April 2025

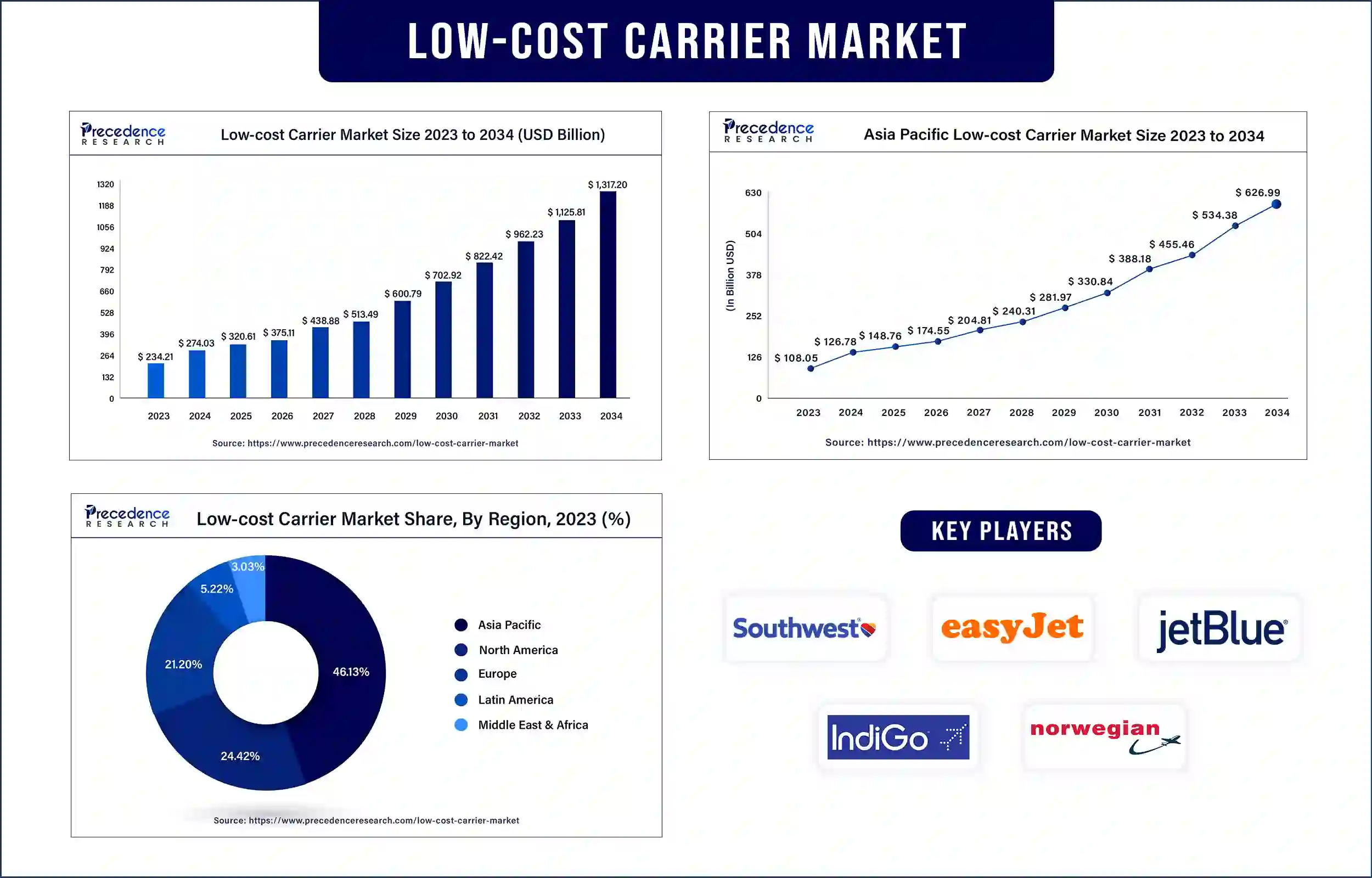

The global low-cost carrier market revenue was valued at USD 234.21 billion in 2023 and is poised to grow from USD 274.03 billion in 2024 to USD 1,317.20 billion by 2034, at a CAGR of 17% during the forecast period 2024 – 2034. Being cost-effective is one of the major reasons this market is growing rapidly.

The low-cost carrier market plays a vital role in the airline sector by providing low-cost without any extra baggage charges, providing the luxury of flying, and saving time for travelers. A low-cost carrier, also known as a low-cost airline, offers low cost due to fewer luxury availability and no traditional service offerings like food, juice, seat allocation, and many more. Multiple low-cost carriers are available across the world, including JetBlue, Southwest Airlines, Vueling, WestJet, Wizz Air, and many others. To make traveling affordable and increase passenger capacity, the seats are placed in such a way that the gap between seats is smaller.

All the major airline services focus on introducing affordable traveling experiences to their customers searching for such options. By satisfying customers’ preferences, low-cost carrier companies enhance the significance of the aviation industry. South East Asia region is considered to contribute the largest share of the low-cost carrier market in comparison to other regions.

The rising demands for discounts and flexibility in fares and travel are driving the low-cost carrier market

In several developing countries, people prefer economically affordable facilities that can also save time, and there comes a low-cost carrier market in rescue. The traveling industry is evolving continuously and is becoming an integral component of the travel industry by playing a significant role in the shifting of affordable and accessible flying. In a country like India, the stakeholders of Civil Aviation developed the idea of a Regional Connectivity Scheme or UDAN Scheme to encourage the connectivity of tier 1 and tier 2 cities. This scheme instantly boosted the economy, tourism, travel, healthcare, trade, and hospitality industries.

Also, this scheme influenced many people to choose airways over road and train routes. By offering cheap fare deals without compromising on the safety of the passengers, low-cost airlines attract people to choose such local flights over other luxurious and high-charge flights. Not only pocket-friendly ticket charges, these airlines also use extensive routes to connect major cities and destinations. With the help of mobile apps, customers can choose their preferred flight and pay with just a few clicks. They also have added some ancillary services, such as the option to customize the customer’s traveling experience by adding flight meals, seat selection, and many more.

In this low-cost carrier market, the aviation industry's profit margin is very low, which makes it challenging to run and make advancements. Various airlines, such as Air Sahara, GoAir, Kingfisher Airlines, and many others, have gone down due to excessive expenses in this business. This is also due to high competition in the aviation industry for fare, routes covered, timing maintenance, and many others.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 274.03 Billion |

| Market Revenue by 2034 | USD 1,317.20 Billion |

| Market CAGR | 17% from 2024 to 2034 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development by Air Arabia

Recent Development by Allegiant Air

Asia Pacific dominated the low-cost carrier market in 2023 due to the increasing middle-class and upper-middle-class population who prefer to fly with low-cost airlines. For instance, in December 2023, Skymark Airlines of Japan served a unique positioning between national carriers and low-cost airlines, offering affordability without compromising comfort. The government of India has also taken various initiatives towards airlines to make them affordable for all classes in society.

As per records from PIB (Press Information Bureau), till December 2023, Rs. 4500 Crores is allocated for the development of airlines in India under government schemes, and more than 1.30 crores people have availed this benefit. Such initiatives are pushing the low-cost carrier market to grow rapidly in the Asia Pacific region.

North America is expected to grow its market during the predicted period from 2024 to 2034. The continuous development and public demand are helping the countries of this region to adopt some advancements and introduce new policies for low-cost airline sectors. Financial constraints are also creating a barrier to the development of the aviation sector in countries like Canada and the U.S. Flair Airlines, which is a low-cost carrier connecting people to places affordably, is a Canadian company.

Advancements in facilities with cost-effectiveness can help the low-cost carrier market grow exponentially

The availability of comfort and all other services added to high-cost flights can help the market grow exponentially from 2024 to 2033. Providing well-trained staff and enhancing the luxury can draw more attention of a major group of people towards low-cost airlines. Government initiatives and funding for the development of the low-cost aviation sector can encourage people to choose these modes of traveling rather than road and train facilities. Collaboration among companies can also provide luxury with affordability. Continuous advancements in routes and connecting a wide range of cities at once also hold the potential to increase market demand.

Low-Cost Carrier Market News

Market Segmentation

By Aircraft Type

By Distribution Channel

By Operations

By Application

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3074

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

April 2025

January 2025

February 2025

January 2025