September 2024

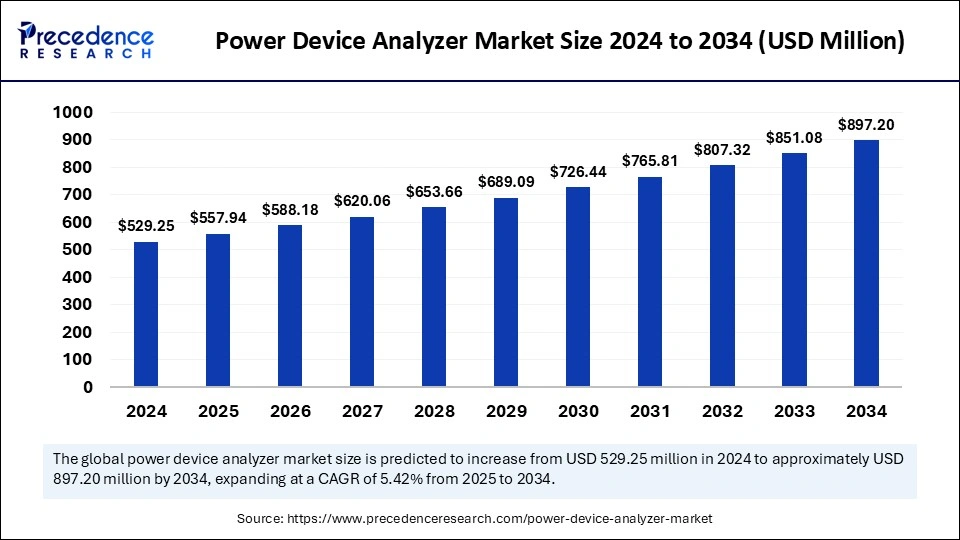

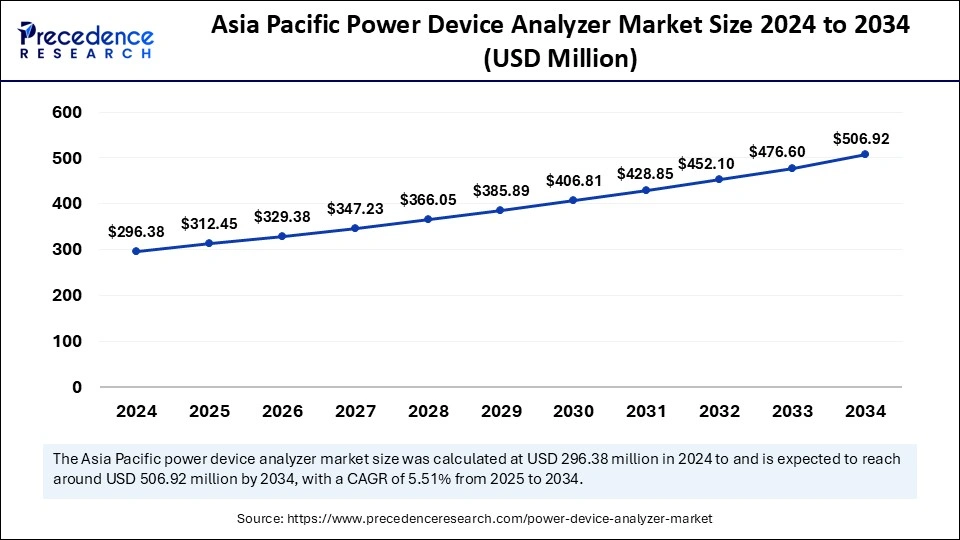

The global power device analyzer market size is calculated at USD 557.94 million in 2025 and is forecasted to reach around USD 897.20 million by 2034, accelerating at a CAGR of 5.42% from 2025 to 2034. Asia Pacific market size surpassed USD 296.38 million in 2024 and is expanding at a CAGR of 5.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global power device analyzer market size was estimated at USD 529.25 million in 2024 and is predicted to increase from USD 557.94 million in 2025 to approximately USD 897.20 million by 2034, expanding at a CAGR of 5.42% from 2025 to 2034. The increase in production and adoption of consumer electronics majorly drives the growth of the power device analyzer market.

Artificial Intelligence is playing an important role in revolutionizing the landscape of many industries. AI and Machine Learning algorithms can analyze huge amounts of data from power device analyzers to identify and detect patterns that can help in making informed decisions. Manufacturers of power analyzer devices can benefit from the adoption of AI technology. The AI-driven tools can help optimize operational processes, streamline production, perform predictive maintenance, and maintain consistency in quality. Integrating AI algorithms into these devices can open up new avenues of applications. With AI technology, these devices can help improve the reliability and efficiency in detecting faults and managing energy. In addition, AI can enhance the accuracy and precision of power device analyzers, reducing energy waste.

Asia Pacific power device analyzer market size was exhibited at USD 296.38 million in 2024 and is projected to be worth around USD 506.92 million by 2034, growing at a CAGR of 5.51% from 2025 to 2034.

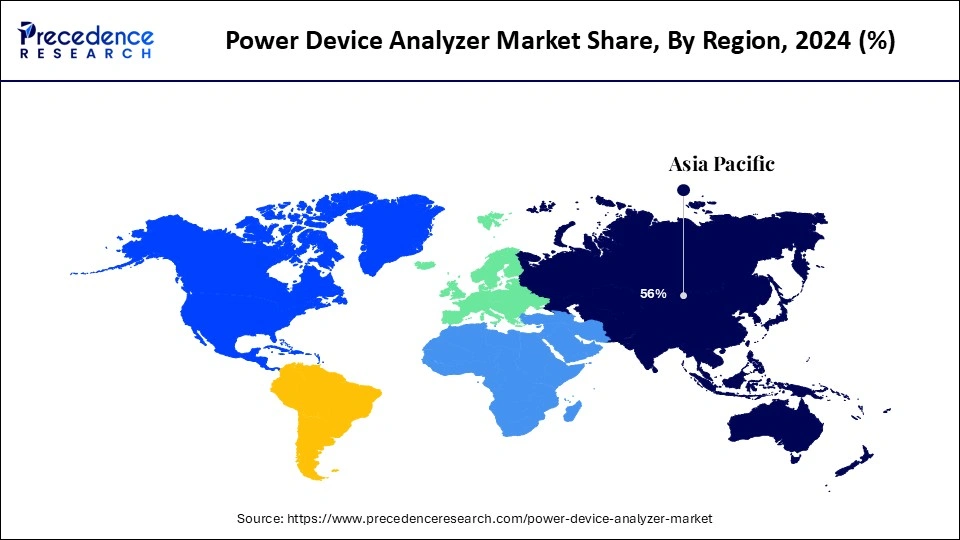

Asia Pacific dominated the power device analyzer market with the largest share in 2024. This is mainly due to the increased production of electronic devices. The rapid pace of industrialization further supported the region’s dominance. This region has become a prominent hub for industrial production, with countries like China, South Korea, and India leading the way. There is a robust automobile industry, boosting the production of electric vehicles. Moreover, there are stringent regulations and policies that promote energy efficiency, contributing to regional market growth.

India and China are major contributors to the Asia Pacific power device analyzer market. The Indian government is constantly making efforts to promote renewable energy. A rise in disposable income, awareness about sustainable practices, and a rapid shift toward renewable energy sources are boosting the growth of the market in India. Moreover, China is the world’s largest producer of vehicles, boosting the adoption of power device analyzers in the automotive industry. Countries like China, Japan, South Korea, and Taiwan are the largest producers of electronics, supporting market expansion in the region.

North America is projected to witness the fastest growth in the market in the coming years. The presence of well-established industries and leading automakers in the region is a key factor supporting the growth of the market in the region. There is a strong emphasis on energy efficiency to reduce carbon emissions. Thus, various industries are using power analyzers to optimize energy consumption. Well-known automotive companies like Tesla, Volkswagen, and BMW have manufacturing plants in North America that create lucrative growth opportunities in the market. The rising development of smart grid infrastructure also contributes to regional market growth since smart grids require power analyzers for monitoring power quality and fluctuations to avoid downtime.

Europe is expected to witness noticeable growth throughout the forecast period. There is a rapid shift toward renewable energy, which is a major factor driving the growth of the market in the region. The European government has implemented stringent regulations to reduce carbon emissions, prompting manufacturing industries to prioritize energy efficiency to reduce environmental impact. Moreover, European countries are investing heavily in smart grid infrastructure, requiring power analyzers for grid management.

A power analyzer is utilized to measure the flow of power in an electrical system. This means the rate of electrical transferal between a sink and a power source. The measurement of power flow is an important aspect. These analyzers are widely used to measure the power flow in direct current (DC) systems or alternating current (AC) systems. The rising demand for power for various purposes is a key factor boosting the growth of the power device analyzer market. These devices have a broad scope of application across different end-use industries.

The growing consumption of highly engineered as well as energy efficient electronic products is further contributing to market expansion. The increasing demand for electric-powered devices in the automotive and healthcare industries and the rising production and consumption of consumer electronic devices are anticipated to drive the growth of this market. In addition, stringent regulations regarding energy efficiency encourage manufacturers to adopt power device analyzers.

| Report Coverage | Details |

| Market Size by 2034 | USD 897.20 million |

| Market Size in 2025 | USD 557.94 million |

| Market Size in 2024 | USD 529.25 million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.42% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Current, End-user and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Demand from the Automotive Industry

The growing demand for power device analyzers from the automotive industry is a major factor driving the growth of the market. The rising sales of automobiles, including passenger cars, transportation vehicles, and electric vehicles, worldwide directly contribute to market growth. Electric vehicles (EVs) especially utilize power device analyzers for various components, such as batteries and electrical systems. The rising awareness amongst people regarding energy efficiency and stricter regulations regarding environmental sustainability are boosting the sales of electric vehicles. For instance, in 2024, 853,000 out of 1.595 million units of passenger cars sold in China were EVs. China’s NEV (New Energy Vehicles) production increased by 28.8% in 2024. In addition, the rapid shift toward renewable energy sources, such as wind and solar power, is boosting the demand for power device analyzers to ensure the reliability and efficiency of these systems.

Shortage of Skilled Personnel

Power device analyzers need specifically trained and highly skilled personnel to operate and handle these devices. These devices generate, transform, consume, or measure electrical parameters like current, phase, voltage, power, harmonics, etc. This requires a strong technical background to comprehend the methodologies to conduct tasks properly. There is a significant shortage of skilled personnel to operate these devices smoothly, which limits the growth of this market. The lack of experienced and skilled personnel in developed and emerging countries is holding back the expansion of this market. In addition, the high cost of these devices limits the growth of the power device analyzer market.

Increasing Demand for IoT Devices

The increased penetration of the internet globally has encouraged the adoption of smart and Internet of things devices, which create immense opportunities in the power device analyzer market. IoT devices generate vast amounts of data about power consumption. Analyzing power data from these devices helps reduce energy waste. Moreover, power device analyzers ensure the efficiency and reliability of IoT devices by monitoring power fluctuations. In addition, technological advances are likely to propel the market's growth in the near future. Technological advancements enable the development of more compact and user-friendly power device analyzers.

The both AC and DC segment dominated the power device analyzer market with the largest share in 2024. Both AC and DC analyzers are used in various industries since they provide detailed insights into power quality and fluctuations. The encouragement from many governments worldwide to conduct regular inspections to adhere to regulations regarding energy efficiency further bolstered the segment. These analyzers are widely utilized in the automotive industry to check power flow in electric vehicles. The rise in demand for electric vehicles also supported the segment's dominance.

The AC segment is expected to grow at a notable rate throughout the projection period. This is mainly due to the increasing usage of AC analyzers in home and business applications since they widely use alternating current. The increasing usage of consumer electronics and IoT devices further propels the segment’s growth.

The below 1000A segment led the market in 2024 and is likely to sustain its growth trajectory over the studied period. Many industries commonly utilize below 1000A power device analyzers. They are used in industries like automotive, energy, healthcare, manufacturing, aerospace, and defense to check power fluctuations and quality in various equipment. It also offers sufficient flexibility for various applications, making it a preferred choice in various industries.

The automotive segment led the power device analyzer market by capturing the largest share in 2024. This is mainly due to the increased production of vehicles and automotive components. Power analyzers are regularly used in the automotive industry to check power flow in electrical systems, drivetrains, and batteries. These devices are increasingly being used in electric vehicles. Various government policies around the world promoting environmentally sustainable practices encourage the usage of electric vehicles on a larger scale, further supporting the segment’s growth.

The consumer electronics & appliances segment is projected to expand at a rapid pace during the forecast period. The increasing production and adoption of numerous electronic devices, like TVs, smartphones, laptops, refrigerators, and smartwatches, drive segmental growth. Power analyzers play a crucial role in monitoring power fluctuations in these devices, ensuring efficiency and reliability.

By Type

By Current

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

August 2024