January 2025

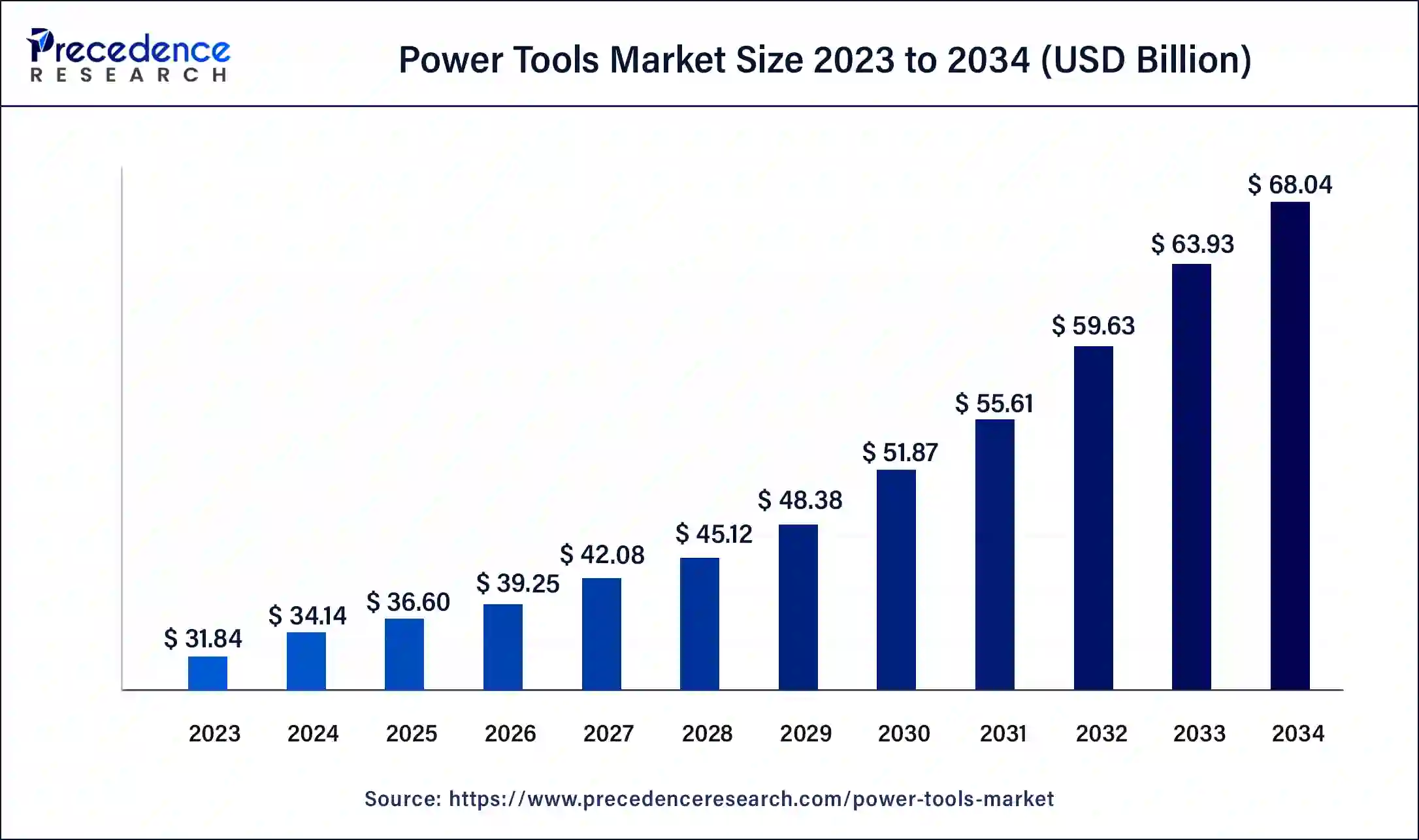

The global power tools market size was USD 31.84 billion in 2023, estimated at USD 34.14 billion in 2024 and is anticipated to reach around USD 68.04 billion by 2034, expanding at a CAGR of 7.1% from 2024 to 2034.

The global power tools market size accounted for USD 34.14 billion in 2024 and is predicted to reach around USD 68.04 billion by 2034, growing at a CAGR of 7.1% from 2024 to 2034. Rising construction activities in developing regions can boost the market.

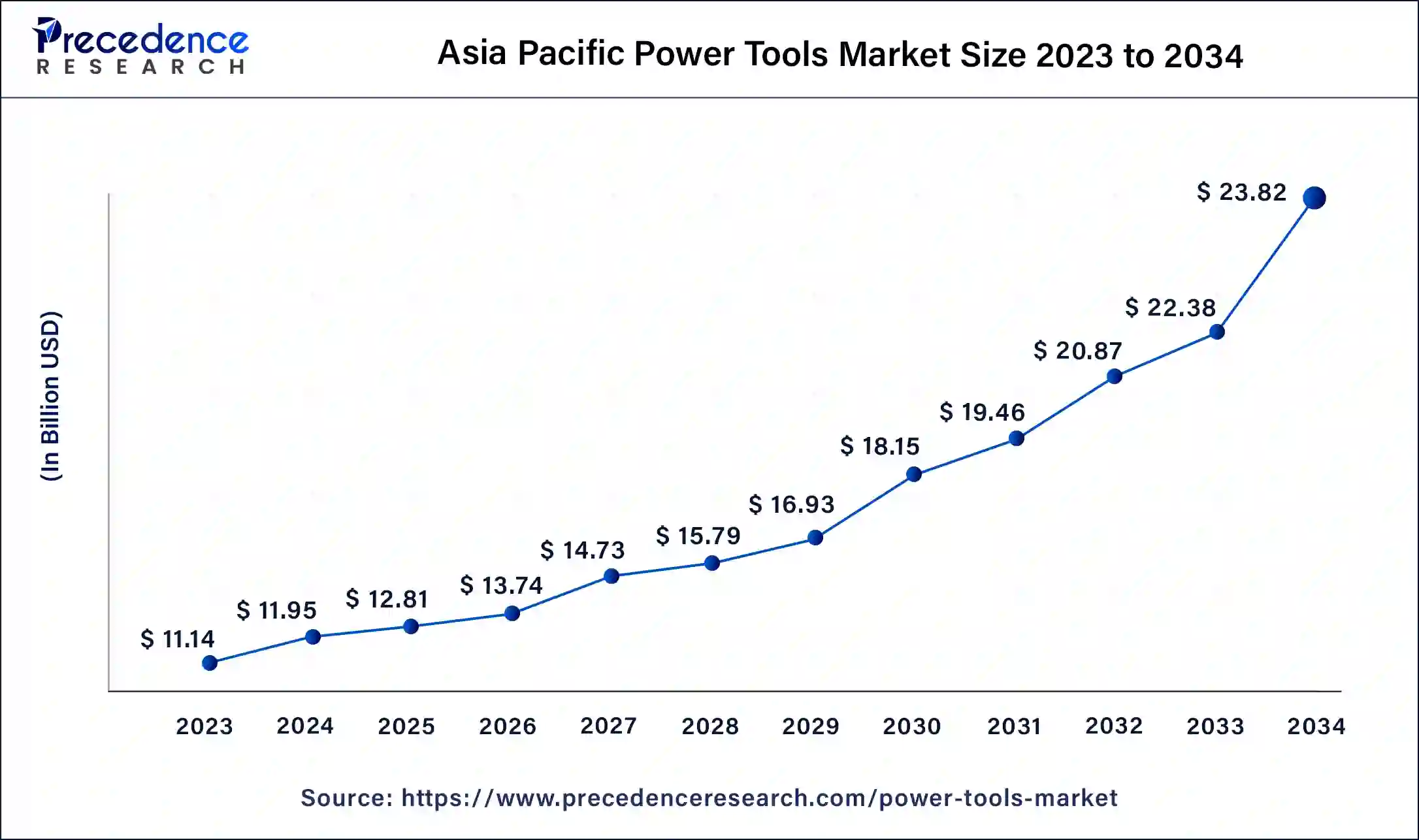

The Asia Pacific power tools market size was estimated at USD 11.14 billion in 2023 and is expected to be worth around USD 23.82 billion by 2034, at a CAGR of 7.30% from 2024 to 2034.

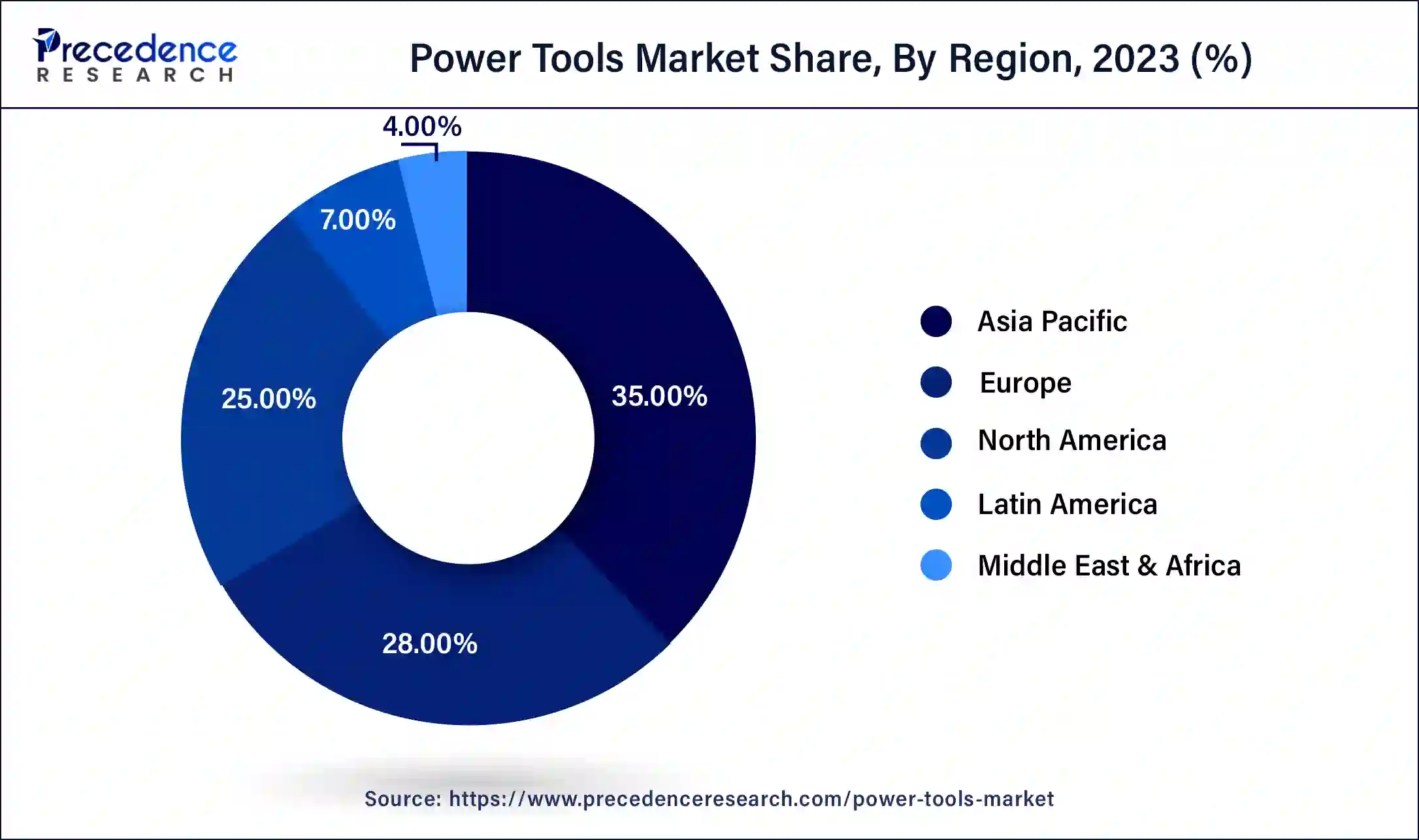

Asia Pacific dominated the power tools market by region in 2023. Several reasons, including the region’s population, rapid economic expansion, rising urbanization, technical innovations, and expanding middle class, contribute to its supremacy in the market. The economy of Asia Pacific is also greatly enhanced by the presence of some of the fastest-growing economies in the world, including those of China, India, and South Korea nations. The economic dominance of Asia Pacific has also been enhanced by smart infrastructure investments, advantageous government policies, and a move towards innovations and enterprises.

More than 85% of the world's power tools are produced in China. World-famous brands like DeWalt, Black-and-Decker, and Bosch use Chinese manufacturers to produce some of their power tools or components in China. In 2020, the scale of China's electric market is about 80.9 billion yuan, and the average compound annual growth rate of China's electric market from 2015 to 2020 is 6.9%. A list of Chinese suppliers of power tools is prepared for your perusal to learn more about China's power tool industry.

North America is expected to grow rapidly in the global market by region during the forecast period. The market is expected to grow for several reasons, including the consistent demand for power tools driven by ongoing construction activities, infrastructure, and the do-it-yourself culture. Additionally, positive economic trends and rising disposable income support the expansion of the power tools market in North America.

Power Tools Market Overview

The power tools market refers to any equipment or gadget that runs on an external energy source, like compressed air or electricity and is referred to as a power tool. The power tools provide increased speed, strength, and efficiency over manual tools, which are entirely dependent on human labor. The advancements in technology, building and manufacturing activity, and customer demands for ease and efficiency all have an impact on the market.

The power tools market is extremely useful in a variety of industries. The power tools are essential in many different industries because they offer strength, accuracy, and efficiency. Additionally, the industry that produces and distributes portable or stationary tools for a variety of uses, including drilling, sanding, and cutting, that are driven by electricity, batteries, or compressed air is known as the market. It caters to both professional and do-it-yourself users and contains devices devices including drills, saws, grinders, and sanders.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.10% |

| Power Tools Market Size in 2023 | USD 31.84 Billion |

| Power Tools Market Size in 2024 | USD 34.14 Billion |

| Power Tools Market Size by 2034 | USD 68.04 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Mode of Operation, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of modular construction in developing regions

The growing demand for power tools is driven by an emphasis on construction practices in developing nations, which can be attributed to expanded infrastructure projects, urbanization, and industrialization. The requirement for effective and potent equipment to speed up the construction of new buildings, roads, and facilities increases as a result, propelling the market's expansion of the power tools market.

Need for ongoing maintenance and repair

The need for ongoing maintenance and repair may slow down the power tools market. Consumers might look at maintenance and repairs as an extra costly strain, particularly if they happen frequently or need expert help. The users may experience inconveniences as a result of routine maintenance and repairs that interfere with do-it-yourself projects or workflow.

Improved safety

The improvement in the safety of power tools can be the opportunity to grow the power tools market. The goal of power tool producers is to improve user safety, convenience, and comfort through ergonomic features such as anti-vibration technology, easily navigable controls, pleasant grips, and lightweight, compact designs. Active torque control (ATC) systems and onboard dust reduction (DR) systems assist in collecting dust that contains silica, which is dangerous. ATC also halts drill spinning when a bit jams, preventing injury. Additional safety measures on tools include the capacity to turn off instruments like grinders right away if the user abruptly shifts position in any direction.

The drills segment dominated the power tools market by product in 2023. The drills are tools used for making holes in material like a drill bit or a drill machine. The drills are very adaptable instruments that may be utilized for a wide range of jobs, from minor home maintenance to building projects. For many customers, their extensive range of users makes them indispensable. The modern drills are engineered to be highly user-friendly, with lightweight construction, ergonomic handles, and simple controls. The professionals and do-it-yourself will find this accessible. In order to improve drill performance and usefulness, manufacturers are always coming up with new features and technologies.

In several industries, including manufacturing, automotive, aerospace, and woodworking, drills are indispensable tools. Their broad use in professional contexts can be attributed to their application in machining, fabrication, assembly, and maintenance operations, among other things.

The drills are becoming more and more popular as cordless power tools become the preferred option over corded ones. With cordless drills, users may work in places without power outlets since they are more mobile, convenient, and flexible. The performance and run-time of cordless drills have been enhanced by technological developments in battery technology, which has increased their popularity.

The saws segment is expected to grow to the highest CAGR in the power tools market by product during the forecast period. Globally, as urbanization and infrastructure building projects increase, saws are becoming more and more necessary for construction tasks like cutting metal, wood, and other materials. An increasing number of people are choosing to take on do-it-yourself (DIY) home renovation and improvement projects.

The need for this market is further fueled by the fact that saws are necessary equipment for do-it-yourself. Technological Developments: As a result of technological developments, saws have become more effective and adaptable, meeting a wide range of requirements and uses. Because of this, saws are becoming more widely available and have a greater range of applications, which has increased their market share. The saws are widely utilized in a variety of industries, including woodworking, automotive, aerospace, and manufacturing. As these sectors expand.

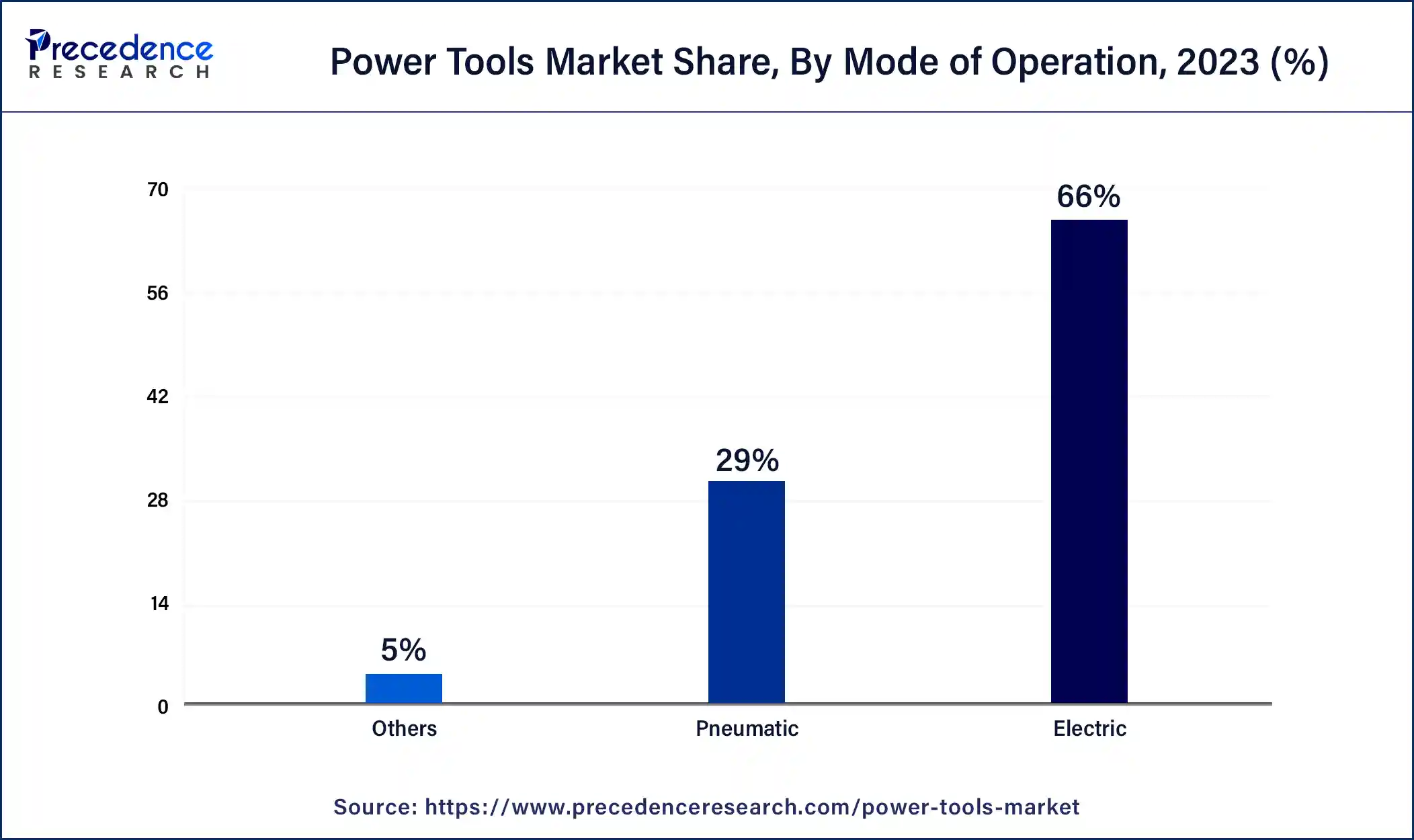

The electric segment dominated the power tools market by mode of operation in 2023. In general, people believe that electric power tools are safer than instruments with pneumatic or gasoline power. They are favored in many job areas because they remove the dangers involved in handling combustible fuels or using high-pressure pneumatic systems. Due to their fewer pollutants and less environmental impact, electric power tools are becoming more and more popular over their gasoline-powered counterparts as people become more conscious of environmental issues.

This trend supports initiatives in a number of businesses to encourage sustainability and lower carbon emissions. Power tools are required for building, renovating, and maintaining projects because of the worldwide trend of urbanization and infrastructure development. These projects require electric tools because of their adaptability, dependability, and user-friendliness, which contribute to their market domination.

The pneumatic segment is expected to grow at a rapid pace in the power tools market by mode of operation during the forecast period. Many industrial industries, including manufacturing, automotive, aerospace, construction, and metallurgy, employ pneumatic power tools extensively. They are favored for heavy-duty drilling, grinding, riveting, and fastening tasks that call for high torque and continuous operation. The pneumatic tools are well-known for having an excellent power-to-weight ratio, which makes them appropriate for heavy-duty tasks requiring a high degree of mobility and maneuverability.

When compared to electric tools of the same size and weight, they provide more power, which makes them invaluable in industries that require high-performance tools. The pneumatic tools are renowned for their resilience to severe operating environments, high temperatures, and frequent use. Compared to electric tools, they have fewer moving parts, which lowers the possibility of mechanical problems and downtime.

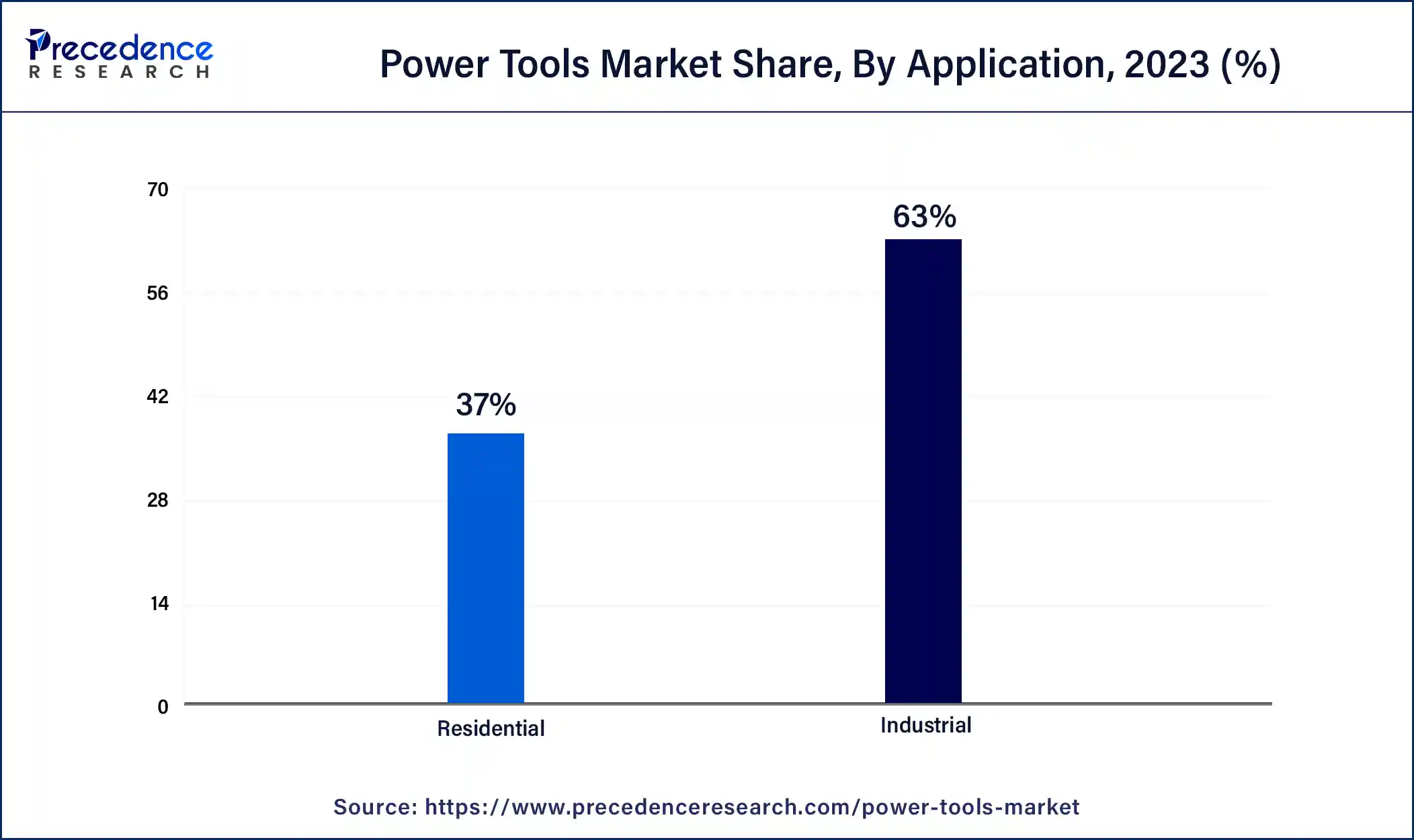

The industrial segment dominated the power tools market by application in 2023. Industrial applications frequently need powerful power tools that can sustain demanding, ongoing use. To fulfill production demands, power tools used in the manufacturing, construction, automotive, aerospace, and metalworking industries must have excellent performance, dependability, and durability. Industries are increasingly dependent on automation and mechanization to increase production, efficiency, and accuracy. Power tools are vital in automated manufacturing processes because mass production and assembly activities depend on speed, accuracy, and consistency. Industrial applications frequently include specialized activities requiring particular power tool types designed to meet industry requirements. These might include industrial-grade saws for cutting massive materials in construction, precision grinders, or pneumatic drills for heavy-duty drilling in metal production.

The residential segment is expected to grow to the highest CAGR in the power tools market by application during the forecast period. The power tools that are more versatile, efficient, and perform better have been made possible by technological developments. The adoption of power tools is accelerated by features like digital controls, brushless motors, lithium-ion batteries, and cordless operation, which make them more appealing to domestic users. Power tool usage that integrates with smart technology is encouraged by the growing trend toward smart house solutions.

Tech-savvy households looking for convenience and automation will find smart power tools interesting because they provide features like app-based controls, remote monitoring, and connectivity with other smart equipment. The demand for power tools in residential applications is influenced by housing development projects and urbanization trends. Power is required when urban populations rise, and new housing developments are built. Globally, there has been a notable surge in home improvement and restoration projects, fueled by elements including evolving lifestyles, an aging housing stock, and rising disposable incomes.

Power tools are necessary for many jobs, including painting, gardening, plumbing, electrical, and carpentry, which supports the expansion of the home market. Among homeowners who would rather do home repair work themselves rather than employ professionals, the Do-It-Yourself (DIY) culture is becoming more and more popular. The market for home power tools is driven by the ability of do-it-yourself enthusiasts to complete a variety of chores successfully and economically with the help of power tools.

Segment Covered in the Report

By Product

By Mode of Operation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

September 2024

January 2025