February 2025

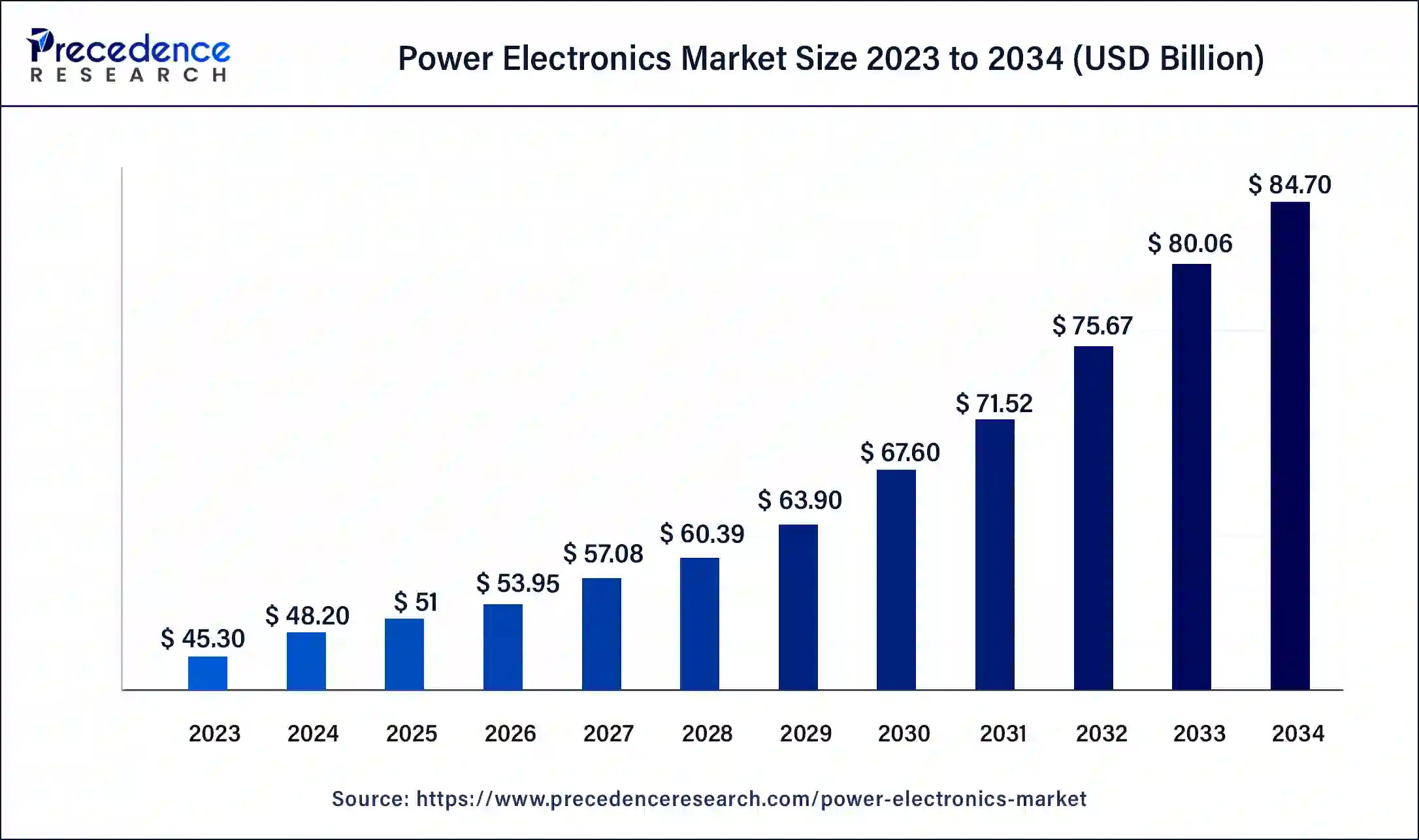

The global power electronics market size was USD 45.30 billion in 2023, calculated at USD 48.20 billion in 2024 and is expected to reach around USD 84.70 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034.

The global power electronics market size accounted for USD 48.20 billion in 2024 and is expected to reach around USD 84.70 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034. The North America power electronics market size reached USD 16.31 billion in 2023.

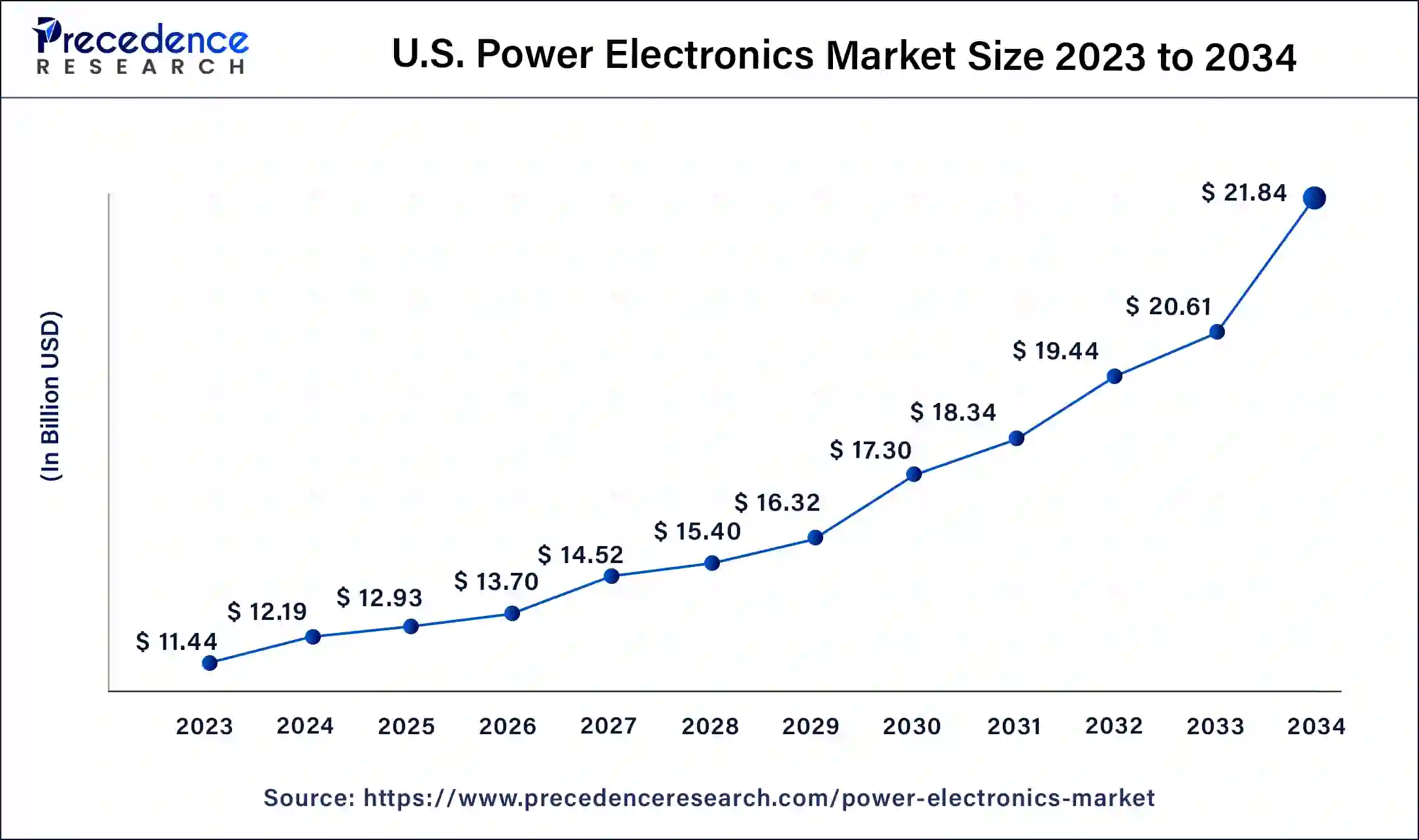

The U.S. power electronics market size was estimated at USD 11.44 billion in 2023 and is predicted to be worth around USD 21.84 billion by 2034, at a CAGR of 6% from 2024 to 2034.

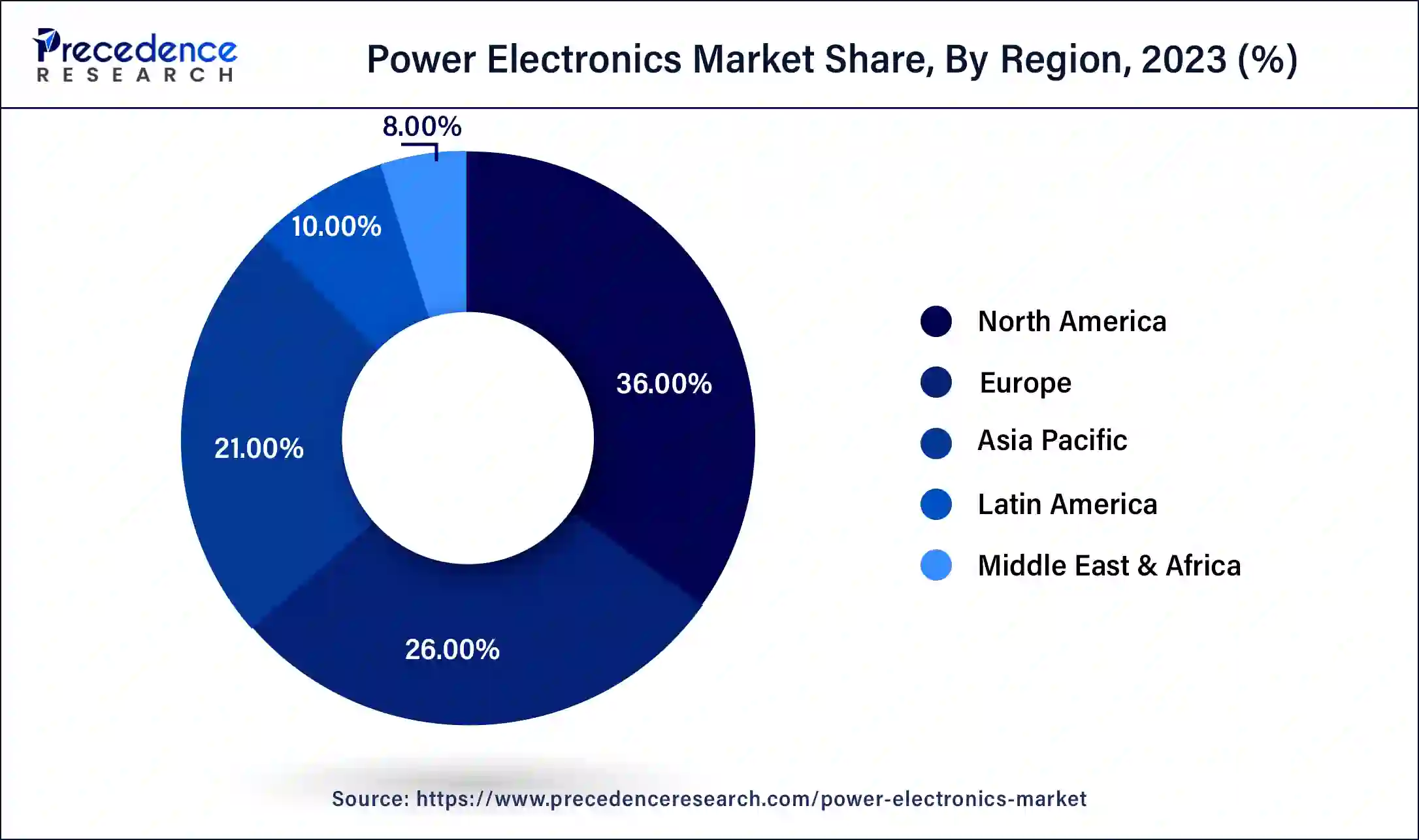

Based on region, the North America region accounted for 36% of revenue share in 2023. Asia Pacific is also estimated to be the most opportunistic market during the forecast period. It accounted for around 40% of the market share in 2020. This region is characterized by the presence of numerous top manufacturers in various industries such as consumer electronics, automotive, ICT, and industrial. The rising government initiatives to deploy renewable energy sources is fostering the demand for the power electronics. Moreover, countries like India, China, Japan, and South Korea are presenting lucrative growth opportunities owing to the presence of top electronic manufacturers. The government in these countries are framing favorable regulations that attracts FDIs and the manufacturers are increasingly investing in this region owing to the cheap availability of the various factors of production. Hence, Asia Pacific is the largest and the fastest-growing market.

The growing demand for the electric vehicles across the globe is expected to drive the global power electronics market. Various vehicle components such as windshield wiper control, interior lightings, ignition switch, and power steering utilizes power electronics. The power electronics play a crucial role in managing the electric energy of the electric vehicles. Therefore, the rapidly growing electric vehicle industry is anticipated to boost the growth of the global power electronics market during the forecast period. Moreover, the rising concerns regarding the environment has compelled the government across the nations to control the vehicle emissions. Regions like Europe and North America have strictly adopted various regulations to reduce their carbon footprint. Furthermore the increased awareness amongst the population regarding the negative effects of vehicle emissions on the environment have fueled the demand for the electric and hybrid vehicles among the consumers. The top vehicle manufacturers are investing heavily in the development of power efficient and emission free vehicles. Therefore, the rising penetration of the electric vehicles across the globe is estimated to drive the demand for the power electronics in the forthcoming years.

The power electronics are increasingly used across various energy conversion end use applications. The rapidly growing demand for the power-efficient devices across numerous end use verticals is significantly boosting the growth of the global power electronics. The increasing demand for the automation technologies and emergence of industry 4.0 are the major factors that drives the growth of the power electronics market. The rising adoption of the automated assembly lines and industrial robots is a significant market driver. However, the ongoing shortages of the semiconductors across the global markets is hampering the market growth. The rising gap between the demand and supply of the semiconductors may have a potential adverse effect on the global power electronics market during the forecast period.

| Report Highlights | Details |

| Market Size in 2023 | USD 45.30 Billion |

| Market Size in 2024 | USD 48.20 Billion |

| Market Size by 2034 | USD 84.70 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segment Covered | Material, Application, Device, and Regions |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on the material, the silicon segment dominated the global power electronics market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is simply attributed to the extensive use of silicon in the production of various power electronics for the different end use applications. Further, silicon is currently the most desirable substrate for producing most of the semiconductor wafers and it is most desirable for the low-power application.

On the other hand, the sapphire is estimated to be the most opportunistic segment during the forecast period. This is mainly due to the rising adoption of the sapphire in the production of various products such as smartwatches, LED lights, and optical wafers.

Based on the application, the aerospace & defense segment dominated the global power electronics market in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. The rising adoption of the power electronics in the aerospace & defense industry for wider applications such as cabin lighting, flight control, communications, power drive controls, and navigations to name a few, is significantly augmenting the growth of this segment. The aerospace and defense industry is investing heavily on the development of compact, low weight, and cost effective equipment and along with it also focusing on improving surveillance, communications, and commands. This factor has resulted in the growth of the segment.

On the other hand, the automotive is estimated to be the fastest-growing segment during the forecast period. This is attributed to the rising demand for the electric and hybrid vehicles among the global consumers. Furthermore, the increased disposable income and increased awareness regarding the environment among the population of the developed regions like Europe and North America is fueling the adoption of the electric vehicles. Therefore, the rapidly growing automotive industry is expected to drive the growth of the power electronics in the upcoming future.

Based on the device, the discrete segment accounted for 65% revenue share in 2023. The discrete segment consists of thyristors, diodes, and transistors, which are extensively used in the production of the electronic circuitry. This segment accounted for around 64% of the market share in 2020. It is used in industrial applications owing to its lower noise production and low power consumption. The increased utilization of discrete devices in the power invertors, motor drives, and electric power grids has resulted in its dominance in the market.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In March 2021, Infineon Technologies introduced StrongIRFET 2 power MOSFETs. It is available in the voltage range of 80 and 100V and is optimized for both the high and low frequencies.

The various developmental strategies like new product launches, acquisitions, and partnerships fosters market growth and offers lucrative growth opportunities to the market players.

Market Segmentation

By Material

By Application

By Device

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

December 2024

November 2024