August 2024

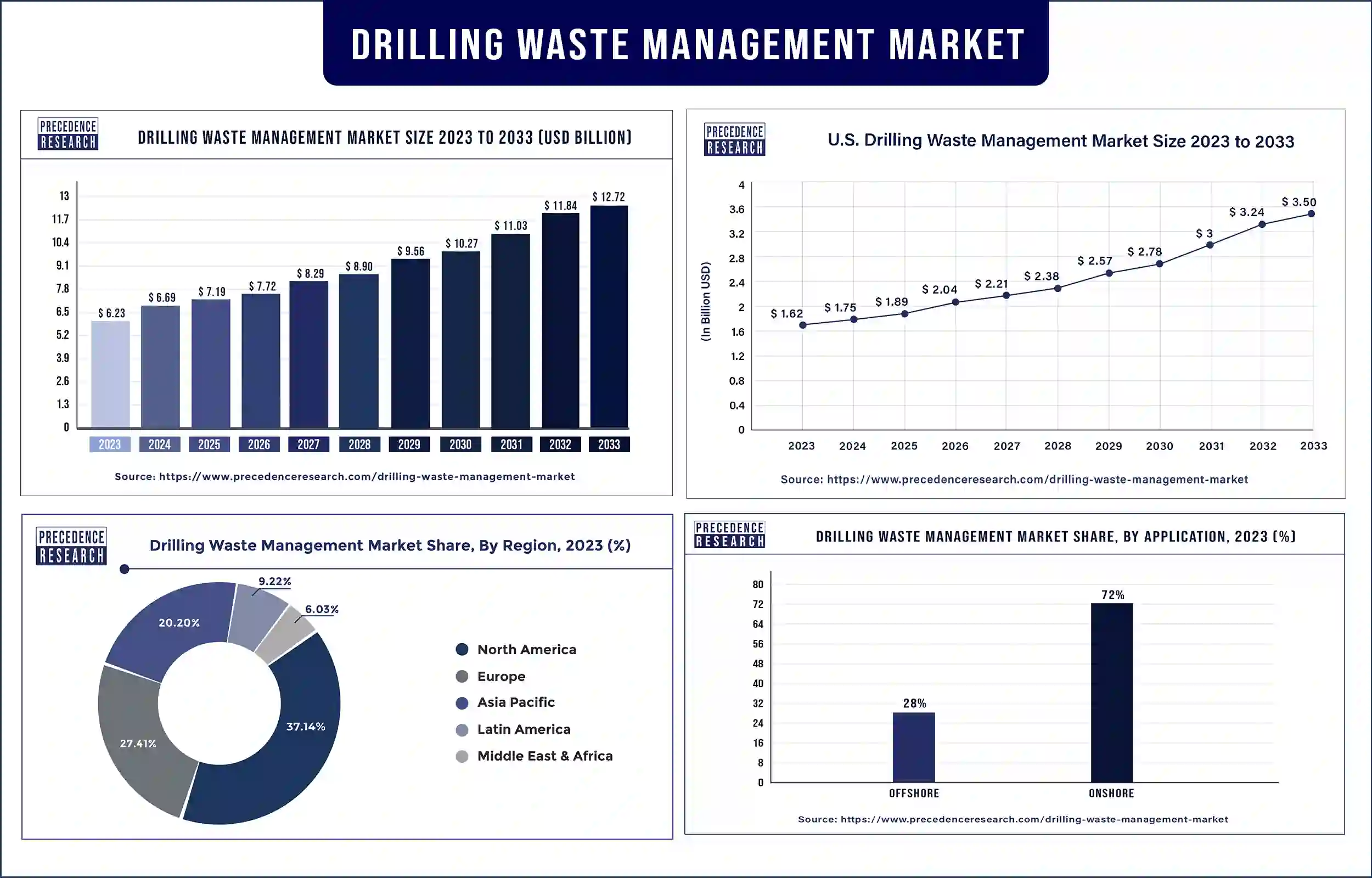

The global drilling waste management market revenue was valued at USD 6.23 billion in 2023 and is poised to grow from USD 6.69 billion in 2024 to USD 12.72 billion by 2033, at a CAGR of 7.4% during the forecast period 2024 - 2033. The growing environmental concerns towards effective waste management are expected to drive the growth of the drilling waste management market.

The drilling waste management market is a constituent of successful operation activities regarding E&P operations, which is crucial for environmental protection, production operation, and effective drilling. The strict legal regulations towards restricting the expansion of land and water pollution, along with financial advantages to drive the adoption of effectively handling generated waste, are anticipated to enhance market growth. The rising ecological awareness in emerging countries, increasing global demand for energy, and growing industry commitment to sustainable practices are expected to drive market growth. In addition, ongoing advancements in waste treatment technologies such as thermal treatment units and solids control systems, increasing awareness of environmental issues, and increasing efficient disposal solutions of fluids and drilling cuttings are further anticipated to drive the growth of the drilling waste management market during the forecast period.

Growing exploratory operations and production in the oil and gas industry to fuel the market growth.

The rising oil and gas production from emerging countries is a direct result of the rising energy demand globally. Production operations and region exploration have increased as a result of this growth. Drilling is a crucial part of the oil and gas exploration and production procedures. The quantity of drilling waste, which involves cuttings and drilling mud, increases because of the rapid growth in drilling activity. Due to this, it is important to have a proper waste management application for drilling processes that also prevents environmental concerns. Opportunities for managing drilling waste are contributed by an increase in production and exploratory operations. These are driving factors expected to enhance the growth of the drilling waste management market.

However, the negative impacts of drilling waste on the environment may restrain the market growth. The various drilling-related wastes and products have the capacity to harm the environment. The pollution of aquatic bodies, contamination of the land, and air pollution are the major effects of great concern. Aquatic life is put at risk when infected drill cuttings are incorrectly disposed of in the ocean. The air is made harmful and unhealthy for both animals and humans by the high emission of air pollutants from internal ignition engines. Some of these pollutants' outcomes such as soil acidification, damage to plants, and respiratory problems in both animals and humans. These factors are considered to hinder the drilling waste management market over the forecast period.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 6.69 Billion |

| Market Revenue by 2033 | USD 12.72 Billion |

| Market CAGR | 7.4% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Innovation in the Drilling Waste Management Market by Geminor

Recent Innovation in the Drilling Waste Management Market by Caterpillar Oil & Gas

North America dominated the drilling waste management market in 2023. The increasing drilling activities, especially in the oil and gas sector, strict government regulations regarding the proliferation of land and water pollution, rising ecological awareness, and growing environmental concerns regarding effective drilling waste management are expected to drive market growth in North America. The U.S. and Canada are the major leading countries in North America. The U.S. holds the largest country-level share of the market. A strong judiciary and robust legislation have effectively pushed the waste management laws in the U.S. The demand for drilling waste management has contributed to significant growth in recent years, enhanced by the growing oil and gas industry. As the U.S. continues to exploit and explore its largest energy resources, the demand for sustainable and effective waste management services has become paramount. The drilling procedure creates substantial amounts of waste such as mud, drill cuttings, and other by-products that can prevent environmental risk in the U.S. These are the major factors expected to enhance the growth of the drilling waste management market in North America.

Asia Pacific is expected to grow fastest during the forecast period. The region is contributing a large amount of exploration activity merged with enhancing the construction business, which is expected to intensify. The increasing demand for drilling waste management solutions, increasing regulations and environmental awareness, and rising stakeholder engagement and community awareness are expected to drive market growth in the Asia Pacific. China, India, Japan, and South Korea are the major leading companies in the Asia Pacific region. China has the largest market share in drilling waste management.

China is a leading oil and gas consumer. So many drilling wastes are manufactured during oil and gas exploitation and exploration in China. China has successfully run and built projects to dispose of wastes in salt mines, which completely demonstrates the superiority and feasibility of this technology. China has a bright future in the drilling waste management industry and is expected to drive the growth of the market in the Asia Pacific region.

Growing offshore exploration activities

Offshore oil and gas production and exploration activities across the world have significantly increased over the past few years. Offshore production shows one-fourth of global gas production and one-third of global crude oil output. The majority of the hydrocarbon reserves have been offshore, which helps the increasing significance of the navigational sector for extraction. In addition, rising technological advancements in offshore exploration activities have also accelerated offshore drilling's expansion into ultra-deep and deep oceans, which has surged in significance. These are the major opportunities expected to drive the growth of the drilling waste management market in the coming future.

Market Segmentation

By Service

By Application

By Waste Type

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3608

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

August 2024

January 2025

January 2025

January 2025