February 2025

The global preclinical CRO market size is accounted at USD 6.76 billion in 2025 and is forecasted to hit around USD 13.14 billion by 2034, representing a CAGR of 7.66% from 2025 to 2034. The North America market size was estimated at USD 3.01 billion in 2024 and is expanding at a CAGR of 7.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global preclinical CRO market size was calculated at USD 6.28 billion in 2024 and is predicted to reach around USD 13.14 billion by 2034, expanding at a CAGR of 7.66% from 2025 to 2034.

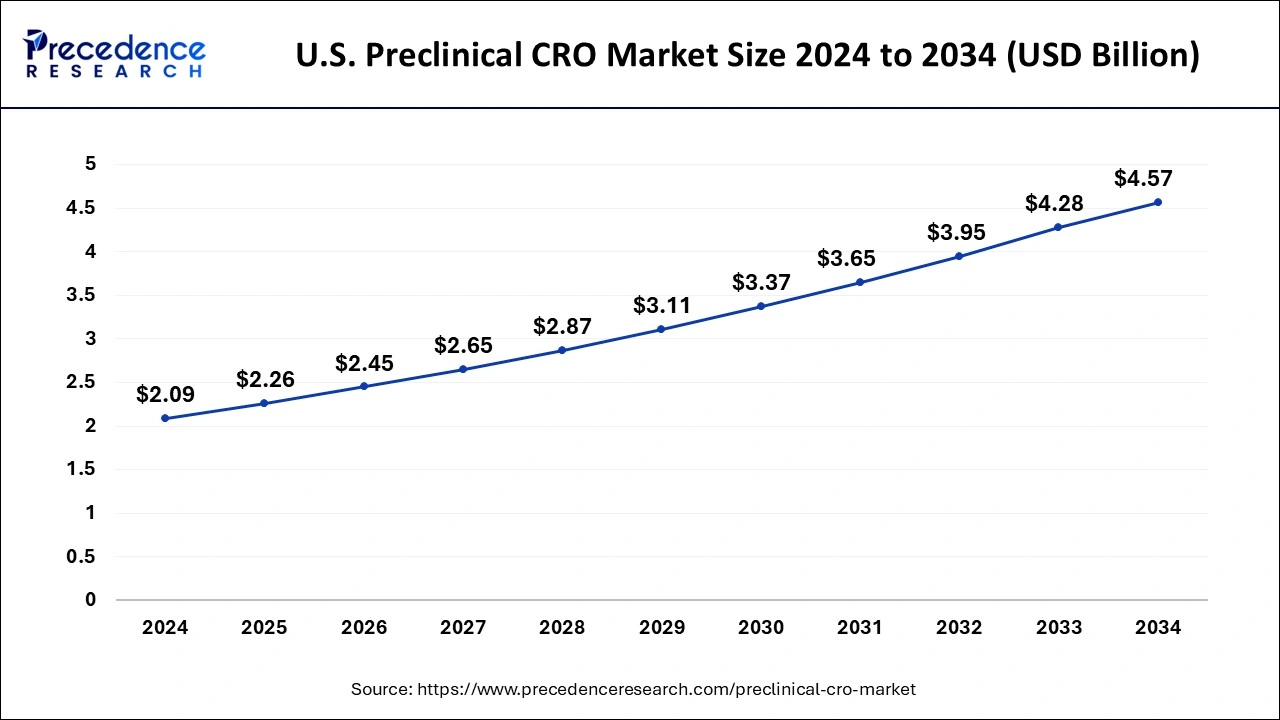

The U.S. preclinical CRO market size was exhibited at USD 2.09 billion in 2024 and is projected to be worth around USD 4.57 billion by 2034, growing at a CAGR of 8.14% from 2025 to 2034.

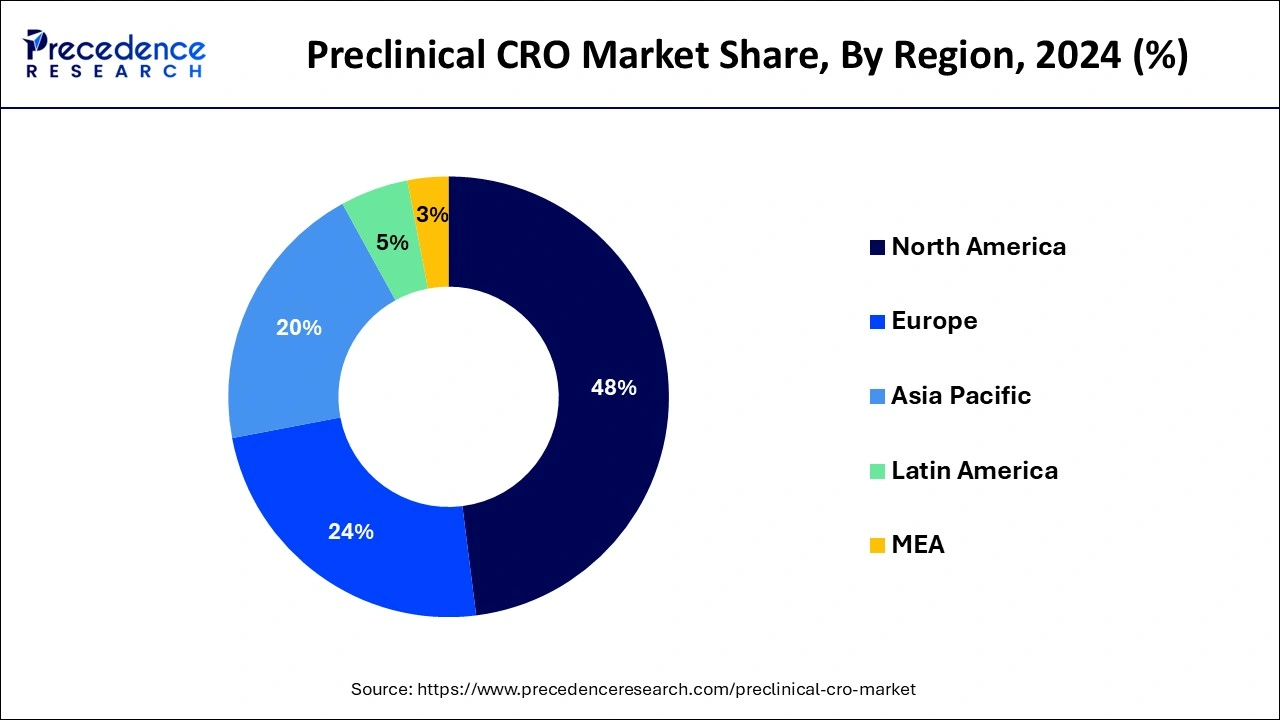

Based on region, North America dominated the global preclinical CRO market by 47.14% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This can be attributed to the presence of numerous top biopharmaceutical industry players in the region. The increased volume of outsourcing activities for the preclinical phase of the drug development by the biopharmaceutical companies has fostered the growth of the market in this region. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), the US conducts more than half of the research & development activities in the pharmaceutical field and also holds intellectual rights of a significant amount of new medicines. The biopharmaceutical industry accounted for around 4% of the US GDP in 2015. Therefore, the rapidly growing biopharmaceutical industry is expected to play a crucial role in the growth of the global preclinical CRO market.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is due to the rising prevalence of chronic diseases among the population. Further, the countries like China, India, and South Korea are characterized by the presence of certain big CROs, which are known for conducting preclinical studies at low cost. Moreover, the rising number of CROs in the region is boosting the growth of the preclinical CRO market in Asia Pacific.

The rapid expansion and growth of the contract research organizations (CROs) in the past few years has boosted the growth of the preclinical CRO market. Various biopharmaceutical companies, medical device companies, and government research organizations avail the services provided by the CROs on a contract basis. The rising prevalence of various chronic diseases and gene-related diseases needs to be catered to. This need resulted in the increased investments in the research activities by the numerous biopharmaceutical and medical device companies, for the development of new and innovative drugs and devices for the diagnosis, prevention, and treatment of chronic diseases. Preclinical CROs enables the biopharmaceutical and medical device companies to focus on their core activities by providing the solutions and services regarding the research and development of the medicine and devices. Therefore, the rapid growth and development of the biopharmaceutical industry is expected to play a major role in the growth of the global preclinical CRO market.

The rising need for the development of new life-saving drugs is boosting the investments in the preclinical studies. Preclinical CROs are playing a crucial role in the development of new drugs and staging the concepts for the commercialization of the newly developed medicines. The recent outbreak of the COVID-19 virus has significantly contributed towards the increased activity of the preclinical CROs. The COVID-19 was new to the world, and hence its preclinical study was of utmost importance. This resulted various organizations and governments to inject huge investments in the preclinical research of the virus. Moreover, favorable government policies and regulations regarding the preclinical studies especially in the developed regions of North America and Europe are the major drivers of the preclinical CRO market across the globe.

| Report Highlights | Details |

| Market Size in 2025 | USD 6.76 Billion |

| Market Size by 2034 | USD 13.14 Billion |

| Growth Rate from 2025 to 20344 | CAGR of 7.66% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on service, the toxicology testing segment dominated for around 24% of the market share in 2024. As per the research results published by the Sevier Research Institute, around 50% of the preclinical testing witnessed failure owing to the toxicology tests. Therefore the extensive use of the toxicology testing across the preclinical CRO industry is anticipated to drive the demand for the preclinical CRO services.

On the other hand, the bioanalysis & DMPK studies segment is estimated to be the fastest-growing segment during the forecast period. This is attributed to the increased importance of the DMPK in evaluating the intrinsic properties of drugs and facilitates toxicology testing. Moreover, bioanalysis provides quantitative analysis and is increasing being used at every stage of medicine development process. Therefore the rising uses of bioanalysis and DMPK in the preclinical research is estimated to drive the growth of this segment.

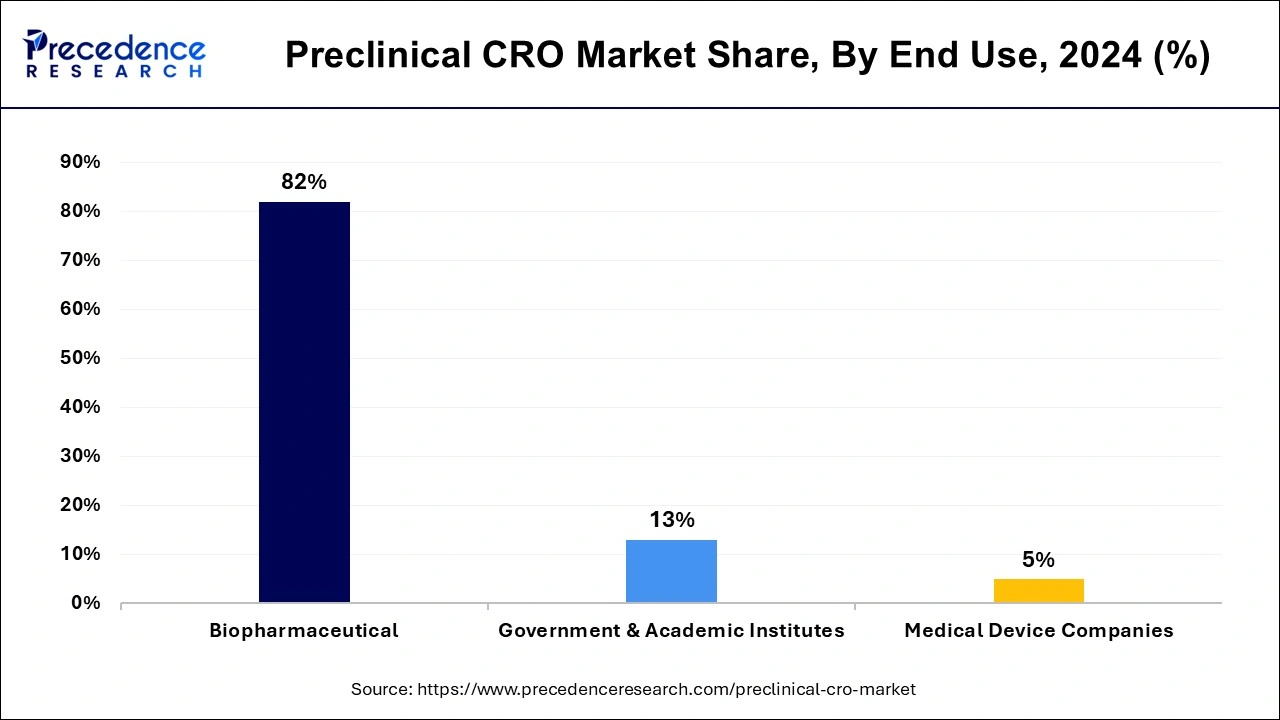

Based on end use, the biopharmaceutical segment accounted for around 82% of the market share in 2024. The increasing number of medium and small biopharmaceutical companies across the globe is boosting the growth of this segment. The small and medium-sized biopharmaceutical companies lack in adequate resources and expertise in preclinical trials of drug development. Therefore, they are increasingly outsourcing the preclinical research works to the preclinical CROs that boosts the demand for the preclinical CROs services. Further, the rapid growth of the biopharmaceutical industry is expected to drive the demand for the preclinical CRO services in the upcoming future. The biopharmaceutical industry alone accounts for around 20% of the global pharmaceutical industry and is rapidly growing.

On the other hand, government & academic institutes segment is expected to be the most opportunistic segment during the forecast period. This can be attributed to the increased investments by government and academic institutions on the preclinical studies on the discovery and development of various drugs and medical devices. The rising outsourcing activities of such institutes is expected to drive the growth of the preclinical CRO market.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In September 2020, Innoplexus and Paraxel collaborated to launch Clearinghouse, an online resource for the researchers and clinical trial sponsors that provided all the datasets and information regarding the COVID-19 virus.

The various developmental strategies like partnerships, collaborations, and joint ventures fosters market growth and offers lucrative growth opportunities to the market players.

By Service

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024