January 2025

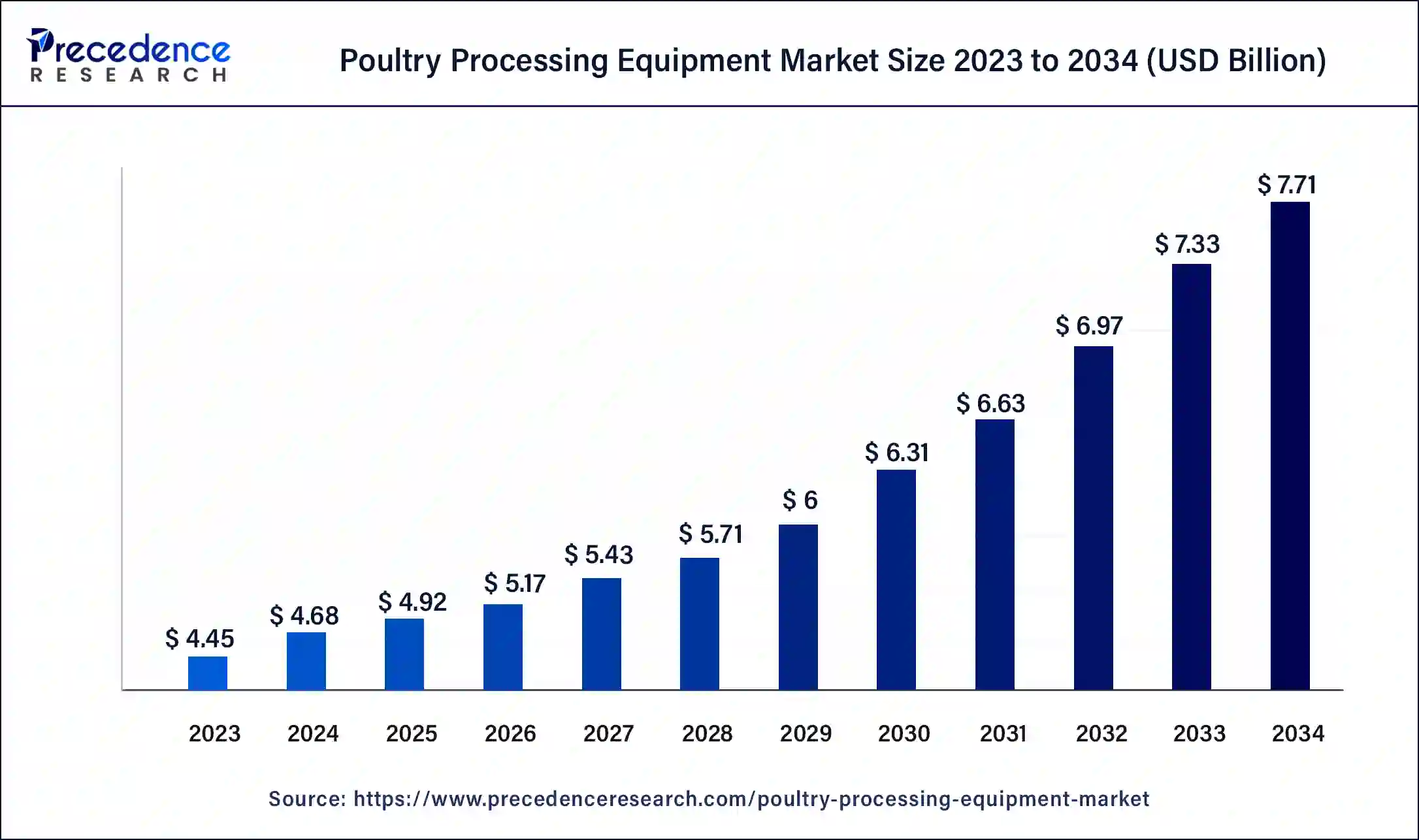

The global poultry processing equipment market size was USD 4.45 billion in 2023, calculated at USD 4.68 billion in 2024 and is expected to be worth around USD 7.71 billion by 2034. The market is slated to expand at 5.12% CAGR from 2024 to 2034.

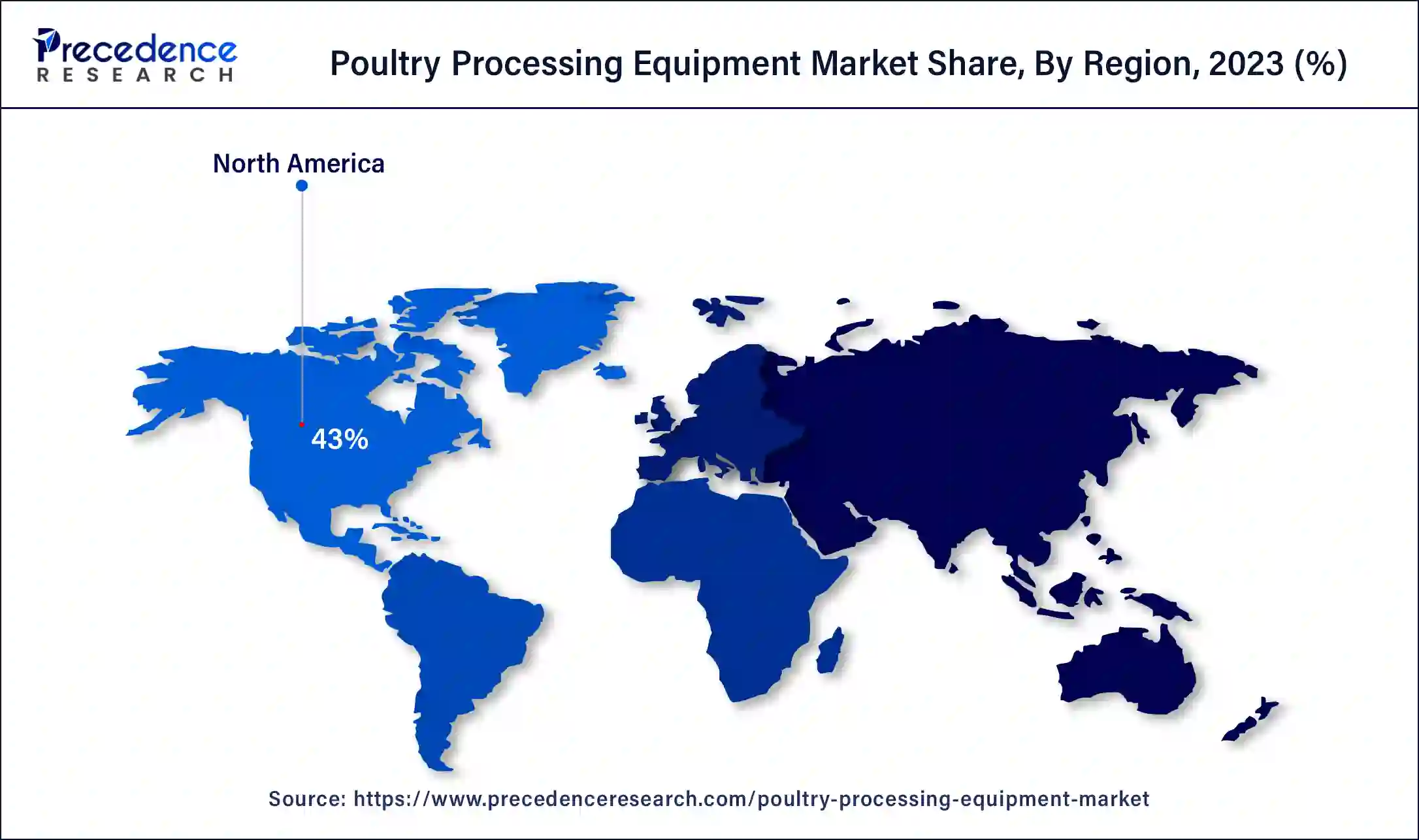

The global poultry processing equipment market size is projected to be worth around USD 7.71 billion by 2034 from USD 4.45 billion in 2024, at a CAGR of 5.12% from 2024 to 2034. The North America poultry processing equipment market size reached USD 1.91 billion in 2023. The growing production and consumption of poultry meat across the globe is a key factor driving the poultry processing equipment market growth.

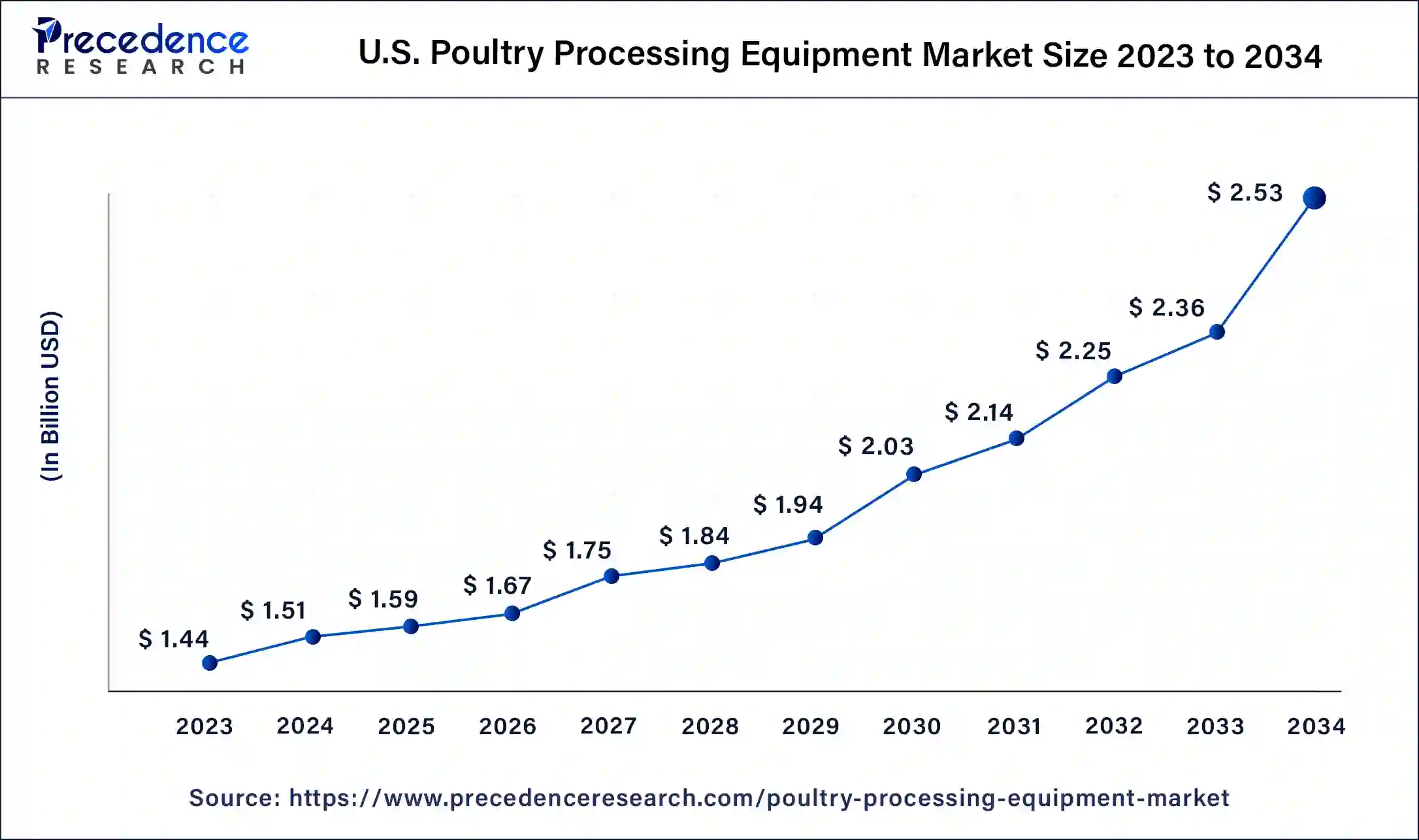

The U.S. poultry processing equipment market size was exhibited at USD 1.44 billion in 2023 and is projected to be worth around USD 2.53 billion by 2034, poised to grow at a CAGR of 5.25% from 2024 to 2034.

North America dominated the poultry processing equipment market in 2023. The rise in government support for the growth of the market in the region shows the strong influence on the North America poultry processing equipment market. The United States holds the largest market share in this region. This is due to the growing need for processed chicken products and the presence of top poultry processing equipment producers. Moreover, changing lifestyles and dieting habits in the U.S. have also led to growing consumption of processed chicken products in the region.

Asia Pacific is anticipated to grow at the fastest rate in the poultry processing equipment market during the projected period. In the region, China shows the fastest growth because of the increasing manufacturing and consumption of poultry meat products, government support, and the growing adoption rate of innovative processing technologies. Furthermore, the population of China is expanding at a rapid pace. Which directly affects the demand for poultry products in the region.

The global poultry processing equipment market is an industry that manages the production, manufacturing, and distribution of equipment utilized in the processing of poultry products. This instrument is also used to process different poultry products, like turkeys, ducks, chickens, and geese, which go from numerous steps of the e-processing cycle, from slaughtering to packaging and preservation. The market includes an extensive range of machinery, such as evisceration machines, slaughter equipment, de-feathering machines, and packaging equipment. The equipment utilized in poultry processing is created to maximize efficiency, safety, and hygiene throughout the processing of poultry products by maintaining the freshness and quality of the product as well.

Role of AI in the Poultry Processing Equipment Market

AI can help the poultry processing equipment market to adjust animal welfare, environmental impact, and production efficiency. AI can speed up breeding processes and automate tasks like controlling incubation and egg grading. Furthermore, AI algorithms analyze plenty of data gathered from poultry farms, which includes feed consumption, bird health metrics, environmental conditions, and production yields. By processing this data, artificial intelligence (AI) can detect anomalies, predict trends, and optimize different aspects of production for greater efficiency.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.71 Billion |

| Market Size in 2023 | USD 4.45 Billion |

| Market Size in 2024 | USD 4.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing preference for flavored products

Customers' rising preference for umami-flavored products is anticipated to boost market growth in the upcoming years. Customers' rising health awareness is linked to their willingness to eat a high-quality meat meal containing antibiotics and growth hormones, which is estimated to drive the sales of poultry products. Additionally, the various health advantages associated with the consumption of these products can propel the growth of the poultry processing equipment market further.

In February 2024, a Canadian-owned QSR chain, Mary Brown’s (MB) Chicken, launched in the UK market, with plans for rapid expansion with a select group of franchise partners. The chain is known for its Signature Chicken, Taters, Big Mary chicken sandwich, and its popular Tater Poutine, which combines hand-cut, breaded, and fried potatoes smothered in gravy and cheese.

Lack of technological awareness

Developing economies where costly processing equipment is hard to obtain can play a key market restriction factor. The advancements in the processing equipment market are anticipated to be constrained by a lack of technological awareness and advances in the local market. Moreover, increasing raw material prices can further affect the poultry processing equipment market expansion.

Technological advances in meat and poultry processing equipment

The food industry's shifts towards more organized supermarkets and hypermarkets have substantially impacted the poultry processing equipment market. Tumbling and evisceration machinery are also essential for poultry. Meat quality is a key priority in the industry, and this can lead to the increased use of automated processing machines. Poultry slaughtering, de-feathering, de-boning, and cut-up machines are important machinery in this field. Also, the trends in the HoReCa sector veganism can impact market expansion further.

The poultry slaughtering equipment segment dominated the poultry processing equipment market in 2023. The growth of the segment can be linked to the growing adoption of these machines across industries. Also, the requirements for semi-automated slaughtering equipment are ready to increase as they are advantageous for many small slaughterhouses by making faster and more precise deliveries. Slaughtering equipment improves the quality, appearance, and marketability of the product, which can help further expand the segment.

The de-feathering equipment segment will show the fastest growth in the poultry processing equipment market over the projected period. This equipment is increasingly used to slaughter and de-feather chickens, ducks, and turkeys. These machines also help key players to increase productivity and lessen the risk of injuries to workers. These factors collectively can contribute to the segment's expansion during the forecast period.

The offline segment dominated the poultry processing equipment market in 2023. The expanding food service industry is the key factor driving the segment's growth. Many consumers across the globe have started trying new foods that have been invented and tested by various offline channels. Moreover, the presence of a wide range of poultry products in offline channels gives freedom of choice to the consumers, which can directly affect the growth of the segment.

The chicken processing segment led the poultry processing equipment market in 2023. The growth of the segment is attributed to the rising demand for chicken meat along with the necessity for efficient and cheap poultry processing equipment. Chicken is a common poultry type consumed across the globe due to its high nutritional content and low cost. It is also utilized to make different types of dishes. Also, chicken meat has its unique versatility, flavor, and texture. Which can fuel the segment's growth shortly.

Top Chicken Consumers Country in 2022

| Country | Chicken Consumption 2022 (metric Tonnes) |

| China | 24,436 |

| United States | 18,111 |

| Brazil | 10,131 |

| Russia | 4,953 |

| Mexico | 4,950 |

| India | 4,946 |

| Indonesia | 4,077 |

| Japan | 3,458 |

| Egypt | 2,64 |

| United Kingdom | 2,397 |

The turkey processing segment is expected to grow at the fastest rate in the poultry processing equipment market during the forecast period. The growing need for flavored and standard food products, such as sausages, can drive the segment's growth. However, the increasing demand for a protein-based diet with a growing number of meat eaters across the globe are key factors driving the segment's growth throughout the forecast period.

Segments Covered in the Report

By Product Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

February 2025