April 2025

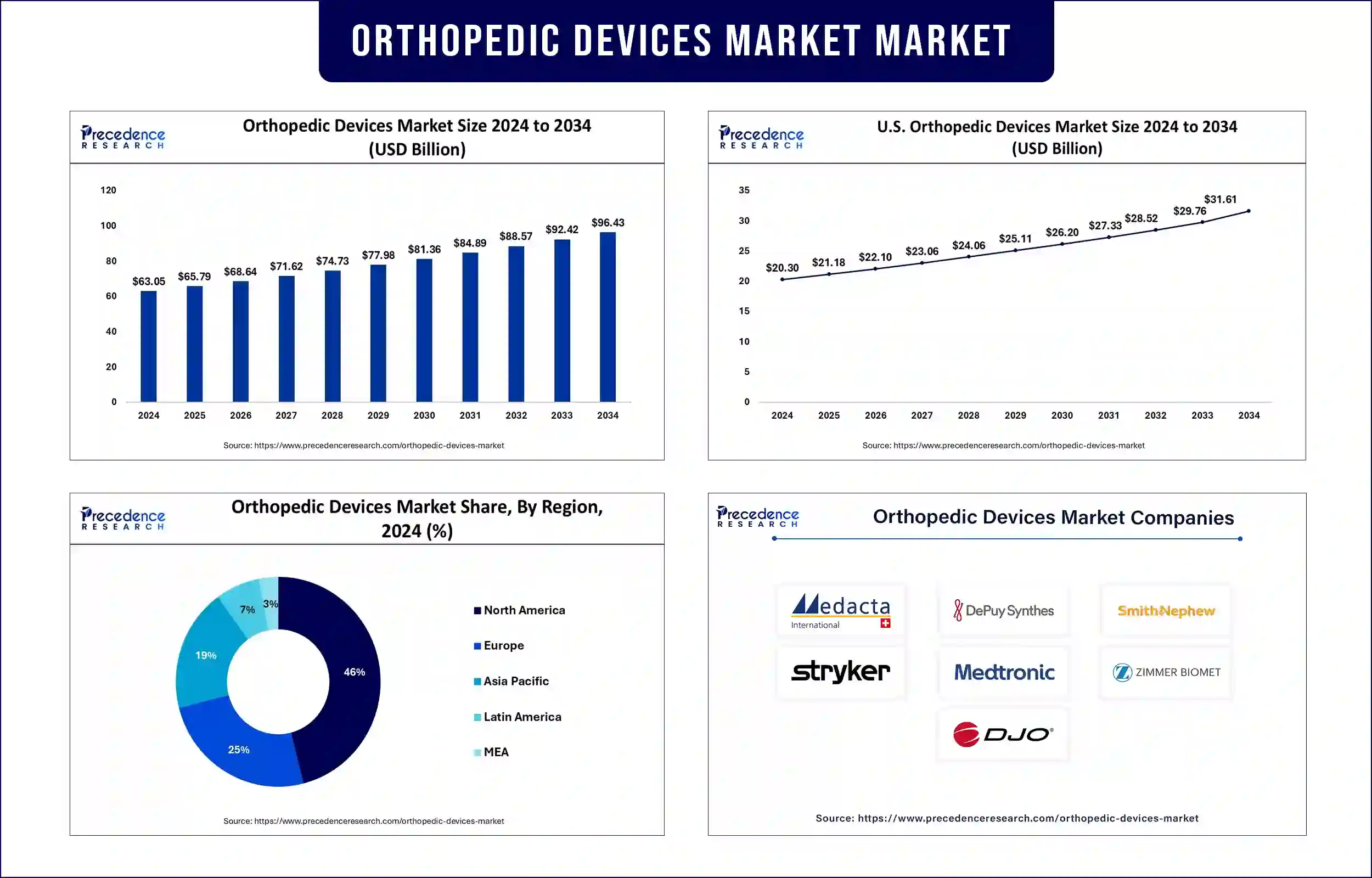

The orthopedic devices market revenue surpassed USD 65.79 billion in 2025 and is predicted to attain around USD 92.42 billion by 2033 with a CAGR of 4.34% during the forecast period. The increasing prevalence of musculoskeletal disorders, rising geriatric population, and advancements in orthopedic technologies are driving market growth.

The orthopedic devices market includes medical implants together with instruments and equipment that serve the diagnosis and treatment of musculoskeletal conditions. Patients widely apply these devices in procedures that include joint replacement, together with fracture fixation, spinal fusion and sports injury procedures. Market growth facilitated by the healthcare providers' start using minimally invasive surgery procedures along with orthopedic implant technological advances and rising healthcare costs.

As the Indian population ages, it is expected that the prevalence of MSDs, which are a significant cause of physical disability in older adults, notably increase. Such rising health conditions emphasize how important orthopedic devices become for enhancing both medical results and patient quality. Furthermore, the orthopedic devices market demonstrates substantial development due to escalating musculoskeletal illnesses along with ongoing technical improvements.

Stakeholders cooperate with the FDA through active engagement to report their XR technology experiences in surgical systems, including robotic-assisted surgical systems, which directly benefits the FDA's regulatory and scientific activities and encourages innovative orthopedic device development. Orthopedic care continues its dedication to including state-of-the-art technology, which seeks to enhance surgical results while reducing healing periods for patients

Growing Prevalence of Musculoskeletal Disorders

The increasing number of osteoarthritis, osteoporosis, and spinal disorders cases is expected to drive the demand for orthopedic devices. The rising number of musculoskeletal disorders in patients with osteoarthritis osteoporosis, and spinal conditions drives the interest in orthopedic medical products.

Advancements in Implant Technologies

The revolution of orthopedic surgery occurs through continuous innovations in implant engineering. Recent advances in 3D-printed implants and robotic-assisted surgeries have produced stronger implants that enhance surgical accuracy and speed up patient healing processes. Medical safety and efficiency evaluations for these devices are conducted by the FDA Orthopaedic and Rehabilitation Devices Panel, which consists of orthopedic experts to ensure adherence to rigorous standards.

Rising Demand for Minimally Invasive Surgeries

Minimally invasive surgical procedures continue to expand the orthopedic devices market, as the increased patient and surgical demand. A high number of patients, along with surgeons, opt for arthroscopic and robot-assisted surgical procedures, as these procedures enable them to experience shorter hospital visits and quicker healing while reducing their exposure to surgical complications. The FDA gave clearance to the initial orthopedic surgical system with extended reality (XR) integration in 2019, which initiated increased attention to these advanced surgical systems and their effect on user outcomes. The NIBIB operates as a research institution focused on uncovering novel information about medical implant-related immune responses to create long-term biocompatible materials.

Aging Population

Population aging worldwide stimulates more need for orthopedic medical treatments. Individuals who are age 70 or older experience the greatest disability-adjusted life years (DALYs) from musculoskeletal conditions based on research found in the Journal of Orthopaedic Surgery and Research in 2025. The continuously rising data demonstrates society's urgent requirement for strong orthopedic solutions that tackle health issues experienced by elderly populations.

North America is projected to maintain its leadership in the orthopedic devices market due to well-established healthcare infrastructure, high adoption of advanced orthopedic technologies, and increasing healthcare expenditure. The market benefits from key market participants while obtaining regulatory backing from the U.S. Food and Drug Administration (FDA). The FDA authorized multiple advanced orthopedic devices, which expanded medical treatment possibilities for patients. The Orthopaedic and Rehabilitation Devices Panel of the FDA comprises orthopedic surgery professionals who determine the safety and effectiveness standards for these devices during evaluations.

Asia Pacific is anticipated to experience the fastest growth due to expanding healthcare facilities, growing medical tourism, and an increasing burden of orthopedic disorders. Medical device accessibility improvement serves as the main focus of WHO's Global Atlas of Medical Devices while the region works toward improved healthcare results. The WHO's resolution on assistive technology contributes to the orthopedic devices market expansion in the region, according to recent projections.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 65.79 Billion |

| Market Revenue by 2033 | USD 92.42 Billion |

| CAGR | 4.34% from 2025 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product Type

By End-user

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview

@ https://www.precedenceresearch.com/sample/1027

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|| +1 804 441 9344

April 2025

January 2025

April 2025

January 2025