December 2024

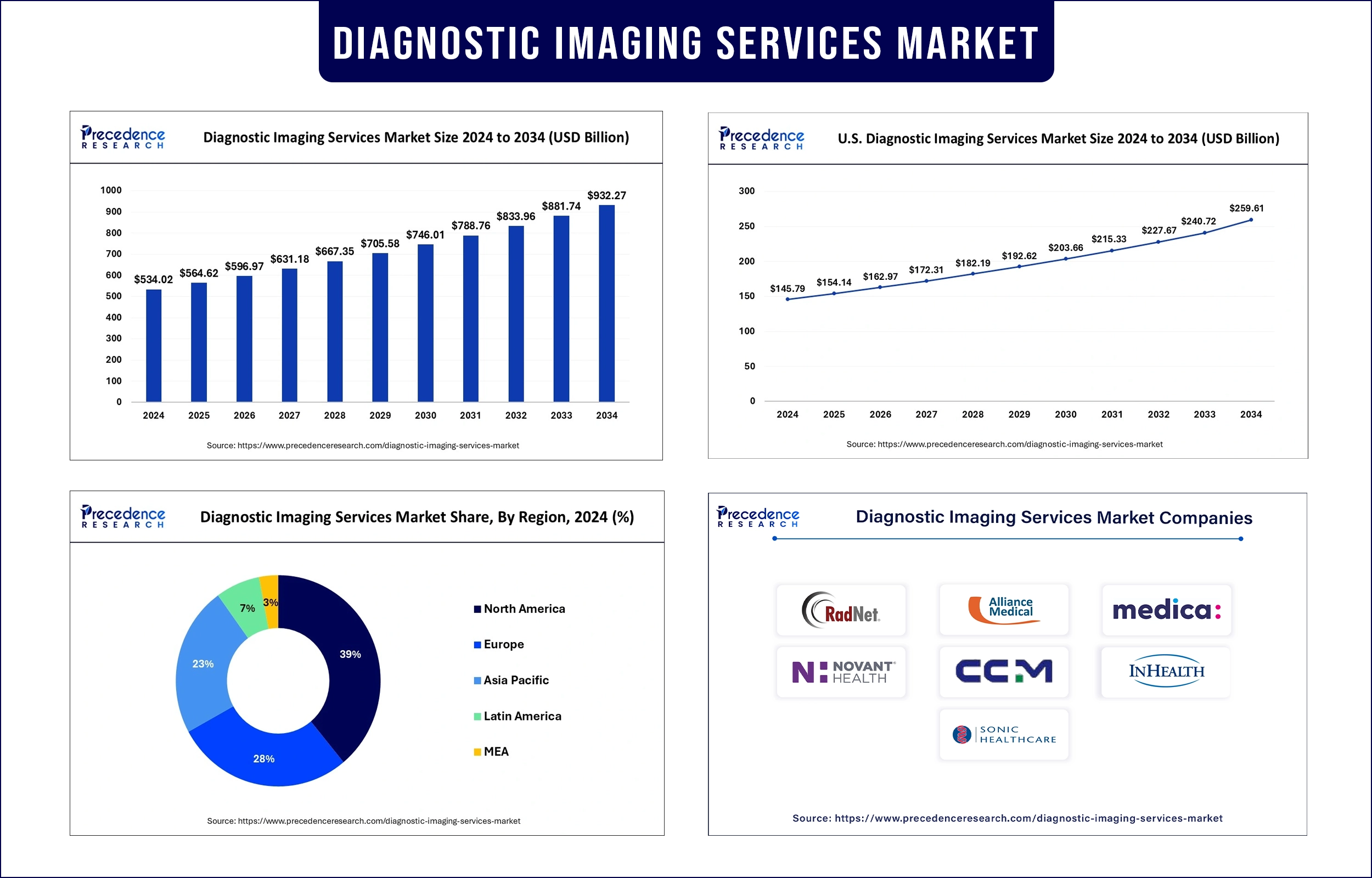

The global diagnostic imaging services market revenue reached USD 564.62 billion in 2025 and is predicted to attain around USD 881.74 billion by 2033 with a CAGR of 5.73%. The integration of artificial intelligence (AI) in imaging, along with the shift toward minimally invasive procedures, is further accelerating market growth.

Interventional radiology diagnostic imaging services are essential to modern healthcare, as they deliver innovative imaging technologies that support medical detection and plan operations and medical management of patients. The increase in diagnostic imaging services market demand stems from these various factors. The market expansion is accelerated by artificial intelligence (AI) in imaging, as the FDA granted approval to more than 200 AI medical imaging products by November 2022. The market grows through increased healthcare investments and beneficial government initiatives that both improve diagnostic imaging service affordability and accessibility.

Artificial Intelligence in Imaging

Diagnostic imaging that integrates artificial intelligence (AI) delivers precise results while cutting the time required for exam analysis and enables the identification of conditions during their early stages. Furthermore, the advancements demonstrate how AI drives the transformation of diagnostic imaging to speed up interventions, which simultaneously produces improved patient results.

The increased dependence on AI as a workflow simplifier for imaging diagnostics drives this increasing trend. Ezra obtained FDA clearance for Ezra Flash in June 2023, as this AI technology boosts MRI image quality to facilitate speedier and cheaper full-body scans. Similarly, RapidAI obtained FDA clearance in February 2025 for Lumina 3D, an AI solution that aids automated 3D imaging reconstruction during head and neck CTA scans to speed up diagnostic and treatment procedures.

Growing Demand for Portable Imaging Solutions

The demand for portable and point-of-care imaging devices is rising, particularly in emergency care settings and home healthcare services. The National Institute of Biomedical Imaging and Bioengineering (NIBIB) operates the Point-of-Care Technologies Research Network (POCTRN), through which it advances the development of these technologies for better, speedy diagnostics across different healthcare environments.

Academic research demonstrates that basic training helps patients generate ultrasound images of professional quality at home, thus indicating an emerging trend toward diagnostic autonomy for patients. The healthcare field shows an increasing preference for portable diagnostic systems since these solutions enhance patient care through better accessibility and diagnostic process speed.

Expansion of Teleradiology Services

Remote interpretation of imaging scans is improving access to diagnostic services in rural and underserved areas, driving market growth. HRSA implements evidence-based programs that expand health information access through telehealth technologies to improve the quality of healthcare information in rural regions. The World Health Organization (WHO) stresses the need for telemedicine growth as it enhances distant healthcare delivery to populations who lack access to care.

Medical professionals who integrate teleradiology within established healthcare systems enable immediate accurate diagnoses that shorten patient transfer times and speed up appropriate medical care delivery. This strategy decreases the healthcare demands on urban medical centers while solving the insufficient supply of radiology professionals in rural communities. Modern teleradiology technologies have created a transformative effect that fills gaps in healthcare services and delivers equal diagnostic service opportunities to all patients.

Rising Adoption of Hybrid Imaging Modalities

Disease diagnosis experiences a revolutionary change due to the increasing use of hybrid imaging systems, including positron emission tomography-computed tomography (PET-CT) and single-photon emission computed tomography-computed tomography (SPECT-CT), that provide advanced imaging perspectives. Medical diagnostics today depend heavily on hybrid imaging techniques, with their implementation allowing healthcare providers to detect diseases early and design individualized treatments for patients.

PET-CT technology adoption throughout Canada has risen by 39.5% throughout the previous decade at the time of 2012, reaching 43 units for a current total of 60 units in the 2022–2023 period. Such diagnostic methods merge functional with anatomical imaging techniques to deliver improved accuracy for diagnosis and treatment strategies. The combination of PET metabolic data with MRI anatomical data through hybrid PET/MRI enhances the precision of treatment planning steps and disease staging, especially in oncologic cases.

North America dominated the diagnostic imaging services market due to the strong healthcare infrastructure, technological advancements, and supportive reimbursement policies. The presence of leading market players and extensive R&D activities further contribute to regional growth. The United States market achieves higher diagnostic scan affordability due to beneficial reimbursement systems.

Regional expansion in the diagnostic imaging services market receives support from leading companies, including GE HealthCare Technologies Inc., Siemens Healthineers AG, and Koninklijke Philips NV, as these organizations drive extensive research and development initiatives. Early diagnosis and treatment planning, as chronic disease rates increase, including cancer and cardiovascular conditions, drives the need for modern imaging services.

Asia Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period, owing to the rising healthcare expenditures, improving medical infrastructure, and the growing demand for advanced diagnostic services in countries, including China, India, and Japan. Medical investments across Asia Pacific expanded dramatically, according to the World Health Organization, as multiple nations dedicated additional funds for medical facilities and services development during 2023.

The aging demographic in Japan, according to the National Institutes of Health (NIH), has raised diagnostic process requirements, thus boosting market expansion. The U.S. Food and Drug Administration (FDA) documented enhanced international organizations and Asia Pacific nations working together to develop better diagnostic imaging standards and expand access throughout 2024. The growing diagnostic imaging services market in the region receives its momentum from these technological and demographic factors.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 564.62 Billion |

| Market Revenue by 2033 | USD 881.74 Billion |

| CAGR | 5.73% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Modality

By End Use

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1531

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344

December 2024

January 2025

April 2025

January 2025