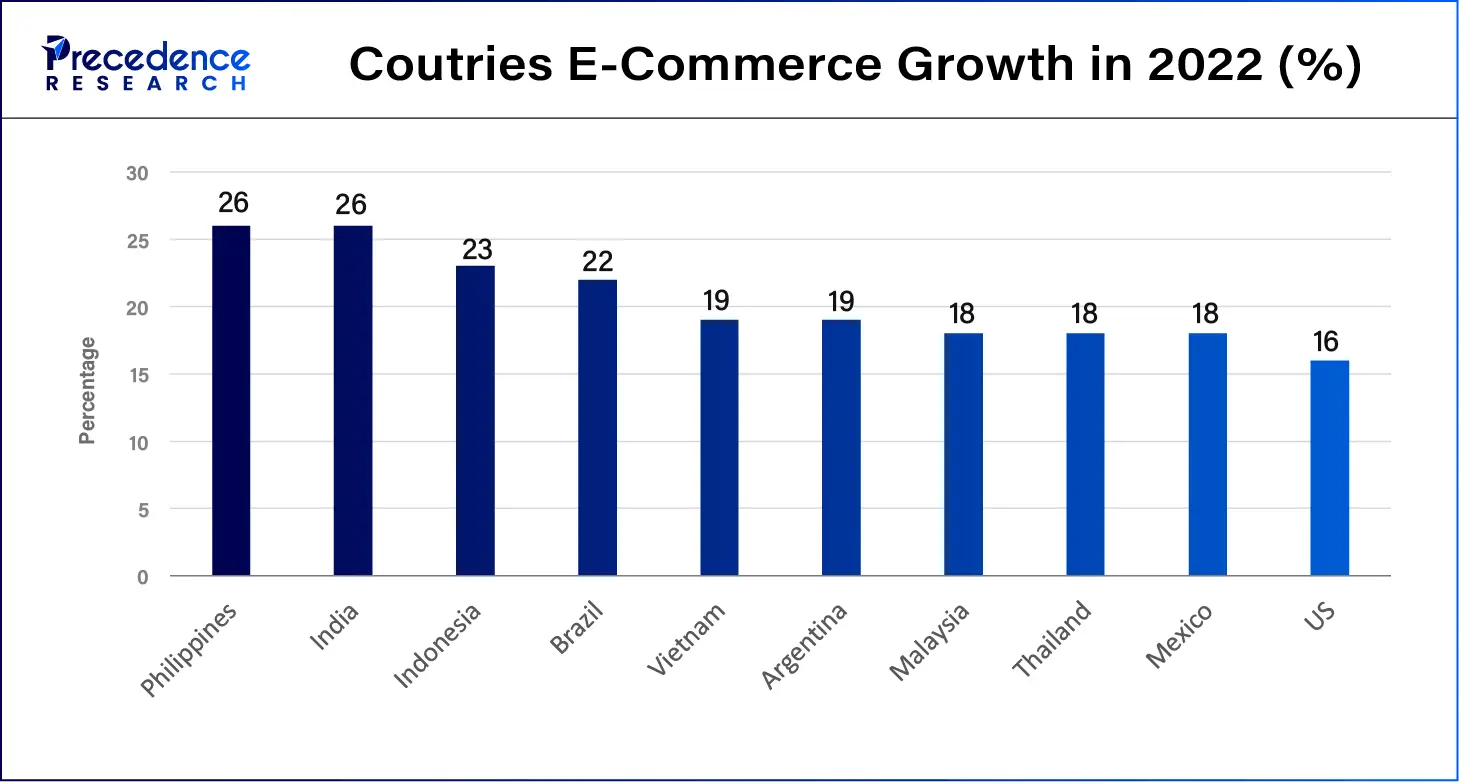

Asia Pacific is projected to host the fastest-growing postal services market in the coming years, owing to the increasing spending on internet-based purchases and enhancing infrastructure in some of the major international countries, including China, India, Japan, and South Korea. The growth of internet use and access to smartphones increased the opportunities for online buying, which affected the needs of the postal services, particularly on parcel delivery. Rising cross-border e-commerce in countries such as China, which is among the world’s largest exporters, has also facilitated the postal services sector. Furthermore, the middle-income class is rising, and the adoption of technologically integrated supply chain solutions is rising.

Growing e-commerce is expected to facilitate the global postal services market in the coming years. Factors such as an increase in e-commerce activity, especially in countries including China, India, and the U.S., have made the post services adopt measures that meet the need for efficiency in last-mile delivery. Moreover, shorter final delivery is achieved through smart technologies, including drones and self-driving vehicles.

| Report Coverage | Details |

| Market Size by 2034 | USD 287.41 Billion |

| Market Size in 2024 | USD 249.37 Billion |

| Market Size in 2025 | USD 252.93 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 1.43% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Service, Destination, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing e-commerce activities

Increasing e-commerce activities are projected to drive growth within the postal services market. E-commerce business is expected to grow tremendously in 2023 and 2024 as more and more consumers shift towards online shopping and improved delivery. The UPU points out that postal networks delivered unprecedented parcel traffic last year, demonstrating an increasing dependence on the last-mile delivery infrastructure.

Furthermore, the WEF states that omnichannel initiatives, such as hybrid delivery methods, are changing the supply chain since e-commerce ecosystems adjust to high customer demand. The growing e-commerce trend in the period of 2020-2024 is further propelling the postal services market in the coming years.

Increasing operational costs

Rising operational costs are anticipated to hamper the growth of the postal services market. The cost of labor has been pushed high, especially in developed countries, due to efforts applied by delivery firms to retain employees due to increased wage expectations. The adoption of hi-tech features, such as automation and real-time tracking while enhancing the performance, exacts high set-up costs as well as charging high maintenance. Additionally, these compounding factors relating to the operation of post and courier services affect profit margins and hinder the expansion of small-scale postal service providers.

High demand for last-mile delivery solutions

Increasing reliance on e-commerce platforms is anticipated to create immense growth avenues in last-mile delivery services and the postal services market. Furthermore, the need for improved last-mile delivery solutions further boosts the market for advanced and last-mile reaching postal services to cater to growing e-commerce shopping.

E-commerce activities and postal services growth (2023–2024)

| Metric | Year | Value |

| U.S. e-commerce retail sales growth | 2023 | 9.8% increase in Q1 |

| Parcel volumes handled by postal services | 2023 | Record-breaking levels |

| Mobile commerce share of global traffic | 2023 | Over 70% of e-commerce traffic |

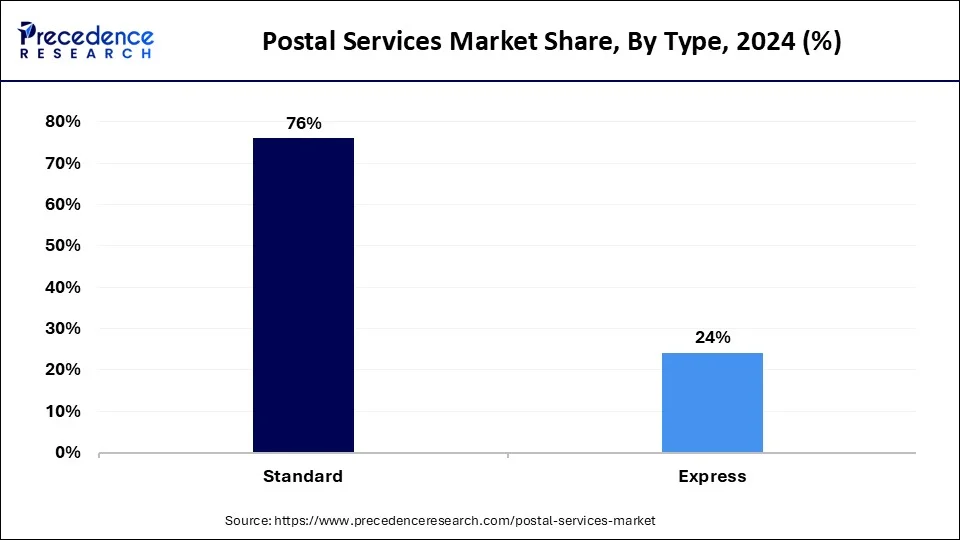

The standard segment held a dominant presence in the postal services market in 2023; as the shift to e-commerce continues, consumers and businesses have increasingly selected cheaper, less urgent modes of transportation. The growth of e-commerce around the world is expected to continue to cause consistent growth for standard deliveries in developing nations where customers demand faster delivery services for less than the value of the service. According to the Universal Postal Union (2023), nations such as India and Brazil have experienced a gradual but steady increase in the demand for standard posts, with more and more customers opting for online purchasing. Furthermore, the standard segment receives increased delivery infrastructure largely through higher levels of sortation and routing.

The express segment is expected to grow at the fastest rate in the postal services market during the forecast period of 2024 to 2034, owing to the growing consumer demand for improved and faster deliveries by delivery companies. The uptake of the segment was common within the developed region, mainly driven by giant firms, such as Amazon and DHL, venturing into express logistics. They aim to cater to the growing need for same-day or next-day delivery. Furthermore, the an increase in demand for express delivery across the world, especially in high-density urban areas.

The shipping & package services segment accounted for a considerable share of the postal services market in 2023 due to the growing e-commerce sectors. Small and medium-sized parcel delivery companies experienced increased growth in business, especially in the year 2023, as people embraced e-commerce. This segment is expected to maintain its supremacy as e-commerce giants emerge across the world and buyers seek faster and more reliable delivery services. Furthermore, e-commerce firms such as Amazon and Alibaba have invested in increasing their delivery channels to cover increasing delivery volumes.

The first-class mail segment is anticipated to grow with a significant CAGR in the postal services market during the studied years, owing to its dependability and short transit time when delivering sensitive documents. Despite certain erosions from digital communication substitutes, letter segments appeared indispensable for bills, official correspondence, and legal notices. Healthcare, banking, and law firms are examples of businesses that still extensively rely on first-class mail, something that assures consistent business.

The domestic segment led the global postal services market in 2023 due to the escalating volume of sales made through e-commerce platforms and the rapid and expanding demand for efficient and national delivery services. The consumer durables goods segment has greatly benefited from increased demand brought about by the growth of online businesses and the trend of carrying out cross-border deliveries in a shorter time. Furthermore, the increasing demand among people for faster delivery and cheaper delivery services.

The international segment is projected to expand rapidly in the postal services market in the coming years, owing to the increase in Internet sales and international commerce. The use of mail and parcel services is set to remain on an upward slope as the globe becomes connected and the materials that require cross-border delivery are delivered faster. Additionally, there was an increase in free trade relations and decreased physical hurdles in international shipping.

By Type

By Service

By Destination

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

July 2024