July 2024

Prescription Lens Market (By Type: Single Vision, Bifocal, Trifocal, Progressive, Workspace Progressives, Others; By Application: Myopia, Hyperopia/Hypermetropia, Astigmatism, Presbyopia; By Coating: Anti-reflective, Scratch Resistant Coating, Anti-Fog Coating, Ultraviolet Treatment) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

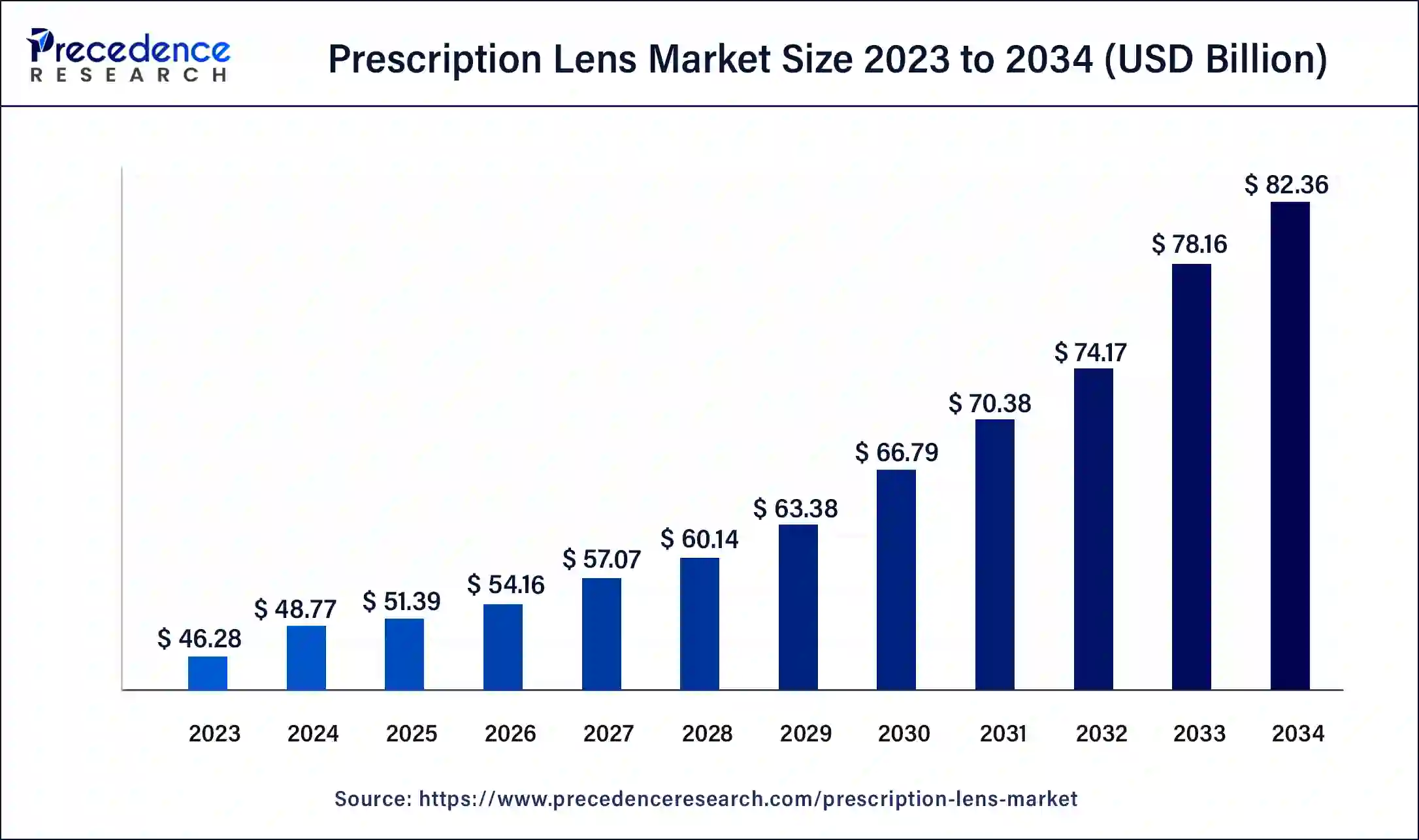

The global prescription lens market size was USD 46.28 billion in 2023, calculated at USD 48.77 billion in 2024 and is expected to reach around USD 82.36 billion by 2034, expanding at a CAGR of 5.38% from 2024 to 2034. The North America prescription lens market size reached USD 14.81 billion in 2023 The prescription lens market is driven by the increasing prevalence of astigmatism, hyperopia, and myopia among refractive errors.

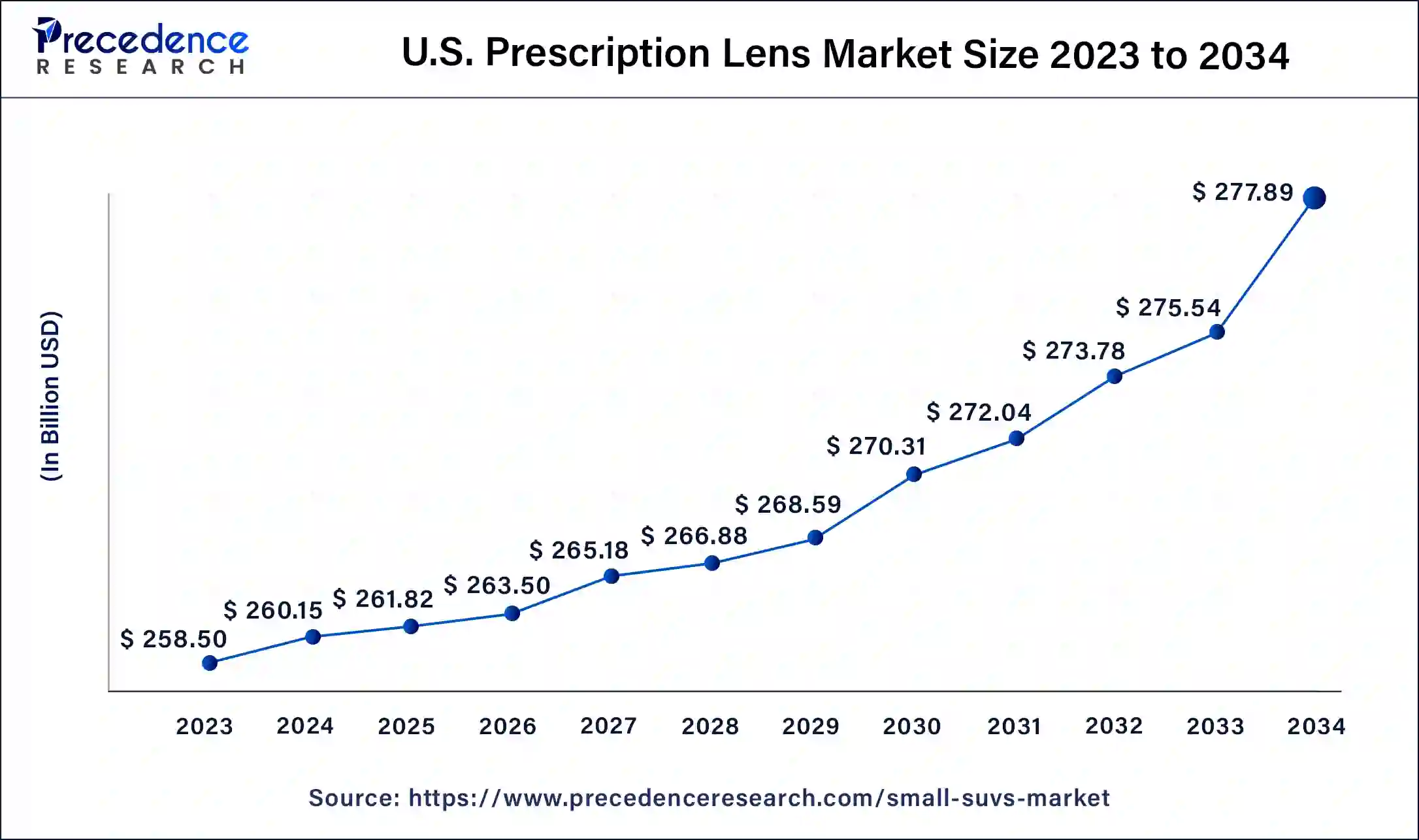

The U.S. prescription lens market size was exhibited at USD 11.85 billion in 2023 and is projected to be worth around USD 21.55 billion by 2034, poised to grow at a CAGR of 5.58% from 2024 to 2034.

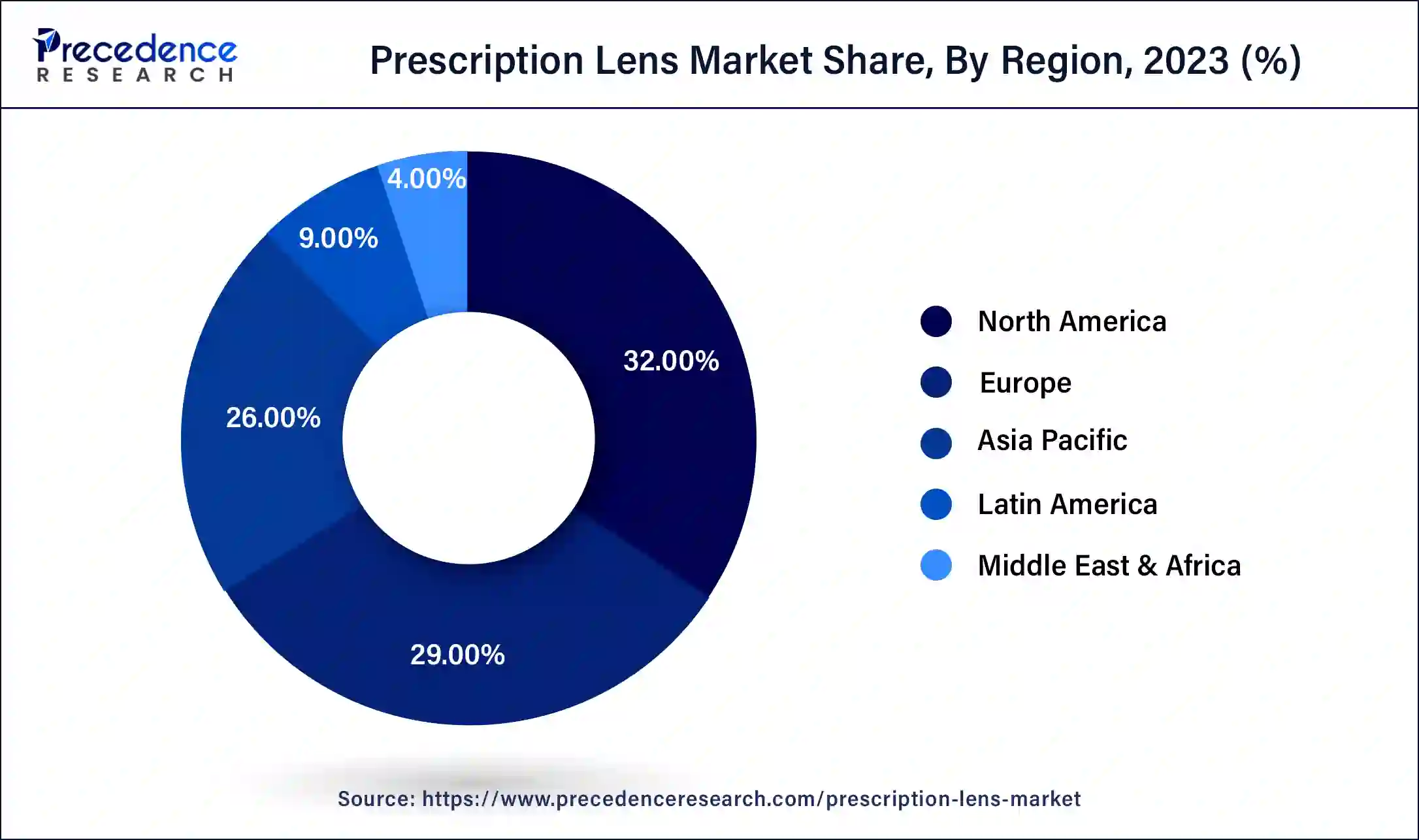

North America dominated the prescription lens market in 2023. North America has led the way in optical technology innovation. Businesses make significant investments in R&D, which results in innovations like blue light-filtering lenses, photochromic lenses, and anti-reflective coatings. Initiatives and campaigns for public health have increased awareness of the value of eye health, which has increased demand for prescription lenses. The need for corrective lenses is driven by an aging population, which raises the prevalence of age-related visual issues such as cataracts and presbyopia.

Asia-Pacific is observed to be the fastest growing in the prescription lens market during the forecast period. Consumers seeking improved visual comfort and protection are drawn to lenses with photochromic, blue-light-blocking, and high-definition features resulting from advances in lens manufacturing technologies. With contemporary diagnostic equipment and software, eye characteristics may be precisely measured, resulting in more effective and individualized prescription lenses. The governments in the area are putting laws and initiatives into place to enhance eye health, like free corrective lens distribution to low-income groups and schoolchildren, as well as subsidized eye care services. Improved standards and regulations for eye care goods provide better quality and safety, fostering consumer confidence and market expansion.

The manufacture, distribution, and retailing of lenses that optometrists prescribe to treat refractive vision disorders such as astigmatism, presbyopia, hyperopia, and myopia are all included in the prescription lens market. To improve their performance and longevity, these lenses can be constructed from various materials, including glass, plastic, and polycarbonate, and they can also have a variety of coatings and treatments applied. Many kinds of lenses are available on the market, including progressive, bifocal, trifocal, and single-vision lenses.

By producing and selling lenses, the prescription lens market represents a sizeable portion of the eyewear sector and positively impacts the world economy. It supports various vocations, including those in retail, healthcare, and manufacturing and distribution. The need for prescription glasses is growing as the world's population ages. As presbyopia and other conditions become more prevalent, there is an increasing demand for vision correction technologies. In the prescription lens industry, sustainable practices are becoming increasingly important. To meet consumer demand for sustainable products, businesses are looking into eco-friendly materials and production techniques to lessen their environmental impact.

| Report Coverage | Details |

| Market Size by 2034 | USD 82.36 Billion |

| Market Size in 2023 | USD 46.28 Billion |

| Market Size in 2024 | USD 48.77 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.38% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Coating, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of refractive errors

Refractive error is becoming more common, and this is a serious health concern that requires immediate attention. When incident parallel light rays cannot converge at a sharp focus on the retina with accommodation at rest, it results in refractive error, also known as ametropia. Myopia (shortsightedness), hypermetropia (longsightedness), and astigmatism are refractive defects. Refractive error results from an imbalance between the axial length of the eyeball and the combined refractive power of the cornea and lens of the eye. This usually happens when the eye is maturing in childhood. Refractive error development is known to be influenced by both environmental and genetic factors. The precise causes of refractive error are currently being investigated. This drives the growth of the prescription lens market.

A growing number of awareness programs

Awareness campaigns frequently showcase the newest optical technology developments. These days, prescription lenses have various improvements, like blue light filters, anti-reflective coatings, and photochromic technology that adapts to changing illumination. Knowledge initiatives raise knowledge about these advancements and stimulate demand for more sophisticated, up-to-date prescription lenses. For instance, prominent lens makers such as Essilor and ZEISS run campaigns highlighting the advantages of cutting-edge lens technologies and enticing customers to replace their prescription lenses.

Risk associated with prescription lenses

The possibility of erroneous prescriptions is one of the most significant hazards. A wrong prescription can cause various visual issues, such as headaches, eye strain, blurry vision, and even long-term vision loss. If the lenses are not custom-made for the patient, there is an increased danger. Prescription lenses can be pricey, particularly if they have sophisticated features like progressive, photochromic, or anti-reflective coating. Customers may find the high cost a significant deterrent, especially if they lack sufficient insurance coverage. This limits the growth of the prescription lens market.

Growing need of digital lens technology

Accurate and personalized lens creation is made possible by digital lens technology. Computer-aided design and manufacture (CAD/CAM) technology allows lenses to be customized to meet each person's prescription, lifestyle, and visual requirements. This degree of personalization improves comfort and clarity of vision, which increases customer appeal for digital lenses. A sizable market for digital lenses comprises younger consumers who are more tech-savvy and active on digital gadgets. This group responds well to marketing tactics highlighting the advantages of digital lenses for improving visual performance and lowering eye strain, which will propel market expansion. This opens an opportunity for the growth of the prescription lens market.

The single vision segment dominated the prescription lens market in 2023. People who need glasses for astigmatism, nearsightedness, or farsightedness can benefit from single-vision lenses. These glasses uniformly distribute focus across the whole surface area of the lens and feature only one optical prescription correction. It is the sort that most people who wear glasses typically obtain.

The progressive segment is observed to be the fastest growing in the prescription lens market during the forecast period. Progressive or varifocal lenses, which offer a seamless transition from distant to near correction, make clear vision at all distances, intermediate, close, and far, possible. No-line bifocal lenses are another name for progressive lenses. The prescription at the top of these specialist lenses differs from that at the bottom. Unlike bifocal lenses, which have a sharp line etched in the lens, these lenses have a progressive shift in prescription.

The top portion of the lens performs well for distance. The bottom part becomes stronger and stronger until the bottom (for reading) is the most substantial part. The wearer of a progressive lens can see everything from up close to far away.

The myopia segment dominated the prescription lens market in 2023. Globally, myopia, or nearsightedness, is rising, particularly in children and young adults. According to studies, about half of all people on the planet will be myopic by 2050. Genetic predisposition, less outdoor activity, and increased screen time are the leading causes of this spike. Technological developments in digital lens production enable highly personalized lenses suited to each person's unique requirements. Customers find myopic lenses more enticing because this customization enhances visual clarity and comfort.

The presbyopia segment is observed to be the fastest growing in the prescription lens market during the forecast period. People usually start to experience presbyopia in their early to mid-40s. Presbyopia is a condition that more people worldwide are suffering as they get older. One sizeable demographic group, the Baby Boomer generation, is currently in the age range where presbyopia is frequent. This increases the number of people who purchase presbyopia-correcting lenses. Multifocal vision correction, including driving, sports, computer work, and reading, is frequently necessary for modern lives. This makes adaptable and efficient presbyopia-correcting lenses more necessary.

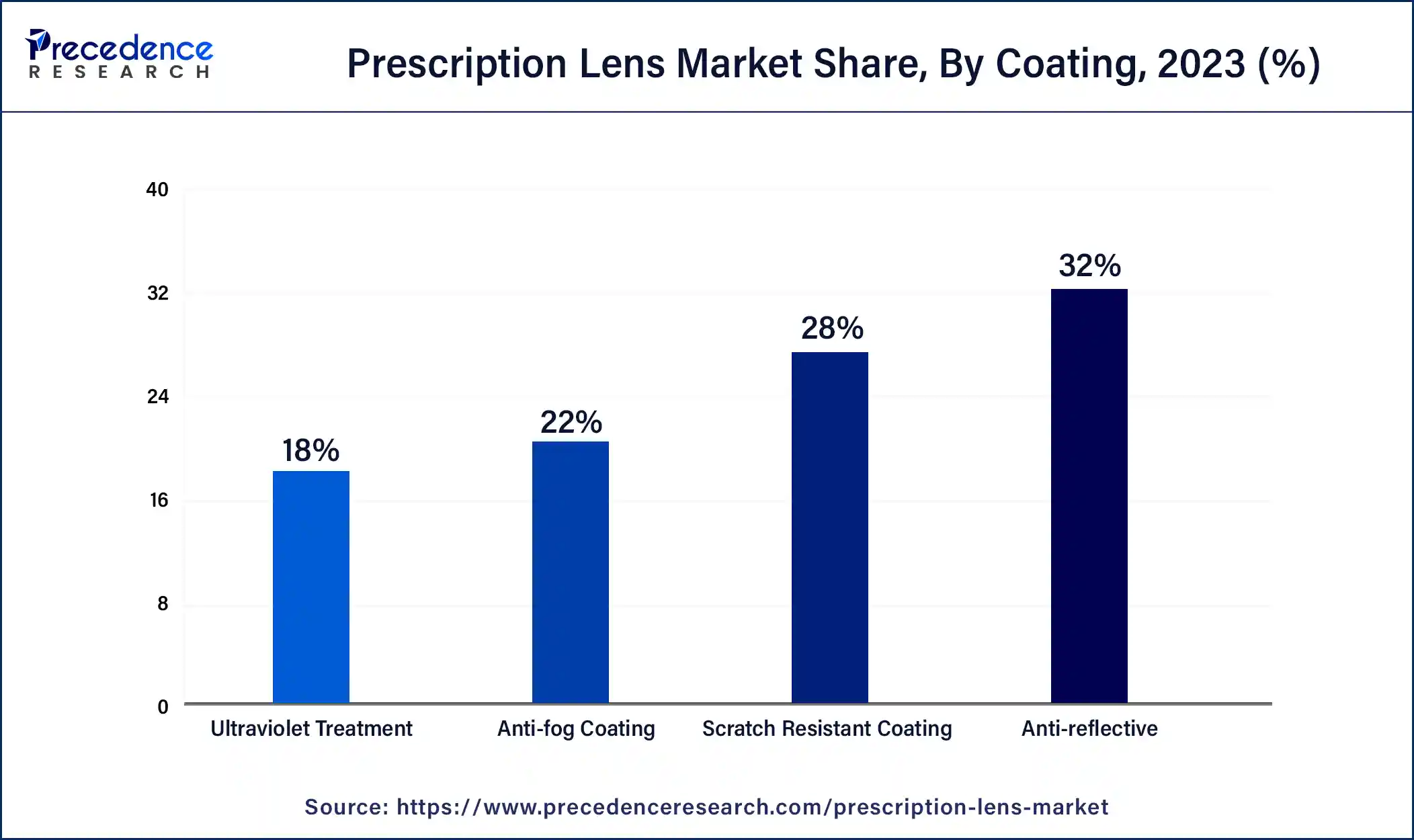

The anti-reflective segment dominated the prescription lens market in 2023. Anti-reflective coating, sometimes referred to as "AR coating" or "anti-glare coating," enhances visual clarity, lessens eye fatigue, and enhances the appearance of eyeglasses. Compared to wearing eyeglass lenses without AR coating, sharper vision, less glare when driving at night, and increased comfort during extended computer use are among the visual benefits of anti-reflective coating. The glare from light bouncing off your lenses is also eliminated by anti-reflective coating. Lenses with AR coating reduce reflections, improve night vision for driving, and make reading and computer use more pleasant.

All eyeglass lenses should apply AR coating, but it significantly benefits polycarbonate and high-index lenses. These materials reflect light more than ordinary glass, or plastic lenses do if anti-reflective coating is not used.

The ultraviolet treatment segment is observed to be the fastest growing in the prescription lens market during the forecast period. UV-protective coatings for eyeglass lenses shield the eyes from UV radiation, much like sunscreen shields the skin from the sun's rays. Excessive UV radiation exposure is believed to result in cataract development, retinal damage, and other eye issues. Regular plastic eyeglass lenses block most UV light, but for increased safety, a UV-blocking dye can increase UV protection to 100%. Alternative materials for eyeglass lenses, such as polycarbonate and most high-index plastics, already include 100% UV protection; thus, they don't need an additional lens treatment.

Segments Covered in the Report

By Type

By Application

By Coating

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

March 2025

July 2024