February 2025

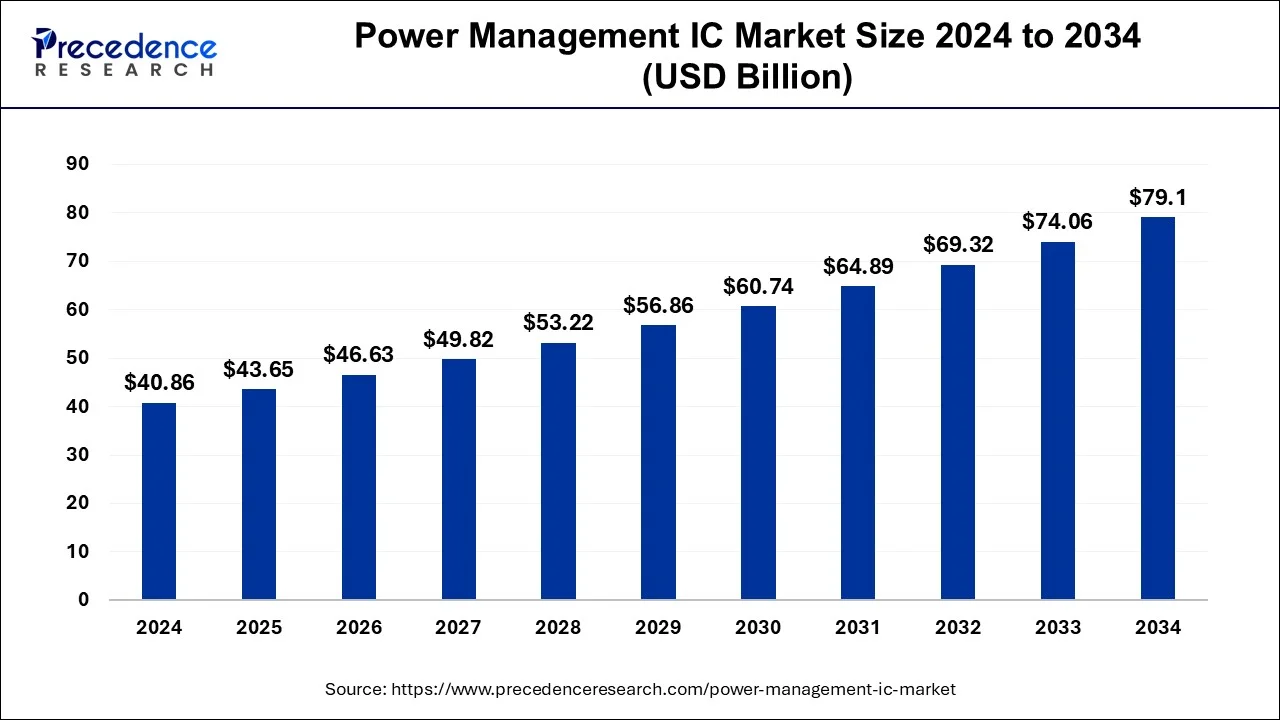

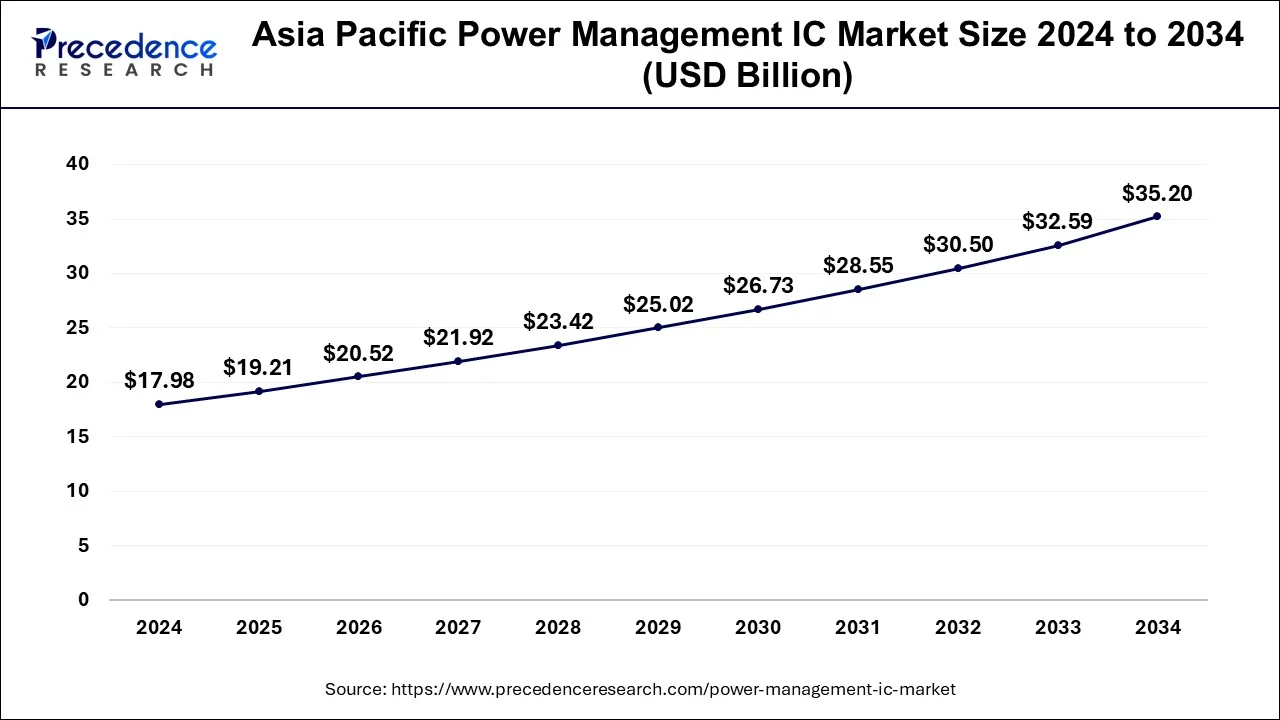

The global power management IC market size is calculated at USD 43.65 billion in 2025 and is forecasted to reach around USD 79.11 billion by 2034, accelerating at a solid CAGR of 6.83% from 2025 to 2034. The Asia Pacific market size surpassed USD 17.98 billion in 2024 and is expanding at a CAGR of 6.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global power management IC market size accounted for USD 40.86 billion in 2024 and is expected to exceed USD 79.11 billion by 2034, growing at a CAGR of 6.83% from 2025 to 2034. The power management IC market growth is attributed to the increasing demand for energy-efficient IC solutions across various industries.

The advancement of artificial intelligence and machine learning in consumer electronics and smart grid and energy storage systems is likely to open new growth opportunities for the power management IC market. AI power solutions are incorporated into engineering solutions since engineers use AI algorithms to analyze big data and create improved power solutions. Machine learning makes renewable energies easily incorporable due to the active control of the dynamic electrical load and maintaining system reliability. A primary application of machine learning in the manufacturing industry is to improve production efficiency and minimize costs. Moreover, AI-driven predictive analytics enables the prediction of failure areas in power systems, hence increasing their reliability. Such advancements help position AI as an enabler, reframe the industry, and advance intelligent energy management systems.

The Asia Pacific power management IC market size was exhibited at USD 17.98 billion in 2024 and is projected to be worth around USD 35.20 billion by 2034, growing at a CAGR of 6.95% from 2025 to 2034.

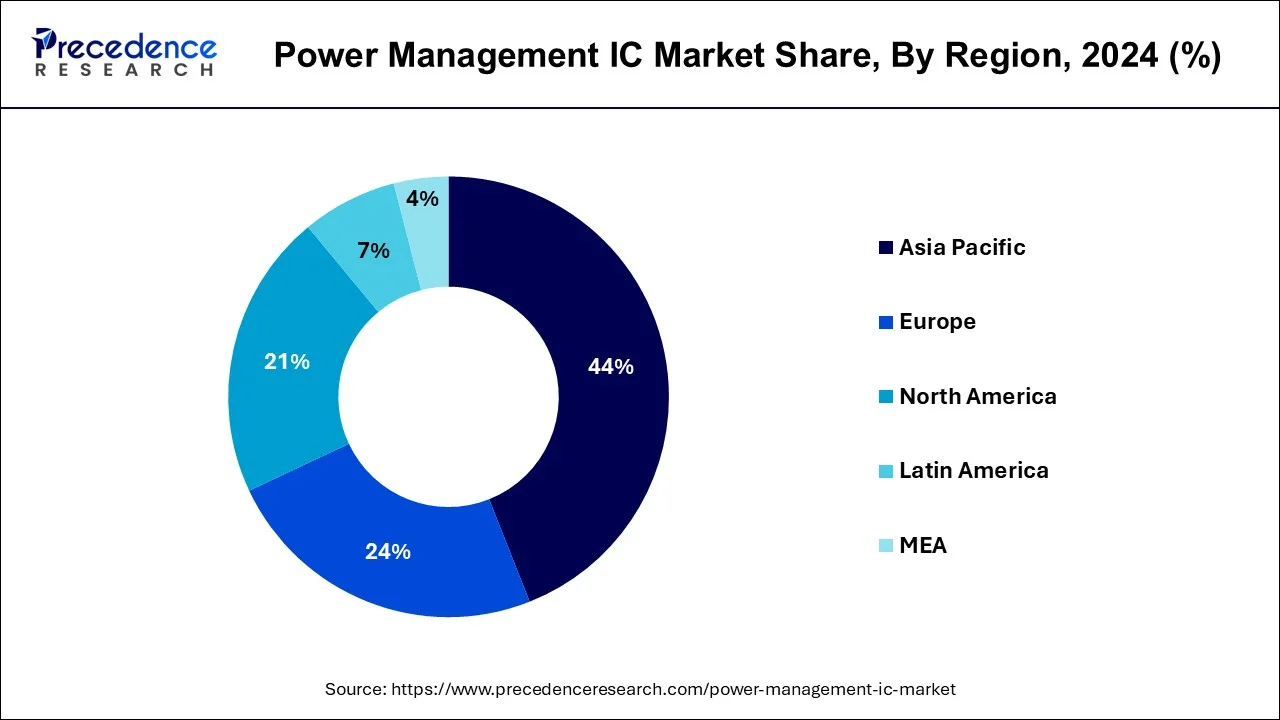

Asia Pacific dominated the global power management IC market in 2024. Asia’s most developed countries, such as China, Japan, South Korea, and India, are steering the movement in regard to the manufacture and use of innovative technologies, including electric automobiles, electronics for households and industries, and robotics. The region is experiencing a large chunk of smartphone production and selling around the world, in addition to the electrification of automobiles. Additionally, the semiconductor companies and technology developers have increased their research expenditure to cater to the increasing demand for low-power and high-performing ICs in this region.

North America is projected to host the fastest-growing power management IC market in the coming years due to developments in automotive electrification, renewable energy systems, and a shift towards smarter technologies. The United States is seeking to quickly expand infrastructure associated with electric vehicles and invest in clean energy generation and storage, which leads to increased demand for power management ICs, which are unique to each specific application. Moreover, there is a growth in connectivity of more IoT devices, such as smart connections to household appliances, industrial applications, and wearable electronics.

The power management IC market growth is fuelled by the increasing need for energy-efficient solutions in cars, home electronic appliances, and industrial use. PMIC stands for power management integrated circuits, which are versatile blocks that accurately manage the flow of electrical currents within a device, optimize battery life, and enhance the performance and safety of an apparatus.

Due to emergent industrialization, technology growth and the growing consumer electronics segment further facilitate the market in the coming years. The market’s growth is further backed up by the high demand for efficient power solutions in data centers, the emergence of 5G networks, and the growing rapid electric vehicle charging infrastructure. Other factors include the development of power semiconductor technology and the government's focus on renewable energy for power projects.

| Report Coverage | Details |

| Market Size by 2024 | USD 40.86 Billion |

| Market Size in 2025 | USD 43.65 Billion |

| Market Size in 2034 | USD 79.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.83% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for energy-efficient devices

The increasing demand for energy-efficient devices is anticipated to drive growth in the power management IC market. The necessity for energy-efficient devices is expected to ensure a strong & constant growth of the users of power management ICs. PMICs help minimize energy consumption in both plug-in and battery-powered devices by adjusting voltage levels and efficiently managing energy usage. This slightly increases the need for increased efficiency technologies within sectors of the economy.

Governments around the world are putting in place very strict policies on energy efficiency as a way of trying to solve the problem. These regulatory measures put pressure on manufacturers in the power management IC market to incorporate higher technologies, including low-power microcontrollers and adjustable power-controlling technologies, including power management IC. Furthermore, the rising energy requirements require optimization of the management of power.

Hamper growth due to high development costs

High development costs for advanced power management ICs are anticipated to restrain power management IC market growth. Manufacturers spend hefty sums of money on research and development, not forgetting the prototyping phases of their specialized devices, such as those used in electric vehicles or renewable energy systems. The scale of integration of leading-edge features, including GaN and SiC, increases costs, as they are very difficult to manufacture. Small companies are unable to cope with such competition, which becomes a hindrance to the growth of the market. This fact intensifies these financial issues by demanding constant innovation in response to efficiency and environmental issues, which underlines the need for cost control.

Growing adoption of electric vehicles (EVs)

The growing adoption of electric vehicles is projected to create immense opportunities for the players competing in the market. The continuously growing interest in driving electric vehicles (EVs) serves as a significant growth factor in the power management IC market. Governments are promoting electric vehicle use through subsidies and supporting the construction of EV charging stations. Since car manufacturers are investing in solutions that help improve range and reliability, there is a need for special ICs for EV applications. This dynamic underlines the need for power managing ICs in the course of shifting the scale of transportation towards sustainability.

The switching regulators segment held a dominant presence in the power management IC market in 2024, as they are highly efficient and versatile. They have become the most popular type of power management IC in circulation. Several such regulators are imperative in applications where power conversion is needed, such as automotive systems, industrial facilities, and portable electronics. Due to the capacity to transform power with less output as heat, they are critical in devices with tight form factors and stringent energy standards. IEA states that energy-efficient technologies, such as switching regulators, play a role in reducing energy intensity in international systems. Furthermore, technology development is constantly being improved by incorporating even more compelling GaN and SiC materials.

The power management ASICs/ASSPs segment is expected to grow at the fastest rate in the power management IC market during the forecast period of 2025 to 2034. These ICs are preferred in the automotive and the IoT markets where tailormade power needs are a must for integrated solutions. Their design offers trademark scalability to integrate into compact systems with the desired efficiency in smart wearable devices, connected home appliances, and ADAS. The European Commission’s 2023 report on sustainable energy technologies showed that the advancements in ASICs/ASSPs are critical for enhancing the energy efficiency of intelligent connected objects. Additionally, the high number of EVs requires custom power management.

The consumer electronics segment accounted for a considerable share of the power management IC market in 2024 due to the increasing need for mobile, power-conscious gadgets. These modern ICs are mainly used to regulate power consumption in devices such as smartphones, laptops, and smart home appliances. This segment has been growing due to the rising demand for power backup for longer durations, in addition to the growth of smart devices.

The automotive segment is anticipated to grow with the highest CAGR in the power management IC market during the studied years, owing to the popularization of electric vehicles (EVs) and the development of integrated advanced driver-assistance systems (ADAS). The espousal of electric mobility has put lots of pressure on power management solutions to control the lifespan of batteries, the rate of charging, and the general utility of EVs. This growth highlights the increasing importance of power management ICs in the automotive industry. Moreover, the adoption of high-sensitivity ICs that are able to handle the high power of EVs further fuels the market in this sector.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

December 2024

November 2024