December 2024

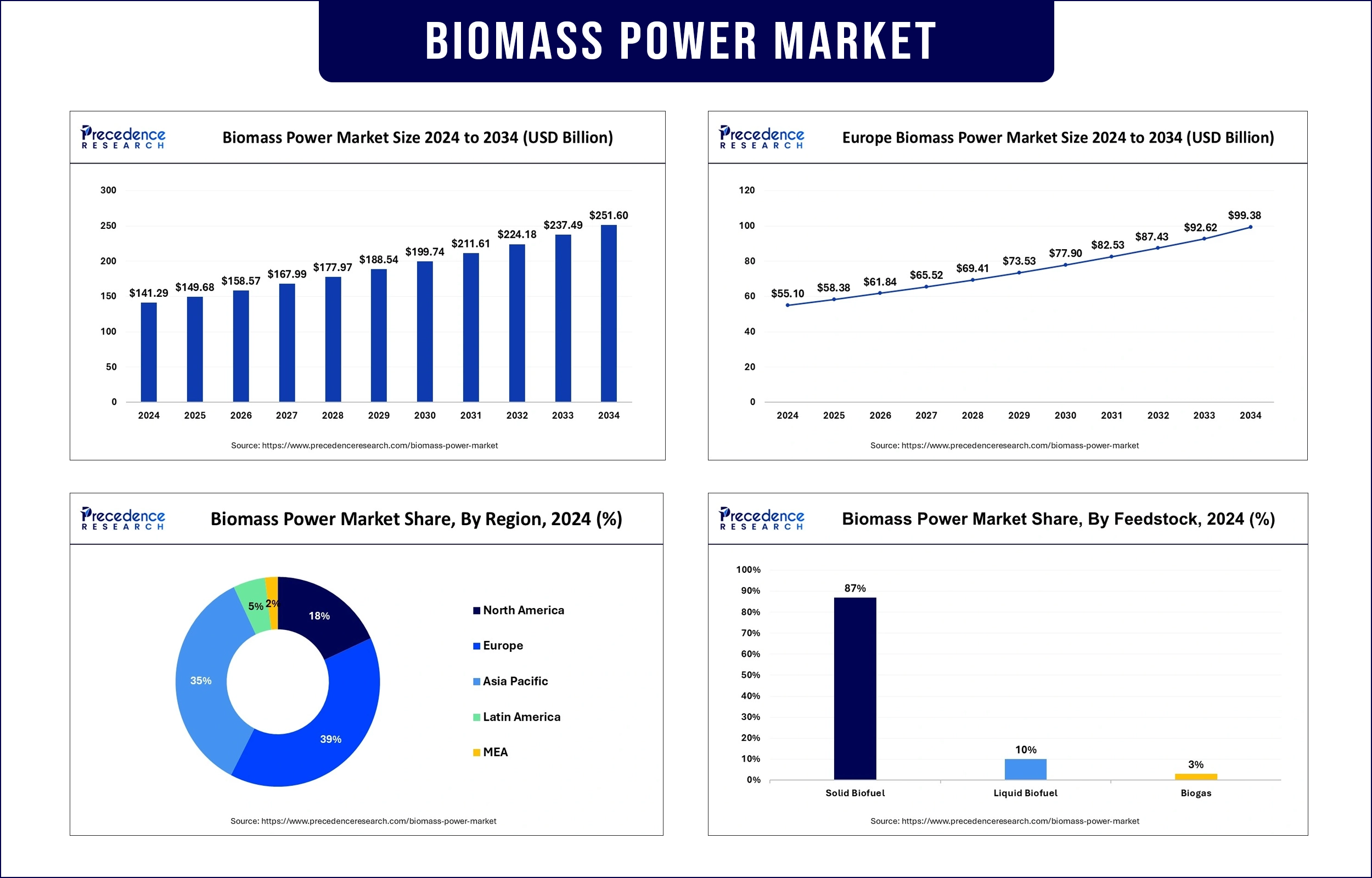

The biomass power market revenue surpassed USD 149.68 billion in 2025 and is predicted to attain around USD 237.49 billion by 2033 with a CAGR of 5.95% during the forecast period. The increasing focus on renewable energy, government incentives, and the need for sustainable alternatives to fossil fuels are major factors driving market growth.

The biomass power market creates electricity and heat by using agricultural residues, forestry waste, and energy crops, which are organic materials. The conversion of bio-based materials through direct combustion alongside anaerobic digestion or gasification leads to the production of clean energy. Biomass power emerges as an essential carbon-neutral alternative energy source as environmental priorities and worldwide emission reduction initiatives increase. Furthermore, increasing investments in biomass cogeneration facilities and supportive government regulations are contributing to the market's upward trajectory during the forecasting period.

Feedstock Insight

The solid biofuel segment held the highest biomass power market share in 2024, driven by the widespread use of wood chips, pellets, and agricultural residues in combustion-based biomass plants.

The liquid biofuel segment is expanding at a notable pace during the forecast period, fueled by technological advances in second-generation biofuels and increasing interest in bioethanol and biodiesel as substitutes for fossil fuels.

Technology Insights

The combustion segment accounted for the largest biomass power market share in 2024, owing to its operational simplicity, low capital costs, and suitability for both large-scale and decentralized biomass power systems.

The gasification segment is projected to grow at a notable CAGR during the forecast period. This growth is supported by the increasing adoption of advanced gasification systems, which offer higher efficiency and lower emissions compared to traditional combustion.

Rising Demand for Clean and Renewable Energy

Different regions of Europe, North America, and Asia Pacific have established subsidies and tax benefits with renewable energy requirements to boost biomass acceptance. European Union member states need to boost their renewable energy consumption through biomass implementation based on targets set in the Renewable Energy Directive (RED). Moreover, the initiatives demonstrate worldwide support for developing environmentally sustainable energy technologies with fiscal backing and governmental policy frameworks.

New restrictions for forest biomass utilization under the RED generated European leader approval in March 2023. This removed funding for specific forest wood burning to produce energy and barred using forest wood from primary and old-growth sources for renewable energy quota calculations.

Government Incentives and Policy Support

Governments in Europe, North America, and Asia-Pacific support the adoption of biomass through political incentives. In 2024, through its Section 45 legislation, the United States offers businesses a per kWh federal tax credit to generate electricity from qualifying renewable sources, including biomass. Additionally, the multiple global organizations demonstrate their dedication to sustainable energy solutions, thus further facilitating the biomass power market in the coming years.

Technological Advancements in Conversion Methods

Modern improvements in gasification and pyrolysis, and anaerobic digestion policies create better efficiency and scalability potential for biomass power systems. These advance gasification technologies let users transform multiple biomass sources into clean syngas. Higher yields of bio-oil obtained through better technological advances of pyrolysis processes. This enables the production of transportation fuel products to enrich renewable energy diversity. Furthermore, the increased biomass energy adoption rates support worldwide efforts to develop cleaner power systems.

Waste-to-Energy Integration

The combination of biomass processing systems with municipal solid waste (MSW) management has gained prominence for decreasing harmful emissions to support circular economy practices. The development of new WTE facilities causes environmental concerns for international communities. Moreover, the developments showcasing waste-to-energy technologies contribute to sustainable waste management with energy production success, further facilitating the market in the coming years.

Europe dominated the global biomass power market with the largest share, driven by the rigorous renewable energy mandates and strong networks for biomass supply chain management. Three European nations, namely Germany, Sweden, and the Netherlands, have created strong policies for biomass resources use.

In December 2024, Idex, a major player in low-carbon energy, continued its European expansion with a strategic project in Belgium. In partnership with Veolia and BW, the group announced the construction of a large-scale biomass power plant aimed at supplying green heat and electricity to the Université catholique de Louvain.

The German energy policy known as EEG 2023 uses a €28 billion investment to achieve a renewable energy target of 80% by 2030. Additionally, the revised Renewable Energy Directive under EU body regulations mandates achieving 42.5% renewable energy use by 2030, thus further propelling the market in this region.

Asia Pacific is expected to expand at a double-digit CAGR in the biomass power market during the forecast period, owing to the increasing rural power projects and substantial agricultural waste resources. The government of China, together with India, Japan, and South Korea, invest funds to develop biomass power generation plants. This developed systems help these growing nation to decrease their reliance on coal.

Japan's feed-in-tariff and feed-in-premium schemes under which it operates now have 6,364 MW of biomass power capacity with the addition of 60 MW in the previous quarter of 2023, as per the IEA Bioenergy report. Moreover, the biomass power infrastructure in the region expands with ongoing supportive policies and technology transfers, thus fuelling the market in coming years.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 149.68 Billion |

| Market Revenue by 2033 | USD 237.49 Billion |

| CAGR | 5.95% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Technology

By Feedstock

By End Use

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/1819

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025