February 2025

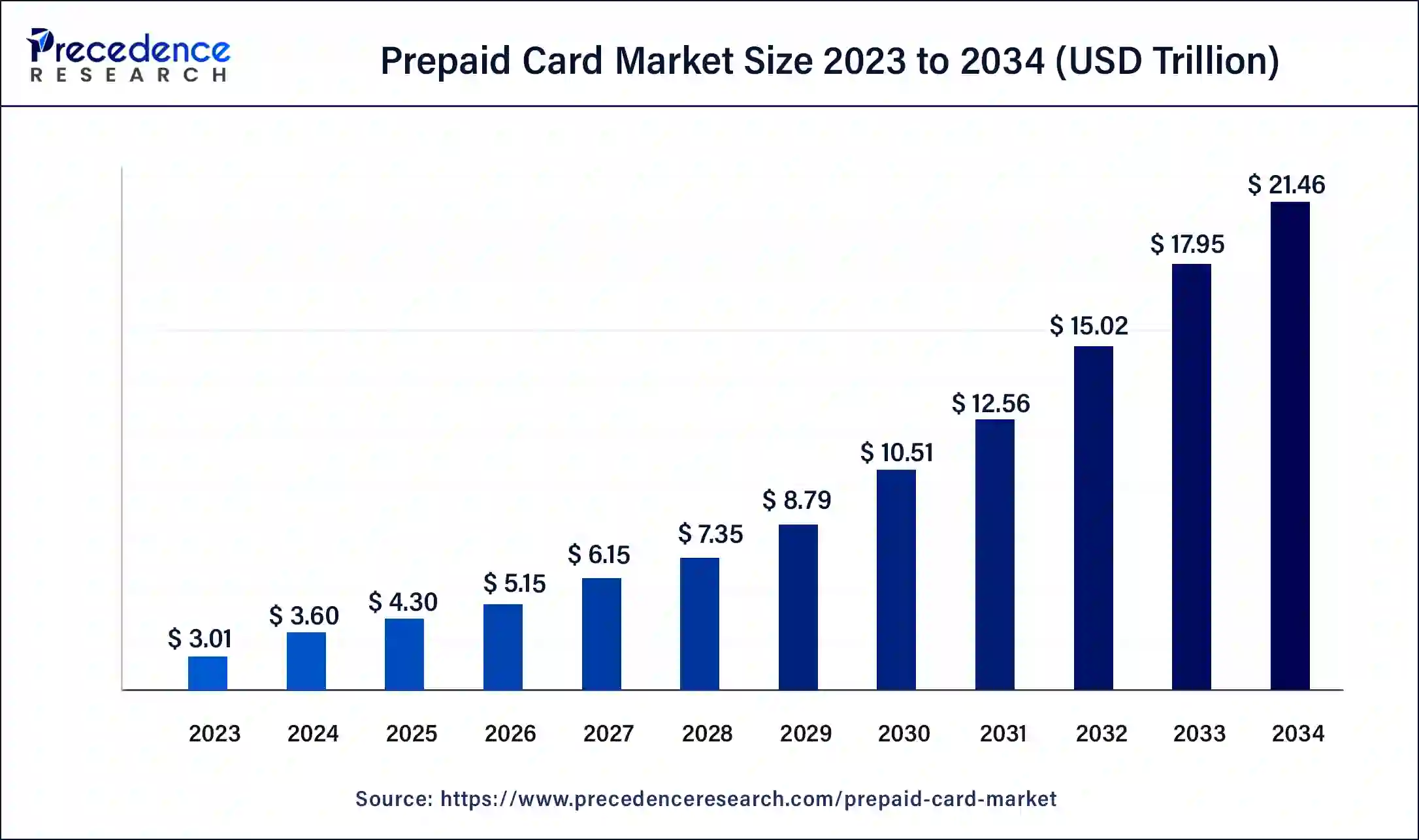

The global prepaid card market size surpassed USD 3.01 trillion in 2023 and is estimated to increase from USD 3.60 trillion in 2024 to approximately USD 21.46 trillion by 2034. It is projected to grow at a CAGR of 19.54% from 2024 to 2034.

The global prepaid card market size is projected to be worth around USD 21.46 trillion by 2034 from USD 3.60 trillion in 2024, at a CAGR of 19.54% from 2024 to 2034. The rapid rise of global e-commerce and an increasing switch to digital payment systems are the major factors responsible for growth in the prepaid card market.

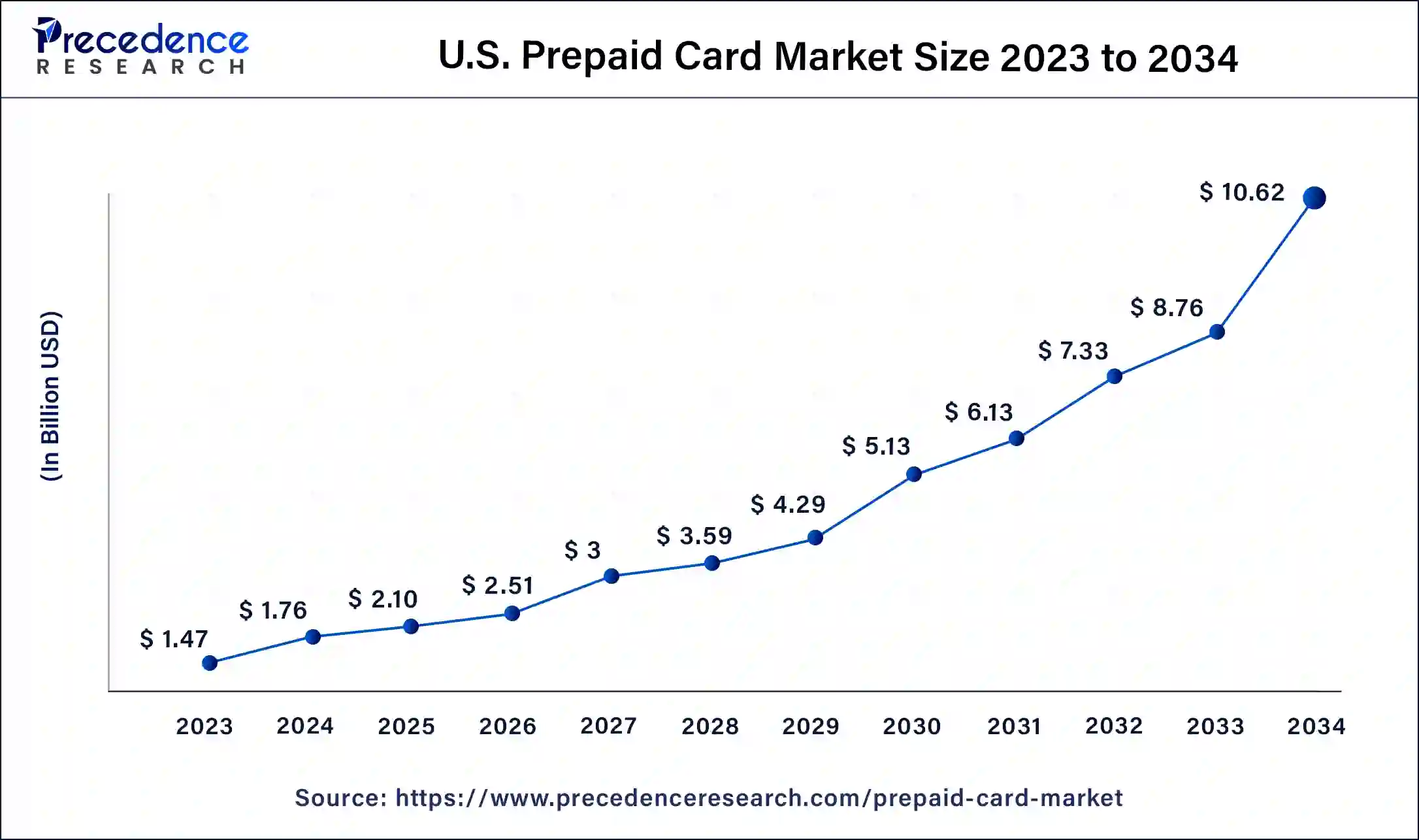

The U.S. prepaid card market size was exhibited at USD 1.47 trillion in 2023 and is projected to be worth around USD 10.62 trillion by 2034, poised to grow at a CAGR of 19.69% from 2024 to 2034.

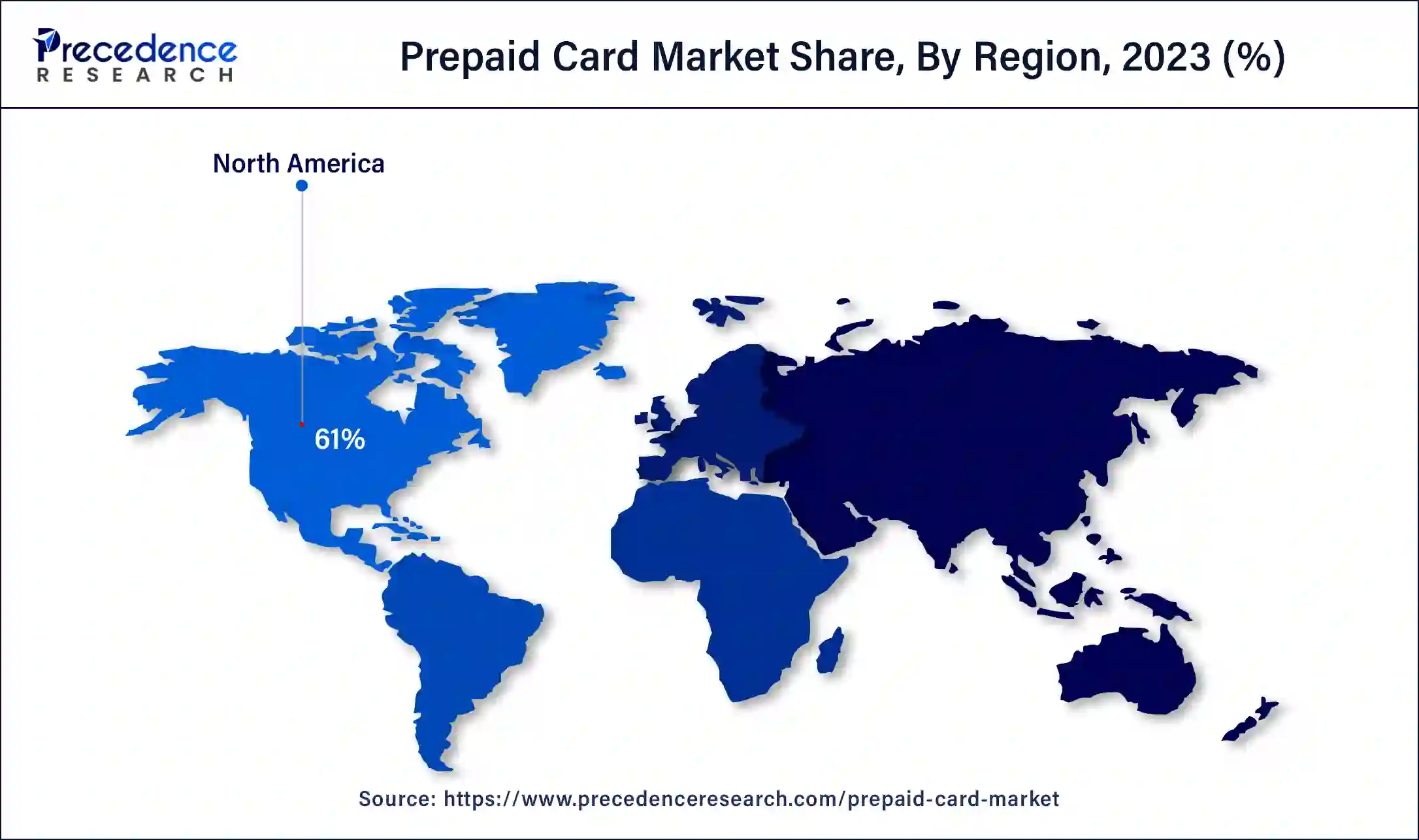

North America held the largest share in the prepaid card market in 2023. The region is home to the world’s most prominent fintech service providers and a robust financial sector pushing innovations. Research and development investments allow players in the market to constantly improve upon features provided through prepaid cards including better user interface, increased data security and better integration with digital payments through smartphones. Competition among the large prepaid card market players in the region incentivizes further R&D investment which can help develop new applications that integrate well with prepaid cards such as digital wallets and other contactless payment alternatives.

Asia-Pacific is set to be the fastest growing region in the prepaid card market during the forecast period between 2024 and 2034. Retail prepaid cards have seen a boom in the region with increased urbanization leading to a growing number of retailers now issuing prepaid cards covering supermarkets and convenience stores under their ambit. Corporate players are also using prepaid cards to distribute benefits such as employee perks. Governments in the region are also using prepaid cards to disperse benefit payments and incentivizing the use of digital payment methods.

Prepaid cards are a type of payment card that is preloaded with a specific amount of money. These cards allow an individual to withdraw cash, pay bills, and make purchases until the pre-defined limit is reached. Prepaid cards work similarly to credit and debit cards. The main difference between a debit and prepaid card is that the former is linked to your bank account. Prepaid cards require you to load money onto the card to use them. Prepaid cards have the added security benefit of not being linked to your bank account and do not need a credit check, allowing individuals with poor or no credit history to access them. Prepaid cards by design require holders to pay before using them. This model eliminates the risk of non-payment for the issuing authority. This allows banks more flexibility in terms of risk management posed by cardholders who may not have a formal banking relationship and strong payment histories.

The growing e-commerce market and popularity of digital payment platforms is driving consumers to increasingly opt for prepaid cards. Prepaid cards offer more flexibility and convenience compared to standard debit or credit cards, making them more accessible.

Lack of sufficient regulatory oversight and complex fee structures associated with the cards are challenges facing growth in the prepaid card market. However, the growing demand for cashless transactions, especially in the Asia Pacific, is a major opportunity for players in the market. The growing acceptance of prepaid cards by retail and financial institutions is also a huge opportunity for growth in the prepaid card market.

What role does AI play in the prepaid card market?

Artificial intelligence is playing a huge role in revolutionizing the fintech industry. This extends to the prepaid card sector as well. AI enhances fraud detection, streamlines prepaid card processing operations, and creates a more engaging user experience. AI-powered algorithms analyze vast quantities of data to identify and prevent fraudulent activities in real-time by learning usage patterns and flagging suspicious activity, triggering immediate alerts. Natural language processing is used to enhance the customer support experience by enabling 24/7 assistance with issues such as card activation, balance enquiry, and resolution of queries. AI-powered analysis can also be leveraged to make data-driven decisions by analyzing transaction data and identifying potential market opportunities and predict customer behavior. For instance, AI can analyze spending patterns during the holiday season and with collaboration from vendors, can offer targeted promotions.

| Report Coverage | Details |

| Market Size by 2034 | USD 21.46 Trillion |

| Market Size in 2023 | USD 3.01 Trillion |

| Market Size in 2024 | USD 3.60 Trillion |

| Market Growth Rate from 2024 to 2034 | CAGR of 19.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased demand for alternatives to cash payments and rise of e-commerce

Prepaid cards provide an alternative to traditional bank cards. Prepaid cards are not connected to an individual’s bank account and do not require opening one to operate. This makes them a more convenient option, especially for underbanked regions. Prepaid cards offer a safe way for consumers to make international payments and at times offer attractive exchange rates. A rise in demand for alternatives to cash payments is driving demand in the prepaid card market as consumers look for safe and flexible payment solutions that require the benefits of electronic transactions.

Prepaid cards are also used for access to public assistance benefits. Certain prepaid cards may be issued for food assistance or making purchases at pharmacies for medicine. Open loop prepaid cards are also used to pay workers who don’t have bank accounts and thus can’t receive direct deposits. Prepaid cards are a way to gain quick access to funds at a cost. In some instances, these fees are lower than other alternatives for underbanked and unbanked individuals. The nature of prepaid cards also makes it difficult to overdraft, lowering instances of paying overdraft and related fees.

According to the U.S. International Trade Administration, the global B2C e-commerce revenue is expected to grow to US$ 5.5 trillion by 2027 with a CAGR of 14.4% with consumer electronics, fashion, toys/hobby and nutraceuticals driving the growth. Incentives for cashless payments on e-commerce platforms, coupled with the global rise in smartphone penetration and innovations in wireless technology has made digital payments popular. This growth is driving demand for prepaid cards as a quick and easy way to perform online payments.

Complex fee structures and security concerns

The fee structures associated with prepaid cards include monthly fees, transactional fees, reload fees and inactivity fees, among others. These charges and complicated fee structures add to negative perceptions around the cards. This discourages consumers from opting for prepaid cards.

The rise of fraud and security issues around prepaid cards is curbing growth in the prepaid card market. Fraudulent or unauthorized transactions, identity theft and data breaches pose serious concerns for consumers using these cards. Since the cards are not linked to individual bank accounts, they can also be used for criminal activities like the purchase of illegal goods or services. The lack of sufficient regulatory oversight around prepaid cards contributes to this concern. Many of the features that make prepaid which made it an innovation also attract exploitation in the form of money laundering. Prepaid card companies need to establish security measures, and fraud prevention systems to alleviate these concerns among consumers.

Demand for cash alternatives in emerging economies

There is a significant demand for cash alternatives in Asia Pacific and Latin America. According to the World Bank, from 2017 to 2020, the annual number of cashless transactions per person globally rose from 91 to 135. This figure has doubled in low and middle-income economies with a 17% growth in high-income economies. The COVID-19 pandemic has also spurred a significant rise in cashless payment alternatives. Emerging economies such as India, China and Brazil have a significant share of underbanked consumers, who are turning to prepaid cards as a convenient, accessible way to participate in the growing digital economy. Nonbank prepaid card providers (sponsors) usually sell prepaid cards and may have business arrangements with money service businesses and retailers who perform the role of agents on behalf of sponsors.

The gifts cards segment held a significant share of the prepaid card market in 2023. Gift cards are popular among consumers for their convenience and flexibility, making them a preferred choice for gifts. Recipients can choose their desired products or services, which adds to the appeal. Many businesses use gift cards as promotional tools, offering them as incentives or rewards for loyalty programs, which boosts their market share.

The demand for gift cards surges during holidays and special occasions like Christmas, birthdays, and anniversaries, driving a significant portion of annual sales. Gift cards are easy to purchase, can be personalized, and are simple to use, making them an attractive option for both givers and recipients.

The closed loop segment held the largest share in the prepaid card market for 2023. A closed loop card is accepted at certain businesses within a network of linked merchants. They are widely used by travelers and students as a quick and easy way to perform transactions and conduct foreign exchange. Closed loop cards by businesses to incentivize brand loyalty through exclusive discounts, promotions and tailoring the consumer experience.

The open loop prepaid card segment is expected to be the fastest growing in the forecast period between 2024 and 2033. Open loop cards can be used at multiple transaction gateways where the card brand is accepted. Open loop prepaid cards offer greater flexibility and convenience, allowing card holders to access a wide variety of online businesses. In some instances, open loop cards can also be used to withdraw cash from ATMs and perform international transactions.

The retail segment accounted for the largest share in the prepaid card market. Retail business chains offer prepaid cards, allowing customers to earn perks such as points, discounts and other benefits. Retail chains also allow loyal customers to access flexible payment solutions, increasing overall customer convenience and satisfaction. Retail prepaid cards also usually carry lower fees compared to credit card transactions, making it a cost-effective approach. Since retail cards are not linked directly to bank accounts, there is added protection against major financial losses through fraud or theft.

The government segment is expected to be the fastest growing in the prepaid card market. Governments worldwide are increasingly using prepaid cards to give citizens access to social security payments. Digital transactions have several advantages over traditional money transfer methods used at the federal level. The accessibility and speed of electronic transactions done through prepaid cards helps governments eliminate delays in fund transfers. These cards also provide a safer alternative to cash and checks are a convenient method to receive government disbursements. Prepaid cards also can save government agencies a substantial amount of money in payment processing expenses.

Segments Covered in the Report

By Offering

By Card Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

January 2024