July 2024

Prenatal and Newborn Genetic Testing Market (By Technology: Screening Method, Diagnostic Technology; By Diseases: Down Syndrome, Phenylketonuria, Cystic fibrosis, Sickel Cell Anemia; By End-use: Hospitals, Maternity and Specialty Clinics, Diagnostic Centers) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

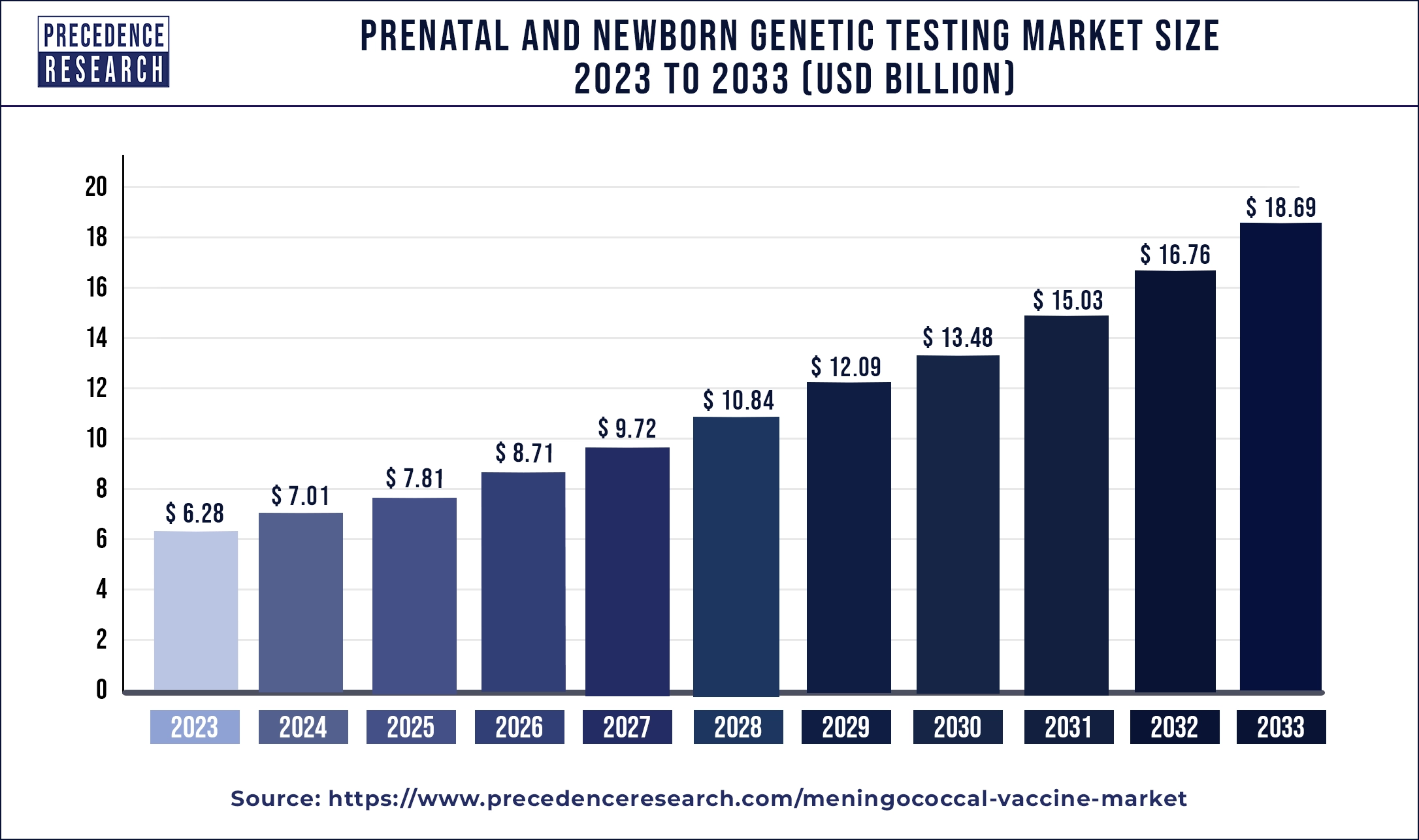

The global prenatal and newborn genetic testing market size was USD 6.28 billion in 2023, calculated at USD 7.01 billion in 2024 and is expected to reach around USD 18.69 billion by 2033, expanding at a CAGR of 11.52% from 2024 to 2033. The rising prevalence of genetic disorders in infants or newborns is driving the demand for the market.

Prenatal and newborn genetic testing is the device that detects and provides information about the genetic disorders and birth abnormalities of the fetus. It helps families and physicians make responsible decisions about the fetus. Genetic testing provides information about the fetus's health and congenital disorders like trisomy 13, Down syndrome, and spina bifida. The rising awareness among parents about the health of the fetus and pregnant lady drives the demand for prenatal and newborn genetic testing. Nowadays, the majority of couples are added to these tests with routine pregnancy testing. The growing prevalence of genetical and prenatal disorders in infants is driving the growth of prenatal and newborn genetic testing. Additionally, the rising research and development activities in technology upgradation drive the growth of the prenatal and newborn genetic testing market.

| Report Coverage | Details |

| Market Size by 2033 | USD 18.69 Billion |

| Market Size in 2023 | USD 6.28 Billion |

| Market Size in 2024 | USD 7.01 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 11.52% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, Diseases, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising awareness among new parents

The rising awareness among the new age expecting parents about the health of the child and mother during the pregnancy drives the demand for prenatal and newborn genetic testing. Prenatal and newborn genetic testing helps in detecting the health risks of the baby and plan. Prenatal and newborn genetic testing helps couples who are having multiple miscarriages with the detection of the main causes associated with their problem. It helps the pregnant couple to find out whether their baby is healthy during pregnancy or has some disabilities or genetic disorders such as Down syndrome, which rises as the age increases. The higher availability of the resources, the affordability of testing, and the awareness among patients or expecting couples for testing the health of the mother and child is driving the expansion of the prenatal and newborn genetic testing market.

False results

The challenges surrounding the adoption of prenatal and newborn genetic testing are multi-faceted. Technical errors in test devices can potentially yield false results, undermining the reliability of the testing process. Fur thermore, the lack of skilled professionals to operate these devices presents a significant barrier, impeding their widespread use. These issues collectively contribute to restraining the growth of the genetic testing market for prenatal and newborn care. Addressing these challenges is imperative to ensure the accurate and effective implementation of genetic testing, thereby enabling healthcare professionals to provide informed and timely care to expectant mothers and newborns.

Technological evolution in the testing device

The rising investments in technological advancements in prenatal and newborn genetic testing devices are driving the opportunity for the growth of the market. The rapid advancements in modern technologies, such as the discovery of cell-free fetal DNA in maternal plasma that, drive the screening methods for fetal chromosomal aneuploidies. Such types of tests are mentioned as non-invasive prenatal screening and non-invasive prenatal tests (NIPTs). Additionally, the rising investments in research and development activities in the expansion and technological advancements are driving the growth of the prenatal and newborn genetic testing market.

The screening segment dominated the prenatal and newborn genetic testing market in 2023. The growth of the segment is attributed to the higher adoption of technologies kike screening for detecting abnormalities in the fetus during pregnancy. The screening technologies give a precise and clear image of the fetus's health during the pregnancy. There are several types of screening tests available in prenatal and newborn genetic testing, such as carrier screening, which is the blood test that is offered to both parents. Screening for abnormal chromosomal numbers: these texts include cell-free fetal DNA screening and serum screening. Screening for physical abnormalities, which includes Nuchal translucency, AFP screening (maternal serum screen), Quad screen, and fetal anatomy scan. The rising number of middle-aged pregnancies that are above 35 years of age has the number of complications detected by prenatal and newborn genetic testing. Thus, all these factors drive the expansion of the screening segment.

The Down syndrome segment held the largest prenatal and newborn genetic testing market share in 2023. A rising number of infants are born with the genital disorders of Down syndrome, which is a chromosomal anomaly that is associated with multiple congenital defects and causes mental retardation and severe health issues. The growing prevalence of Down syndrome in newborns is driving the demand for prenatal and newborn genetic testing. The increasing adoption of prenatal and newborn genetic testing by pediatricians, multispecialty hospitals, and other healthcare institutions is driving the growth of the prenatal and newborn genetic testing market.

The hospital segment dominated the prenatal and newborn genetic testing market in 2023. The growth of the segment is attributed to the higher availability of skilled working professionals, technologically equipped and upgraded devices, and better reimbursement policies that drive the segment’s growth. The rising preference for hospitals by pregnant couples for routine testing and diagnostics is driving the adoption of prenatal and newborn genetic testing by hospitals. The rising investments in healthcare institutions by the government and private sectors are the development of infrastructure and technologies in healthcare facilities, which boosts the growth of prenatal and newborn genetic testing in hospitals.

North America led the prenatal and newborn genetic testing market with the largest share in 2023. The growth of the market in the region is increasing due to the rising awareness about healthcare among the population and the well-established healthcare infrastructure, which has impacted the growth of new testing and diagnostic devices in the market. The rising demand for minimally invasive genetic testing treatment in countries like the U.S. is driving the expansion of the market. Additionally, the rising prevalence of the major healthcare and pharmaceutical infrastructure is contributing to the expansion of the market. And the rising investments in technological advancements in diagnostics devices are further propelling the growth of the prenatal and newborn genetic testing market.

The first public health initiative for genetic diseases is newborn screening. State-mandated newborn screening programs exist in the United States, and the illnesses examined for could differ throughout states. A nationwide newborn screening program is being developed. Birth screening programs have been able to significantly expand because of modern technology. Over 4 million babies, or more than 95% of all newborns born in the U.S., get screenings for a range of disorders every year. Early detection and treatment can significantly lessen the severity of the condition and potentially even avoid it altogether. Roughly three thousand neonates are found to have one of these serious illnesses.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the market in the region is expected to rise due to the rising prevalence of babies born with genetical disorders such as sickle cell anemia, Down syndrome, etc., which drives the demand for prenatal and newborn genetic testing for the early detection of diseases and helps to make the informed decision regarding the fetus. Technological adoption in healthcare services is driving rapidly in countries like India and China, and the rising population ratio in these countries is creating major opportunities for the expansion and adoption of prenatal and newborn genetic testing devices in the major hospitals that drive the growth of the prenatal and newborn genetic testing market in the forecast period.

At any given moment, between 72 and 96 million Indians are afflicted with a rare illness. These diseases, which mostly affect young children and continue to be one of the primary causes of death in newborn intensive care units (NICUs), have a hereditary basis in around 80% of cases. In response to the current state of affairs in India, LifeCell has launched GenomeScope Newborn and GenomeScope NICU, a suite of sophisticated genetic screening tests that identify genetic alterations linked to childhood-onset illnesses in both healthy and ill neonates. A diagnostic test called GenomeScope NICU examines more than 6000 genes to determine the hereditary origin of inexplicable symptoms in critically sick infants younger than 24 months of age. On the other hand, the GenomeScope Newborn test can identify inherited genetic problems in infants even before symptoms appear since it is made to gather information on over 4000 genes and examine 954 clinically relevant genes.

Segments Covered in the Report

By Technology

By Diseases

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

December 2024

August 2024

August 2024